By Syed Zahid Ahmad Alig

Earnestly the Modi Government needs pure Welfare Economist to guide the nation by framing such a budget that promises to –

- Control inflationary pressures

- Put the growth rate at higher trajectory

- Generate more employment and income opportunities

- Fetch more export opportunities

- Make Rupee stronger in terms of dollar

- Continue the relieves the public deserving subsidies in petrol, gas and food grains

- Assure relief in tax reforms

Interestingly all the above expectations can be fulfilled if the Government seeks views and opinions from expert Welfare Economist who in turn could suggest the Government to reduce the burden of public debt and invite more investments for infrastructure development by mode of equity, lease finance and advance purchase etc. instead of just seeking loans from open market to match the deficit budget.

With raised demand for more flagship programs like right to work, right to education and Food security etc., the new Government would require more funds to spend for welfare of the people. Simultaneously the demand of infrastructure development to facilitate economic growth of the country, would add pressure for more funds. When demand of funds of development works clubbed with relief and welfare of people, the sought amount surpasses the total receipts by the Government. Thus the Government seeks market loans to meet extra demand. This continued process of seeking market loans to meet budgetary gap has caused the Central Government to take market loans worth more than three times of annual income and expenditure budget. There could be many financiers lining up to extend loans to the new Government for financing public budget; but the Government need to review the impact of excessive market loans compared to total receipts.

Sources: – http://www.finmin.nic.in/stats_data/monthly_economic_report/2014/indapr14.pdf

Sources: – http://www.finmin.nic.in/stats_data/monthly_economic_report/2014/indapr14.pdf

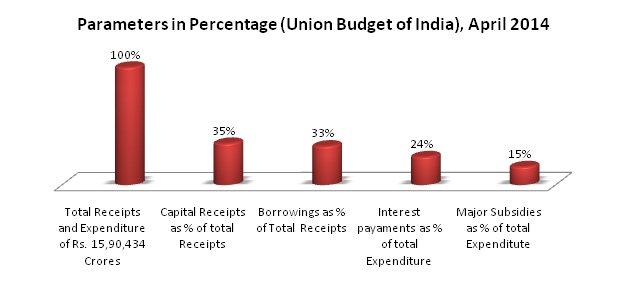

Looking into the above figures drawn up from monthly report for April 2014, we can see that we need to pay 24% of total receipts as interest payment and left with mere 76% of total receipts to repay borrowed loans and make other expenditures. Ultimately the Government may not find it comfortable to spend more than 15% of total receipts on welfare of public by subsidizing the necessities. It has declined the capacity of the Government to spend for Welfare of the poor people. How can the Government repay the outstanding loan and incur other welfare expenditure in a situation where the total debt pressure has already crossed three times to total annual receipts in 2014-15?

The NDA government needs to draw more and more equity funds for infrastructure development so as to reduce the burden of interest payment and debt finance at one hand and facilitate infrastructure development without interest burden on the other. This could be done by inviting private players to fetch equity funds from domestic and international market. Government should expand the structure of Foreign Investment Promotion Board by adding private players into it.

By spending 24% on total receipts to pay interest on borrowed loans compared to 15% for subsidies, the UPA Government failed to serve to the people of India. Their budgets were more considered as opportunities to make money by those money lenders who borrow money from market like US at 2% p.a. and lend to Indian Government at minimum 8% p.a.. This lobby with support of planning commission have been looting Indian Government and burdening Indian public with increased tax slaps and interest burdens ultimately pushing the public into inflation and poverty.

With inducement of more private equity players to finance our infrastructure development projects, the demand for market borrowing would be reduced to an extent that we may feel ease in fiscal deficit. The lesser market borrowings and more equity financers in union budget would certainly allow India manage fiscal deficit, restructure the tax rates to defuse the inflationary pressure and boost the growth of income and employment opportunities.

With less pressure to repay interest and principle over borrowed loans, the Government may be in a position to visualize subsidized and granted schemes for welfare of poor deserving Government support. Government may bring Good Days (Ache Din) for the people of India if succeed to manage fiscal deficit with balance in equity and loan funds for development and welfare projects.

Hope the Modi Sarkar will change the situation to bring Ache Din.

0 Comments