by admin | May 25, 2021 | Islamic Banking, News, Opinions

By:- Syed Zahid Ahmad for Maeeshat

By:- Syed Zahid Ahmad for Maeeshat

In 2006 the RBI’s Working Group to examine the financial products used in Islamic banking mentioned that ‘as distinct from modern, conventional banking, Islamic banking due to its inextricable influence of religious doctrines has often evoked a sense of mysticism and curiosity’. RBI officials being financial professionals found it worth to analyze the products used under Islamic banking; nevertheless took ten years to make recommendation about Islamic banking for financial inclusion. RBI’s ruling about Islamic banking largely changed after Dr. Raghuram Rajan became RBI Governor. But the way State Finance Minister declined this proposal; one may guess that mysticism is still the roadblock for Islamic banking in India.

Government declared RBI’s proposal of Islamic Banking as irrelevant

On 9th December 2016 replying to a query about RBI’s proposal on Islamic banking, the State Finance Minister Shri Santosh Gangwar stated that on consideration of inter-departmental group report, it is observed that even to introduce limited products, various legal changes would be required. Moreover, the objectives of financial inclusion for which Islamic Banking was explored by RBI has no relevance, as Government has already introduced other means of financial inclusion for all citizens like Pradhan Mantri Jan Dhan Yojna, Pradhan Mantri Suraksha Bima Yojna, Pradhan Mantri Mudra Yojna etc. Earlier it was often asked that if countries like UK, France and Switzerland can adopt Islamic banking, why India can’t go for it? But we forget that unlike these countries India experienced worst communal riots during partition to get independence. Considering the socio – political sensitivity of Islamic banking, after few incidences of religious intolerances in recent past, it was not easy for the Government to approve proposal of Islamic banking.

Islam basically guides the humanity to make fair transactions

Based on level of economic development, the model of banking and finance for particular economy may differ from other. Historically the models of banking and finance have changed drastically. Institution of banking was not found during 7th century. Similarly the so called modern banking may not find place after 2175 because with digitalization of money we are changing way of financial transactions. Had Islam described any banking model in 7th century that would have observed unfit for 21st Century? Since Islam is a Godly defined standard art of living; meant for present and future civilizations; instead of prescribing any particular banking model for a particular economy, Islam through ethical principles guides the humanity to transact fairly at any point of human civilization. According to Islamic teachings accumulation of wealth through interest or by any unethical practice is prohibited; wealth should not be hoarded with misery; nor should circulate among the richer only. Islam also guides the humanity to attain economic growth by inducing need based expenditure. Islam also guides the humanity to provide support (from excess of wealth) to the poor and needy among relatives, neighbours, prisoners and wayfarers. Islamic teachings are so secular that even in practice like Zakat (specific financial prayer) fractional amount is provisioned for support to non Muslims also.

Islam has not guided any particular religious banking model

Islam being a religion for all humanity and not for Muslims only lays principles for all human beings. Since, no banking model is proved to be guided by Quranic Ayats or by practice of Prophet Muhammad ﷺ, or his companions, whosoever claims any particular model as Islamic banking may be attempting to present self defined model of Islamic banking otherwise. That’s why despite holding 32% asset of so called global Islamic banking asset, there is no bank on the name of Islam in Saudi Arabia. The term of Islamic banking is rather used by such bankers who intend to draw surplus capital hold by Muslims out of Saudi. Nevertheless need to access financial services without indulging in interest and other unethical practices is a genuine need for Muslims in India and around the world. With no provision of banking without interest in India, after observing upsurge trend in business of Islamic banking in more than 50 countries, Muslims in India considered it as a solution to get rid of interest. Thus Muslim community with less than one percent representation in the regulatory body (RBI) kept appealing for Islamic banking in India.

It took a decade for RBI to change its rulings about Islamic Banking

The story of Islamic banking in India began way back 2005 when RBI constituted an internal Working Group under Anand Sinha to examine financial instruments used in Islamic Banking. Report of this Working Group came in July 2006. This Working Group instead of interacting with Islamic banking professional, rather based on study of two theological websites concluded that “in the current statutory and regulatory framework it would not be feasible for banks in India to undertake Islamic banking activities in India or for branches of Indian banks abroad to undertake Islamic banking outside India.” But after Dr. Raghuram Rajan being appointed as RBI Governor, the Ministry of Finance requested RBI to give its considered opinion regarding feasibility of introducing Islamic Banking in India after examining all the legal, technical and regulatory issues relating to the matter. Accordingly, an Inter-Departmental Group (IDG) on Islamic banking was constituted in RBI and the report prepared by the Group was submitted to the Government during February 2016. RBI had also forwarded a Technical Analysis Report to the Government in December, 2015. On the basis of the recommendations of the IDG, it was suggested that a few products similar to conventional banking products may be considered for introducing through Islamic windows in the conventional banks after necessary notification by the Government. Also it was informed to the Government that once decided, RBI would undertake further work to put in place the operational and regulatory framework to facilitate introduction of such products by banks in India.

Calling Interest – free banking as Islamic Banking is a mistake

Considering the socio political fabric of India where Hindus are in majority, it is better to understand that interest is not forbidden for Muslims only, but also for other communities like Christians and Jews etc.. Interest is also not admired in Hindu and Budhist scriptures. Scholar L. C. Jain in his book ‘Indigenous Banking in India’ (published by Macmillan and Company, London in 1929) has written that “from the early Buddhist literature usury was held in contempt, as appears from the special law made against it by Vasishtha – the well-known law-giver of that period. The highest castes were not to be usurers, but the Vaishyas, who were traders, were excluded from the operation of the law. In the Jatakas also, the condemnation of usury can be seen; ‘hypocritical ascetics are accused of practising it”. So ideally Hindus Upper Castes and Buddhists should also refrain from dealing with interest. In short prohibition of interest should not be called as Islamic Banking. It may rather be counted as ethical issue mentioned in almost all religions and not only in Islam.

Banks are not primarily serving the poor and needy class

According to All India Report on Sixth Economic Census, self-finance is major source of finance for 80.1% establishments (46.86 million out of total 58.5 million) in India. It reflects scope for banks to financially support more Indian establishments. On the other data on size of bank credits suggests that not even one percent loan is granted in size between Rs. 2 to 5 lakhs. According to the Report on Fifth Annual Employment – Unemployment Survey 2015-16 whose average monthly income of 66.7% households is not more than Rs. 10,000 can hardly afford to apply for loan over Rs. 5 lakhs. It means banks are not providing one percent loans to 2/3rd of Indian households whose average monthly income is not more than Rs. 10,000. Households are not even drawing one percent bank loans. It is also observed that just 12.3% of total NPAs including write off and structured loans are upon micro industries compared to 55.2% upon medium and large industries. So, if banks want to reduce the NPAs, it is required that Indian banks should shift their focus for credit disbursement from medium and large industries to micro and tiny establishment.

Islam is not against secular fabric of Indian Finance

Indian capital market is largely Shariah compliant without any mystical practices in the stock market. Notably more non Muslims are users of Shariah index compared to Muslims. Similarly if we resolve to design and adopt micro equity products under banking network so as to financially support 50 millions micro and tiny establishments who are otherwise deprived of capital support, we can help India develop one of the best banking products. Besides allowing India to attain a better growth trajectory micro equity products may also create space for religious Muslims to participate in nation’s development. Products like Micro equity finance may allow Indian Muslims along with 50 million micro and tiny sized enterprises may find opportunity to access sought capital in secular manner.

Micro Equity Fund for 50 million Micro and Tiny Enterprises:

Around 50 millions micro and tiny size enterprises in India are deprived of financial scheme. They are too small in size to approach the specified MSE stock exchange. In most cases, the financial need of millions of micro and tiny enterprises (ranges between Rs. 1 to 5 lakhs) is falling below average finance extended by banks and above finance limit for MFIs. So, they are neglected segment in Indian finance. Hope the Government while promoting digital money, may like to support these neglected enterprises. If Government could help them by mode of micro equity finance through available network of banks, MFI and BCs in India, we may see upsurge in registered Udhyog Aadhar in near future. By now only 3.6% establishments are registered under Udhyog Aadhar. Ideally this number should be at least 80% of existing establishments reported by Economic Census.

Two Different modes of Micro Equity Finance:

There could be following two modes to extend Micro Equity Finance –

- Banker may invest fractional share in micro enterprises owned by any entrepreneur with option to buy back investors share periodically. Till the time investor possess unit share in the enterprises, the entrepreneur is supposed to proportionately share the earned profit / loss. This would allow the banker / financier to earn profit through investments along with optional disinvestments on monthly basis or otherwise after expiry of agreement period.

- Any asset (say Shop) be jointly purchased by the entrepreneur and banker; allowing the entrepreneur use the shop after paying monthly rent to the banker against outstanding unit shares in that asset. The entrepreneur should be allowed by the banker to buy back bank’s unit share in the asset at varied price on monthly / weekly basis. The entrepreneur should pay varied amount as rent to the banker according to bank’s outstanding share in the shop at particular month. After selling out all unit shares in the asset, the banker should execute release deed to transfer all legal rights in favour of the entrepreneur; and thereafter the entrepreneur need not require paying any rent to the banker.

Is there any observation report about Micro Equity Finance?

Yes! BASIX Social enterprise group has already taken lead into pilot for Micro Equity Finance in Mewat district of Haryana where actual repayment rate by bank customers are hardly 20%. Contrast to this fact, the repayment rate by customers served through Participatory Micro Finance model in same geography is 99%. BASIX group started the pilot of Participatory Micro Finance in July 2011. They directly finance the livelihood of target customers instead of sanctioning loan on interest. This process involves buying and selling of commodities (after adding profit) to the customers and allow repaying the whole amount in instalments. There were investments in assets by mode of diminishing partnership also. Recently this group initiated pilot project of micro equity in enterprises by mode of diminishing partnership wherein customers are allowed to buy back investors’ share on weekly / monthly basis. Though this pilot is too small and incomplete to cite, interestingly so far the outcome of this pilot is far better than actually projected. Though like any cash driven activity, demonetization has also adversely affected the repayment in this model; nevertheless the retrieved profit is much higher than scheduled profit during June to December 2016.

Micro Equity Finance as innovative product for micro enterprises

The limited scope to introduce Islamic banking product through equity mode in Indian market is in fact a very big opportunity. All we need to explore possible product sub categories for equity financing. This could be explored through portfolio management, mutual funds and equity financing (direct as well as through venture capital). There is scope to develop different need based products in Indian economy. Equity financing could be for listed / unlisted but registered (under MCA) companies. Equity could be simple equity or Diminishing Equity Finance. Even through Diminishing Equity Finance we can provide support to customers to accumulate capital in form of assets / network for companies.

Huge untapped market for Micro Equity Finance

So, there is huge scope for equity financing in India subject to work we do before presenting the prospects of equity financing for Indian economy and banking segment in a secular fabric without calling it Islamic or Shariah banking. The people who like to market it as Shariah banking can do it in their own pockets / markets to grab potential customers. But until Indian economy tastes the fruits of equity financing through banking network, it is very crucial that financial experts proposing equity finance to Indian banking segment should not propagate concept of Islamic Banking. Once the equity finance yields better returns than other asset side products used under conventional banking, the banks would self demand for some more innovative products that could bring better returns.

Challenges for Micro Equity Finance in India

There are still some challenges to propose equity financing in India. The banking segment has very little experience in equity financing and majority of genuinely needful customers are not eligible to approach banks or stock markets for equity finance. Considering the limited to finance less than 30% of paid up capitals through equity investments, it would be a better way to suggest banks to invest in financial institutions or cooperatives having reach to poor and needy customers actually deserving the micro equity finance. Besides limitation to invest less than 30% paid up capital, banks also need to assure better returns with minimum NPAs. Considerably the fact that just 12.3% bank’s NPAs (including write offs and restructured loans) are with micro industries against 55.2% NPAs with medium and large industries; banks may like to reach more micro and tiny establishments through MFI or cooperatives. These institutions may not be constrained through cap of investing less than 30% paid up capital. Banks can reach to maximum unbanked people with better returns and lesser NPAs.

Micro Equity Finance may help creating transparent economy

So, in short we have to propose a new strategic plan to boost financial inclusion for inclusive growth so that more capital should flow to poor and deprived communities. We have to suggest means to reduce banks NPAs and increase returns without exploiting the borrowers. We also need to link equity financing with digital payment where transparency is at par level and does not allow corruptions. We should propose to suggest that x amount of equity promoted y amount of value addition after c amount of consumption and i amount of capital accumulation. Hope we will professionally present our modified concept in Indian economy.

Micro Equity Finance may help India reform domestic economy

Islam is a secular religion based on Godly prescribed guidelines to make a justified economy to live in. Islam has not prescribed any particular model of banking; but set principles to do transactions without exploiting anyone. The financial products based on equity can be introduced as pilot project in India without any legal problem. There is huge untapped market for micro equity finance in India where around 50 millions micro and tiny enterprises are deprived of finance from formal financial sources including banks and stock markets. Micro equity finance may not just enable millions of unorganized sector enterprises, but also enable us to know how much value addition is done through micro equity extended to micro enterprises. Through micro equity finance we may also be able to make better estimate for capital formation in our economy. This product can better support digital monetary transactions and may also be supportive to launch transactional tax in future. At last micro equity finance can not only support the poor workers engaged as own account workers in the unorganized sector, but also enable millions of Muslims deal freely along with maintaining secular fabric of Indian finance.

by admin | May 25, 2021 | Islamic Banking, News, Opinions

In spite of RBI’s green signal, the government says No ?

In spite of RBI’s green signal, the government says No ?

Dr Raja Muzaffar Bhat

Before handing over his charge to present RBI Governor Urjit Patel, former Governor of Reserve Bank of India Raghuram Rajan had proposed working with the Government to introduce Islamic Banking (interest-free banking) to tackle financial exclusion of a vast Muslim population, who for religious reasons do not go for traditional banking.

RBI in its 2016 annual report had given its clearance for opening Islamic Banking windows across India. The proposal in this regard was seen as a major shift in the stance of Reserve Bank which earlier had said that Islamic finance could be offered through non-banking channels like cooperative societies and other investment models.

Before the RBI recommendations could be discussed by Government of India, Union Finance Ministry recently said that Islamic banking was not relevant any more in achieving the objectives of financial inclusion as the Government has already introduced several programmes for all citizens towards financial inclusion. In his written reply to the Lok Sabha, Union Minister of State (MoS) for Finance Santosh Kumar Gangwar said various legal changes are needed if even limited products were to be introduced under Islamic banking.

“RBI had set up an inter-departmental group on Islamic Banking. Entire exercise was aimed at promoting financial inclusion, accessing huge market potential to attract finance from Gulf countries for infrastructure development. However, on consideration of inter-departmental group report, it is observed that even to introduce limited products, various legal changes would be required” MoS Finance Santosh Gangwar told Lok Sabha in the recently concluded session of parliament. Gangwar further said that objectives of financial inclusion for which Islamic Banking was explored by RBI has no relevance, as Government has already introduced other means of financial inclusion for all citizens like Pradhan Mantri Jan Dhan Yojna, Pradhan Mantri Suraksha Bima Yojna, Pradhan Mantri Jeevan Jyoti Bima Yojna, Pradhan Mantri Mudra Yojna etc. Pertinently RBI’s Deepak Mohanty committee in its report posted on the RBI website on December 29, 2015 had recommended that banks open a separate window offering interest free Sharia compliance (Islamic banking) deposits and advances to address financial exclusion based on faith. Mohanty was fully aware of these programmes and digital banking etc., but he still voiced for Islamic Banking and that should be an eye opener for Modi Government. It is estimated that 180 million Muslims in India are unable to access Islamic banking because of non-availability of interest free banking. RBI in its report had said it would explore to introduce interest-free banking products in consultation with the government, but before the consultation could be held , Government of India derailed this whole process.

What experts say :

Syed Zahid Ahmad, Founder of Economic Initiatives

Syed Zahid Ahmad, Founder of Economic Initiatives a Mumbai based advocacy group on Islamic banking has been networking with several Government and Non Government organisations on adoption of Interest free banking in . In his letter to Mr Santosh Gangwar Minister of State (MoS) Finance Govt of India, Zahid said that as an Indian Muslim he was shocked to know about MoS Finance’s observation on RBI’s proposal to allow Interest-free banking windows in India. “We had been hopeful to get positive support from Government over RBI’s proposal presented for financial inclusion of Indian Muslims. Politically we may differ but as a nation we all are Indians and must protect each other’s interest. I request you to kindly review your observation about interest-free windows after listening our concerns in national interest and through good governance kindly allow us to feel that Sabka Saath Sabka Vikas is really meant to ensure socio-economic justice for all Indians irrespective of the region or religion we belong to” reads Zahid’s letter

Amidst all difficulties caused after demonetization and fear of declined income and employment opportunities in near future, Muslims feel that December 9th, 2016 is a black day for them when BJP led Government ruined their hopes to avail required finance in future through interest-free windows. “It seems Government was already under pressure of Shiv Sena for genuine critics over demonetization. The plea submitted by Shiv Sena M.P. Shri Chandrakant Baburao Khaire during zero hour in the Lok Sabha for not allowing “Islamic window” in the banking system might have added pressure for the Government. Thus on Friday, 9thDecember 2016 when Smt. K. Maragatham from AIADMK raised her queries about Islamic windows in banking sector, you perhaps in a desperate mood ruled out RBI’s proposal of interest-free banking windows in India for financial inclusion” Zahid’s letter further reads

Conclusion:

Sachar Committee in its 2005 report said that Muslims had 7.4% share in saving deposit amounts with Scheduled Commercial Banks (SCBs) against 4.7% share in Priority Sector Advances (PSA) outstanding amounts. Besides other factors, main reason for this loss is that Muslims are not able to get interest-free finance from banks. This huge financial loss is putting Indian Muslims economically far behind other communities. If we really want to achieve inclusive growth, we have to ensure financial inclusion among Muslim community. On one side Modi ji gives slogan of “Sabka Saath Sabka Vikas” but when he has to handhold Muslims for achieving this dream, Government ignores them by disallowing interest free banking in India.

The article first appeared in Greater Kashmir. Courtesy: http://www.greaterkashmir.com/news/opinion/blow-to-islamic-banking-in-india/239549.html

by admin | May 25, 2021 | News, Opinions

By Syed Zahid Ahmad –

By Syed Zahid Ahmad –

Surgical strike was upon black money or Indian economy?

On 8th November 2016 breaking news flashed by media describing demonetization of Rs. 500 and Rs. 1,000 notes as surgical strike on black money. We were told that it will burn all black money and suppress those who are funding terror activities. Just after one week it was claimed that terror activities have been stopped. But after two weeks when two Militants were found killed in Kashmir having two new Rs. 2000 notes, we can say that demonetization is failed to stop terror funding. Still after 15 days there is no specific report on impact of this surgical strike upon black money; rather media is busy to either cover news about harassment of general people to exchange currencies or are casting news about slowdown of economy. Now we are unable to judge whether this demonetization was surgical strike upon black money or upon individual poor units of Indian economy because every Individual worker is integrated unit of our economy; and only their collective efforts make the economy shine or doom. So suffering of 90% workers is meant for suffering of our economy. We are afraid this demonetization may kill around 4,00,000 crores of value addition compared to fetching 40,000 crores black money captured during hunt for black money.

Political and Monetary objectives behind demonetization

After observing the demonetization creating political battle between the Government and united opposition, our Prime Minister has stated that 90% public reaction is in favour of demonetization, but he intentionally avoided saying that these 5 lakh respondents are savvy to digital world and supporter of his party. Unfortunately the actual sufferers of this demonetization are not used to respond through mobile apps, but through electoral ballot. Before we submit our feedback, it is time we should try finding the hidden and declared political agenda as well as monetary objectives behind demonetization. We should also analyse impact of demonetization to enhance transparency in our monetary framework and economic structure. Only then we may be able to submit our genuine feedback to honourable Prime Minister.

What is Black Money?

Was there really urgent need for surgical strike upon black money? What is black money? It is defined as income earned but not disclosed to the Government. Money cannot be black or white; rather it could be legal or illegal. How come people of spiritually rich nation like India are so immoral to earn illegal money? Actually it is human tendency to desire wealth and that could only be controlled through morality. With fall in morality we see rise of unethical and corrupt practices in India. The qualified and expert financial professionals including Chartered Accountants (CAs) are capable to guide people how to get escape from taxable regimes. What have been caught as black money during last 15 days does not exceed 33,000 crores. Considerably this amount is hardly 2% of demonetized currency notes. Was the intention of demonetization was meant to catch this 2% black money at all?

BJP came in Power with promise to control corruptions

After globalization the practice of corruption has been institutionalized with skill to manipulate transactional accounts. This not only promoted immorality but also devastated the required framework for good governance. They hardly realized that by guiding people to get rid of taxable regimes they are actually draining wealths from public to private treasuries. The Government initiated globalization for economic growth but in absence of proper checks and balances, we saw rise in corruptions. The rise in corruptions destroyed the image of the Government and ultimately the people decided to not re-elect it again. But we were not safe with just change in Government because we did not differentiate between immoral and illegal money. Thus in 2014 when the people of India elected Shri Narendra Modi as Prime Minister he was confronted with challenges to reduce corruptions in our economy.

Government was under pressure to control black money

After resuming power the new Government hardly take any drastic step to uproot the causes of corruptions, so it was obvious that after crossing half way of its tenure the Government was under pressure to convincingly work on curbing corruptions and generate prosperities for common Indians. Though our Prime Minister tried his level best to market Indian economy, we are still facing challenges to attract the potential investors. Despite attempts to get capital from countries like America, Japan, China and Saudi Arabia India failed to attract sufficient investments due to complicated regulations, heavy tax structure and prevalent corrupt practices in India.

Higher tax structure is root cause of black money

The complicated regulations and higher tax structure in India not only put hurdles to attract investors, but also create scope for corruptions in collecting public revenues. The people in India generally prefer to pay bribes to agents with intention to get escape from taxable regimes. Had the tax structure been modified in accordance to the way suggested by Arth Kranti Pratisthan with objective to let people feel comfortable in paying taxes, people in general would have preferred to earnestly pay taxes instead of paying bribes. Unless the Government adopts complete proposals of Arth Kranti about reforming Indian economy, black money may not be controlled.

Role of Tax and Financial Consultants in Black Money

While the tax consultants and agents guide their clients to get escape from paying taxes, duties, customs and excise etc., there are others to guide people deal with public institutions through means of hook or crook (dealing under the table). Some also guide their clients to avail cheap finances from banks with ideas to run away after depicting bankruptcy. They are responsible for increasing Non Performing Assets (NPAs) in Scheduled Commercial Banks (SCBs). With rise in consultancy companies in the financial sector, we can observe agents striving to settle cases of bankruptcy, one time settlements, debt restructuring and writing off bad loans from bank accounts. There is need that banks hire professional services from specified agencies to appraise loan applications. There is also need of specific regulation to set role and responsibilities of agencies involved in appraisal of loan applications. These agencies may be rewarded for smooth repayment of loans and penalised in case of wilful defaults by customers. There may be possibilities to amend the process of rating risk weighted assets so as to calculate proper risks associate with particular financial products under different circumstances.

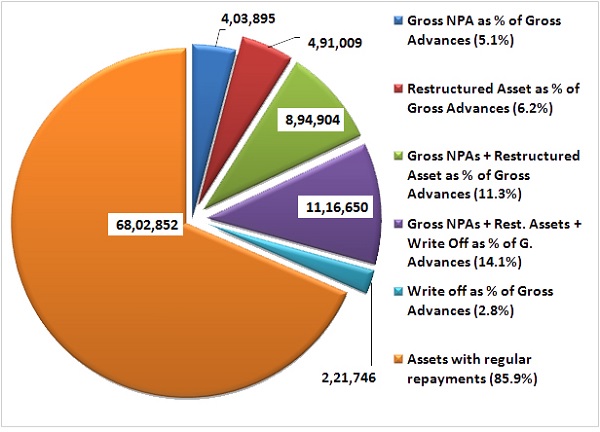

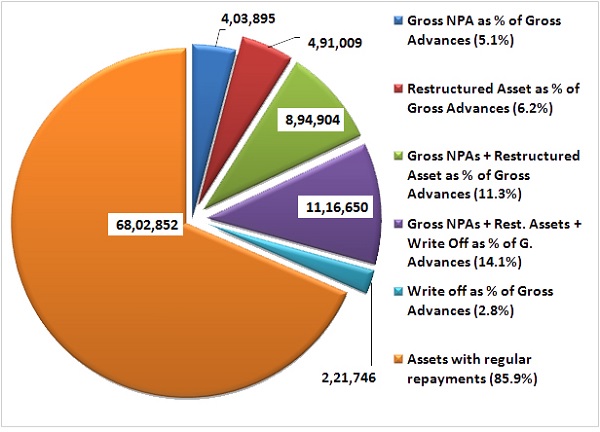

RBI Report on alarming NPAs in Public Sector Banks

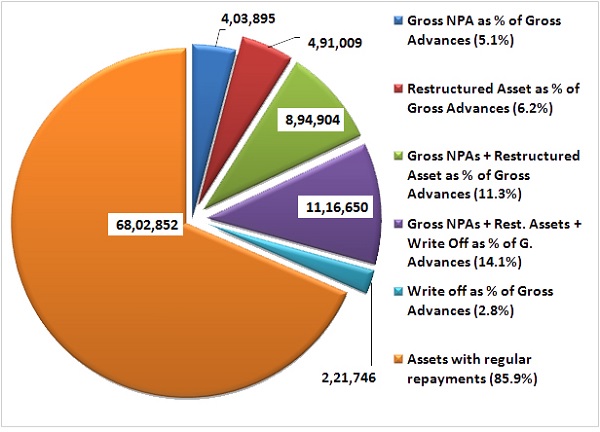

According to S. S. Mundra (Deputy Governor, RBI) by September 2015, percentage of actual default rate (including Gross NPAs, Structured Assets, and Write off Assets) was 14.1% of Gross Assets of all Banks. Considerably for Public Sector Banks this default rate was 17.0% compared to 6.7% for Private Banks and 5.8% for Foreign Banks. According to Mundra, the default ratio was 7.9% in Agriculture and 31.5% in Medium industries. Default ratio by Large industries was also high (23.7%) compared to micro industries (12.3%). After pointing out factors responsible for increasing defaults and NPAs he also suggested lessons from past mistakes. We hope now RBI would take lead to design and pilot innovative financial products (like micro equity, leasing of tangible assets and diminishing partnership etc.) to try suitably meeting the financial needs of agriculture and unorganized sectors enterprises along with holding NPAs under control.

NPA’s, Structured Assets and Write off in Gross Advances by Dec. 2015

Indian banks need Rs. 6 Lakh Crores to stand on BASEL III standard

After global financial crisis, the bankers needed to upgrade their CRAR (Capital to Risk-Weighted Assets Ratio) to stand comfortable under Basel III norms. To meet Basel III norms, Indian banks needed additional capital infusion worth Rs. 6,00,000 crores. The Government also needs to arrange minimum 50% capital support to public sector banks and thus earmarked suitable financial support for public sector banks. However besides public support, the banks also needed to raise capital from their own sources. Thus banks are allowed to sell Masala Bonds and equities. But due to higher NPAs, banks could not succeed to raise required capital.

Government hide the condition of banks before demonetization

There was pressing need for Indian banks to improvise their balance sheets by increasing quality assets to attract more capital. To do so they needed more liquidity to increase outstanding credits along with putting control over NPAs. They also needed fresh infusion of capital / equities from public and private sources. Since the banks were not finding easy to increase outstanding credits with normal liquidity, there was a need that Government of India should help them get extra support to mobilize deposits without high pressure to immediately pay back to depositors. If by any means the poor financial status of Indian banks would have been disclosed, people in large would have lost faith over Indian banks; and started withdrawing their deposits. This could have put Indian banks at risk of bankruptcy. Thus it was required that Government should hide the financial objective and pose political agenda behind demonetizing the higher denomination currency.

Three declared objectives behind demonetization

Thus the Gazette of India published on 8th November, 2016 reflected the following three basic reasons behind demonetization of Rs. 500 and Rs. 1,000 notes –

- Fake specified bank notes were largely in circulation and it was difficult to identify genuine bank notes from the fake ones and that the use of fake currency notes was causing adverse effect to the economy;

- High denomination bank notes were used for storage of unaccounted wealth as evident from the large cash recoveries made by law enforcement agencies;

- Fake currency were causing damage to the economy and security of the country by financing subversive activities such as drug trafficking and terrorism,

Have we failed to secure minting and circulation of our currency?

The notification did not cite any statistical data about quantum of fake currency notes in circulation and its impact on Indian economy. Unfortunately the reasons pointed in the notification suggest that we have somehow failed to maintain required secrecy of minting currency and allowed our enemies to mint fake currencies and circulate in our economy. We are humiliated to observe that corruption in our economy has increased to a level high where corrupt people are not only hoarding black money but also helping enemies to pump in and circulate fake currencies to enable financing of subversive activities in India.

People of India are forced to deposit their cash into banks

Government succeeded to hide the poor conditions of banks before demonetizing 86% Indian currencies (Rs. 500 and 1000 note) and forced the people of India to deposit their cash holdings into bank accounts if they want to legalize it. The way Government announced the demonetization, people could not get time to convert their cash holdings into bullions or real estate rather forced to deposit all cash holdings into banks to convert old currencies into new currencies.

Government may earn Rs. 3.54 crores after demonetization

During fiscal 2015-16, the combined fiscal deficit and revenue deficit of Central and State Governments was respectively Rs. 8,85,290 crores and Rs. 3,40,754 crores. The fiscal deficit of the Central Government alone was Rs. 5,35,090 crores. But the demonetization is expected to help Government minimize its fiscal deficit and enable to invest in public sector banks. By 31st March 2016 out of the total Rs 16.42 lakh crore of bank notes in circulation as much as Rs 14.18 lakh crore consisted of Rs 500 and Rs 1,000 notes. It is expected that banks would receive around 75% of debarred notes (approx. Rs. 10.63 lakhs crores) whereas 25% notes will not be surrendered by their holders for lack of evidence to prove it legally earned money. So, the Government is expected to earn Rs. 3.54 lakhs crores. This will obviously help the Government of India improve its fiscal deficit and invest required capital into public sector banks.

What Indian banks expected to get through demonetization?

On the other side with increased inflow of Rs. 10.63 lakhs crores from public while depositing old currencies and withdrawing limited amount of new currencies, the Indian banks expect high increase in liquidity. Thus it is expected that banks would like to increase disbursement of credits (at least by Rs. 5.4 lakhs crores) at lower interest rate. This may enable banks improve their balance sheets if they put control over their NPAs against increased outstanding credits after demonetization. This may help banks get more capital investments from Non-Government sources. Thus with inflow of extra liquidity banks may be in a better position after demonetization.

Why Cooperatives and MFIs are not allowed to transact?

From 9th November till date the banks are not in a position to meet the money demanded by the public. In 15 days the Indian banks could not calibrate even half of ATMs operative in India. The supply of money through cooperative societies and Micro Finance Institutions (MFIs) has been chocked up. Debarring cooperatives and MFIs during demonetization has added monetary crisis in the rural sector. The farmers are loosing value for their produces and opportunity to so Rabi crops.

Demonetization is promoting digital commerce companies

Considerably demonetization has helped digital commerce companies like Paytm to register over 300% growth in offline store transactions in just one week. Whereas cooperatives and MFIs weer forced to shut their offices locked after demonetization; and god knows when they would be able to resume their businesses. There was news that lakhs of Mini ATMs would be operative in rural India, but so far no report is available about its progress.

Will Indian banks be stronger after demonetization?

If the economy with increased credit really help boosting economic transactions, and even if we see normalcy in economic activities in our economy; do our banks be in safer positions? There is little doubt about it for following reasons-

- Before investing capital into Indian banks, the potential Non-Government investors would obviously like to check how banks perform after demonetization. Banks would have to prove their profitability comparable to profits if offered under investment in non banking companies. Digital commerce companies are likely to pose better prospects compared to banks.

- Investors would like to ensure that banks do not disburse credits in haste and are not being exploited by politically appointed directors and intermediaries.

- To get attractive returns, banks may need to successfully execute innovative financial products to reduce NPAs. This requires banks to be in a position to get back the financed tangible assets in case customers declare insolvency.

- The RBI may require to moderate the regulatory norms for banking companies so as to allow them earn sustainable profits and need not to look for the government packages for their bail-out.

- Focus need to be paid on promoting merchant banking products with more participation than just formal lending businesses.

- More importantly the RBI needs to set strict guidelines and regulations to ensure that intermediaries and agencies bridging the gap between banks and customers should not intend to favour customers by looting banks.

- There would be laws required to declare bank’s non interest income (rental income or profit) to be treated as par to interest income.

- Banks would need to shift their focus from large and medium industries to micro industries if wish to reduce NPAs.

- Since we are moving towards cashless economy, the future of banks may not be as brighter as of digital commerce companies.

India needed tax reforms before demonetization to control black money

The Government should realize that black money cannot be controlled unless we reform our regulatory frameworks, and tax structure in a manner that every Indian should feel it pleasant to register its enterprise and pay taxes instead of avoiding it by hook or crook. The Government is expected to pay regard to the common people for their cooperation over surgical strike on black money; and now need to introduce tax reforms. Hope this will be done before we feel the need for next demonetization.

Why Anil Bokil of ArthKranti is not convinced with demonetization?

According to Mr. Sailesh Menon of Economic Times, Mr. Anil Bokil of Arth Kranti also does not agree that this was demonetisation. Mr. Bokil was cited as saying that the government has only replaced large denomination currencies with even more larger notes. What Arthakranti Pratishthan proposed was to positively change India’s socio-economic scenario by restructuring tax policies, limiting the use of hard cash, making capital and credit cheaper and reducing the flow of black money in the system.

Conclusion:

Mr. Narendra Modi might be sincere to improvise the governance, but the way he took decision to demonetize Rs. 500 and 1,000 notes, it was surprising and left us with no option but to follow his decision. We have been admiring his several initiatives like Swach Bharat Abhiya, Digital India and Jan Dhan Yojna etc. and also admire the objective to create cashless economy, but this time we are forced to follow demonetization. It seems that demonetization has failed to stop funding of terrorism, rather adversely affecting 90% Indian workers associated with agriculture and unorganized sector where economic activities are mainly transacted through hard cash. The issuance of Rs. 2000 note in place of Rs. 1,000 may make easier to hoard black money in future. This demonetization has also adversely affected Cooperatives and MFIs to serve poor people managing there livelihoods. The economic growth rate is expected slow-down due to squeeze of liquidity from public. The consumption has drastically fallen to a level where it can pool the demand lower side; thus may imbalance the market forces. We expect that banks and digital commerce companies will get advantages of demonetization. Government of India may improve its fiscal deficit and find easy to extend capital support to public sector banks required to maintain higher CRAR for Basel III standard. However we fear that banks may not be in better position after demonetization because they actually need shift in banking mechanism from commercial to merchant banking to earn sought revenues to attract fresh investors. Banks need to invent new financial products and services to compete with growing digital commerce companies. Unless India reforms tax structure and commercial regulations, demonetization alone cannot help us slice our black economy. India needs a systematic long term plan and not one phase demonetization to reform the economy to check corruptions. If Mr. Narendra Modi was impressed with presentation made by Arth Kranti Pratisthan at all, he should have adopted their complete proposals instead of picking up single plan of removing larger currencies from system. We are afraid that India will be striving hard to find its target growth trajectory because we find it hard to counter the side effects of demonetization along with bias approach towards cooperatives and MFIs.

Author can be reached on economicinitiatives@gmail.com

By:- Syed Zahid Ahmad for Maeeshat

By:- Syed Zahid Ahmad for Maeeshat