by Editor | Jul 30, 2021 | Business, Corporate, Opinions

By Dr Shariq Nisar

Corporate Governance refers to the set of systems, principles and processes basis, which a company is governed. Aim of Corporate Governance is to promote corporate fairness, transparency and accountability. Over the years, Corporate Governance has become the cornerstone of good business practices. It encompasses the processes, practices and policies that a company relies on to make formal decisions and to manage the organisation. The concept of Corporate Governance is becoming increasingly important for companies in India, as the companies are becoming increasingly aware of their public image and realising the importance to behave ethically. There is increasing empirical evidence that good governance correlates with increased shareholder value and particularly bad governance is a red flag for increased risk.

The primary focus of Corporate Governance starts with the board of directors, how the board conducts itself and how it governs the company as it is mainly the responsibility of the board of directors to ensure good Corporate Governance.

Elements of Corporate Governance:

Principle 1: The corporate governance framework must help promote transparent and fair markets and the efficient allocation of resources.

Principle 2: The corporate governance framework must identify basic shareholder rights and provide equitable treatment of all shareholders.

Principle 3: The corporate governance framework must disclose and minimize conflicts of interest of market participants.

Principle 4: The corporate governance framework must encourage active co-operation between companies and their stakeholders.

Principle 5: The corporate governance framework must facilitate the disclosure of material information to aid in informed decision-making.

Principle 6: The corporate governance framework must ensure effective supervision by the board and enhance the board accountability to stakeholders.

Corporate Governance Parameters

- Board Effectiveness: This relates to the Board’s objective oversight of the company’s actions. Whether the company has a strong board composition with diversity across skills and a non-executive chairperson or not.

- Conflict of Interest:Disclosure and minimization of conflicts of interests and strong internal controls systems to address conflicts in related party transactions (RTP).

- Stakeholder Management:Active co-operation between corporations and stakeholders to pursue the corporate governance agenda. Well-articulated supplier or vendor selection and management policies.

- Executive Remuneration:Judicious remuneration closely aligned with company growth.

Benefits of Corporate Governance:

- Ensures corporate success and economic growth.

- Maintains investors’ confidence, which helps in lowering the capital cost and bringing a positive impact on the share price.

- Minimizes wastages, corruption, risks and mismanagement.

- Helps in brand formation and development.

Indian Corporate Governance Scorecard:

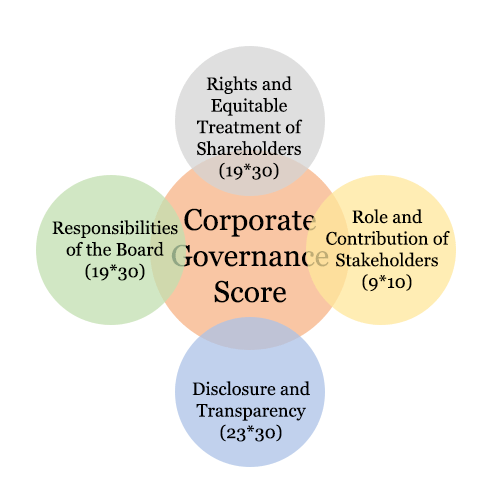

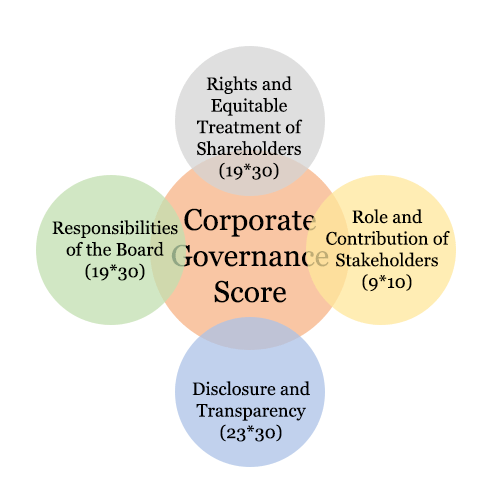

The Corporate Governance Scorecard is an initiative of the BSE and International Finance Corporation (IFC). Institutional Investor Advisory Services (IiAS) is the technical partner responsible for preparing the scorecard. The Scorecard is an assessment of the Corporate Governance practices of a company. The Scorecard builds upon the Organisation for Economic Cooperation and Development (OECD) principles of Corporate Governance and draws on the lessons from global best practices. Besides, the Scorecard also considers the Indian context. Overall, the idea behind the Scorecard is to recognise the current level of corporate governance practices and help companies enhance these to globally relevant levels. Following are the four parameters on which the Indian Scorecard is based:

- The Rights and Equitable Treatment of Shareholders

- Role and Contribution of Stakeholders

- Disclosure and Transparency

- The Responsibilities of the Board (Effective supervision and accountability)

Benefits of Scorecards:

- Increased awareness and greater visibility of global best practices;

- Greater investor insight into corporate governance;

- An opportunity to review and analyze the quality of corporate governance within companies and economies;

- Assists regulatory institutions to identify strengths and weaknesses in corporate governance practices; and

- Motivation to enhance company’s corporate governance practices beyond the minimal requirements of laws and regulations;

Evaluation Framework:

The scorecard comprising 70 questions is categorised under the four principles. The scoring is based on three marking techniques:

- 0, 1 or 2 points (0 being the lowest and 2 being the highest)

- The information disclosed must be available in public to corroborate

- Whether the company needs to improve on the given element of Corporate Governance, as asked by the question or follows at least Indian standard, or follows a global practice

- 0 or 2 points for yes/no questions. Negative responses attract 0 points, positive responses attract 2 points

- Questions marked as ‘Not applicable’ are not given any mark and the question is excluded from the final marking

- The non-applicability of a particular question leads to exclusion of the question for overall score calculation. This may bring down the score for the company which may not reflect the correct picture.

Further, each of the four principles on which the questions are based, have been assigned weights based on:

- Number of questions under each of the category

- The relative importance of the questions in that category

| Category |

Number of Questions |

Category Weight |

| Rights and equitable treatment of shareholders |

19 |

30 |

| Rights and equitable treatment of shareholders |

9 |

10 |

| Rights and equitable treatment of shareholders |

23 |

30 |

| Rights and equitable treatment of shareholders |

19 |

30 |

| Total |

70 |

80 |

Based on the scores calculated by the above method, companies are then categorised into four: The category reflects their adoption of corporate governance practices.

| Score |

Category based on the adoption of Corporate Governance practices |

| >= 70 |

Leadership |

| 60-69 |

Good |

| 50-59 |

Fair |

| <50 |

Basic |

Observartions:

The first Indian Corporate Governance Scorecard was released in December 2016 when 30 companies were assessed. In 2017, scorecards of 100 companies published. In 2019, in addition to the companies in BSE100, 50 recently listed companies were also added to the Scorecard.

BSE has also developed a CGS Tool Kit, which makes it convenient for all listed companies to conduct a self-evaluation using the scorecard criteria and methodology. Companies would do well to check their scores.

by admin | May 25, 2021 | Corporate, Corporate Governance

By Mayabhushan Nagvenkar,

By Mayabhushan Nagvenkar,

Panaji : Lack of ethical grounding in corporate governance is the reason behind scandals like the one involving diamantaire Nirav Modi in India, just as absence of values in business practices triggered global accounting scandals like Enron and WorldCom, says Ajit Parulekar, Director, Goa Institute of Management, the state’s top B-school.

Speaking to IANS following the announcement of a six-month intensive workshop for the management school’s faculty and Board of Governors on Transformative Teachers conducted by The Dalai Lama Center for Ethics and Transformative Values at Massachusetts Institute of Technology (MIT), Parulekar also said that after the workshop the institute’s trained faculty would work with primary schools in Goa to promote value-based education.

“The world over, you have issues of governance which led to things like Enron and WorldCom. India has not been spared in any of this. Nirav Modi and Punjab National Bank and so many other things that have happened, shows clearly that corporate governance leaves a lot to be desired,” Parulekar said.

Modi is a fugitive high-profile diamond merchant who is accused of defrauding the Punjab National Bank of over Rs 11,000 crore and is being investigated by the Central Bureau of Investigation.

“Eventually we hope that this is going to help a wider audience, not just through our faculty and board and our students. We also wish to get some of our faculty trained in value-based education, who in turn will work with primary schools in Goa. We will then be able to bring in value-based education to primary schools in Goa,” Parulekar said.

The workshop, he said, would help influence faculty in the way they choose to conduct their courses.

Priyadarshi, who leads the resource team for the workshop, said that ethical decision-making ensures fair and transparent mechanisms in governance practices and can curb corrupt mindsets.

“It is crucial to the long-term stability of any organisation or institution and benefits all stakeholders. It is essential to the well-being of society… Individuals who create and safeguard existing systems or structures must have some grounding in ethics to minimise conditions that perpetuate corrupt models and mindsets,” he said.

Ethical learning, he said, should permeate all forms of learning and should not be limited to a single course or subject.

“We live in a complex world and people need to learn relevance and applications of ethics and value-based learnings so it does not remain an isolated cerebral exercise,” he said.

Commenting on the six month intensive programme announced by GIM, Priyadarshi said, that it is designed as a very hands-on approach initiative “in the spirit of most of MIT programmes for effective behavioral and social change”.

“We believe in longitudinal goals which requires continuous engagement and practice of the discipline. Habits are hard to change especially when there’s is a lack of will to do so. The programme helps deepen one’s understanding of the importance and motivation for such positive changes by working through aspects of values, empathy, emotions, meaning and sense-making,” Priyadarshi said.

(Mayabhushan Nagvenkar can be contacted at mayabhushan.n@ians.in)

—IANS

by admin | May 25, 2021 | Corporate, Corporate Governance, Opinions

By Amit Kapoor,

By Amit Kapoor,

Vishal Sikkas exit from Infosys seems to have been accentuated by the streak of comments made by co-founder N.R. Narayan Murthy. The comments bordered on complaints, raising issues of corporate governance and at time accusations. The episode, like a soap opera with significant twists and turns, has been played in public glare over the last few months.

The resignation has had its first casualty by way of wiping off the value of Infosys stock on the bourses. The impact was close to Rs 22,000 for Infosys and Rs 700 crore of mark down for Murthy’s stock. The episode rakes up significant issues about corporate governance and transparency, the agency problem (precisely the question of control between shareholders and professional management), important issues about the strategy of Infosys and the pressure to perform in a volatile global environment

1. VUCA Environment. The pressure seems to have been built on the enterprise while operating in a Volatile, Uncertain, Complex and Ambiguous (VUCA) environment. Today’s business environment is bombarded with ideas countering the notion of globalisation and the negative impact of free trade. The benefits of globalization, driven by the free movement of goods, services, and information are countered by deeply seated myths and assumptions which smack right in the face of trade theorists. To top it all, the pressure has been further created by the current US administration’s views on outsourcing and immigration. To bluntly put it, the world is in the throes of economic nationalism.

2. Business Model. The archaic business model of Infosys, driven by the idea of scale and labor arbitrage has come under severe strain. The debate for years has been the innovative potential of Infosys and the value the enterprise can create. To put this into perspective, we must look at the trajectories of growth, impact the firm has had on the global industry et al. The enterprises to compare here are Microsoft and Infosys who effectively started at the same time and have had trajectories of growth that are significantly different.

I must as well admit that I have not been a great fan of Infosys of the past as it was built on the idea of exploitation of labor with abysmal levels of productivity numbers for its engineers. This is where the present team of Vishal Sikka, Ravi Venkatesan et al have been working quite hard and making admirable strides on redefining the business model. The effect of the new business model was as well visible through the rising productivity numbers of the enterprise and its talent.

3. Corporate Governance and Transparency. This issue needs to be assessed very carefully. It is clear that Murthy looks at Infosys having an impeccable record on governance and transparency. No one can find a reason to not follow the highest standards as espoused by Murthy. The practice needs to be followed to the hilt, though the issues need to be discussed within the confines of the boardroom. This discussion becomes important as Murthy cannot be seen as an activist shareholder who is at loggerheads with the management.

The episode leads us to look deeply at the issues of corporate control in the country. It is not the first time that we have had battles fought between shareholders and professional managers. The Infosys saga can as well be seen through the lens of conflict of interest and control. To say the least, a conflict of this nature will not only undermine but has the potential to ruin the enterprise. It cannot be ignored that Murthy is the co-founder and has had a great stake in building the enterprise — though the action of making the grievance public seems to have had a counterproductive effect.

The situation at hand demands an immense level of maturity by all parties involved. This would require all parties concerned to tone down the rhetoric, stand down from their respective positions and sit across the table to discuss the issues. If this is not done on an immediate basis, the loss would entirely be felt by Infosys, the poster boy of Indian IT Industry, that I am sure wouldn’t liked by Murhty, the board or Infosys stakeholders. We must keep in mind that all organisations need to change, evolve their business model and adapt to the new realities. This will certainly have to be done while keeping in mind that the core of Infosys is kept intact which in itself seems to be jeopardised at the moment.

(Amit Kapoor is chair, Institute for Competitiveness, India. The views expressed are personal. He can be contacted at amit.kapoor@competitiveness.in and tweets @kautiliya.)

—IANS