Net income of companies listed on the Saudi stock market totaled SR22.7 billion in the fourth quarter of 2013, taking the total earnings for the year to an all-time high of SR101 billion for the year, according to analysts and researchers.

The Tadawul All-Share Index (TASI) rose 74.5 points or 0.85 percent to close at 8,835.12 on Sunday.

Major gainers were petrochemical industries, real estate development, and banks and financial services.

“Listed companies have done very well in 2013 and net income exceeded the SR100 billion level for the first time and reached SR103 billion. This is very good news,” said John Sfakianakis, chief investment strategist at Masic in Saudi Arabia.

“Given the solid macro fundamentals and the additional liquidity that we continue to see, I won’t be surprised if TASI continues to show resilience,” he told Arab News. “It’s hard to know where the TASI will go from here but the prospects look bright. The month of January was solid given all the turmoil we have seen in emerging markets and the massive deleveraging that continues in many of these countries,” Sfakianakis added.

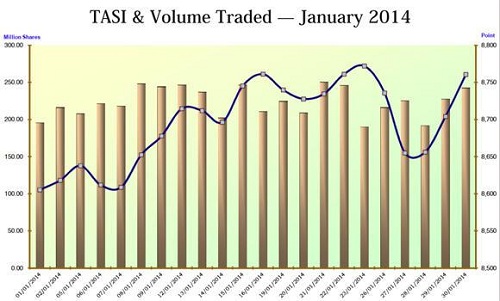

In January, the TASI closed at 8,760.62 points, gained 225.02 points or 2.64 percent over the close of December 2013. The index surged 24.38 percent in January compared to the same period of the previous year.

Highest close level for the index during the month was 8,771.99 as on Jan. 23.

According to the Tadawul’s Monthly Statistical Report for January, total equity market capitalization at the end of January reached SR1.80 trillion ($480.45 billion), increased by 2.79 percent over December 2013.

The total value of shares traded for the month of January 2014 reached SR139.25 billion ($37.13 billion), edged higher by 20.17 percent over the previous month.

The total number of shares traded reached 4.92 billion shares for the month of January compared to 4.33 billion shares traded during the previous month, increased by 13.54 percent.

The report said total number of transactions executed during January reached 2.54 million compared to 2.14 million trades for the month of December 2013, surged by 18.53 percent.

Jarmo T. Kotilaine, a regional analyst, told Arab News: “The overall health of the corporate sector is strong and the dynamics of the nonoil economy benign. After a couple of years of strong expansion, however, the rate of growth in many areas may begin to moderate somewhat.”

He said: “Bank lending growth is already moderating the rapid growth in government spending in recent years will, in purely relative terms, give way to somewhat more measured pace. Depending on the dynamics of the global oil market, the contribution of the oil sector could even be negative (if output cuts are required in response to production gains elsewhere).

“As we are anticipating more companies to be listed during 2014, Tadawul should enjoy more depth and breadth status which should create stability if not encouraging more traders to participate,” Basil Al-Ghalayini, CEO of BMG Financial Group, said.

“Furthermore, on the geopolitical front, in the event that the Syrian crisis is resolved, regional markets, including the Saudi one, should enjoy a bullish trend after waiting for so long for the last link of the Arab Spring chain to be finally concluded for good,” Al-Ghalayini added.

The Riyadh-based Jadwa Investment said TASI maintained its upward trend during January, buoyed by strength in global markets and strong domestic fundamentals, though it lost some momentum toward the end of the month as worries about emerging market economies weighed on investor sentiments. Volumes rose to a nine-month high in January.

Ten of the 15 sectors were up in January. “Performance was broadly in line with market perceptions of fourth quarter results. Two of the smaller sectors — media and publishing, and transport — recorded high gains. Disappointment about some fourth quarter results hit insurance, multi-investment and industrial investment,” Fahad M. Alturki, head of research at Jadwa Investment, said.

0 Comments