by Editor | May 25, 2021 | Business, Corporate, Corporate Reports, Large Enterprise

New York : Oil prices rallied for a third straight session as the Organization of the Petroleum Exporting Countries (OPEC) said the oil market showed signs of rebalancing.

New York : Oil prices rallied for a third straight session as the Organization of the Petroleum Exporting Countries (OPEC) said the oil market showed signs of rebalancing.

The West Texas Intermediate for November delivery on Wednesday increased $0.38 to settle at $51.30 a barrel on the New York Mercantile Exchange, while Brent crude for December delivery rose $0.33 to close at $56.94 a barrel on the London ICE Futures Exchange, Xinhua news agency reported.

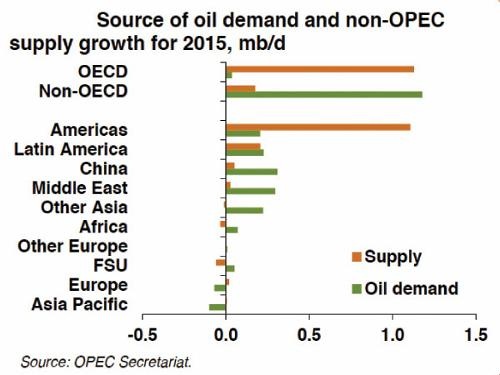

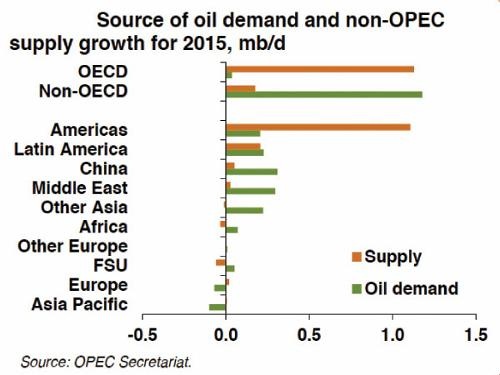

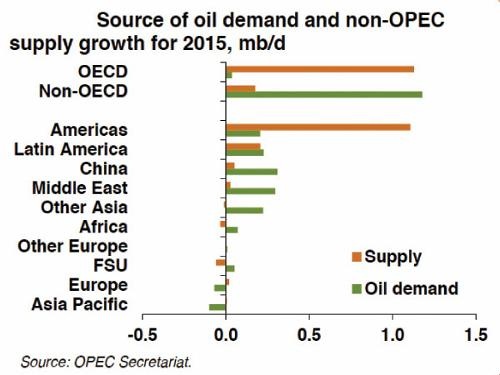

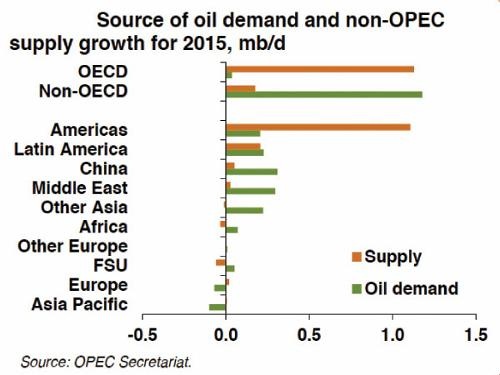

World oil demand growth in 2017 is now expected to increase by 1.5 million barrels per day, representing an upward revision from previous report, mainly reflecting recent data showing an improvement in economic activities, according to the OPEC’s monthly report on Wednesday.

In 2018, world oil demand is anticipated to grow by 1.4 million barrels per day, due to the improving economic outlook in the world economy, particularly China and Russia, the report added.

The OPEC also said the oil market was gradually tightening after years of supply glut.

—IANS

by Editor | May 25, 2021 | Commodities, Commodities News, Corporate, Corporate Governance

New Delhi : While works contract services relating to oil and gas exploration in the offshore areas beyond 12 nautical miles shall attract 12 per cent GST, the transportation of natural gas through pipeline will attract 5 per cent GST without input tax credit, Finance Ministry said on Wednesday.

New Delhi : While works contract services relating to oil and gas exploration in the offshore areas beyond 12 nautical miles shall attract 12 per cent GST, the transportation of natural gas through pipeline will attract 5 per cent GST without input tax credit, Finance Ministry said on Wednesday.

“Offshore works contract services and associated services relating to oil and gas exploration and production in the offshore areas beyond 12 nautical miles shall attract Goods and Services Tax (GST) of 12 per cent. Transportation of natural gas through pipeline will attract GST of 5 per cent without input tax credits (ITC) or 12 per cent with full ITC,” the ministry said in a statement.

The decisions were taken by the GST Council in its 22nd meeting on October 6 with the aim to reduce the cascading of taxes arising on account of non-inclusion of petrol, diesel, Aviation Turbine Fuel (ATF), natural gas and crude oil and to incentivise investments in the exploration and production sector.

The Council also decided that the import of rigs and ancillary goods imported under lease will be exempted from Integrated GST, subject to payment of appropriate IGST on the supply/ import of such lease service and fulfilment of other specified conditions.

Further, GST rate on bunker fuel has been reduced to 5 per cent, both for foreign going vessels and coastal vessels, it said.

Notifications to give effect to these proposals will be issued shortly, it added.

—IANS

by Editor | May 25, 2021 | Corporate, Corporate Governance, News

New Delhi : India and Kazakhstan on Wednesday discussed expanding cooperation in hydrocarbons and nuclear energy sectors, as well as expanding the International North-South Transport Corridor by linking it to the Kazakhstan-Turkmenistan-Iran rail link, an official statement said here on Wednesday.

New Delhi : India and Kazakhstan on Wednesday discussed expanding cooperation in hydrocarbons and nuclear energy sectors, as well as expanding the International North-South Transport Corridor by linking it to the Kazakhstan-Turkmenistan-Iran rail link, an official statement said here on Wednesday.

These and other issues figured at the two-day meeting of the Inter-Governmental Commission (IGC) with Kazakhstan, co-chaired by Petroleum Minister Dharmendra that ended on Wednesday in the central Asian nation’s capital at Astana, an Indian Petroleum Ministry release said.

The Kazakhstan delegation to the talks was led by its Energy Minister Kanat Bozumbayev.

The two sides discussed “ideas for stepping up the cooperation in energy sector, trade, economic, investment, transport and connectivity, agriculture, information technology, space, healthcare and cultural spheres between the two countries,” the statement said.

“Both leaders agreed to collaborate in the oil and gas sector for mutual benefit and further strengthen the engagement by addressing issues of concerns to Indian investors, particularly in Kazakh hydrocarbon sector,” it said.

“They explored possibility of expanding the International North-South Transport Corridor (INSTC) by linking it to the Kazakhstan-Turkmenistan-Iran rail link,” it added.

This transport corridor is a 7,200 km multi-mode network of ship, rail and road for transporting cargo between India, Russia, Iran, Europe and Central Asia. It mainly involves moving freight from India, Iran, Azerbaijan and Russia via this network.

“Kazakhstan is strategically located between Europe and Asia and offers enormous business opportunities for investments. The country is rich in mineral resources, such as uranium, oil and natural gas,” the statement said.

Bozumbayev invited Indian investments in various sectors, especially in hydrocarbons, infrastructure, nuclear energy, co-production of films, food processing and information technology, it added.

Pradhan was accompanied by a delegation of officials from various ministries, the Railway Board and the state-run oil explorer’s foreign arm ONGC Videsh Ltd.

—IANS

by Editor | May 25, 2021 | Banking, Economy, Markets, News

Mumbai : Healthy macro-economic industrial production data, along with broadly positive Asian markets buoyed the key Indian equity indices — the BSE Sensex and the NSE Nifty 50 — during the mid-afternoon trade session on Wednesday.

Mumbai : Healthy macro-economic industrial production data, along with broadly positive Asian markets buoyed the key Indian equity indices — the BSE Sensex and the NSE Nifty 50 — during the mid-afternoon trade session on Wednesday.

According to market observers, brisk buying was witnessed in healthcare, banking and oil and gas stocks.

At 12.35 p.m. the wider 51-scrip Nifty50 of the National Stock Exchange (NSE) traded at 10,114.25 points — up 21.20 points or 0.21 per cent.

The 30-scrip Sensitive Index (Sensex) of the BSE, which opened at 31,188.95 points, traded at 32,283.36 points — up 124.70 points, or 0.39 per cent, from its previous close at 32,158.66 points.

The Sensex has so far touched a high of 32,287.55 points and a low of 32,137.71 points during intra-day trade.

“The BSE Sensex and the broader NSE Nifty were trading higher on the back of positive Asian markets and slight improvement in industrial production as shown by the IIP data which was released yesterday,” Dhruv Desai, Director and Chief Operating Officer of Tradebulls, told IANS.

—IANS

by Editor | May 25, 2021 | Commodities, Commodities News, Economy, Markets, News

Mumbai : A day after closing at their lowest levels in a week’s time, key Indian equity indices — the NSE Nifty50 and the BSE Sensex — on Wednesday surged on the back of positive global cues and healthy buying in metal, oil and gas, and banking stocks.

Mumbai : A day after closing at their lowest levels in a week’s time, key Indian equity indices — the NSE Nifty50 and the BSE Sensex — on Wednesday surged on the back of positive global cues and healthy buying in metal, oil and gas, and banking stocks.

According to market observers, easing geo-political tension in East Asia and healthy buying in index heavyweights like Reliance Industries, Adani Ports, HDFC and Tata Steel aided the upward trajectory of the indices.

The wider 51-scrip Nifty of the National Stock Exchange (NSE) reclaimed the psychologically important 9,900-mark to touch a high of 9,909.45 points during intra-day trade.

However, the Nifty50 could not retain that level and closed at 9,884.40 points — up 88.35 points or 0.90 per cent.

The 30-scrip Sensitive Index (Sensex) of the BSE, which opened at 31,534.57 points, closed at 31,646.46 points — up 258.07 points or 0.82 per cent from its previous close at 31,388.39 points.

The Sensex touched a high of 31,727.98 points and a low of 31,533.02 points during the intra-day trade.

The BSE market breadth was bullish with 1,805 advances and 770 declines.

“Markets rallied sharply on Wednesday after the sharp correction seen on Tuesday. Positive global cues aided the market sentiments,” Deepak Jasani, Head of Retail Research, HDFC Securities, told IANS.

Vinod Nair, Head of Research, Geojit Financial Services, said: “Market recouped from the previous day’s loss, taking cues from positive global markets due to no further escalation in the geopolitical tensions. The domestic market was also filliped by the better than anticipated tax collection under the GST regime.”

“Mid and small-caps outperformed the broader market as investors saw buying opportunity in corrections,” Nair added.

In terms of the broader markets, the S&P BSE mid-cap index rose by 1.49 per cent, and the small-cap index by 1.35 per cent.

On the currency front, the Indian rupee closed on a flat note at 64.02 to a US dollar from its previous close.

“Trading volumes, however, were muted as floods caused by heavy seasonal monsoon rains destroyed homes and disrupted traffic in Mumbai, India’s financial capital on Tuesday, causing many people to stay home on Wednesday,” said Dhruv Desai, Director and Chief Operating Officer of Tradebulls.

“Oil marketing companies traded higher. Auto and auto ancillary stocks continued to trade higher even after the Cabinet cleared an ordinance to hike cess on luxury cars and sport-utility vehicles to 25 per cent from 15 per cent under the GST regime at present,” Desai told IANS.

Sector-wise, all the 19 sub-indices of the BSE ended in the green, led by the S&P BSE metal index, which surged by 342.40 points.

This was followed by the S&P BSE oil and gas index, which rose by 341.57 points, the banking index by 214.44 points and the consumer durables index by 211.93 points.

Major Sensex gainers on Wednesday were: Reliance Industries, up 2.12 per cent at Rs 1,564.15; Adani Ports, up 1.94 per cent at Rs 389.65; HDFC, up 1.83 per cent at Rs 1,759.50; Coal India, up 1.39 per cent at Rs 241.50; and Tata Steel, up 1.35 per cent at Rs 638.65.

Major Sensex losers were: Mahindra and Mahindra, down 1.28 per cent at Rs 1,360.10; Power Grid, down 0.35 per cent at Rs 215.05; NTPC, down 0.30 per cent at Rs 168; Cipla, down 0.19 per cent at Rs 566.85; and Dr. Reddy’s Lab, down 0.16 per cent at Rs 2,040.35.

—IANS

New York : Oil prices rallied for a third straight session as the Organization of the Petroleum Exporting Countries (OPEC) said the oil market showed signs of rebalancing.

New York : Oil prices rallied for a third straight session as the Organization of the Petroleum Exporting Countries (OPEC) said the oil market showed signs of rebalancing.