MCX bullion MARKET ANALYSIS WEEKLY ANALYSIS (23/06/2014 TO 27/06/2014)

By A.R.BASHA

Global impacts:

Gold and silver prices has raised due to global queues of uncertainties in Middle East, Federal keep the rates lower for long term and fall of US dolour 4.5 bps drop would impact future contract President Obama’s decision to send some soldiers to Iraq as “military advisors” may also have had something to do with it. In the background, the unwind of China’s commodity financing deals may be helping to boost the price of gold as Chinese speculators sell their physical gold and at the same time buy back their hedges in the futures market. This mechanism assumes that the paper market dominates the pricing of gold rather than the physical market, which seems possible given the difference in volumes. The effect would probably be the opposite in other commodity markets affected by the Chinese financing deals however, such as iron ore and copper which was happened earlier.

In CoT historical volatility report silver exchange traded funds (ETFs) have seen a net inflow of 1.6% so far this year, while gold ETFs have seen a net outflow of 2.8%. That suggests retail is still bullish on silver, which may provide an underpinning of demand for the white metal.

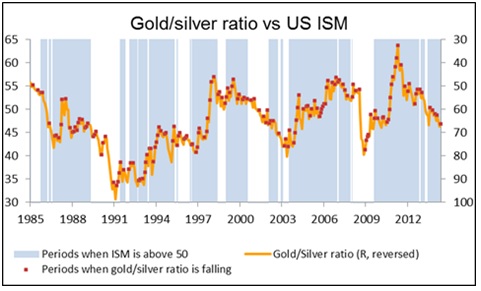

Finally, it’s usual for silver to outperform gold when US manufacturing is expanding, as shown by the Institute of Supply Management (ISM) index being above 50. That’s because silver has many more industrial uses than gold does.

My opinion is by seeing all this factors if tension increased in Iraq that will impact the gold and silver price in fact silver will outperform the Gold.

India Analysis:

1. WPI Inflation Up to 5-Month High

2. Consumer Inflation Declines in May

3. Holds Policy Rate at 8%

4. Economic Growth Decelerates in Q1

5. WPI Inflation Slows in April

6. Consumer Inflation Up to 3-Month High

7. Wholesale Inflation Up to 3-Month High

India Wholesale Inflation Slows for 3rd Straight Month

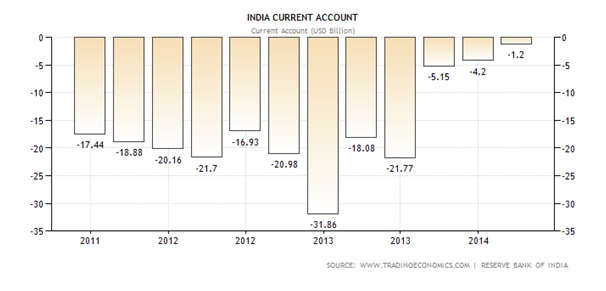

Strengthening of USD against rupees 4th straight week .CAD Deficient has been lower than since 2011 other factors flatten the Indian Rupee.

Let me go to the technical point of view analysis.

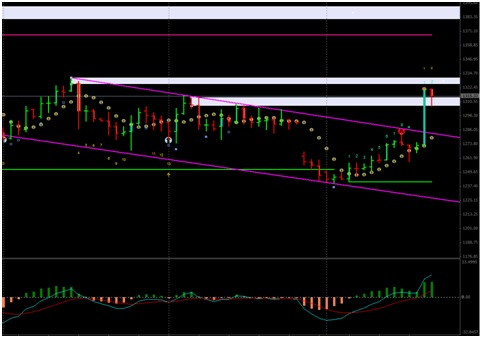

In studying about gold chart market broken important resistance line and retraced for the current move.

Gold current range is 1318 to 1334. Breaking upside the market will be reach to next resistance point to 1381.

Gold Mcx: breaking above 27900 then it will reach to 28850.

Silver will reach 47460 next target would be 51426.

0 Comments