Of late it has begun to dawn on the Muslims of the sub continent to do money transactions according to Islamic Shariah where interest based transactions are proscribed. Though, the clergy too remained mired in a confused state vis a vis the current banking system which runs on interest-based profits. Lack of alternative has made them and vast majority of Muslims to crowd round such banking and financial institutions. Peeved by the ongoing ‘interest’ menace, Dr. Mohamed Sayeed Shingeri MBA, Ph.D. (Halifax University in the state of Wyoming, USA) had established The Taqwa Credit Cooperative society Ltd on October 4, 2015.

The Taqwa Credit Cooperative Society Ltd, known as “Taqwa Financial services” has been a frontrunner for interest-free banking system. It is an immutable part of the Taqwa Islamic Banking Services. The registered Head Office is in Bhatkal, Karnataka. It represents the Islamic financial Model in Kernataka.

After a successful operation in Bhatkal, Taqwa obtained the license for the state of Karnataka and established their first Corporate office and second Branch in Jayanagar Bangalore on March 24, 2018, successfully. Taqwa has now obtained NOC from RCS Karnataka for Multi-state license of six states namely; Tamil Nadu, Andhra Pradesh, Kerala, Goa, Maharashtra and Telangana for which operational procedures are under process to receive permission from Centre in New Delhi.

Dr Mohamed Sayeed Shingeri – The pioneer

Dr. Mohamed Sayeed Shingeri MBA, Ph.D. from Halifax University in the state of Wyoming, USA is the pioneer in the field of establishing interest-free Islamic banking system in India. Born on Oct 1, 1955 in Bhatkal, Karnataka, India, he authored two priceless books on Islamic Banking.

Worked for over two decades in Multinational Banks and acquiring rich experience in banking management, Shingeri was the head of the ‘Unit Financial Control’ in the Royal Bank of Canada, besides holding senior position in the National Bank of Abu Dhabi (Islamic Banking) as its head of ‘Policies and Procedures” for three odd years. He had been extensively researching in the field of Islamic banking for 30 years guided fully by the highest Shari’a Authority of India Qazi Moulana Mujahidul Islam Al Qasimi and Moulana Abul Hasan Ali Nadvi.

A man of letter

Dr Shingeri has authored numerous books on Islamic Banking. His recent treatise on “A Practical Model of Islamic banking” has been well received. The book has been published by White Paper Publications, Mumbai.

He worked for Multinational banks and gained rich experience of 3 decades in banking in Islamic countries. He has extensively done research in the field of “Islamic Banking and Finance” along with the highest Shari’a authority of India, late Qazi Moulana Mujahidul Islam Al Qasimi.

He delivered lectures on various aspects of Islamic Banking and participated in several conferences across the World.

‘Only Islamic model can replace the Jewish-controlled interest-based financial system’

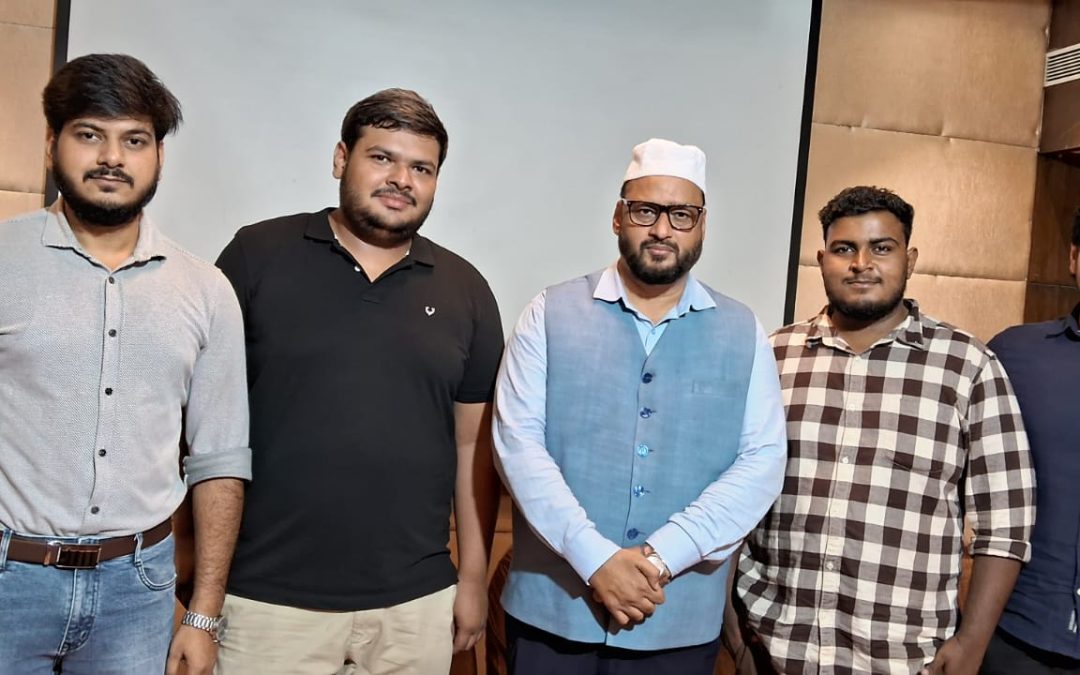

A day-long programme has been held in Bhatkal recently, where the dignitaries delivered speeches on varied shades of Islamic financial model. Speaking on the occasion, Moulana Mufti Atique Ahmed Darul-Uloom Nadwatul Ulma, stressed on the need of popularizing Islamic banking model and held ‘Jewish orchestrated interest-based financial system’ for the current global financial crisis. He said it’s only the Islamic model that has the potential to replace the current ‘interest-corroded model’.

The president of the Cooperative society, Dr. Mohamed Sayeed Shingeri, while calling it ‘a people’s Cooperative society’, said initially the society had been registered as a district cooperative society which has now acquired the state-level status due to increased consumer ships.

0 Comments