By : Dr Shariq Nisar (www.shariqnisar.com)

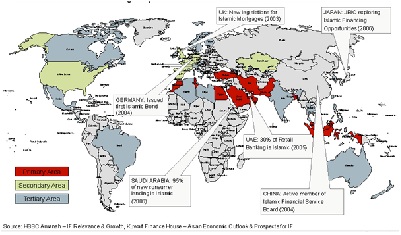

Islamic banking and finance, also known as Ethical banking, Shariah compliant banking, interest-free banking, PLS Finance or as Special Finance, has reached the shores of more than 75 nations of the world. Surprisingly the nations who have taken keen interest in promoting this concept also include hardcore secular and developed nations such as the UK, the USA, France, Germany, Singapore etc. Robust performance of Islamic banking and finance sector during the recent financial crises has added to its allure. Emergence of green and ethical movement has further contributed to the euphoria surrounding Islamic banking. IMF and the World Bank have come up with researches that find Islamic banking and finance more stable in comparison with the current form of banking practiced across the globe.

Many Muslim nations of the Middle East and Far East have made substantial progress in promoting Islamic banking and finance in their jurisdictions through favourable taxation and other policy supports. Western nations such as the UK and the USA, on the other hand promote Islamic banking through the slogan of “no favor but no discrimination”.

In our country too there has been demand for allowing Islamic Banking so that foreign institutions, especially those from the Middle East and Far-East can be encouraged to invest in the Indian economy. Another advantage sought in favor of Islamic Banking was financial inclusion of India’s largest minority which hitherto could not be achieved for various reasons, the most prominent among them being non-availability of products adhering to religious and cultural requirements of the community.

Taurus Mutual Fund was the first Mutual Fund in the country which launched a dedicated scheme for Shariah compliant investors. Prior to them Tata Mutual Fund had launched a scheme but they strategically refrained from making any explicit claim of Shariah compliance.

The real fillip to Shariah finance market in India came in 2010 when the BSE decided to launch a Shariah Index- in association with TASIS. During the same period Kerala government decided to promote an Islamic NBFC to promote infrastructural development in the state. Unfortunately both these event could not sustain the momentum as the market silently went into hibernation and the Kerala government got entangled with legal issues for its decision to promote an Islamic finance company.

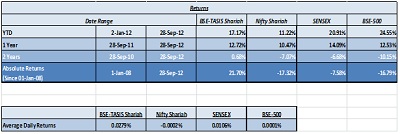

In the last few months however situation has started to change for good. Kerala government has won the case filed against it for promoting Islamic Finance in the state. BSE TASIS Shariah Index has outperformed most of the prominent indices in India (See the graph). Several other institutions in the country have come forward to launch Shariah compliant products. (please see the section Islamic Finance products in India) and most importantly RBI governor Dr D Subbarao has written to the government to do the necessary changes in the banking regulation to allow Islamic Banking in the country. Looking at Government’s current resolve to financial reform it is not unimaginable that government may come up with some sort of policy to allow at least Islamic NBFC in the country. And last but not the least let’s not forget that the next general election is not too far and the Government desperately needs something in its report card to show to the minorities that it has done something for them too.

What is Islamic Finance?

Islamic finance is a system of finance based on Islamic law, or Shariah. It aims to achieve economic and social justice in all financial matters. In contrast to conventional finance, Islamic finance takes into account the moral consequences of financial transactions, ensures that financial contracts are fair and equitable, and guarantees that financial rewards are correlated with the level of risk and responsibility borne by all parties – Islamic finance is commonly known as “ethical finance” or “participatory finance” for this reason.

What are the reasons for the Growth of Islamic Finance?

An industry on the horizon, Islamic finance has seen rapid growth in the past three to four decades. This growth can be attributed to a growing Muslim population, which is also the fastest growing consumer market, and the fact that Muslim-majority countries endowed with natural resources have very high liquidity. Islamic finance has also attracted and benefited from other groups such as international institutions that helped develop its regulations and improve its products and services. With the recent financial crisis, Islamic finance has gained even further momentum by attracting world-wide attention.

Islamic Finance Products in India

National Spot Exchange of India Ltd has received Shariah Compliance Certificate from TASIS for its platform for electronic trading of Gold, Silver, Copper, Lead, Zink and Nickel on Spot Basis.

General Insurance Corporation of India (GIC Re) has successfully completed third year of its operation in Shariah compliant Re-insurance (Re-Takaful). The company has started Retakaful operations from UAE and Malaysia.

Taurus Ethical Fund (TEF), India’s first shariah compliant scheme has performed relatively better than its peers.

Pure Stock Pension Fund (PSPN), this is India’s first shariah compliant scheme under the regulation of the IRDA. This is the only Pension scheme in India which is regularly audited for Shariah compliance. This scheme too has performed very well over the years.

Taurus Asset Management Company (TAMCO) in association with the Multigain Shariah Investment has launched a Shariah compliant PMS scheme named TM Shariah Strategy.

Secura India Real Estate Fund – India’s first Shariah Compliant Venture Capital Fund, approved by SEBI has completed its first scheme and now announced the launch of its second series.

BSE TASIS SHARIAH 50 INDEX

The launch of BSE TASIS Shariah Index has been one of the most happening news from India. Hardly any worthwhile publication of the world, be it from Australia or America to a small Island in the South of the Indian Ocean to the hinterland of China, could afford to miss this news.The important highlights of this Index areits methodology and performance in comparison with those of its peers. TASIS Shariah screening norms are most conservative and despite that index’s performance has been far superior. The third notable feature of this index is the 8% cap assigned to its constituents. This is India’s first cap weighted Index. Hence it is expected to display a reduced volatility.

Source: BSE TASIS Shariah 50 Index; Note: The performance given is this diagram is till the end of September2012.

Islamic Finance: Across the Globe

Islamic Finance: Global Asset

0 Comments