Jeddah: Peace, followed by infrastructure investment, should be given priority for recovery from the ill-effects of the Arab Spring that swept the Middle East-North Africa (MENA) region in recent years.

Jeddah: Peace, followed by infrastructure investment, should be given priority for recovery from the ill-effects of the Arab Spring that swept the Middle East-North Africa (MENA) region in recent years.

This positive outlook emerges in the context of the International Monetary Fund (IMF) report released Friday, which has painted a grim picture as a result of the region’s conflicts which in turn have created daunting economic challenges as well as the refugee crisis.

Nose-diving growth, soaring fiscal imbalances and decimated labor markets across the region call for newly concerted efforts from donor countries and coordination among humanitarian aid groups and development bodies, said the report, released ahead of a United Nations summit on the refugee crisis.

IMF Managing Director Christine Lagarde said, while the world’s attention had been drawn to the humanitarian impact of wars, economic disasters were also unfolding.

“Much of the productive capital in conflict zones has been destroyed, personal wealth and income losses are enormous, and human capital deteriorates with the lack of jobs and education,” she wrote in a blog post accompanying the report.

The UN General Assembly on Monday is due to hold a high-level summit to coordinate international responses to the refugee and migration crisis.

The IMF report followed Thursday’s release of World Bank research, which said the burden of large numbers of refugees and displaced persons was largely borne on the shoulders of poor countries, a fact that likewise called for coordination between humanitarian and development aid policies.

“Peace, followed by infrastructure investment has to be the priority. Only then can you create a platform for recovery.

The medium to long term education is the key,” said James Reeve, deputy chief economist and assistant general manager at Samba Financial Group. “There are no simple answers because sectarian hatred, which is at the heart of the conflicts, is deep rooted.”

Reiterating that war and population displacement are never helpful for economic development, John Sfakianakis, director of economic research at the Gulf Research Center, said: “If falling oil prices and near stateless conditions are added to the mix of challenges, then it becomes hard to expect economic opportunities to abound. Falling oil prices hurt some more and others less yet violence and war impact deeply those involved.”

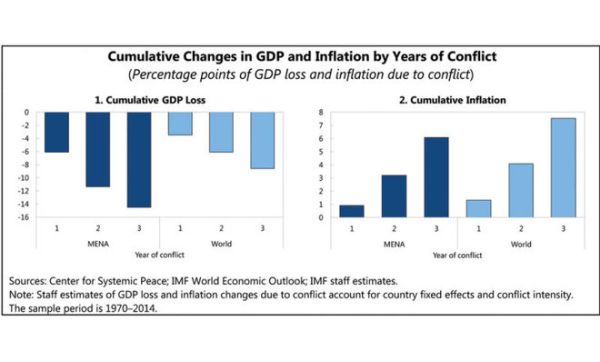

MENA’s recent conflicts have slashed economic growth to such an extent that Syria’s GDP in 2015, after four years of fighting, accounted for less than half of its pre-conflict level in 2010.

Yemen lost an estimated 25-35 percent of its GDP in 2015 alone, while in Libya, where dependence on oil has made GDP growth extremely volatile, GDP fell by 24 percent in 2014 as violence picked up.

West Bank and Gaza offers a longer-term perspective on what can happen to growth in a fragile situation. Furthermore, these conflicts have led to high inflation and exchange rate pressures.

In Iraq and Afghanistan, inflation peaked at more than 30 percent during the mid-2000s, and in Yemen and Libya at more than 15 percent in 2011, on the back of a collapse in the supply of critical goods and services, combined with a strong recourse to monetary financing of the budget.

Syria is an even more extreme case, where consumer prices rose by more than 300 percent between March 2011 and May 2015.

Conflicts in MENA countries also had economic impact on their neighbors.

In Jordan, the conflicts in neighboring Syria and Iraq slowed down economic growth by about 1 percentage point in 2013.

Meanwhile, despite the slowdown in growth, core inflation accelerated in 2014 to 4.6 percent, from 3.4 percent in 2013, initially mostly driven by rents, partly reflecting additional demand from the country’s large refugee population and a limited short-term supply response.

Similar dynamics were at work in Lebanon, where GDP growth slowed to 2.8 percent in 2012 and 2.5 percent in 2013 from an average of 9 percent in 2007-2010.

The IMF said that since the middle of the 20th century, the MENA region has experienced more frequent and severe conflicts than any other parts of the world.

Conflict has pushed countries like Iraq, Libya, Syria, and Yemen “further into fragility, erasing previous development gains for a whole generation.”

(Credit: Arab News)

0 Comments