by Editor | May 25, 2021 | News

By Rajnish Singh,

By Rajnish Singh,

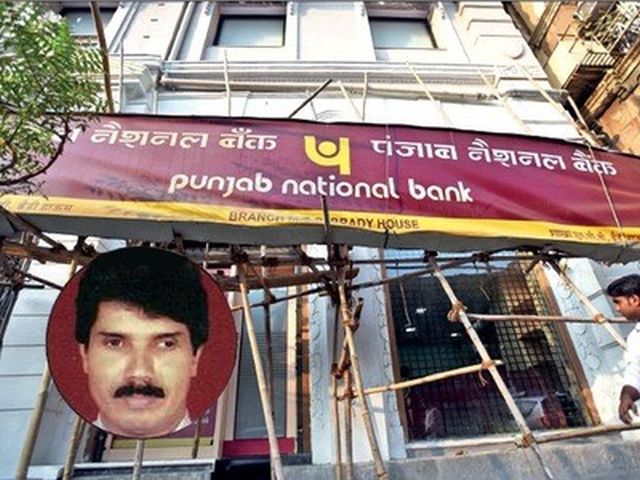

New Delhi : The practice of illegally issuing Letters of Understanding (LoUs) and Foreign Letter of Credits (FLCs) and then rolling them over to favour Nirav Modi and Mehul Choksi groups started in 2008 and continued till these were discovered in January this year, according to CBI officials.

The illicit activities resulting in fraud of Rs 11,300 crore occurred under the nose of top Punjab National Bank officials but they claimed to be unaware of the scam.

The revelation came to the fore during questioning by CBI officials of Rajesh Jindal, who was holding the charge of Mumbai-based PNB’s Brady House Branch Head between August 2009 and May 2011, Gokul Nath Shetty, a retired Deputy Manager from the same branch who retired in May 2017, Bechu B. Tiwari (Chief Manager, in charge of Forex Department), Yashwant Joshi (Scale II manager of Forex Department) and Prafful Sawant (Scale I officer, export).

The officials questions said they merely continued with the practice which is said to have started in 2008. It was not immediately clear who was in charge of the Forex Department when the illegal practice began.

The Central Bureau of Investigation (CBI) officials said the alleged multi-crore fraud by issuing LOUs and FLCs for sanction of loan to diamantire Nirav Modi and his uncle Mehul Choksi’s group of firms continued during Jindal’s tenure. Jindal, posted as GM Credit at PNB’s Head Office in New Delhi, was heading the second largest branch of the PNB when the practice of issuing the LoUs without sanctioned limits continued.

Jindal was arrested on Tuesday night after his day-long questioning in Mumbai. He was the 12th accused person to be arrested in the case so far. The CBI investigators had managed to get his custody till March 5 from the special CBI court on Wednesday.

Tiwari , Joshi and Sawant were also arrested on Monday for their alleged role in the scam and will remain in police custody till March 3.

All five PNB officials arrested so far were part of the forex department at the bank’s Brady House branch at the time of the fraud took place, said officials, adding these employees, in collaboration with the staff and associates of the firms headed by Nirav Modi and Choksi, commited wrongdoings for personal gains.

The first FIR in the scam registered on January 31 alleged that Shetty and a single window operator Manoj Kharat, during their forex department posting, fraudulently issued eight LoUs (which are a form of bank guarantee) equivalent to Rs 280 crore on February 9, 10 and 14, 2017, favouring the Nirav Modi companies to Allahabad Bank, Hong Kong, and Axis Bank, Hong Kong, without following prescribed procedure.

It added that the funds raised for import bills were not utilised for such purposes in many cases. Shetty and Kharat, arrested last week, are currently in CBI custody until March 3.

PNB’s employee Tiwari, in his capacity as Chief Manager, was to monitor Shetty’s transactions. However, Tiwari told the interrogators that during 2015-17, he did not monitor the fraudulent and illegal LoUs issued by Shetty.

An offcial close to the investigation said that Tiwari issued three circulars on February 19, 2016, February 7 and March 14, 2017, purportedly for the sake of keeping a check on the LoUs sent through the SWIFT code of the PNB’s Brady House Branch without any name. However, he neither followed it up nor took any steps to see why his instructions were not followed by Shetty, Joshi or Sawant.

“Tiwar’s deliberate acts of omissions led to the continuance of concealment and large scale liabilities of PNB to the foreign banks,” said the official.

The CBI filed the first FIR against Diamond R Us, Solar Exports and Stellar diamond whose partners have been named as Nirav Modi, his brother Nishal, uncle Mehul Choksi and wife Ami– who left the country earlier in early January. The second FIR was filed on February 15 for an amount of Rs 4,886.72 crore against the Gitanjali group headed by Choksi.

CBI officials said details of additional amounts (of around Rs 6,400 crore) would be added to the first FIR.

The second FIR also names 11 directors of the three Cholksi owned Gitanjali group companies– Gitanjali Gems Ltd, Gili India Ltd and Nakshatra Brands Ltd.

The PNB fraud came to light on January 16 when officials of Nirav Modi companies approached the bank for buyers’ credit without collateral saying they had been getting such facility for years. The bank said that the official who had earlier allowed such illegal facility through LoUs and FLCs had retired by then, and on checking by officials, the whole fraud unravelled.

(Rajnish Singh can be contacted at rajnish.s@ians.in)

—IANS

by Editor | May 25, 2021 | Banking, Corporate, Corporate Buzz, News, Politics

New Delhi : In light of the massive Rs 11,300 crore ($1.8 billion) scam allegedly involving jeweller Nirav Modi that has hit state-run Punjab National Bank (PNB), industry chamber Assocham said on Sunday that the government should surrender its majority control of banks, which should be allowed to function like private sector lenders.

New Delhi : In light of the massive Rs 11,300 crore ($1.8 billion) scam allegedly involving jeweller Nirav Modi that has hit state-run Punjab National Bank (PNB), industry chamber Assocham said on Sunday that the government should surrender its majority control of banks, which should be allowed to function like private sector lenders.

In a regulatory filing earlier this week, PNB said it had detected the gigantic fraud in one of its Mumbai branches, putting the quantum of fraudulent transactions at $1,771.69 million. The amount is equivalent to eight times the bank’s net income of about Rs 1,320 crore ($206 million).

“The PNB’s fraudulent transactions worth Rs 11,300 crore should act as a strong trigger for the government for reducing its stake to less than 50 per cent in the banks which should then be allowed to work on the lines of private sector lenders with a full sense of accountability to their shareholders protecting interest of depositors,” Assocham said in a statement here.

“The public sector banks (PSBs), ironically, are slipping from one crisis to the other and there is a limit the government can keep bailing them out at the cost of taxpayers’ money, even if it is the principal shareholder in these lenders,” it said.

The industry body said PSB senior managements spend bulk of their time “receiving and implementing directions from the bureaucrats even for innocuous issues.”

“In the process, the core banking functions, including all important risk mitigation and management, take a back seat.”

“The problem has become more grave with banks adopting new technologies which can prove both boon and bane,” it added.

In this connection, a Special CBI Court in Mumbai on Saturday remanded to police custody till March 3 three accused persons in the case.

The three includes a retired PNB Deputy Manager Gokulnath Shetty, Single Window Operator Manoj Kharat and an authorised signatory of the prime accused Nirav Modi’s group companies.

Besides these, the Central Bureau of Investigation (CBI) has named 10 other directors and officials as accused in the scam.

“Once the government equity in the banks is reduced below 50 per cent, there would be much more autonomy along with accountability and responsibility of the senior management,” Assocham said.

“The boards should then be truly taking the policy decisions while the CEOs would run the banks with full authority, coupled with the commensurate responsibility, instead of looking towards the bureaucrats for directions,” it added.

Assocham Secretary General D.S. Rawat in a statement urged the Reserve Bank of India (RBI) to take the lead to “engage with the industry in finding ways to do clean business in the entire financial sector, be it the public sector or private sector banks or even the non-banking finance companies.”

In this regard, Chief Economic Advisor (CEA) Arvind Subramaniam has also advocated more private participation in public sector banks.

Speaking at an event in Chennai on Saturday, Subramaniam said while the government was going for recapitalisation of public sector banks, the scrutiny, monitoring and disciplined deployment must be ensured only through greater private participation in banks.

According to him, there should be less public lending to private sector and the mode to achieve that is to have higher private participation in the banking sector.

He said more privatisation could be the way forward since there was no guarantee that better governance recommendations of banks, instead of privatisation, would be implemented effectively.

—IANS

by Editor | May 25, 2021 | Banking, Economy, Markets, News

By Porisma P. Gogoi,

By Porisma P. Gogoi,

Mumbai : The weekly trade in the Indian equity markets was almost flat. However, a slew of domestic developments like a $1.8 billion fraud reported by the Punjab National Bank (PNB) and release of major macro-economic data impacted the movements of the two key equity indices, analysts said.

On a weekly basis, the barometer 30-scrip Sensitive Index (Sensex) rose a tad by 5 points or 0.01 per cent to close at 34,010.76 points.

The wider Nifty50 of the National Stock Exchange (NSE) closed trade at 10,452.30 points — bit lower by 2.65 points or 0.02 per cent from its previous week’s close.

“Local factors were more at work during this week. Globally, the markets — especially the US markets — have done very well over the last six sessions. But upper moves in the domestic markets have been limited because of local factors,” Deepak Jasani, Head, Retail Research, HDFC Securities, told IANS.

“The market sentiments kept facing new challenges one after the other. This caused some concern in terms of their financial impact and/or political repercussions,” he added.

According to Jasani, it was the third consecutive week of losses for the Nifty50 index.

During the week, a massive-sell off in the banking sector stocks was triggered after the Reserve Bank of India (RBI) announced new norms to deal with non-performing assets on Monday.

Besides RBI’s latest move, the massive $1.8 billion fraud detected at one of the Mumbai branches of PNB — the country’s second largest public sector bank — on February 14 also spooked investors.

The markets were closed on Tuesday for Mahashivratri.

“The truncated week began with a gap-up opening on Monday; however, bulls failed to keep the momentum and eventually ended the week on lower note as the sentiments got further dented by a $1.77 billion fraud reported by the PNB earlier this week,” D.K. Aggarwal, Chairman and Managing Director of SMC Investments and Advisors, told IANS.

PNB shares started to decline after the bank detected a multi-crore fraud case and authorities blamed billionaire diamond trader Nirav Modi for the fraud along with wife Ami, brother Nishal and maternal uncle and business partner Mehul Choksi.

The bank’s shares plunged drastically following the news — over 9 per cent — along with the stocks of Choksi-promoted jewellery company Gitanjali Gems, which plunged almost 20 per cent.

On the macro-front, Aggarwal said: “The CPI (Consumer Price Index) fell marginally to 5.07 per cent in January, while industrial activity has shown growth of 7.1 per cent in December.”

“The December growth showed not only a robust year-on-year growth but also a strong chronological improvement in the industrial activity,” he added.

On the currency front, the rupee strengthened by 18-19 paise to close at 64.21-22 against the US dollar from its last week’s close at 64.40.

Provisional figures from the stock exchanges showed that foreign institutional investors sold off scrips worth Rs 2,849.1 crore, while domestic institutional investors purchased scrips worth Rs 2,368.01 crore during the week.

Figures from the National Securities Depository (NSDL) revealed that foreign portfolio investors off-loaded equities worth Rs 3,006.58 crore, or $467.77 million, during February 12-16.

“The benchmark index Nifty closed below 10,500 levels as banking stocks dragged after the PNB fraud case,” Arpit Jain, AVP at Arihant Capital Markets, told IANS.

“On the domestic front the country’s exports increased by 9 per cent in January, while trade deficit touched a three-year high of $16.3 billion due to an increase in crude oil imports,” he added.

Sector-wise, banks, consumer durables and auto fell the most, while metals, FMCG, and oil and gas indices ended marginally in the positive.

The top weekly Sensex gainers were: Tata Steel (up 2.52 per cent at Rs 688.30); Reliance Industries (up 2 per cent at Rs 921.70); Asian Paints (up 1.75 per cent at Rs 1,143.70); Dr Reddy’s Lab (up 1.55 per cent at Rs 2,212.75); and Hindustan Unilever (up 1.51 per cent at Rs 1,352.45).

The losers were: State Bank of India (down 9.85 per cent at Rs 271.75); Yes Bank (down 6.91 per cent at Rs 311.90); Axis Bank (down 5.41 per cent at Rs 537.75); ICICI Bank (down 4.05 per cent at Rs 321); and ITC (down 2.67 per cent at Rs 266.35).

(Porisma P. Gogoi can be contacted at porisma.g@ians.in)

—IANS

by Editor | May 25, 2021 | Banking, News, Politics

New Delhi : The Central Bureau of Investigation (CBI) has arrested Punjab National Bank’s retired Deputy Manager, Gokulnath Shetty and two others in a multi-crore bank fraud case, officials said on Saturday.

New Delhi : The Central Bureau of Investigation (CBI) has arrested Punjab National Bank’s retired Deputy Manager, Gokulnath Shetty and two others in a multi-crore bank fraud case, officials said on Saturday.

“CBI has Shetty, Single Window Operator Manoj Kharat and authorised signatory of the Nirav Modi Group of Firms, Hemant Bhat,” a CBI official said.

The official said that they will be presented before the CBI special court in Mumbai later in the day.

PNB’s retired Deputy Manager and Operator are named in the CBI FIR along with 10 directors of the three private firms namely Krishnan Sangameshwaran, Nazura Yashjaney, Gopal Das Bhatia, Aniyath Shivraman, Dhanesh Vrajlal Sheth, Jyoti Bharat Vora, Anil Umesh Haldipur, Chandrakant Kanu Karkare, Pankhuri Abhijeet Varange and Mihir Bhaskar Joshi.

According to the FIR, it was alleged in the PNB complaint that Gitanjali Gems, Gili India Ltd and Nakshatra Brand Ltd and their directors in connivance with Sethi and other officials had caused an alleged loss of Rs 4,886.72 crore to the bank.

The CBI on Friday registered fresh FIRs against 10 directors of the Gitanjali Group of companies under charges of criminal conspiracy and cheating of Indian Penal Code and Prevention of Corruption Act against Mehul Choksi, the Managing Director of Gitanjali Gems Ltd based at Mumbai’s Walkeshwar.

The FIR has also named two former bank employees who were said to be directly involved in the fraudulent transactions.

Additionally, three companies of Gitanjali Group were also named in the CBI FIR registered on Thursday for causing alleged loss of Rs 4,886.72 crore.

The Enforcement Directorate (ED) on Thursday launched a nation-wide raid on the offices, showrooms and workshops of billionaire diamond trader Nirav Modi.

The multi-pronged action came a day after the Punjab National Bank admitted to unearthing a fraud of Rs 11,515 crore involving Nirav Modi’s companies and certain other accounts with the bank’s flagship branch (Brady House Branch) in Mumbai and its second largest lending window in India.

The fraud, which includes money-laundering among others, concerns the Firestar Diamonds group in which the CBI last week booked Modi, his wife Ami, brother Nishal Modi and their uncle Mehul Choksi.

—IANS