By: Md Ayub Khan, Sr Research Analyst, TASIS

On 4th September 2013 Raghuram Rajan took over the charge as Governor of the Reserve Bank of India (RBI) to become the 23rd Governor; He succeeded Duvvuri Subbarao. He was a former chief economist with the International Monetary Fund (IMF) and later became economic advisor to the Prime Minister of India. He also headed the committee set up by Prime Minister on “Indian Financial Sector Reform”. Rajan is acclaimed for predicting the 2008 global crisis and his deep insight of economic affairs. Having him held key positions; the expectations of public were high. It was a feeling among the people that Rajan after becoming governor would wave magic wand and slumping Indian Economy would recover.

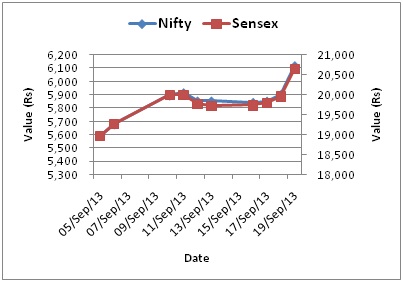

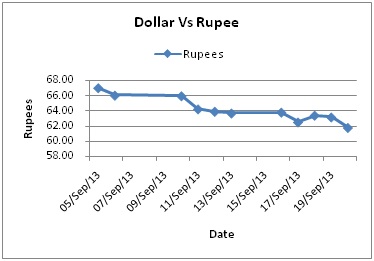

And it did happen, the day after he commenced his official duties, the value of rupee which plunged nearly 20% since May 2013, gained 1.58% at INR66.01 against dollar. On August’13 the rupee in its value witnessed an all time low of 68.85. Stock market also responded to the Rajan phenomenon and rose by 2.22% to 18,979.76. Currently the value of rupee is around 62, the Sensex and Nifty are at 20,263.71 and 6,012.10 respectively.(Change as per September third week’s closing)

The positive sentiment of the market is attributed to the measures taken by Rajan. He announced a slew of measures to attract foreign funds, a move welcomed by the market, and it resulted in the appreciation of the rupee and the trend looks persistent. The announcement included a special window to swap foreign currency non-resident (FCNR) dollar funds mobilised by banks, the limit was enhanced from 25% to 50% for exporters to re-book cancelled forward exchange contracts. He also extended the facility to importers who were not allowed to re-book their cancelled forward contracts. He restored the permission to invest 400 % (from 100% previously) of a domestic corporate’s networth in foreign market provided it has raised the funds through external commercial borrowing (ECBs) route.

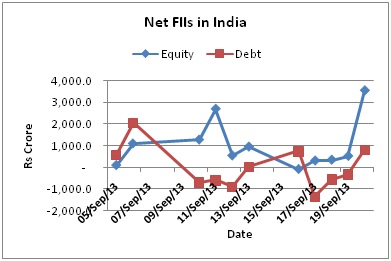

The appreciation in the value of rupee restored the investors’ sentiment in the market and the market witnessed steady FIIs Inflow in India. Since 5th September 2013, the net FIIs inflow in India was Rs 1,132 Crore. Earlier the market was gripped by the fear of possible capitulation by FIIs; during the quarter June’13 to August’13 the country witnessed the highest net FIIs outflow of Rs 77,981 core since the global financial crisis.

“Recent announcements over the FCNR-B, supportive trade data and easing investment facilitation in debt markets have resulted in imparting long needed and much sought after credibility over both – the financing of the CAD and the actual CAD,” says Deutsche Bank in a report.

The Challenges:

With everything seems to go smooth with the announcement made by Rajan, there are also certain challenges to be faced by him. Indian economy is gripped under other problems and foremost among them is the Inflation. It would be very interesting to see what steps he would take to curb the inflation. RBI has no control over inflation; it is the Government’s spending which mainly constitutes to inflation. The government has failed to reduce its expenditure and the coming 2014 election would further increase the expenditure worsening the situation furthermore. To meet the demand the government would increase its borrowing adding fuel to the rising inflation. The slow economic growth is other negative factor, if the GDP growth is lower than the interest rate (the rate at which government pays off its debt) the government would have to borrow more money to make the payment which means increase in fiscal deficit and Rajan has no control over it.

Tension between USA and Syria is also other big factor which may affect the global Oil price. If USA attacks Syria the oil price will rise and it would spur the inflation which will have huge impact on economic growth.

To sum up RBI chief definitely seems to live up to his expectations to revive the Indian economy, but there are tough challenges to combat before we start celebrating.

0 Comments