JEDDAH – Despite some weakness in the first half of the year, the world economy continues to recover, OPEC Monthly Oil Market Report for July 2014 said.

Global GDP growth in 2014 is now forecast at 3.1 percent, slightly higher than the estimated 2.9 percent for 2013. The US experienced a surprisingly large contraction in economic activity in the first quarter due to severe winter weather, leading to a downward revision in US GDP growth to 1.6 percent from 2.4 percent previously.

However, with the US economy expected to rebound and continued large monetary stimulus in the Euro-zone and Japan, the OECD is seen growing by 1.7 percent in 2014 and 2.0 percent in 2015.

China’s GDP is forecast to grow by 7.2 percent in 2015 from 7.4 percent in the current year. India and other major emerging economies are forecast to recover. This, in combination with the expected improvement in OECD economies, leads to a global GDP growth forecast of 3.4 percent in 2015.

However, a number of uncertainties remain, ranging from the consequences of monetary policies in the developed economies to the threat of deflation in the eurozone, as well as the risk of geopolitical tensions and potential spillovers.

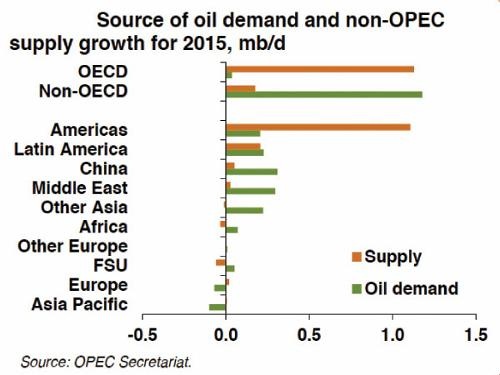

World oil demand in 2015 is forecast to grow by 1.2 mb/d to average 92.3 mb/d, higher than the growth of 1.1 mb/d estimated for 2014.

For the first time since 2010, OECD oil demand is expected to grow, increasing by 40 tb/d, with Americas being the only OECD region exhibiting growth.

Europe is expected to decline further, but at a slower pace, while Asia-Pacific oil demand will continue to contract. Non-OECD oil demand growth is expected to be around 1.2 mb/d, coming mainly from China, the Middle East, and Other Asia.

In terms of products, consumption growth will be primarily driven by increased use of diesel oil and gasoline in the transportation industry, as well as to a lesser extent LPG and naphtha for petrochemical feedstocks.

However, factors that could impact oil demand growth include the pace of economic activities in major consuming nations; the strength of substitution toward natural gas and other fuels; efforts to reduce subsidies; and ongoing policies to enhance fuel efficiency, especially in the transportation sector.

Non-OPEC supply is expected to grow by 1.3 mb/d in 2015 to average 57.0 mb/d, lower than this year’s estimated increase of 1.5 mb/d. OECD Americas is expected to see the highest growth, with contributions from the US and Canada, followed by Latin America due to the increase in Brazilian production.

However, a high level of uncertainty is associated with the 2015 non-OPEC supply forecast coming from geopolitical developments; regulatory and environmental concerns; and technical challenges such as sharper-than expected decline rates, particularly in tight oil plays, and unplanned shutdowns. These factors could impact supply projections in either direction.

OPEC NGLs and non-conventional oils are expected to increase at a faster pace in 2015, rising 0.20 mb/d to average 6.0 mb/d, following growth of 0.15 mb/d this year.

The above forecasts suggest a demand for OPEC crude of 29.4 mb/d in 2015, a decline of 0.3 mb/d from the current year. Therefore, even if next year’s world economic growth turns out to be better than expected and crude oil demand outperforms expectations, OPEC will have sufficient supply to provide to the market.

The OPEC Reference Basket increased further in June by $2.45 to $107.89/b, its highest value this year. Its year-to-date value stood at $105.30/b. Crude oil futures were sharply higher as concerns mounted that geo-political tension could disrupt oil supplies. This is despite the fact that crude oil markets were adequately supplied. The Nymex WTI front-month gained $3.35 over the month to average $105.15/b. Compared to the same period in 2013, the WTI value was significantly higher, by $7.33, at $100.84/b.

On the InterContinental Exchange (ICE), the Brent front-month gained $2.73 to $111.97/b. Year-to-date, ICE Brent, at $108.82/b, was higher compared to the same period last year.

Speculators’ net bets on rising Brent prices hit a record high on geo-political tension in the Middle East. Money managers increased their net long futures and options positions in ICE Brent by 18,451 lots to 242,201 contracts, the highest ever recorded by the exchange. The Brent/WTI spread closed the month at less than $7/b after having widened to nearly $10/b mid-month, when Brent was at a nine-monthpeak due to concerns over reduced exports from Iraq. The Nymex WTI was supported by positive microeconomic data from the US.

The Brent/WTI spread ended the month narrower at $6.82/b.

The OPEC Reference Basket (ORB) extended its previous month’s gains by nearly $2.50 in June to reach its highest value this year, uplifted by a surge in crude oil outright prices. For most of June, global crude oil markets were rattled by supply concerns due to the ongoing crises in Libya and Ukraine, while the geopolitical tension in Iraq has fuelled fears of disruption in exports from the Middle East region. This is despite the fact that crude oil markets were adequately supplied during the month. In fact, some markets were over supplied amid poor refining economics, which caused physical crude oil markets in many regions to weaken significantly. Physical crude markets were under pressure with the differentials of physical crudes to their respective benchmarks at their lowest in over a year in most markets. Moreover, these supply-related headlines and geopolitical tension in Iraq and Ukraine kept the speculators on the long side of the market, supporting a rise in prices.

Meanwhile, OPEC’s oil production rose in July from June, a Reuters survey found on Wednesday, as a fragile recovery in Libyan supply outweighed fighting in Iraq and reduced output from Angola.

Despite the increase, unrest in Africa and the Middle East is still weighing on supply. That could hinder OPEC’s ability to boost output later in the year, when the International Energy Agency expects demand for OPEC crude to rise.

Supply from the Organization of the Petroleum Exporting Countries has averaged 30.06 million barrels per day (bpd) in July, up from 29.92 million bpd in June, according to the survey based on shipping data and information from sources at oil companies, OPEC and consultants.

This puts OPEC’s output close to the group’s nominal target of 30 million bpd. Outages in the group, such as in Iraq and Libya, are effectively helping OPEC to balance the market, rather than voluntary cutbacks, analysts said.

“OPEC seems to be in control of its production at the moment, probably due to the external events,” said Eugen Weinberg, commodities analyst at Commerzbank in Frankfurt.

The 12-member OPEC pumps a third of the world’s oil. In July, the largest increase has come from Libya, where supply rose by 210,000 bpd to 430,000 bpd, the survey found.

0 Comments