MCX Bullion market Analysis for the week (16/6/2014 to 21/06/2014)

By R. M.Basha

Silver Analysis:

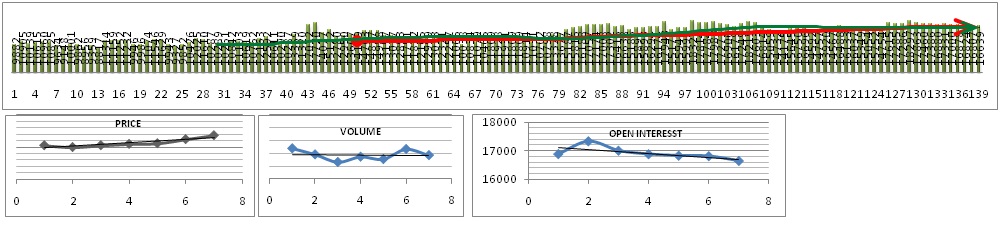

Silver market in Mcx last week has been appreciated 4.24% which is highest since February 2014.Silver(USD) appreciated 4.09%

What is favouring for the market is

1. High volume

2. Incresed in open interest

3. Broken important supply line

4. Demand increased (Based on Equilibrium of Index Analysis)

Our expectation for next week silver remains bullish. Expecting silver at Mcx can go up to 42800 there is multiple resistance from 42800 to 43200 levels

Range resistance in Silver -USD at 20.16 and 20.39.

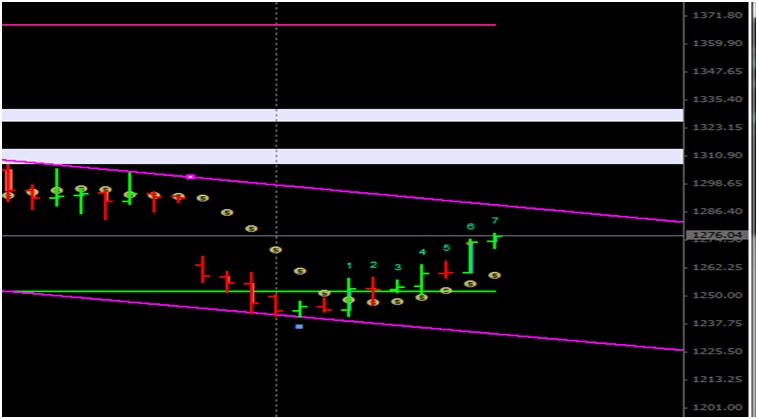

T.M. count for Friday was 7 which means Monday must be a bull trend. Tuesday or Wednesday will be a bullish reversal is highly possible .there after countdown will start.

When we are looking at last 100 days trend: price ——-up , volume —-average , open interest —–average

Last 7 days open interest has been dropping at higher levels which mean the institutional investor not holing their position at higher prices.

A short term bullish runs going to exhaust at 42800 levels. (Wednesday may be a bearish engulfing)

A sudden increase of volume and open interest could take the market into higher level but retracement is expected before it.

GOLD ANALYSIS

Gold is also following silver .Above chart show how exactly resembles silver .same kind of resistance has been visible in gold .market can go to 1290 and resistance at 1310.

Please read the risk disclaimer carefully: These reports and analysis are published for educational purposes only and should NOT be taken as instructions to buy or sell any commodity. THESE SERVICES ARE INSTRUCTIONAL ONLY AND DESIGNED TO FAMILIARIZE MEMBERS WITH HOW AND WHEN TRADES ARE TAKEN BY A PROFESSIONAL TRADER. All Trading involves risk. Leveraged trading has large potential rewards, but also large potential risk. Be aware and accept this risk before trading. Never trade with money you cannot afford to lose. All forecasting is based on statistics derived from past performance of any trading methodology is no guarantee of future results. No “Safe” trading system has ever been divided and no one can guarantee profits or freedom from loss. Before you make any investment or trading decisions, you should carefully inform yourself about the opportunities and risk. Apart from the financial aspects, this might also include the fiscal and legal ones. Please particularly note that the past performance of a trading system or trading strategy is not indicative of future results. Please do not recreate and copy these materials.

0 Comments