by admin | May 25, 2021 | Business, Large Enterprise, SMEs

Anil Ambani

Mumbai : Reliance Infrastructure (RInfra) on Wednesday said that it has completed the Rs 18,800-crore sale of its Mumbai integrated distribution business to Adani Transmission (ATL), which will help RInfra reduce its debt by nearly two-thirds to Rs 7,500 crore.

At a media briefing here following a board meeting to approve the transfer of the Mumbai power business, RInfra Chairman Anil Ambani announced the closure of the deal which had been signed in December last year.

“For Reliance Infrastructure, this is truly a transformative transaction. The company’s gross debt will be reduced from about Rs 22,000 crore to only Rs 7,500 crore, representing a steep debt reduction of 65 per cent in a single transaction,” he said.

In the past eight months, the sale has received regulatory approvals from the Competition Commission of India, shareholders of the company and the Maharashtra Electricity Regulatory Commission.

RInfra and ATL had signed the Definitive Binding Agreement for 100 per cent stake sale of the integrated business of generation, transmission and distribution for Mumbai in December 2017.

Reliance Energy, operating the Mumbai power business, supplies to nearly three million residential, industrial and commercial consumers in the city suburbs covering an area of 400 sq km. It caters to a peak demand of over 1,800 MW, with annual revenues of Rs 7,500 crore with stable cash flows, the company had said.

Speaking of the company’s engineering and construction business, Ambani said that some of the showpiece projects in Rinfra’s order book include the Rs 7,000-crore Versova-Bandra Sealink, Mumbai Metro Line 4, Kudankulam Nuclear Power Project in Tamil Nadu and the integrated LNG Terminal and power project in Bangladesh.

—IANS

by admin | May 25, 2021 | Business, Commodities, Commodities News, Corporate, Corporate Buzz, Large Enterprise

Sydney : Embattled Indian miner Adani Group has parted ways with mining services giant Downer and said it will build and run the Carmichael coal mine, Australia’s biggest coal venture in central Queensland’s Galilee Basin, on its own, a media report said.

Sydney : Embattled Indian miner Adani Group has parted ways with mining services giant Downer and said it will build and run the Carmichael coal mine, Australia’s biggest coal venture in central Queensland’s Galilee Basin, on its own, a media report said.

Adani in a statement on Monday revealed that both parties had cancelled a conditional $2.6 billion contract as part of Adani’s cost-cutting drive following last week’s decision by the Queensland state government to veto an A$900 million federal government loan to Adani.

The split comes after Australian company Downer became the target of a nationwide activist campaign pressuring it to quit the Carmichael project in central Queensland, abc.net.au reported.

The move raises further questions about the fate of the massive project, with Downer one of only two mine contractors – along with Thiess – considered capable of handling an operation producing up to 60 million tonnes of coal a year.

It is the latest in a long series of project hiccups for the Carmichael mine, including the veto of Adani’s application for a Northern Australia Infrastructure Facility (NAIF) loan last week, and its so far unsuccessful attempts to raise finance in China.

Adani said in a statement it remained committed to the project and the split with Downer was “simply a change in management structure”.

“Following on from the NAIF veto last week, and in line with its vision to achieve the lowest quartile cost of production by ensuring flexibility and efficiencies in the supply chain, Adani has decided to develop and operate the mine on an owner operator basis,” the statement said.

“Adani and Downer have mutually agreed to cancel all Letter of Awards and Downer will provide transitional assistance until March 31, 2018.

“Adani remains committed to develop the Carmichael project and will ensure the highest level of standards and governance.

“This will not affect our commitment or the number of local jobs across Queensland.”

Adani had intended to outsource the operation of its Carmichael mine to Downer under an agreement that was worth $2bn at the time of its announcement in 2014.

The very first act of Queensland’s newly re-elected Labor government was to make good on its election promise to veto a loan to Adani of up to $1bn from the federal Northern Australian Infrastructure Fund (Naif).

The government has said it backs the mine and wants the jobs it will create, but also says the project must be viable without taxpayer funds, including federal funds.

Adani is yet to secure funding for the mine. Earlier this month, Chinese lenders ruled out providing finance, joining Australia’s big four banks in avoiding the controversial project.

—IANS

by admin | May 25, 2021 | Business, Corporate, Corporate Reports, Large Enterprise, World

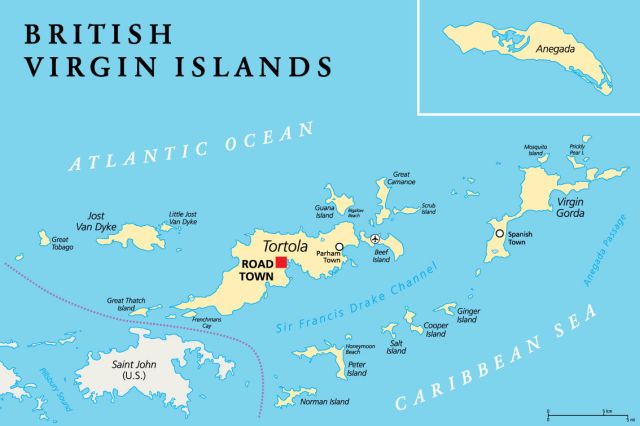

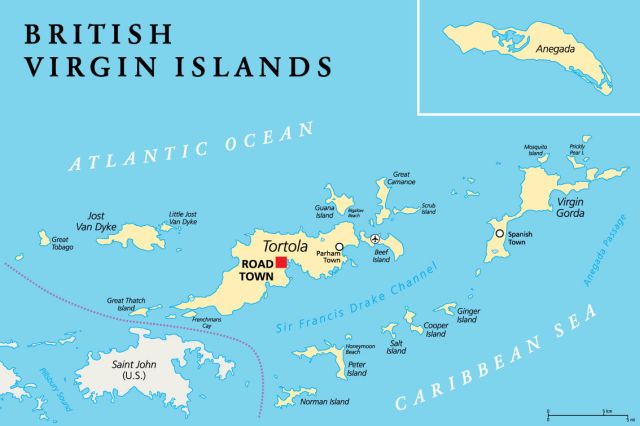

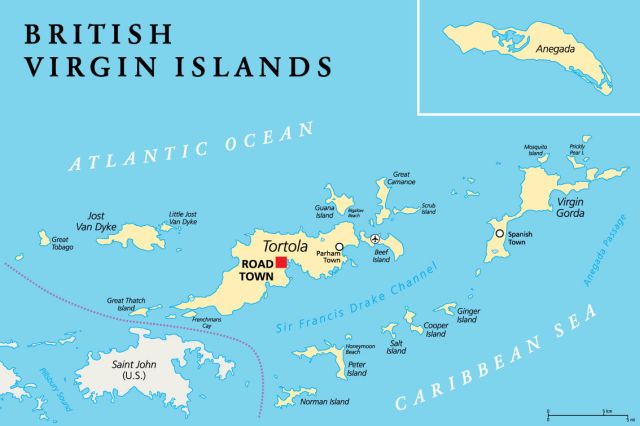

British Virgin Islands

Canberra : An investigation by the Australian Broadcasting Corporation (ABC) has alleged that the Adani Group’s Australian operations have “previously unknown tax haven ties in the British Virgin Islands”.

ABC’s ‘Four Corners’ programme has uncovered the British Virgin Islands links of Gautam Adani’s Australian ventures.

The Adani Group has promised a $22 billion windfall in taxes and mining royalty payments for Australia over the life of the Carmichael coal mine it has been given approval to build in Queensland. ABC quoted experts as saying that the “opaque web of companies and trusts” behind Adani’s Australian assets gives it ample opportunity to minimise the tax it pays.

“Absolutely, Adani has put in place multiple ways in which they can minimise the amount of tax they pay in Australia, and maximise the amount of profits if they choose in Caribbean tax havens,” Adam Walters, research director at the consultancy Energy and Resource Insights, told Four Corners.

Adani Group’s assets in Australia include the Abbot Point Coal Terminal near Mackay in Queensland, a terminal expansion project it has approval to undertake at Abbot Point, and a planned railway line of nearly 400 km from the port to the giant mine it wants to build in the Galilee Basin – aided by a subsidised loan of up to a $1 billion it is seeking from the Federal Government’s Northern Australia Infrastructure Facility.

It was previously thought that Atulya Resources, a Cayman Islands domiciled company controlled by members of the Adani family, was the ultimate holding company for Abbot Point, the expansion project, and the railway.

However, filings in Singapore by privately-owned Adani companies show that a company registered in the British Virgin Islands, sits behind Atulya Resources, ABC reported.

It is variously described in the offshore company filings as ARFT Holding Limited, AFRT Holding Limited and Atulya Resources Family Trust.

The Adani Group’s filings with Australia’s corporate watchdog, ASIC, fail to mention this company, instead continuing to list Atulya Resources as the owner.

The British Virgin Islands’ company’s apparent position at the apex of the structure is disclosed in the financial reports of a series of Adani companies controlled by Vinod Adani, also known as Vinod Shantilal Adani or Vinod Shah.

Vinod Adani, the older brother of Gautam Adani, has been under investigation in India over an alleged scam designed to shift money offshore, says ABC.

Investigating officers from India’s Directorate of Revenue Intelligence accused Vinod Adani, along with ex-Adani Group employees and Adani companies, of executing a “planned conspiracy of siphoning off foreign exchange abroad … and Trade Based Money Laundering”.

But the case was recently quashed by an adjudicator.

After hearing the Adani Group’s defence, he ruled in late August that the transaction between Vinod Adani’s companies and subsidiaries of Adani Enterprises was at “arms’ length” and on legitimate commercial terms.

The Adani Group told authorities that Vinod Adani, as a non-resident Indian domiciled in Singapore, was an independent businessman with “no involvement” with the Adani group of companies.

However, Vinod Adani’s intimate involvement in the ownership structure of Adani’s Australian operations casts doubt on that claim.

Vinod Adani is the sole director of a number of Singapore-registered companies that control the Australian rail and port assets and are in turn owned first in the Cayman Islands and then in the British Virgin Islands, says ABC.

Another previously unknown British Virgin Islands-based entity provides a potential conduit for the Adani Group to shift potentially billions of dollars from its Australian operations offshore.

Carmichael Rail Australia Ltd BVI, registered in the British Virgin Islands, appears to directly control trusts established for the railway project in Australia.

One of those trusts is eligible to receive an “overarching payment” of $2 a tonne from the coal extracted from the Carmichael mine, rising by inflation for two decades. Carmichael is licensed to mine 60 million tonnes of coal a year.

Adam Walters says this gives Adani Group multiple ways to “skin it” and move revenue to the Caribbean: “Either to the Cayman Islands via Singapore or directly to the notorious tax haven of the British Virgin Islands.”

Specialist tax lawyers and bankers who spoke to ABC’s Four Corners say there is nothing unlawful about the structure Adani has established for its Australian operations.

Meanwhile, the Queensland government and business groups have defended the proposed Carmichael coal mine.

Queensland Premier Annastacia Palaszczuk has said the company will be held to account. “I’ve made it very, very clear to the people of this state that we have the strictest environmental conditions attached to this,” Palaszczuk said.

Queensland Minister for Natural Resources and Mines Anthony Lynham has said the mine would be subject to “strict monitoring” throughout the construction process.

—IANS

by admin | May 25, 2021 | Commodities, Commodities News, Commodity Market, Corporate, Corporate Reports, Finance, Investing, News

New Delhi : The Adani Group’s entire A$3.5 billion (Rs 178 billion) debt-funded ‘investment’ in Australia is gravely at risk, the US-based Institute for Energy Economics and Financial Analysis (IEEFA) said on Monday.

New Delhi : The Adani Group’s entire A$3.5 billion (Rs 178 billion) debt-funded ‘investment’ in Australia is gravely at risk, the US-based Institute for Energy Economics and Financial Analysis (IEEFA) said on Monday.

In a new report it details how Adani’s Abbot Point Coal Terminal has excessive financial leverage, negative shareholders equity and runs the risk of becoming a stranded asset if Adani’s Carmichael mine does not get a $1 billion Australian subsidy.

The Abbot Point Coal Terminal is due for a $1.5 billion debt refinancing next year and a cumulative debt refinancing of $2.11 billion by 2020.

Currently, operating at just over 50 per cent capacity, the Abbot Point Coal Terminal needs the Carmichael mine to fill the gap created as its current take-or-pay contracts progressively expire.

“Securing this refinancing is going to be a real challenge, not the least because the port value has been tied to the success of the Carmichael coal mine proposal which is itself yet to secure funding and which the ‘big four’ Australian banks have refused to touch,” an official statement quoting report co-author Tim Buckley said.

Buckley’s the IEEFA’s Director of Energy Finance Studies, Australasia.

“The potential for a loss of up to $1.5bn on any decision to walk away from Carmichael mine and rail proposal, explains why the Adani Group has been so focused on securing Australian tax payers money and royalty holidays to subsidise his loss making ventures,” he said.

“To the extent able to be analysed from Australian Securities and Investments Commission records, Adani’s entire mine, rail and port operation in Australia looks to be 100 per cent debt financed and shareholders funds now tally an unprecedented, negative $458 million combined. The value at stake for the Adani Group’s Carmichael mine proposal is far bigger than previously understood,” Buckley added.

Whilst Adani continues to search for overseas project funding, the report, “House of Cards: The Escalating Financial Risk of Adani’s Abbot Point Coal Terminal”, the report traces events that make the Carmichael project an even greater financial risk.

The events include Adani’s major proposed off-take coal customer, Adani Power Ltd’s 4.6 GW power plant at Mundra in Gujarat, is financially distressed and its equity is for sale for just Re 1 but has no buyers so far.

India’s thermal coal imports have continued the downward trend of the last two years and are down 13 per cent year-to-date in 2017 compared to the prior year.

And, in the light of new solar infrastructure projects delivering electricity at prices now 20 per cent below many Indian thermal power plant tariffs, financial analysts don’t see any imported coal demand to justify more expensive seaborne supplies.

—IANS

by admin | May 25, 2021 | Corporate, Corporate Buzz

Raipur:(IANS) Adani Group on Monday said it has signed an initial agreement with the Chhattisgarh government to develop two critical projects in the state at an estimated cost of Rs. 25,200 crore.

Raipur:(IANS) Adani Group on Monday said it has signed an initial agreement with the Chhattisgarh government to develop two critical projects in the state at an estimated cost of Rs. 25,200 crore.

The two projects comprise of a coal to poly-generation (CTP) project and a rice-bran solvent extraction plant and refinery.

“Both these projects will not only enhance the economic growth of the state but will also create substantial employment opportunities for the people of Chhattisgarh,” state Chief Minister Raman Singh said in the statement.

According to the company, the CTP project, estimated at Rs.25,000 crore has a potential to generate 5000 jobs as well as substantial revenue for the state.

The second project comprising the rice-bran solvent extraction plant is estimated to cost around Rs. 200 crore and has the potential to generate more than 600 jobs in the state.

“These projects will help the state of Chhattisgarh strengthen its overall socio economic status,” said Adani Group chairman Gautam Adani.