by admin | May 25, 2021 | Banking, News, Politics

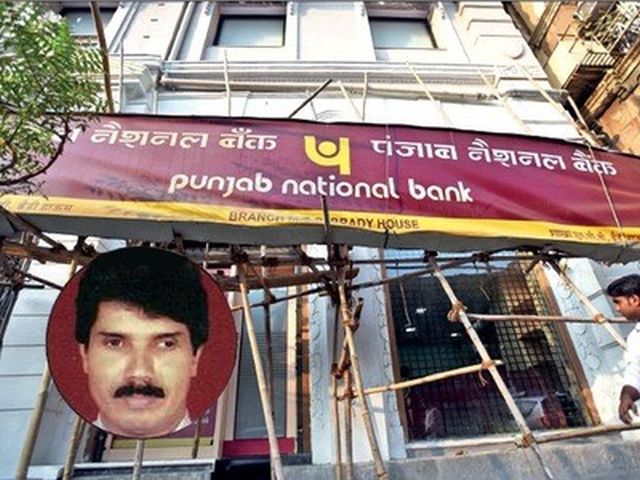

New Delhi : The Central Bureau of Investigation (CBI) has arrested Punjab National Bank’s retired Deputy Manager, Gokulnath Shetty and two others in a multi-crore bank fraud case, officials said on Saturday.

New Delhi : The Central Bureau of Investigation (CBI) has arrested Punjab National Bank’s retired Deputy Manager, Gokulnath Shetty and two others in a multi-crore bank fraud case, officials said on Saturday.

“CBI has Shetty, Single Window Operator Manoj Kharat and authorised signatory of the Nirav Modi Group of Firms, Hemant Bhat,” a CBI official said.

The official said that they will be presented before the CBI special court in Mumbai later in the day.

PNB’s retired Deputy Manager and Operator are named in the CBI FIR along with 10 directors of the three private firms namely Krishnan Sangameshwaran, Nazura Yashjaney, Gopal Das Bhatia, Aniyath Shivraman, Dhanesh Vrajlal Sheth, Jyoti Bharat Vora, Anil Umesh Haldipur, Chandrakant Kanu Karkare, Pankhuri Abhijeet Varange and Mihir Bhaskar Joshi.

According to the FIR, it was alleged in the PNB complaint that Gitanjali Gems, Gili India Ltd and Nakshatra Brand Ltd and their directors in connivance with Sethi and other officials had caused an alleged loss of Rs 4,886.72 crore to the bank.

The CBI on Friday registered fresh FIRs against 10 directors of the Gitanjali Group of companies under charges of criminal conspiracy and cheating of Indian Penal Code and Prevention of Corruption Act against Mehul Choksi, the Managing Director of Gitanjali Gems Ltd based at Mumbai’s Walkeshwar.

The FIR has also named two former bank employees who were said to be directly involved in the fraudulent transactions.

Additionally, three companies of Gitanjali Group were also named in the CBI FIR registered on Thursday for causing alleged loss of Rs 4,886.72 crore.

The Enforcement Directorate (ED) on Thursday launched a nation-wide raid on the offices, showrooms and workshops of billionaire diamond trader Nirav Modi.

The multi-pronged action came a day after the Punjab National Bank admitted to unearthing a fraud of Rs 11,515 crore involving Nirav Modi’s companies and certain other accounts with the bank’s flagship branch (Brady House Branch) in Mumbai and its second largest lending window in India.

The fraud, which includes money-laundering among others, concerns the Firestar Diamonds group in which the CBI last week booked Modi, his wife Ami, brother Nishal Modi and their uncle Mehul Choksi.

—IANS

by admin | May 25, 2021 | Corporate, Corporate Buzz, News, Politics

By Venkatachari Jagannathan,

By Venkatachari Jagannathan,

Chennai : Only the naive would believe that just two officials were involved in the $1.8 billion fraud in Punjab National Bank (PNB) and that the whole bank was in the dark for the past seven years, said a top leader of a major bank union.

He also asked the PNB management to reveal what kind of due diligence was done on diamond trader Nirav Modi and his companies before extending a loan of Rs 1,700 crore.

“The PNB management is blaming other banks for not sharing details of their due diligence done on Modi’s business. The $1.8 billion fraud is done on non-fund based transaction. The PNB management has to clarify what kind of due diligence it had done while lending to Modi’s firms a sum of Rs 1,700 crore,” C.H.Venkatachalam, General Secretary, All India Bank Employees’ Association (AIBEA) told IANS.

He also said the BJP government has not appointed workman and officer directors in public sector banks and that had weakened the checks and balances.

The PNB had said the alleged fraud was carried out by two staffers by not entering the transactions in the bank’s core banking solution but only in SWIFT signalling another bank’s overseas branch that the transaction is valid.

According to PNB’s complaint, some fraudulent issuance of Letters of Undertakings (LoU) were detected at its Brady House branch in Mumbai. The complaint said that the fraud came to light after the retirement of the deputy manager in the Brady House branch when employees of a set of partnership firms linked to diamond trader Nirav Modi presented import documents and asked for credit to pay their suppliers in January this year. The branch officials had asked for 110 per cent margin for issuance of LoU.

However the partnership firms argued that they had been availing such a facility in the past, but the branch officials did not find any official record in support of their argument.

It is clear, PNB stumbled upon the fraud by providence and not by its own intelligence, Venkatachalam said.

Simply put, LoU is a guarantee issued by a bank to another bank or its branch located in a foreign country. As per the LoU, the foreign bank or the foreign branch of an Indian bank would deposit the required sum in the Nostro account of the LoU issuing bank in that country. The importer then is paid the money.

When the borrower defaults, the foreign bank or the foreign branch of an Indian bank would claim its dues from the bank that issued the LoU.

According to PNB, the total fraud discovered linked to diamond trader Modi under the LoU was around $1.8 billion.

“There must be involvement of top officials of PNB to facilitate Modi’s fund needs. A high profile person like Modi would not directly deal with a low level officials at branch level,” Venkatachalam said.

A retired senior official of a government bank K.Srinivasan told IANS: LoUs are issued for a fee. Banks daily deploy their funds in various investment avenues including call money market. So, huge deposit in Nostro account would have been known to the PNB. Further the fee earned on such LoUs must have been booked,” Srinivasan said.

Srinivasan said, PNB management cannot simply say for seven years they were in the dark about the fraud.

Similarly, it is strange as to how the auditors — internal, statutory and concurrent — as well as the inspection team from RBI missed to check the deposits in Nostro accounts, the withdrawals from there and the fee income earned on LoUs, Srinivasan said.

Meanwhile, the Reserve Bank of India (RBI) some time back had asked the Indian banks to link core banking solution and the SWIFT network and also encrypt the messages sent using the SWIFT system, said a senior official in a core banking solution company.

“Some of the old version of core banking solution are not linked to the SWIFT system. As a result, bankers used to feed the fund transfer or other transactions in their core banking system and then send the necessary message to an overseas bank using the SWIFT console, the senior official in a banking software company told IANS preferring anonymity.

The SWIFT or the Society for Worldwide Interbank Financial Telecommunication is a network used by financial institutions to communicate financial transactions.

He said the PNB must have been using the old version of core banking solution without updating the same.

(Venkatachari Jagannathan can be reached at v.jagannathan@ians.in)

—IANS

New Delhi : The Central Bureau of Investigation (CBI) has arrested Punjab National Bank’s retired Deputy Manager, Gokulnath Shetty and two others in a multi-crore bank fraud case, officials said on Saturday.

New Delhi : The Central Bureau of Investigation (CBI) has arrested Punjab National Bank’s retired Deputy Manager, Gokulnath Shetty and two others in a multi-crore bank fraud case, officials said on Saturday.