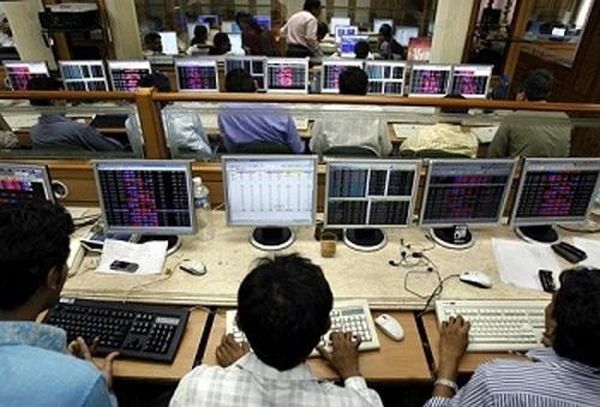

Mumbai : Key Indian equity indices on Tuesday fell from their record high levels to close on a flat-to-negative note as investors booked profits in metals, automobile and IT stocks.

Mumbai : Key Indian equity indices on Tuesday fell from their record high levels to close on a flat-to-negative note as investors booked profits in metals, automobile and IT stocks.

According to market observers, mixed global cues, coupled with heavy selling pressure in index heavyweights like Infosys, Mahindra and Mahindra (M&M), Tata Steel, State Bank of India (SBI) and Tata Motors, among others, added to the losses.

The broader Nifty50 of the National Stock Exchange (NSE) closed lower by 28.35 points, or 0.27 per cent, at 10,335.30 points.

The barometer 30-scrip Sensitive Index (Sensex) of the BSE closed at 33,213.13 points — down 53.03 points or 0.16 per cent.

The Sensex touched a high of 33,294.30 points and a low of 33,164.28 points during the intra-day trade.

However, the BSE market breadth was slightly bullish — 1,398 advances and 1,320 declines.

The broader market indices outperformed the BSE Sensex. The S&P BSE mid-cap index closed higher by 0.14 per cent and the small-cap index by 0.46 per cent.

“Markets corrected on Tuesday after the Nifty touched life highs in the previous session (on Moday). The indices had opened lower in the morning on the back of mixed Asian markets and a negative closing for the US markets overnight,” Deepak Jasani, Head – Retail Research, HDFC Securities, told IANS.

On Monday, the key indices scaled fresh highs, both on closing as well as intra-day basis.

The Sensex closed at a fresh high of 33,266.16 points, after touching a record high of 33,340.17 points intra-day, while the broader Nifty50, which touched an intra-day record high of 10,384.50 points, closed at a new high of 10,363.65 points.

“Major Asian markets ended on a mixed note, while European indices like FTSE 100 and CAC 40 traded higher,” Jasani added.

Vinod Nair, Head of Research, Geojit Financial Services, said: “Markets ended on a negative note after a volatile trade due to strong resistance around recent high and profit booking in PSU banks and metal stocks after the recent solid performance.

“The domestic macros remain positive supported by ample reforms and good Q2 results so far, while rising oil price in the global market and tomorrow’s (Wednesday) FED policy influenced domestic market to take a wait and watch approach.”

On the currency front, the rupee strengthened by 10-11 paise to close at 64.75 against the US dollar from its previous close at 64.85-86.

“Indian shares fell on Tuesday, retreating from record highs hit in the previous session, as recent outperformers such as SBI fell, while Infosys dropped after going ex-dividend,” Dhruv Desai, Director and Chief Operating Officer of Tradebulls, told IANS.

“Government’s measures on bank recapitalisation, infrastructure, and crop prices, coupled with domestic flows, would support India stocks even as downgrades in earnings continue,” he added.

Sector-wise, the S&P BSE metals index declined by 264.53 points, followed by automobile index by 104.34 points and IT index by 66.72 points.

On the other hand, the S&P BSE consumer durables index rose by 139.98 points, banking index by 69.52 points and realty index by 67.73 points.

Major Sensex gainers on Tuesday were: Axis Bank, up 8 per cent at Rs 523.05; ONGC, up 2.38 per cent at Rs 191.10; Bharti Airtel, up 0.98 per cent at Rs 497.65; Hero MotoCorp, up 0.63 per cent at Rs 3,854.75; and Wipro, up 0.39 per cent at Rs 294.35.

Major Sensex losers were: Infosys, down 2.43 per cent at Rs 921.65; M&M, down 2.14 per cent at Rs 1,345; Tata Steel, down 2.11 per cent at Rs 703.65; SBI, down 2.02 per cent at Rs 305.80; and Tata Motors, down 1.66 per cent at Rs 428.55.

—IANS

0 Comments