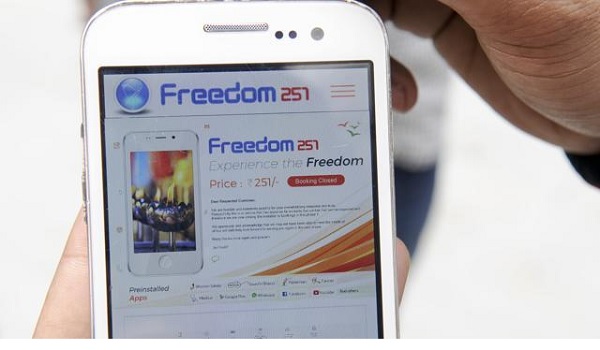

New Delhi : (IANS) As the makers of world’s cheapest Rs.251 (less than $4) smartphone went gaga over being part of Prime Minister Narendra Modi’s “Make in India” and “Digital India” initiatives in last few days, a top government official clarified on Thursday that the government has nothing to do with “Freedom 251” smartphone.

New Delhi : (IANS) As the makers of world’s cheapest Rs.251 (less than $4) smartphone went gaga over being part of Prime Minister Narendra Modi’s “Make in India” and “Digital India” initiatives in last few days, a top government official clarified on Thursday that the government has nothing to do with “Freedom 251” smartphone.

“This is not a government project. ‘Make in India’ team has nothing to do with this,” wrote Amitabh Kant, secretary of department of industrial policy and promotion (DIPP), in a Twitter post.

The tweet comes on the heel of the fact that the government is already keeping a close watch on “Freedom 251” and its Noida-based maker Ringing Bells Pvt. Ltd.

On February 23, Communications Minister Ravi Shankar Prasad said his department is keeping a close watch on Ringing Bells. The minister said the Department of Telecommunications has inquired whether the company can provide phones at such a low price, which works out to less than $4.

“This was done to ensure that there are no discrepancies later. If there are any, we will take action as per the law. Our department is keeping a watch,” Prasad said in New Delhi.

Earlier, informed sources told IANS that the telecom ministry has done an internal assessment on viability of the handset ‘Freedom 251’ and found such a device cannot be offered for not less than Rs.2,300-2,400.

Ringing Bells has promised to deliver 25 lakh handsets by June 30.

In an earlier chat with IANS over phone, Ringing Bells president Ashok Chadha said the company will hand over 25 lakh “Freedom 251″ phones to the people who have registered for it online.

“I am hopeful that we will be able to start delivery latest by April 10 and finish well before the June 30 deadline,” Chadha told IANS.

According to Chadha, the company is looking to set up two more units – one each in Noida and Uttarakhand. But how fast the company is going to start the manufacturing and churn out devices is a big question.

Chadha said that while the manufacturing cost of the phone is high, it will be recovered through a series of measures like economies of scale, innovative marketing, reduction in duties and creating an e-commerce marketplace.

However, how well is the little-known firm placed to achieve this task is not yet clear.

Taking the world by surprise, the company launched “Freedom 251” smartphone last week that, it said, has been developed “with immense support” from the government.

There are, however, some apprehensions about its final appearance and performance.

The Indian Cellular Association has also written to the telecom ministry, urging the government to get to the bottom of the issue as selling a smartphone this cheap is not possible.

0 Comments