by admin | May 25, 2021 | Corporate, Corporate Governance, Economy, Finance, Markets, News, Politics

By Anjana Das,

By Anjana Das,

New Delhi : With an eye on the upcoming Lok Sabha elections, the government may consider raising interest rates applicable to select small savings schemes popular among the economically weaker sections (EWS) and farmers in rural and semi-urban areas of the country.

Sources said the Finance Ministry is currently evaluating the small savings schemes for raising the rates and once decided, the changes may be implemented in the first quarter of the next financial year.

The plan to revise rates for small savings schemes comes close on the heels of the Employees’ Provident Fund Organisation (EPFO) announcing its proposal to increase interest rate to 8.65 per cent from 8.55 per cent on provident fund deposits for 2018-19 in complete reversal to the market trend where rates are expected to fall after the cut in policy rate by the Reserve Bank of India (RBI).

Once implemented, the changes would benefit retired pensioners, elderly persons, farmers and those who mainly depend on interest income from small savings schemes.

Though the quantum of interest rate hike and the choice of schemes for this exercise are still being worked out, official sources said the revision could take place close to the announcement of election dates, as the move is likely to benefit lakhs of small savers in the country.

Once the election dates are announced, the government and the political parties cannot announce any welfare scheme under the Model Code of Conduct.

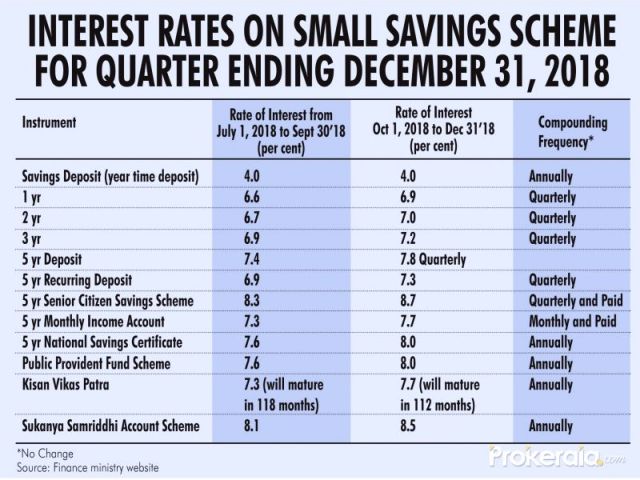

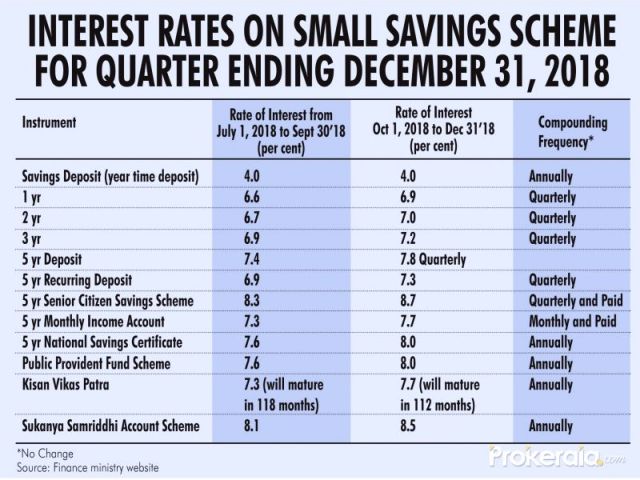

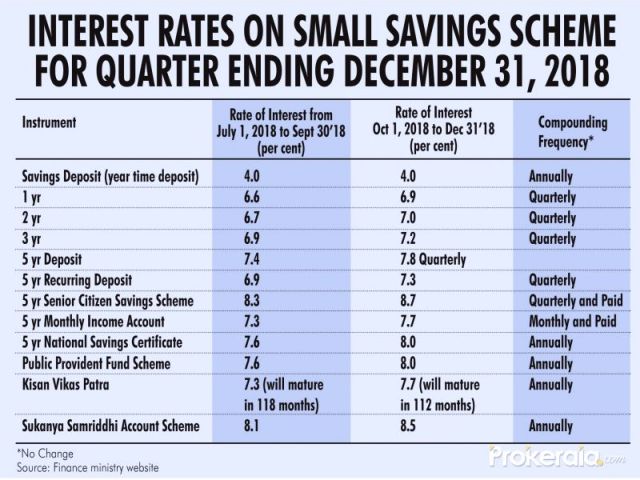

Interest rates on small savings schemes are reviewed periodically and the last hike was announced in September 2018 for the third quarter (October-December).

According to a circular issued by the Finance Ministry in September last year, the interest rates on various small savings schemes were hiked by 30 to 40 basis points.

The interest rates on one-year, two-year and three-year time deposits were hiked by 30 basis points. The rates on other schemes such as the five-year time deposit, Sukanya Samriddhi Yojana and Public Provident Fund (PPF) were increased by 40 basis points.

After the hike, PPF and National Savings Certificate (NSC) earn 8 per cent, the Sukanya Samriddhi Yojana fetches 8.5 per cent while the Senior Citizens’ Savings Scheme gets 8.7 per cent. Only the rate for Post Office savings deposits was kept static at 4 per cent with no revision.

At this stage, the scope for further hike in interest rates on these schemes is limited and rate hike, if any, would only be marginal, in line with the changes made by the EPFO. Sources said that schemes that are currently drawing less than 7.5 per cent could be set for a hike.

Official sources said the rates on these small savings schemes are linked to the yields of government bonds of the same maturity and are calculated by adding a mark-up to the average of the government yield in the preceding quarter. Long-term bond yields have witnessed a sharp drop from levels of 8.15 per cent (10-year G-Sec) to 7.32 per cent.

While the government is looking to make popular changes ahead of the Lok Sabha polls, for the banks any decision to raise rates would be a double whammy. With the RBI trying for a lower rate regime, if the rates are hiked for small savers, it would be seen as going against the direction given by the banking regulator.

After the RBI effected 0.25 per cent reduction in repo rates, banks were reluctant to pass on the resultant cut in interest rates to the customers. As a result, home loan rates still have not fallen as the bankers say that passing on the full rate cut benefits affects their source of revenue and they have no headroom for offering lower interest rates.

The lenders also say that banks must provide for non-performing assets (NPAs) in the profit and loss account, and lower rate of interest robs them off that opportunity.

According to them, to offer lower interest rates, the banks will have to lower deposit rates as well. If most of the small savings schemes become attractive, the banks fear that savings will shift to these schemes, thereby further straining their deposit base and overall financials.

(Anjana Das can be contacted at anjana.d@ians.in)

—IANS

by admin | May 25, 2021 | Corporate, Corporate finance, Corporate Governance

New Delhi : The RBI decides independently on the quantum of interim dividend to be paid to the Centre and a central bank committee is currently examining the issue, the government said on Monday.

New Delhi : The RBI decides independently on the quantum of interim dividend to be paid to the Centre and a central bank committee is currently examining the issue, the government said on Monday.

Queried on the issue following the customary post-Budget Reserve Bank of India (RBI) board meeting here chaired by him, Finance Minister Arun Jaitley said it was the prerogative of the central bank to decide the quantum of RBI’s interim dividend to be paid to the government.

“The RBI takes an independent decision on the interim dividend,” Jaitley said.

RBI Governor Shaktikanta Das said a decision on the issue was yet to be taken and a committee was going into the issue.

“Once the matter is decided, it will be communicated. I cannot pre-judge on the issue… The committee is meeting to decide on the interim dividend,” he said.

The RBI’s audit board had recently taken up the matter. The RBI, which follows the July-June fiscal year, has already transferred Rs 40,000 crore in the current fiscal as interim dividend.

The Finance Ministry wants formal commitment on Rs 28,000 crore interim dividend. If RBI agrees to pay Rs 28,000 crore as interim dividend, the total surplus transfer to the government in the current fiscal would total Rs 68,000 crore.

—IANS

by admin | May 25, 2021 | Corporate, Corporate finance, Corporate Governance, Finance, News, Politics

Piyush Goyal

New Delhi : The Reserve Bank of India on Thursday said that Finance Minister Piyush Goyal will address its Central Board on February 18.

In a late night statement, the RBI said that FM will address the Central Board of Directors in its customary post-budget meeting.

The RBI’s Central Board of Directors consists of 18 members including Governor Shaktikanta Das.

—IANS

by admin | May 25, 2021 | Economy, Markets, News

Mumbai : Expectations of rate cut in the Reserve Bank of India (RBI)’s bi-monthly monetary policy outcome due on Thursday, along with some healthy quarterly results, lifted the key equity indices on Wednesday.

Mumbai : Expectations of rate cut in the Reserve Bank of India (RBI)’s bi-monthly monetary policy outcome due on Thursday, along with some healthy quarterly results, lifted the key equity indices on Wednesday.

Besides, healthy foreign fund inflows also aided the upward movement of market.

Sector-wise, auto, IT and metal stocks led the gains on Sensex, while the consumer durables and utilities declined.

“Domestic market rallied 1 per cent led by broad-based buying across sectors. Nifty breached its narrow trading band of 10,650-10,950 on expectation of a shift in RBI’s policy stance and strong FII inflows,” said Vinod Nair, Head of Research, Geojit Financial Services.

Additionally, drop in bond yield and marginal strength in rupee added strength to the expectation of lowering of rates, said Nair.

The BSE Sensex closed 358.42 points or 0.98 per cent higher at 36,975.23, while the Nifty finished the trade 128 points or 1.17 per cent higher at 11,062.45.

Except for Axis Bank and IndusInd Bank, all other Sensex stocks gained.

Bajaj Finance and Tata Steel closed over 4 per cent higher. ONGC, Bajaj Auto and Tata Motors(DVR) gained in the range of 2 to 3 per cent.

—IANS

by admin | May 25, 2021 | Banking, Corporate, Corporate Governance, News

Mumbai : The Reserve Bank of India (RBI) has imposed separate monetary penalties on lenders — UCO Bank, Axis Bank and Syndicate Bank — over deficiencies in complying with different regulatory norms.

Mumbai : The Reserve Bank of India (RBI) has imposed separate monetary penalties on lenders — UCO Bank, Axis Bank and Syndicate Bank — over deficiencies in complying with different regulatory norms.

The RBI imposed a penalty of Rs 2 crore each on UCO Bank and Axis Bank for non-compliance with its circular on ‘Collection of Account Payee Cheques – Prohibition on Crediting Proceeds to Third Party Account’ and Master Directions on ‘Frauds – Classification and Reporting by commercial banks and select FIs’.

In addition, a separate penalty of Rs 20 lakh was imposed on Axis Bank for contravention of the directions contained in ‘Master Circular on Detection and Impounding of Counterfeit Notes’ and, the ‘Circular on Sorting of Notes – Installation of Note Sorting Machines’.

In another statement, the RBI said it has imposed a penalty of Rs 1 crore on the government-owned Syndicate Bank for non-compliance with the directions contained in ‘Master Circular on Frauds – Classification and Reporting’ and ‘Circular on Risk Management Systems in Banks’.

—IANS