by admin | May 25, 2021 | Commodities, Commodities News, Corporate, Corporate Governance, Economy, Markets, News

By Bappaditya Chatterjee,

By Bappaditya Chatterjee,

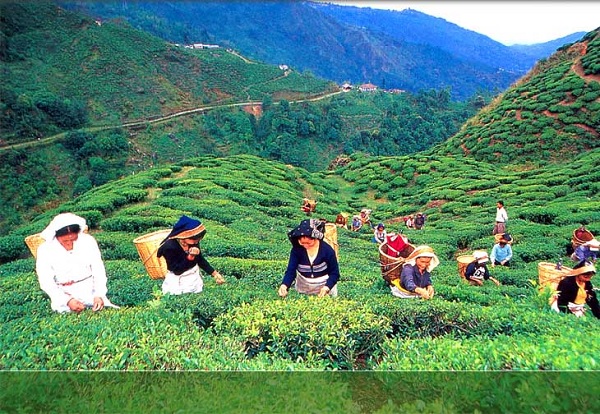

Kolkata : Amid stagnating prices of tea in auctions, the central government is looking at the “imperfection” of the primary market as it aims to bring more efficiency in the system after sellers and buyers of the crop raised issues of operational difficulties along with relatively higher transaction costs involved in the entire process, stakeholders say.

“The (Union) Commerce Ministry has constituted a committee consisting of industry stakeholders to study ways to ensure rejuvenation of the tea sector. This committee will look at all the sectoral issues relating to production, labour welfare, primary markets, marketing, generic promotion, consumer safety, exports and R&D,” Tea Board India Chairman P.K. Bezbaruah told IANS.

“The ministry and Tea Board are also looking at primary market (auction) imperfections and possible manipulation of the market by large oligopsonists, as auction prices are flat for the last 5-6 years,” Bezbaruah, the first industry representative to head the regulatory body, added.

The auction data suggests that about 272.2 million kgs of tea was sold at an average price of Rs 132.62 per kg from January 1 to July 28 this year.

In 2017, the total tea sold in the six operational auction centres located in Kolkata, Guwahati, Siliguri, Kochi, Coonoor and Coimbatore was 591.08 million kgs, with the average price of Rs 134.36 per kg, while the quantity sold in the primary markets was 505.77 million kgs in 2016 at an average price of Rs 135.36 per kg.

Union Commerce Secretary Rita Teaotia had recently pointed out that India’s tea auction platforms “have not had the kind of acceptability” they should have.

She also cited that as the reason for 100 per cent tea not coming to the auctions.

Teaotia had requested Tea Board officials to look at the acceptability of auction platforms and how they can be revamped so that everybody buys through them.

She had also requested the industry to find out ways to make platforms better because they are for the industry to serve its purpose.

However, Indian Tea Association Chairman Azam Monem said when the electronic auction was introduced, the pressing need was to convert the public outcry auction system into a digital platform, make it paperless and lower the transaction costs.

But the issue of transaction cost, involving everything from administrative costs right up to warehousing, logistics, sampling, freight and the like, were “not addressed”, he said.

“We are discussing with the government and the Tea Board in terms of policy (for the auctions). The transaction cost issues for e-auctions have to be addressed and the cost needs to be brought down. Otherwise, it is becoming expensive for producers. There could be, on an average, additional cost of Rs 8-10 a kg for selling through the electronic auction channel,” Monem told IANS.

“We have said that the auction process has to be completely revamped so that it becomes an effective tool for usage. If you make it efficient to achieve good prices, then there should be no reasons for producers not to opt for it,” he added.

Calcutta Tea Traders’ Association Chairman Anshuman Kanoria also said the current auction system is “outdated” and “not so efficient” as it involves “high cost and longer lead time for sale”.

He also alleged that “auction centres become the dumping ground of relatively poor quality tea”.

“The current system of auctions is not viable in terms of competition. People are selling good quality tea privately and there is no law to force them to sell tea through the auction system. Prices in the auctions do not truly reflect the market because relatively poor quality of tea is being sent to centres,” Kanoria contended.

“The price in auctions must be increased by bringing more competition. In a recent meeting with Tea Board officials, we have requested that the format must be changed in order to revamp it. And with the revamped system it should be made compulsory to sell a certain level of tea through auctions, if not 100 per cent,” Kanoria told IANS.

However, producers said there is “no need for any diktat or ordinance” to sell through auctions as they do not prefer to do so because of “the prohibitive cost” and the delay in realisation.

“Around 50 per cent of the tea is sold privately because producers opted to save costs and get better price and remuneration. The current e-auction system is not able to generate the better price because of the procedural and logistical issues, along with financial implications. Also, the time is also limited for the fair price discovery,” Monem added.

(Bappaditya Chatterjee can be contacted at bappaditya.c@ians.in)

—IANS

by admin | May 25, 2021 | Business, Commodities, Commodities News, Economy, Emerging Businesses, Large Enterprise, Markets, News

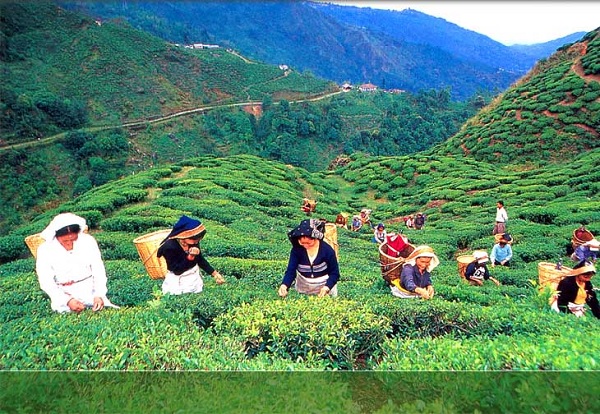

Rome : Global tea consumption and production will keep rising over the next decade, driven by robust demand in developing and emerging countries, notably China and India, according to a new report by the United Nations Food and Agriculture Organisation Intergovernmental Group.

Rome : Global tea consumption and production will keep rising over the next decade, driven by robust demand in developing and emerging countries, notably China and India, according to a new report by the United Nations Food and Agriculture Organisation Intergovernmental Group.

Tea consumption has grown particularly rapidly in China, India and other emerging economies, driven by a combination of higher incomes and efforts to diversify production to include speciality items such as herbal teas, fruit fusions and flavoured gourmet teas, according to the report.

The buoyant tea market will create new rural income opportunities and improve food security in tea-producing countries, it said.

The report, which was finalised in China’s Hangzhou suggests that tea consumption has also benefited from increased awareness of the beverage’s anti-inflammatory, antioxidant and weight loss effects.

“Such health and wellbeing benefits are seen as the key drivers of future consumption growth,” FAO said.

World production of black tea is projected to rise annually by 2.2 percent over the next decade to reach 4.4 million tonnes in 2027, reflecting major output increases in China, Kenya and Sri Lanka – with this China would reach the output levels of Kenya, the largest black tea exporter in the world, the report forecasts.

Global output of green tea is foreseen to increase at an even faster rate of 7.5 percent annually to reach 3.6 million tonnes in 2027, largely driven by China, where the production of green tea is expected to more than double from 1.5 million tonnes in 2015-2017 to 3.3 million tonnes in 2027.

The report also warns that tea production is highly sensitive to changes in growing conditions.

“Tea can only be produced in narrowly defined agro-ecological conditions and, hence, in a very limited number of countries, many of which will be heavily impacted by climate change,” FAO said.

Changes in temperature and rainfall patterns, with more floods and droughts, are already affecting yields, tea product quality and prices, lowering incomes and threatening rural livelihoods. These climate changes are expected to intensify, calling for urgent adaptation measures. In parallel, there is a growing recognition of the need to contribute to climate change mitigation, by reducing carbon emissions from tea production and processing.

The report urges tea-producing countries to integrate climate change challenges, both on the adaptation and mitigation front, into their national tea development strategies.

Global demand for tea is also benefiting from a new clientele. Young urban consumers in large producing countries like China and India have emerged as the fastest growing segment, eager not only to pay a premium for specialty teas but also curious to know more about the product they consume – its quality, origin and contribution to sustainable development.

Young, upper-middle class consumers are looking for fashionable products to be integrated into their lifestyles, which now also includes gourmet quality tea, and consuming them in the sophisticated environments of specialty teashops and exclusive restaurants, hotels and cafés.

While world tea consumption has increased over the last decade, traditional importing European countries, with the exception of Germany, have seen a decline in consumption levels. Overall, the European tea market is largely saturated. Per capita consumption has been declining for more than a decade, facing competition from other beverages, particularly bottled water.

Over the next decade, Western countries in general are expected to see lower consumption growth.

In Britain, for instance, tea consumption is projected to decrease as black tea struggles to maintain consumers’ interest amid increased competition from other beverages, including coffee.

The report argues that the decline in tea consumption in the traditional European markets could be stalled or even reversed by diversifying into other segments, such as organic and specialty teas, and by promoting their health and wellbeing benefits.

The strategy of promoting the health benefits of tea has also proved effective for other markets. For example, loose-leaf tea is seeing new growth in the US, not least as a result of increased public health consciousness.

The report is based on data received from member countries, supplemented by data from FAOSTAT and the International Tea Committee (ITC) as well as other sources, FAO said.

—IANS

by admin | May 25, 2021 | Business, Corporate, Corporate Buzz, Economy, Large Enterprise, Markets, News

By Bappaditya Chatterjee,

By Bappaditya Chatterjee,

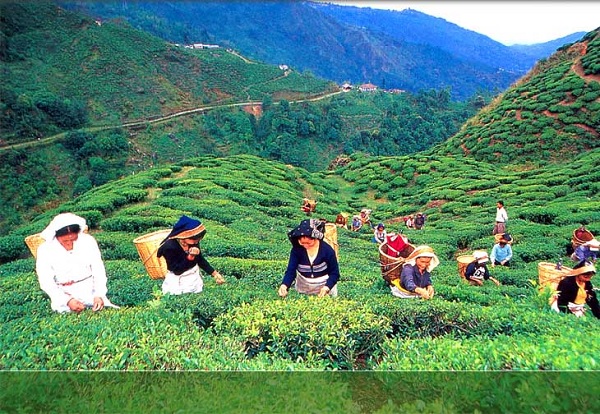

Kolkata : Amid fears of losing export markets to other nations due to the ongoing unrest in the northern West Bengal hills, Darjeeling’s tea planters are hoping that the Geographical Indication (GI) tag will enable them to regain their market share in the future.

All plucking and manufacturing operations in Darjeeling’s 87 gardens have been suspended since June 9 due to the crisis in the region with an indefinite shutdown continuing for over two months.

As a result, there is no availability of second flush premium quality tea in the export market, which is a “setback” to the industry and also to overseas buyers.

Darjeeling has been on the boil since June 8 after the principal hill party, the Gorkha Janmukti Morcha (GJM), renewed the movement for a separate Gorkhaland state. The GJM began the indefinite shutdown from June 12.

“Due to non-availability of Darjeeling tea, the buyers would not be able to get it. If they are unable to get it, there is a possibility that players from other countries — Nepal, Sri Lanka, Kenya — will be able to make a breakthrough into the market,” Aditya Khaitan, Vice Chairman and Managing Director of McLeod Russel India, the world’s largest bulk tea producer, told IANS.

Citing a 1984 situation when there was an export ban on CTC (crush tear curl) tea — the most popular and largely produced variety in the Indian domestic market — he said: “I heard that due to the export ban, lot of English market players started buying Kenyan tea. Till now, it is difficult for us (the industry) to get back the market share that the industry had in 1984. The only concern is that if the players change the blend and get tea from some other origin, Darjeeling may have difficulties in future. It is an apprehension.”

Echoing Khaitan, Goodricke Group Ltd’s Managing Director A.N. Singh recently said the morning cuppa could not go empty, and as such, tea from other origins, which are similar to Darjeeling, would “make their way through”.

“Once the original tea is replaced by the blend, it (Darjeeling tea) would lose the market favour and this is our biggest fear,” he said.

It seemed obvious that the current year’s exports would be hit as the production was only 2.07 million kgs in the January to June period, against 8.13 million kgs during the entire 2016.

However, Darjeeling’s tea planters are hoping that the GI tag to the varieties of muscatel flavour tea (a unique taste found in some variants of Darjeeling tea) would help the industry regain its market share in future, particularly once the supply normalises.

“People will look for alternatives when Darjeeling tea is not available. This is a short-term phenomenon. Due to the unique nature of Darjeeling tea, no one will be able to replace it completely and a GI tag should help in keeping its brand equity intact in the markets,” Ashok Lohia, former Chairman of the Darjeeling Tea Association (DTA), told IANS.

Similarly, the present DTA Chairman, Binod Mohan, said: “Darjeeling tea is protected under the GI Act and I doubt if any other origin tea can replace it. But there would be a shortage in the market as the quantity of Darjeeling tea now available would be sold out in some point of time.”

Meanwhile, faced with an “unusual situation” arising out of the indefinite shutdown in the hills, Darjeeling’s tea planters have sought “financial support” from the central government. “They (Tea Board) wanted a specific proposal and that is being prepared,” Mohan told IANS.

He said industry had earlier faced hardships, but it never experienced such a prolonged shutdown in the second flush production period.

The second flush production is considered the premium variety that contributes about 20 per cent of the industry’s annual production and accounts for approximately 40 per cent of its annual revenue. The estimated loss to the industry has mounted to Rs 350 crore, Mohan added.

(Bappaditya Chatterjee can be contacted at bappaditya.c@ians.in)

—IANS

by admin | May 25, 2021 | Economy, News

Kolkata : (IANS) The Tea Board of India has issued a notification inviting expression of interest (EoI) for taking over the management of six tea estates — Birpara, Garganda, Lankapara, Tulsipara, Huntapara and Dumchipara, controlled by Duncans Industries.

Kolkata : (IANS) The Tea Board of India has issued a notification inviting expression of interest (EoI) for taking over the management of six tea estates — Birpara, Garganda, Lankapara, Tulsipara, Huntapara and Dumchipara, controlled by Duncans Industries.

All the six gardens are located in West Bengal. The notice issued on Monday said the EoI were invited for taking over management of six tea estates individually from interested tea companies-firms/ cooperative societies to “run the gardens in a successful manner as per the provisions of various acts and rules applicable to the tea plantations”.

The notice solicited proposals for taking over the management of the six tea estates “who have failed to comply with the obligations under the Tea Act, 1953 as also the relevant provisions in terms of timely payment of workers dues regarding provident fund, gratuity, ration and other fringe benefits/obligatory dues”.

The Board would also host a bidders’ meeting on March 28 and the last date of submission of EoI is April 12. The Board will open all the responses on the same day.

“The initial tenure of the management control shall be five years which may be extended as per provisions of Tea Act, 1953. At no point of time the management control of the tea estates shall exceed 11 years,” the notice said.

As a pre-qualification criteria, the notice said the annual turnover of the applicant should not be less than Rs.5 crore and the applicant should have sufficient working capital of not less than Rs.2 crore.

The applicant should have experience of not less than ten years in running or managing tea estates having not less than 500 workers for individual gardens, it said.

When contacted, company non-executive chairman G.P Goenka said: “I don’t know and I have no idea. I am in Mumbai.”