by Editor | May 25, 2021 | Investing, Marketing Basics, Markets, Media, Online Marketing, Social Media, Technology, World

Paradise Papers

Washington : As the US Congress investigates Russia’s interference in the 2016 US election by using social media giants, a new trove of confidential documents has revealed that Facebook and Twitter received major investments from firms with ties to Kremlin-owned corporations.

The documents called “Paradise Papers”, were obtained by German newspaper Suddeutsche Zeitung and reviewed by the International Consortium of Investigative Journalists (ICIJ) and several media outlets across the globe.

According to the ICIJ, the records show that one of the Kremlin-owned firms, VTB Bank, quietly directed $191 million into an investment fund, DST Global, which is owned by billionaire Yuri Milner, that used the money to buy a large stake in Twitter in 2011.

“They also show that a subsidiary of the Kremlin-controlled energy giant Gazprom heavily funded an offshore company that partnered with DST Global in a large investment in Facebook,” the ICIJ said in a statement on Monday.

Milner and other partners in the deals reaped large gains when they sold their stakes shortly after Facebook’s initial public offering in 2012 and Twitter’s in 2013.

The disclosure shows that years before Russia meddled in the 2016 US presidential election, the Kremlin had a financial interest in the US social media.

Facebook and Twitter, however, said they had properly reviewed Milner’s investments.

In response to questions from the ICIJ and its partners, Milner said the investments his firm makes, including the Twitter and Facebook deals, have always been based on business merits and have nothing to do with politics.

VTB also confirmed that it had invested in Twitter through Milner’s firm DST Global.

The documents also revealed that Apple was seeking out a new tax shelter around Europe and the Caribbean, ReCode reported.

In an email obtained by the ICIJ, an Apple lawyer inquired about whether moving to one of the six tax havens would allow its Irish subsidiary to “conduct management activities … without being subject to taxation in these jurisdictions”.

In August, Apple had come under fire for striking a deal with the Irish government that allowed it to avoid paying virtually any taxes in many of its global markets.

The European Commission ordered Apple to pay $13 billion in back taxes.

—IANS

by Editor | May 25, 2021 | Investing, Muslim World

Rabat : While Morocco ranked the second in Foreign Direct Investments after South Africa in Sub-Saharan Africa, to date, the kingdom appears to be taking the forefront position in African FDI, according to a report published today by Montaigne Institute, an independent French think tank.

Rabat : While Morocco ranked the second in Foreign Direct Investments after South Africa in Sub-Saharan Africa, to date, the kingdom appears to be taking the forefront position in African FDI, according to a report published today by Montaigne Institute, an independent French think tank.

“Morocco clearly shows its ambitions in becoming a Pan-African, economic and political leader,” said the report, pointing that King Mohammed VI is spearheading the kingdom’s African policy.

The think tank sees that with Morocco’s return to the African Union, kingdom “has its own agenda in conquering markets in Sub-Saharan Africa, which has led to a competition with French companies, particularly in construction,” said the report.

In February 2016, the Moroccan Office chérifien de phosphates (OCP) inaugurated an industrial plant in Ethiopia dedicated to exporting fertilizers to Sub-Saharan markets, the report reminded, before reintegrating the African Union (AU) during the organization’s summit Addis Ababa.

The document also indicates that the kingdom’s potential joining of the Economic Community of West African States (ECOWAS) will provide Morocco with advantages to export its products to the region and accelerate its rise as a continental power.

Recognizing Morocco’s position as a key investor in Africa, French companies have chosen to make Morocco their gateway to sub-Saharan countries, while others have chosen to ally themselves with Moroccan companies to conquer continental markets.

In 2016, Morocco’s trade with Sub-Saharan Africa has recorded an average annual growth of 9.1 percent over the period of 2008-2016 and has generated a surplus trade balance of MAD 11.9 billion, according to the Foreign Exchange Office, Morocco World News reported.

Trade between the two sides has grown at an average annual rate of 9.1 percent since 2008, reaching nearly MAD 20 billion in 2016. The share of these exchanges is three percent of the total in 2016, against 2 percent 2008.

—SM/IINA

by Editor | May 25, 2021 | Muslim World

By Aroonim Bhuyan

By Aroonim Bhuyan

New Delhi:(IANS) Increasing bilateral investments, a greater role for India in regional security and stability and fighting terrorism are among the key issues that are likely to come up for discussion during External Affairs Minister Sushma Swaraj’s visit to Egypt early next week.

“The visit of the Indian external affairs minister next week is a continuation of the historic relations between India and Egypt,” Egypt’s Ambassador to India, Hatem Tageldin, told IANS in an intervieew.

“The Arab region and India are among the biggest trade partners and trade between the two sides is worth around $180 billion,” he said.

The ambassador said that Egypt is working on a number of mega projects from which Indian investors can benefit. “The New Suez Canal that was inaugurated on August 6 is one of them. We are planning to set up a special economic zone of around 500 sq km,” he said.

He said there are already over 50 Indian investors in Egypt and there was around $3 billion of private Indian investment in the north African country.

“Indian companies in the pharmaceutical, IT, infrastructure, energy and auto component sectors are exploring the Egyptian market with the intention of either exporting from India or producing in Egypt,” the ambassador said, citing Maruti Suzuki, Mahindra and the Tata group examples.

Egypt is the hub of entry to as many as 26 African countries and with the signing of a number of pacts between these countries, Indian companies can move product within the region without paying any customs duties.

As for Egyptian investment in India, he said: “I have already visited Bangalore to lay the foundation stone of a new Egyptian factory. There is a second (Egyptian) factory already functioning in Noida and the negotiation process is on for a third factory.”

He also stressed on the issues of regional security and the fight against terrorism that will figure during Sushma Swaraj’s visit on August 24-25.

“The two sides will also discuss regional issues and the situations in countries like Syria, Iraq, Libya and Yemen,” Tageldin said.

“The Indian external affairs minister will also meet the secretary general of the Arab League apart from holding bilateral discussions with our minister for foreign affairs.”

According to the diplomat, Egypt believed in India’s role in the Israel-Palestine peace process. “We trust India to continue its historic support to the Palestine issue,” he said.

Cairo is also looking forward to attracting more Indian tourists to Egypt. “Last year,we had 10 million tourists. The number of Indian tourists was 61,000. I think that is a very humble number,” Tageldin said.

“We process Indian tourists’ visas in a maximum of three days. Also Indian tourists going in groups can get visa on arrival facility by requesting Egyptian tour operators.

Tageldin said Egypt Air, which currently flies to Mumbai, is exploring the possibility of introducing a direct flight to New Delhi too.

According to the ambassador, Sushma Swaraj’s visit is a reflection of the new Indian government’s thrust on looking west – Gulf and the Arab world – after having focussed on the Look East policy in the first year.

(Anoorim Bhuyan can be contacted at aroonim.b@ians.in)

by Editor | May 25, 2021 | Business Summit, Economy, Events, News

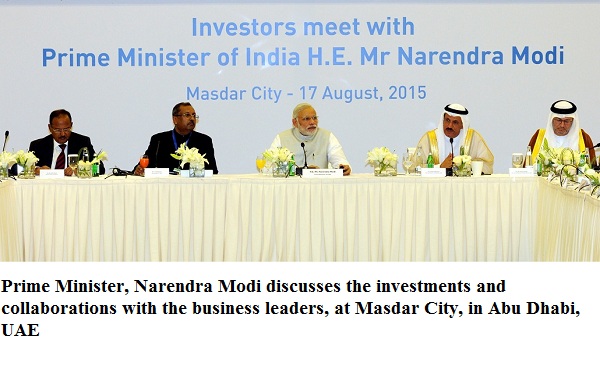

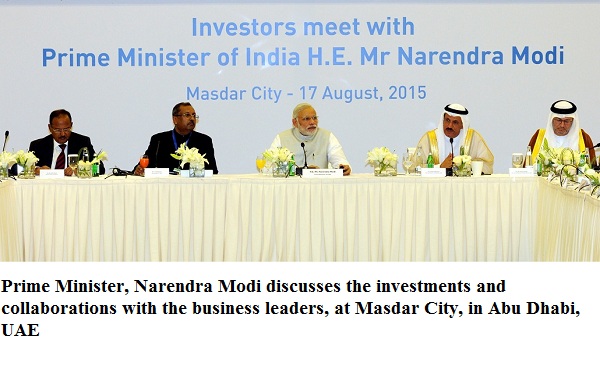

Prime Minister, Narendra Modi discusses the investments and collaborations with the business leaders, at Masdar City, in Abu Dhabi, UAE

Abu Dhabi:(IANS) Prime Minister Narendra Modi on Monday wooed top UAE business honchos, saying India has the potential of $1 trillion investments and also promised to address the concerns of business persons.

Addressing an investors roundtable in Masdar City, a zero carbon city, Modi also promised to erase the deficit of prime ministerial interactions of the past 34 years. Former prime minister Indira Gandhi was the last Indian prime minister to visit in 1981.

He said that though there are 700 flights between India and the UAE but it took 34 years for an Indian prime minister to visit. “I promise this will not happen again,” he said.

Taking pot shots at the previous UPA regime, Modi said he has “some problems in legacy” and that some measures were stalled due to the “indecisiveness and lethargy” of past governments.

“It is my priority to kickstart those things,” Modi said.

Modi said he had been informed about some problems being faced by UAE business persons and added, “I want to assure we are solving these problems.”

He said he will send Commerce Minister Nirmala Sitharaman to try and find solutions to the problems being faced by some UAE investors.

He said that “UAE’s power and India’s potential can make the dream of an Asian Century a reality”.

“It is now commonly believed that India is one of the fastest growing economies. There are several opportunities of development in India. I feel India is a land of many opportunities. The 125 crore people of India are not a market but they are a source of great strength,” he said.

Top corporate honchos attended the meet. “A Who’s Who of UAE Business. UAE and Indian industrialists come together to meet PM @narendramodi,” said ministry of external affairs spokesperson Vikas Swarup.

Those who attended the meet included Etisalat CEO Ahmed Abdulkarim Julfar and Emaar Properties chairperson Mohammed Ali Al Abbar.

Modi said that India now had a decisive government with full majority, and several sectors including insurance, railways, defence manufacturing have been opened up for foreign investment. He touched upon renewable energy, port-led development and low-cost housing as sectors with huge investment potential, said an official statement.

He said that if India and UAE work together, they can make the vision of an Asian century a reality. He said UAE would be the economic focus of the Asian century.

Earlier, he took a tour of Masdar City, a hub of clean technology.

He was accompanied on an hour-long visit of Masdar City by senior officials, who briefed him on various aspects of the project.

He travelled briefly on the PRT (Personnel Rapid Transit) car – a driver-less vehicle which runs from point to point on magnetic strips.

Modi also visited the Micro-Nano Fabrication Facility and the Microscopy Lab. He went on a brief walking tour of the city’s public spaces and was informed about the sustainable building methodology and key architectural elements.