by admin | May 25, 2021 | Economy, Markets, News

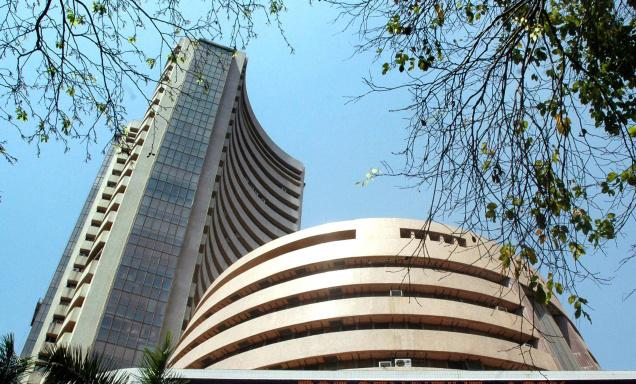

Mumbai : Key equity indices — NSE Nifty50 and BSE Sensex — receded to their 5-month low levels on Friday as investors got spooked after major world economies imposed new trade protectionist measures.

Mumbai : Key equity indices — NSE Nifty50 and BSE Sensex — receded to their 5-month low levels on Friday as investors got spooked after major world economies imposed new trade protectionist measures.

The global sell-off which impacted the Indian equity market was triggered after the US imposed new levies and tariffs on imports from China which in turn led to retaliatory actions by the Chinese government.

Besides fears over trade wars, a rise in crude oil prices pulled the the Nifty50 of the National Stock Exchange (NSE) below the 10,000-points-level. On a closing basis, the NSE Nifty50 declined by 116.70 points or 1.15 per cent to 9,998.05 points.

The barometer 30-scrip Sensitive Index (Sensex) of the BSE closed at 32,596.54 points — down 409.73 points or 1.24 per cent from the previous session’s close.

During the intra-day trade, the Sensex fell over 500 points to touch a low of 32,483.84 points.

The BSE market breadth was tilted towards the bears with 2,149 declines and 558 advances.

“Markets ended sharply lower on Friday. The weakness came triggered by the latest escalation in trade war between the two large global economies,” Deepak Jasani, Head – Retail Research, HDFC Securities, told IANS.

“The Nifty closed at its lowest level since October 11, 2017, while the Sensex closed at its lowest since October 23, 2017. In its upmove, the Nifty had closed above 10,000 points on July 26, 2017 and now it has closed below that level,” he added.

In terms of the broader markets, the S&P BSE mid cap index dipped by 1.36 per cent and the small cap index by 1.54 per cent.

According to Prateek Jain, Director at Hem Securities: “Global trade war tensions spooked investors today after US President Donald Trump ordered at least $50 billion in tariffs on Chinese imports and China announced plans for reciprocal tariffs on $3 billion of imports from the US.”

“Sentiment remained weak following weak clues from the global market. Overnight, US stocks fell sharply on Thursday, with major indices suffering their worst day in weeks as the threat of a trade war with China sparked a widespread sell-off. The market breadth, indicating the overall health of the market, was quite weak,” said Jain.

On the currency front, the Indian rupee strengthened by 10 paise at 65.01 against the US dollar from its previous close at 65.11.

In terms of investments, provisional data with the exchanges showed that foreign institutional investors purchased scrips worth Rs 1,628.19 crore, while the domestic institutional investors sold stocks worth Rs 935.41 crore.

“Volatility expanded and market is losing its grip due to escalating tensions of trade war and spike in oil prices,” said Vinod Nair, Head of Research at Geojit Financial Services.

“Market corrected 10 per cent from its peak while metal and PSU banks continue to be the laggards. We expect domestic chaos to stabilise as pressure of redemption will be over by the end of FY18 but pre-election volatility may take some time,” Nair added.

Almost all the sub-indices of the BSE ended in the red, barring the IT index (up 23.62 points) and Teck (technology, media and entertainment) index (up 20.61 points).

The S&P BSE banking index plunged by 562.95 points, followed by metal index by 388.51 points, capital goods index by 286.20 points, auto index by 203.77 points and healthcare index by 196.43 points.

Major Sensex gainers on Friday were: Adani Ports, up 0.99 per cent at Rs 361.70; Infosys, up 0.75 per cent at Rs 1167.45; Power Grid, up 0.54 per cent at Rs 194.25; Mahindra and Mahindra, up 0.47 per cent at Rs 733.25; and Coal India, up 0.09 per cent at Rs 269.25.

The Sensex losers were: Yes Bank, down 3.87 per cent at Rs 286.70; Axis Bank, down 3.34 per cent at Rs 501; State Bank of India, down 2.90 per cent at Rs 234.60; ICICI Bank, down 2.73 per cent at Rs 275.80; and Tata Steel, down 2.40 per cent at Rs 566.60.

—IANS

by admin | May 25, 2021 | Economy, Markets, News

Mumbai : The key Indian equity indices on Monday witnessed the biggest intra-day gains in around two years with the benchmark BSE Sensex index surging by over 600 points and the Nifty50 of the National Stock Exchange (NSE) by almost 200 points.

Mumbai : The key Indian equity indices on Monday witnessed the biggest intra-day gains in around two years with the benchmark BSE Sensex index surging by over 600 points and the Nifty50 of the National Stock Exchange (NSE) by almost 200 points.

According to market observers, across-the-board buying, as well as positive cues from the global markets on easing trade war fears and hopes of easing inflation in the Consumer Price Index (CPI) data at home slated for release after market hours, lifted the indices by gains last seen in March 2016.

On the NSE, the wider Nifty50 edged higher by 194.55 points, or 1.90 per cent, to close trade at 10,421.40 points.

The barometer 30-scrip Sensitive Index (Sensex) closed at 33,917.94 points — up 610.80 points, or 1.83 per cent, from the previous session’s close.

The Sensex touched a high of 33,962.48 points and a low of 33,468.16 points during the intra-day trade.

However, the BSE market breadth remained tilted to the bearish with 1,370 declines and 1,346 advances.

“Markets rallied sharply today with the Nifty breaking out of the 10,444 resistance in the process. The gains came on the back of positive global equity markets as international trade-war concerns took a backseat to economic optimism following a stronger US jobs report released over the weekend,” Deepak Jasani, Head – Retail Research, HDFC Securities, told IANS.

“Gains were led by ITC, HDFC and Reliance Industries. Broad market indices like the BSE mid-cap and small-cap indices gained less, thereby underperforming the main indices,” Jasani added.

In terms of the broader markets, the S&P BSE mid-cap index edged higher by 0.76 per cent and the small-cap index by 0.56 per cent.

Vinod Nair, Head of Research, Geojit Financial Services, said: “Firm global cues and expectation of ease in domestic inflation to 4.74 per cent excited investors to utilise the bargain opportunity.”

“Investors are positive on blue chips on expectation of faster recovery, however, mid and small cap witnessed reluctance due to high valuation,” Nair said.

On the currency front, the Indian rupee strengthened by 13 paise to close at 65.04 against the US dollar from its last week’s close at 65.17.

Provisional data with the exchanges showed that foreign institutional investors turned net buyers and purchased scrips worth Rs 374.65 crore. However, domestic institutional investors sold stocks worth Rs 464.59 crore.

All the 19 sub-indices of the BSE closed with gains led by the S&P BSE banking index, which escalated by 437.70 points.

It was followed by the auto (up 335.17 points), metal (up 325.30 points), oil and gas (up 321.28 points), capital goods (up 228.70 points) and FMCG (up 219.37 points) indices.

Major Sensex gainers on Monday were: Bharti Airtel, up 4.68 per cent at Rs 420.75; NTPC, up 4.33 per cent at Rs 171; ITC, up 4.09 per cent at Rs 270; Tata Motors, up 3.07 per cent at Rs 352.20; and Tata Steel, up 2.82 per cent at Rs 622.70.

The Sensex losers were: Coal India, down 2.26 per cent at Rs 297.80 and State Bank of India, down 0.12 per cent at Rs 252.85.

—IANS

by admin | May 25, 2021 | Banking, Economy, Markets, News

By Porisma P. Gogoi,

By Porisma P. Gogoi,

Mumbai : The bears, tracking weak global cues, under-performance by banking sector stocks and outflow of foreign funds, ruled the Indian equity markets during the week ended Friday which saw the BSE Sensex and Nifty50 indices dropping over 2 per cent.

Fears of a global trade war following US President Donald Trump’s proposal to impose tariff on import of metals, along with the turmoil in the domestic banking sector, continued to erode the risk-taking appetite of investors.

On a weekly basis, the barometer 30-scrip Sensitive Index (Sensex) of the BSE shed 739.8 points or 2.17 per cent to close at 33,307.14 points.

The wider Nifty50 of the National Stock Exchange (NSE) closed trade at 10,226.85 points — down 231.5 points or 2.21 per cent from its previous week’s close.

“The week gone by saw the Nifty resuming its intermediate downtrend after a minor loss witnessed last week. There were no sectoral gainers, while the top losers were metal, PSU bank, pharma and infra indices,” Deepak Jasani, Head, Retail Research, HDFC Securities, told IANS.

According to D.K. Aggarwal, Chairman and Managing Director of SMC Investments and Advisors, domestic market closed the week in red tracking weak global cues.

“Actually, market participants across the globe reacted to President Donald Trump’s decision to impose tariffs on metal imports,” Aggarwal told IANS.

“Oil prices fell for a second consecutive week as the dollar strengthened and concerns over rising US crude production continued to mount on signs of an inventory build-up at a key US storage hub,” he added.

On the currency front, the rupee closed flat at 65.17 against the US dollar.

“Markets continued to trade lower even though economy growth numbers been positive. The Punjab National Bank fraud (PNB) has taken a big toll on the markets and has resulted in a sell-off in almost all the banks stocks,” said Dhruv Desai, Director and Chief Operating Officer of Tradebulls.

Desai pointed out that the country’s IT sector has emerged as an outperforming sector in the recent correction witnessed in the markets.

“The S&P BSE IT index rose nearly 10 per cent compared to a one per cent fall seen in the S&P BSE Sensex so far in the year 2018,” Desai told IANS.

Vinod Nair Head Of Research at Geojit Financial Services, said: “Market continued to be under pressure on concerns impending global trade war, extension of PSU NPA (non-performing assets) worries and rise in bond yields.”

PSU Bank index — the key underperformer — declined by 5 per cent during the week, Nair said.

“FIIs (foreign institutional investors) are pulling out money given negative cues from both domestic as well on global front. The introduction of Long Term Capital Gains, scam in PNB, repeated signals from the US Fed to hike interest rates rapidly and possibility of downgrades of India weightage from MSCI index are the key factors which is turning FIIs cautious on domestic market,” he added.

Provisional figures from the stock exchanges showed that FIIs sold-off scrips worth Rs 280.74 crore, while domestic institutional investors (DIIs) purchased scrips worth Rs 131.07 crore during the week.

Figures from the National Securities Depository (NSDL) revealed that foreign portfolio investors invested in equities worth Rs 1,384.36 crore, or $212.98 million, during March 5-9.

The top weekly Sensex gainers were: Asian Paints (up 0.73 per cent at Rs 1,127.75); NTPC (up 0.55 per cent at Rs 163.90); HDFC (up 0.32 per cent at Rs 1,818.45); Infosys (up 0.27 per cent at Rs 1,163.40); and Hero MotoCorp (up 0.21 per cent at Rs 3,587).

The losers were: Tata Steel (down 10.32 per cent at Rs 605.60); Tata Motors (down 7.86 per cent at Rs 341.70); Tata Motors (DVR) (down 7.34 per cent at Rs 192.60); Adani Ports (down 6.95 per cent at Rs 377.30); and Bharti Airtel (down 5.81 per cent at Rs 401.95).

(Porisma P. Gogoi can be contacted at porisma.g@ians.in)

—IANS

by admin | May 25, 2021 | Economy, Markets, News

Mumbai : Following a massive global sell-off, the Indian equity markets turned bearish for the second consecutive week — with the BSE Sensex dropping over a 1,000 points and the Nifty50 index over 300 points.

Mumbai : Following a massive global sell-off, the Indian equity markets turned bearish for the second consecutive week — with the BSE Sensex dropping over a 1,000 points and the Nifty50 index over 300 points.

On a weekly basis, the barometer 30-scrip Sensitive Index (Sensex) tanked 1,060.99 points or 3.02 per cent to close trade at 34,005.76 points.

The wider Nifty50 of the National Stock Exchange (NSE) closed the week’s trade at 10,454.95 points — shedding 305.65 points or 2.84 per cent from its previous week’s close.

Since February 1, the BSE Sensex has shed around 1,900 points and the NSE Nifty over 500 points.

“In the week gone by, global stock market witnessed huge sell-off amid the fear of interest rates hike and this too sent the bond yields higher,” D.K. Aggarwal, Chairman and Managing Director of SMC Investments and Advisors, told IANS.

“Back at home, the Union Budget 2018 verdict played a catalyst role and since then market has been tumbling down. Though market recovered and closed in green on Thursday but on Friday market closed red tracking lower Asian and US markets,” he added.

Aggarwal said in line with expectations, the Reserve Bank of India — in its final bi-monthly monetary policy review of the fiscal on Wednesday — kept key interest rate unchanged at 6 per cent with neutral stance, citing concerns about the inflationary push by rising global crude oil prices.

On the currency front, the rupee weakened by 34 paise to close at 64.40 against the US dollar from its last week’s close at 64.06.

Provisional figures from the stock exchanges showed that foreign institutional investors sold off scrips worth Rs 8,260.96 crore, while domestic institutional investors purchased scrips worth Rs 6,286.58 crore during the week.

Figures from the National Securities Depository (NSDL) revealed that foreign portfolio investors off-loaded equities worth Rs 4,738.66 crore, or $738.24 million, during February 5-9.

“The week gone by saw the Nifty correcting further. The Nifty ended with week-on-week losses of 2.84 per cent,” Deepak Jasani, Head, Retail Research, HDFC Securities, told IANS.

“Sectorally, the top gainers were the pharma, metal and media indices. The top losers were the Bank Nifty, infra, FMCG and auto indices,” he added.

The top weekly Sensex gainers were: Sun Pharma (up 5.72 per cent at Rs 582.65); Dr Reddy’s Lab (up 3.43 per cent at Rs 2,194.80); Coal India (up 2.84 per cent at Rs 300.45); Tata Steel (up 2.08 per cent at Rs 683.65); and Power Grid (up 0.36 per cent at Rs 193.20).

The losers were: Yes Bank (down 6.99 per cent at Rs 325.55); HDFC (down 6.84 per cent at Rs 1,773.20); Larsen and Toubro (down 6.01 per cent at Rs 1,329.35); IndusInd Bank (down 5.94 per cent at Rs 1,651.40); and Tata Consultancy Services (down 5.62 per cent at Rs 2,972.30).

—IANS

by admin | May 25, 2021 | Economy, Markets, News

Mumbai : Projection of India’s healthy economic growth outlook, along with bullish global cues lifted the key Indian equity indices to their new highs during the morning trade session on Tuesday.

Mumbai : Projection of India’s healthy economic growth outlook, along with bullish global cues lifted the key Indian equity indices to their new highs during the morning trade session on Tuesday.

Accordingly, the S&P BSE Sensex and the NSE Nifty50 breached their previous respective intra-day high levels.

In the process, the barometer Sensex crossed the 36,000-points-mark and the NSE Nifty50 climbed above 11,000 points.

Market analysts pointed-out other factors such as positive Q3 results, fresh inflows of foreign funds and buying support in metals, oil and gas, IT, banking and consumer durables stocks that aided the key indices’ upward trajectory.

At 10.30 a.m., the 30-scrip S&P BSE Sensex, which had closed at 35,798.01 points on Monday, traded higher at 36,019.40 points, up by 221.39 points or 0.62 per cent.

The Sensex touched a high of 36,051.86 points and a low of 35,863.98 during the intra-day trade so far.

The BSE market breadth was bullish — 1,516 advances and 889 declines.

At the National Stock Exchange (NSE), the broader Nifty50 quoted at 11,046.50 points, up by 80.30 points or 0.73 per cent.

Dhruv Desai, Director and Chief Operating Officer of Tradebulls told IANS: “Indian shares open at record Tuesday as investors received a boost from International Monetary Fund’s projection that India could emerge as the fastest-growing country in the world in 2018 at 7.4 per cent amid optimism over Prime Minister Narendra Modi’s address to the World Economic Forum.”

“Also investors’ expectation from the Union Budget, that is due next week, helped market to reach new highs.”

According to Deepak Jasani, Head – Retail Research, HDFC Securities, Nifty which touched 11,000 points in the early trade on Tuesday gained the last 1,000 points in about six months.

“The Sensex rose to touch 36,000 mark today gaining the last 1,000 points in four days,” Jasani told IANS.

“The bull run in the equity markets continue in India. The turnaround in the industrial growth in October 2017, along with big policy announcements related to Bank recap and Bharatmala led to a good up move in October 2017.”

“In January 2018, we are witnessing FIIs returning to the buy side in a big way after a break. The forthcoming Budget could aid in determining the future direction of markets from hereon,” Jasani said.

On Monday, the equity indices closed on record high levels on the back of upbeat quarterly corporate earnings, along with appreciable influx of foreign funds and healthy buying in IT stocks.

Consequently, the wider Nifty50 closed higher by 71.50 points or 0.66 per cent at a new level of 10,966.20 points.

Similarly, the Sensex closed at a fresh high level of 35,798.01 points — up 286.43 points or 0.81 per cent — from its previous session’s close.

—IANS

Mumbai : Key equity indices — NSE Nifty50 and BSE Sensex — receded to their 5-month low levels on Friday as investors got spooked after major world economies imposed new trade protectionist measures.

Mumbai : Key equity indices — NSE Nifty50 and BSE Sensex — receded to their 5-month low levels on Friday as investors got spooked after major world economies imposed new trade protectionist measures.