Government initiatives to boost housing finance in India

By Syed Zahid Ahmed

Until liberalization the real estate developers were largely dependent upon informal investors who used to invest in properties and release payments in instalments. After possessing the properties, they sell it to other buyers and reinvest in other properties. This accumulated demand for housing in India (from informal investors to secondary buyers) caused total market demand exceeding to actual supply. Supply being less than demand for housing in India caused housing inflation remains higher than overall inflation in India and this attracted many builders to develop properties. To hide actual income and evade liable taxes thereupon, such builders preferred seeking informal investments to realize major value of properties in black (cash). This trend of informal investments into real estate market caused drainage of surplus capital generated in the informal sector into real estate.

Considering the need of formal finance to develop housing units for poor workers, in 2005 the UPA Government floated affordable housing and announced provisioning of 100% Foreign Direct Investments (FDI) for affordable housing. The liberalized FDI caused a boom for foreign investments into Indian real estate. But a large number of informal investors missed to envisage the impact of FDI and went on capitalizing real estate properties and traditional builders kept developing properties booked by these investors. On the other side since large builders with support of foreign investments also kept developing many housing projects, the stock of housing units in Indian market exceeded the actual demand by 2011-12. And so 2012 onwards the Indian real estate market started showing a recessive trend. With hope about new Government at centre taking due initiatives to improve real estate market, majority of builders and investors opted to wait and watch till 2014.

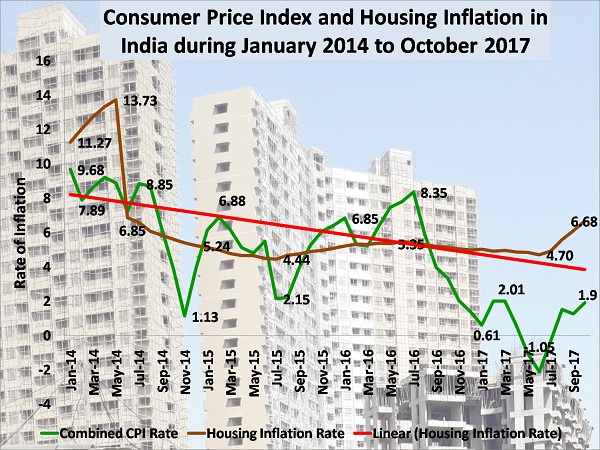

Under excitement about initiatives from the new Government taking place at Centre in May 2014, the Inflation rate for housing in India was recorded as 13.73%. But the way new Government declared its policies about real estate after resuming the charge, the bubble of hope disappeared and the housing inflation took a 52% dip by very next month to record as low as 6.85% in June 2014. Though during last 40 months various initiatives to boost formal finance into housing segment caused bit rise in housing inflation, the overall slowdown of informal investments into real estate disallowed it to reach the level it fell in June 2014. If we analyze various Government initiatives, we may see that Government is unlikely to allow the informal sector capital flow towards real estate. The Government is rather trying to create transparency in the real estate business and ensure fairer and assured delivery to the end buyers of housing units. To do so at one hand the Government is boosting inflow of formal finance into housing projects and on other side extending the reach of credit link subsidy schemes to more and more people.

Source: – http://164.100.34.62:8080

To improve real estate business, the new Government not only launched schemes like ‘Housing for all by 2022’ under the Pradhan Mantri Awas Yojana (PMAY) with target to build 60 million houses (including 20 million for urban areas) but also declared plan to develop 100 smart cities in the country so as to reduce the load of urbanization upon existing cities. To induce the investors and developers for affordable housing, the Government further initiated several other measures like formulating six different models for public private partnership, exempting income tax over affordable housing projects, relaxing Dividend Distribution Tax (DDT) norms, reducing the rate of liable Goods and Service Tax (GST) and Service tax upon affordable housing projects, and waving off the minimum limit on sum capital and areas (acres) for FDI investment in real estate projects.

Further to create transparency and accountability in the real estate market the Government not only introduced the Real Estate (Regulation and Development) Act, 2016, (RERA) but also brought Benami Transaction Act 2016 to block generating illicit wealths through real estate. Though Government succeeded attracting big builders towards affordable housing, the implementation of RERA was discouraging informal builders to tap their traditional investment sources. This ultimately not only reduced the inflation in real estate market, but also disallowed Indian real estate to meet the supply target sought to arrange 6 million housing units under Housing for all by 2022. Though National Housing Bank (NHB) the regulatory authority for housing finance business in India is yet to publish updated Report on Trend and progress of Housing in India, the data observed in IBEF report on real estate by September 2017 suggests that only 1,08,200 housing units were launched in fiscal year 2017. This is not even 4% of annual target if India really aims to launch 2 million housing units in urban areas in seven years (during 2015 to 2022).

Since the Government Initiatives caused to decline the demand for housing by informal investors, India needed to improve demand by genuine home buyers. At present housing loans is the only product than can help increasing the buying capacity of genuine home buyer. The latest available report published by NHB on Trends and Progress of Housing in India was for year 2015 highlighting the scheme of PMAY – Housing for all by 2022. This report tells us that by end of March 2015 total Rs. 10,63,224 crores of housing loan was outstanding upon 1,24,25,659 number of housing loan accounts in India; with 60% market hold by Scheduled Commercial Banks (SCBs) and 40% by Housing Finance Companies (HFCs). Since the number of active housing loan accounts is around 1% of Indian population, India has high potential for development of housing finance business.

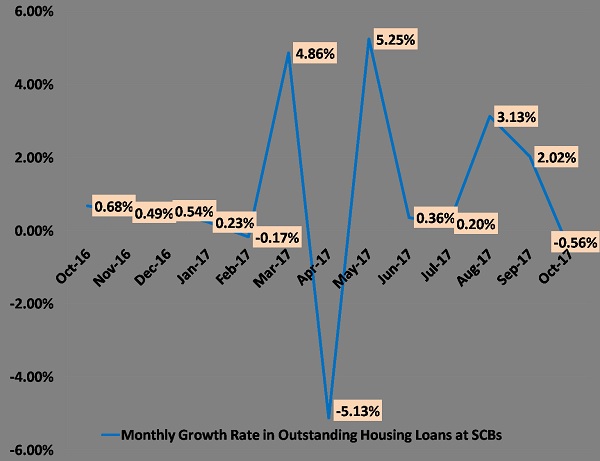

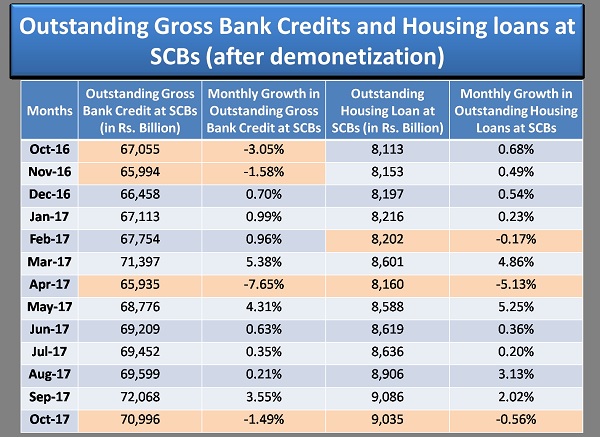

Since NHB has yet to publish any updated report showing the latest data about housing loan collectively disbursed by SCBs and HFCs, we don’t know how HFCs are performing. However it is clear that hardly one percent Indians affords availing housing loans; and more to it the available data at website of the Reserve Bank of India (RBI) suggests that after demonetization on month to month basis, October 2017 was third month registering negative growth in outstanding housing loans at SCBs.

Source: – https://www.rbi.org.in/Scripts/Data_Sectoral_Deployment.aspx

It seems that low interest rate and CLSS alone may not help improving the growth of housing finance business in India. There may be various reasons for negative growth in Housing loan. Fall in income and employment opportunities may be one reason. Housing prices exceeding to the buying capacity of genuine home buyers could be other reason. But the main factor may be lack of alternative housing finance products enabling the poor workers to adjust the payable monthly instalments in accordance to change in level of monthly income. Now the Government needs to initiate alternative housing finance products where a payable instalment is correlated to inflation and income level.

Considering trend of higher rate of inflation in housing compared to general inflation in Indian economy, there is need to consider the scope of availing value appreciation in real estate and to correlate impact of inflation upon income level of customers and market price of real estate before structuring repayment schedule under housing finance. Generally in Indian economy customer’s income get double in a period of around seven. We may find scheduling of Unequal Monthly Instalment (UMI) more suitable to poor customers compared to schedule Equal Monthly Instalment (IMI) under housing finance in India where 83% workers have irregular source of income.