Have we learned lesson from Global Financial Crises !

Dr. ShaikhSaleem

(Director) Millennium Institute of Management Aurangabad.

RBI has released the guidelines for “Licensing of New Banks in the Private Sector” on February 22, 2013. The view that issuing new banking licenses to corporate houses will further financial inclusion, capital adequacy, independent governance and competitive business model is based neither on historical evidence nor on market logic. In the following article I have discussed the facts and figure to prove the point of view.

CAUSES OF GLOBAL FINANCIAL CRISES:

Many historic events are influenced by ideas, institutions, interest, individuals and integrity. The global crisis can be traced to the influence of all the five factors, though there could be legitimate disagreement about their relative contributions. There is a general recognition that several ideas governing economic policy and the conduct of the financial sector have influenced the direction of the events that led to the crisis.

INSTITUTIONS ROLE:

Institutions that were established over a period to ensure efficient and stable, economic and financial activity globally, could not, by and large, anticipate the crisis. At the global level, the International Monetary Fund (IMF), which is responsible for surveillance of economic and financial policies of countries, did not predict the crisis. While it referred to economic imbalances, it expressed itself strongly in favour of the strengths, resilience and positive contribution of the financial sector. The Financial Stability Forum (FSF) which was created after the Asia crisis of 1997 did not issue an alert about the threat to stability. The Bank for International Settlement (BIS) could not identify the onset of the crisis, though some research publications alluded to the evolving risks. Reports of the United Nations Department of Economic and Social Affairs (UNCTAD) did indicate the evolving risks in their publications, but they had no operational significance. The most influential group of the global economy, the G-7 /G-8 consisting of advanced economies, made occasional references to economic imbalances, but the financial crisis which was to originate from some members of this group was not perceived at all. The G-20, yet another group of twenty systemically important nations including emerging economies like China and India, created as a consequence of the Asian crisis of 1997, had not diagnosed the emerging risks in the financial sector. The international monetary system was described by some analysts to be a non-system prone to crisis, but the consequences of the state of affairs were not analysed in terms of their potential for a global crisis.

GOVERNMENTS ROLE:

At the national level, some governments, particularly in advanced economies, could have contributed to the crisis by a pursuit of relentless deregulation in the financial sector and competing for financial sector activities in a globalised financial market as a means towards higher growth. Most national governments did not see the impending crisis on the horizon. The central banks in most countries believed that could be evolving economic imbalances or risks in the financial markets, but that theses were best managed by market forces themselves. There are exceptions to this approach of benign neglect of booms by monetary and regulatory authorities. The European Central Bank (ECB) had expressed its concerns about possible vulnerabilities in the evolving global economies and the issue of potential financial instability and has also taken precautionary measures to minimize the impact of the crisis through preventive monetary and regulatory measures.

PRIVATE SECTOR ROLE:

It is noteworthy that the failure was not only in policy in the public sector, but also in the behavior of the private sector. Participants in financial markets, including large financial institutions, had not anticipated the crisis. In fact, there is a perception that they prevented authorities in public policy from taking acting to prevent a crisis and moderate adverse consequences if a crisis was to occur. The dominant market participants in the financial sector were the beneficiaries of the boom preceding the crisis and fervently resisted interventions to stem the boom. Professional bodies, such as Accounting Standard Boards (ASB)and Credit Rating Agencies (CRA), had also contributed to the crisis by not pointing out the practices that enabled and encouraged excesses in the financial sector. There are several layers prescribed under law and regulations to ensure sound governance practices, and these include the independent directors on boards, audit committees, internal risk management committees, etc. There was obviously a failure in the governance of all theses bodies designed precisely to avoid excesses that would impinge on society as a whole. It is thus clear that there was across-the-board failure of governance in public and private institutions, in global and national institutions, in academic bodies and professional institutions.

PHILOSOPHY OF DEREGULATION:

Powerful and vested interests also contributed to the crisis as is evident from several anecdotes and incidents. Professor JagdishBhagwati warned more than a decade ago of the existing nexus between Wall Street (financial markets) and Washington (governments) in the United States (US), reflecting the cosy relationship between the financial sector and political activity. This has been particularly evident in some of the advances economies where deregulation of the financial sector was initiated and reinforced through legislative changes, followed by regulatory policies consistent with the philosophy of deregulation. Some ofthe advanced economies were losing comparative advantage in agriculture, manufacturing and services to developing and Emerging Market Economics (EMEs), while they continued to have huge competitive advantage in the financial sector. Hence, some of these countries, in particular the US and the United Kingdom (UK), perhaps felt that national interest lies in their dominating financial sector activity, and hence development of the financial sector was coterminous with their national interests. This approach could have led to a race to the bottom in financial sector regulation within their jurisdictions. The cross-border financial arrangements could be particularly conducive to the influential interests since it was possible for them to take advantage of differences in tax regimes and regulations in the financial sector. These cross-border financial arrangements could be particularly conducive to the influential interests since it was possible for them to take advantage of differences in tax regimes and regulations in the financial sector. These cross-border operations could be undertaken by and through the globalised financial sector, especially international banks and their associates.

INDIVIDUAL GREED:

Individuals also make a difference to events as they unfold. There are many who attribute the deregulation in the US to President Reagan, who was followed by President Bush (Sr), President Clinton and President Bush (Jr). Chairman Alan Greenspan’s diagnosis of increased productivity in the US and his attitude to financial innovations such as derivatives and asset bubbles had a strong influence on the thinking in policy circles across the world. The UK showed a similar patterns during the prime ministerships of Margaret Thatcher and Tony Blair.

A recent documentary movie, written and directed by Charles Ferguson, title Inside Job, argues that the global economic crisis arose from a few thousand individual acts of craven self-interest, supported by regulation or lack of regulation. It argues that in many of these acts, there was a thin line between legality and outright fraud.

IMPLECATIONS OF NEW BANKING LICENCES

CORPORATE CONTROL

The heyday of corporate presence in banking was the period spanning from 1947 to bank nationalisation in 1969, when the skew in India’s banking development under the British in favour of the colonial government and British business at the expense of Indian capital was corrected and the banking sector came under the control of Indian business, excepting for the State Bank of India and its subsidiaries.

Immediately after India won Independence, the Imperial Bank of India that was subsequently nationalised to create the SBI accounted for close to a quarter of the deposits of the formal banking system. The cooperative banks accounted for another 6.5 per cent, leaving the rest with the private banks, domestic and foreign. This was followed by a period when a number of unviable banks that had come up in the inter-War period and during the Second World War failed or were amalgamated with others, resulting in a substantial reduction in the number of banks from 566 in 1951 to 210 in 1961 and 85 in 1969.

Among the banks that remained were those controlled by one or other business group. Examples are, Punjab National Bank, Universal Bank of India and Bank of Lahore by the Sahu Jain group; United Commercial Bank by Birla, Oriental Bank of Commerce by Thapar, Hindustan Commercial Bank by JuggilalKamlapat and Indian Overseas Bank by Muthia. Many of these banks featured among the top 20 of that time.

NATIONALISATION OF BANK

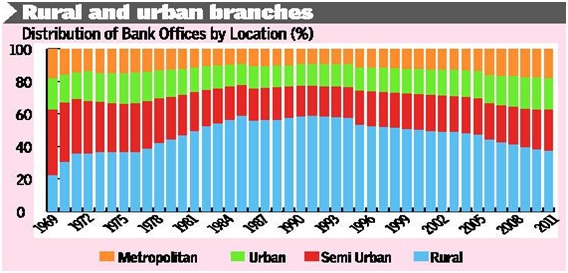

A corollary of this was the lack of any correspondence between the geographical distribution of bank branches and the population. At the end of the 1960s, when around 80 per cent of India’s population was located in rural areas, only 22 per cent of bank branches were in rural areas.

Further, the distribution of branches in semi-urban and urban areas was also skewed. There were as many as 617 towns without any commercial bank, of which 444 had no bank branch at all. This is not surprising. Out of 1,772 new branches established between 1959 and 1964, as many as 1,208 were in centres that were already banked. At the other pole, the five metropolitan centres (Ahmedabad, Bombay, Calcutta, Delhi and Madras) accounted for 18 per cent of bank branches, 46 per cent of total deposits and 65 per cent of bank credit.

After the nationalisation of 14 large commercial banks in 1969, things changed dramatically. There was a huge expansion in banking, with the population per branch falling from 37,000 at the end of 1972 to 18,000 at the end of 1981 and 14,000 by March 1991. Partly as a result of the creation of the category and the establishment of regional rural banks, the number of scheduled commercial banks rose from 74 in 1972 to 270 in 1990 (Chart-1).

Chart-1:

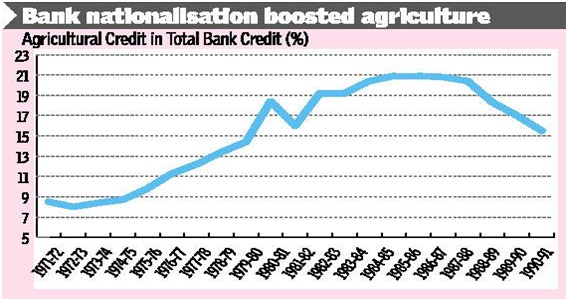

The share of agricultural credit in total non-food credit also rose sharply from 2 per cent before nationalisation to 8.5 per cent in 1970-71 and close to 21 per cent in the mid 1980s, before falling to 17 per cent by the end of the 1980s (Chart-2).

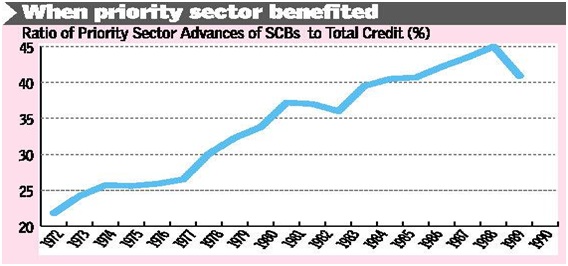

Small scale and other priority sector advances also rose, resulting in the increase in the share of priority sector advances in total credit from 22 per cent in 1972 to as much as 45 per cent at the end of 1980s (Chart-3). In sum, public ownership, the end of corporate control over banks and the turn to social control over banking resulted in dramatic progress in the direction of social inclusion.

Chart-3:

LIBERALISATION POLICY

The importance of the end of corporate control and turn to social banking comes through when we examine developments in the period after 1991, when financial liberalisation was begun, social control diluted and foreign and domestic private banks (though not corporate entities) were permitted to enter. The number of scheduled commercial banks that rose from 270 in 1990 to 302 in 1999 has since declined to 165 in 2011 as banks were closed on grounds of non-viability.

The axe fell more heavily on branches in rural areas, resulting in a decline in the share of rural branches in the total from 58 per cent in 1990 to 37 per cent in 2011. The population per bank branch rose from 13,700 in 1991 to 15,200 in 2001 and close to 16,000 by the end of the first decade of this century.

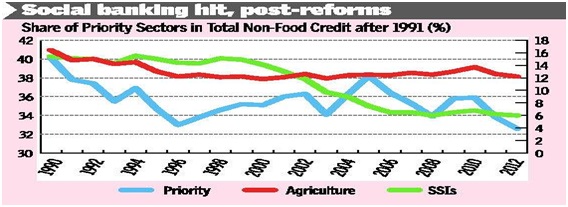

The impact of the turn to private initiative and away form social banking principles was visible also in a decline in the share of priority sector advances in total non-food credit, from 40 per cent in 1990 to 33 per cent in 2012.

The figures for the shares of agriculture and the small-scale industrial sector were 16.4 and 15.4 in 1990 and 12.2 and 6 per cent in 2012, respectively(Chart-4).

Chart-4:

RISK OF CRONY CAPITALISM

Members of the Parliamentary Standing Committee on Finance quizzed the RBI chief on central bank’s guidelines for awarding new bank licences.The members wanted to know how the RBI proposes to prevent diversion of funds by industrial houses owning banks. The members wanted to know how the RBI proposes to prevent diversion of funds by industrial houses owning banks to their own companies and prevent crony capitalism, citing example of coal and telecom sectors. Some members cautioned the RBI against adopting auction route for grant of bank licences, arguing that it could encourage industrial houses with doubtful credentials to obtain licence.The issue of Cobra Post expose with regard to allegations of money laundering by ICICI Bank, HDFC Bank and Axis Bank was also raised during the meeting.The RBI found them guilty and fined them.

OTHER ISSUES:

Conflict of interest, concentration of economic power, likely political affiliations, potential for regulatory capture, governance and safety net issues are the main concerns. Despite stringent guidelines, considerable bank credit is being siphoned to real estate by the borrowers, which is causing concern to the regulator. Added to this, the aspirants of new banks either have direct exposure to real estate or through group entities which may jeopardize the interest of the financial system and the public at large.

The entry of Private Sector Banks forced the PSBs to pay focused attention on customer service to sustain and grow further in the present competitive environment. However, PSBs are constrained to function in uneven level playing field since they continue to balance both commercial element and social cause. In such a scenario, opening of new banks may lead to further drift in clientele base (high-value) and market share of PSBs.

As per the existing guidelines, new private sector banks are expected to meet priority sector lending target (40 percent of net bank credit) as applicable to domestic banks and further they need to meet the branch expansion criteria i.e. opening of 25 percent of its branches in rural and semi-urban areas to achieve financial inclusion and thereby inclusive growth.

The million dollar question is – how the new banks are going to accomplish the desired branch expansion and inclusive growth when the performance of the existing private sector banks itself is far from satisfactory. Of late, some private banks are contemplating to achieve the task by adopting the strategy of Branchless Banking through Business Correspondent (BC) /Business Facilitator (BF) model.

CONCLUSION:

Thus the changes prior to and after 1969 and prior to and after 1990 establish quite clearly that corporate exclusion, public ownership and social control are crucial for financial inclusion and the dilertion of public control aggravatesexclusion.

The prudent banking practices adopted by Public Sector Banks and the moderate protective measures initiated by the regulator has enabled the Indian Banks to insulate from contagious effects of global financial crises. In the post global financial crisis, many central banks across the world shifted their focus and are now moving to protective environment by providing government support to the failed/tainted Private Sector Banks for survival and to face the emerging challenges. Surprisingly, India is opening doors to Private Banks in the financial sector.

A cautious approach needs to be adopted by the regulator with regard to allowing permission to new entities to set up Banks in India in the light of the recent financial crises across the globe causing tainted assets, regulatory failures and non-compliance of Basel norms.

REFERENCES:

- 1. RBI Guidelines for issuing of new banks in the private sector, February 22 2013.

- 2. Deloitte report on RBI Guidelines for new private banks opportunities and challenges.

- 3. The Hindu, Business Line April 16 2013

- 4. A book on Global Crises Recession and Uneven Recovery by Y.V.Reddy.

0 Comments