India’s economic fundamentals stable, says Council chaired by Jaitley

New Delhi : India has macro-economic stability on the back of structural reforms like GST and the long term positive impact of demonetisation, with the financial markets expressing confidence through high-stock valuations, the Financial Stability and Development Council (FSDC) noted in its meeting held on Tuesday.

New Delhi : India has macro-economic stability on the back of structural reforms like GST and the long term positive impact of demonetisation, with the financial markets expressing confidence through high-stock valuations, the Financial Stability and Development Council (FSDC) noted in its meeting held on Tuesday.

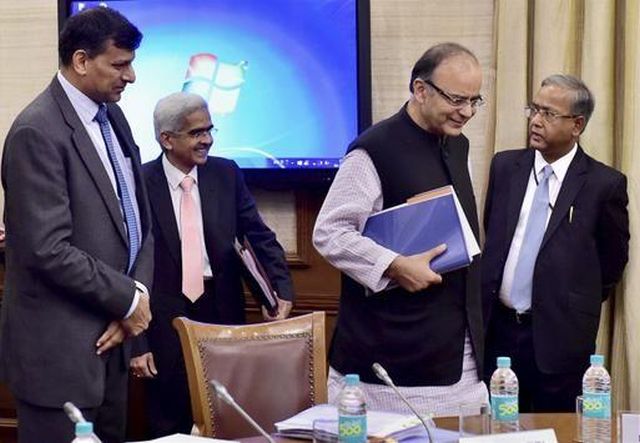

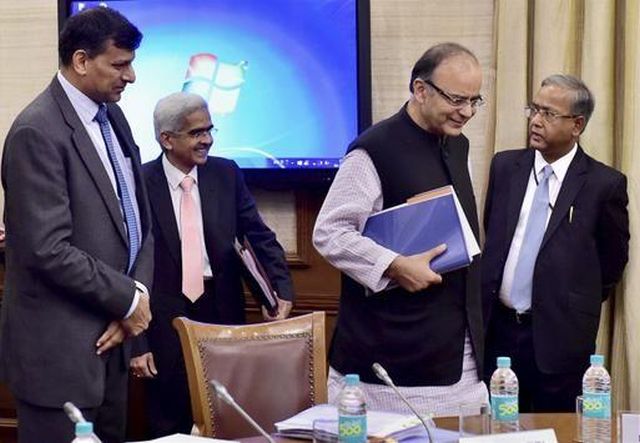

The 17th meeting of the FSDC was held here under the chairmanship of Finance Minister Arun Jaitley.

“The Council noted that India has macro-economic stability today on the back of improvements in its macro-economic fundamentals, structural reforms with the launch of the Goods and Services Tax (GST), action being taken to address the Twin Balance Sheet (TBS) challenge, extraordinary financial market confidence, reflected in high and rising bond and especially stock valuations and long-term positive consequences of demonetisation,” the Finance Ministry said in a statement.

It also deliberated on strengthening the regulation of the Credit Rating Agencies (CRAs).

The Council also discussed the issues and challenges facing the Indian economy and the members agreed on the need to keep constant vigil and be in a state of preparedness for managing any external and internal vulnerabilities.

It also took note of the progress of financial sector assessment programme for India, jointly conducted by the International Monetary Fund and the World Bank.

“The Council directed that the assessment report should be finalised by the end of this year,” it said.

A presentation on the state of economy was made by Chief Economic Adviser (CEA) Arvind Subramanian.

The meeting was attended by Reserve Bank of India Governor Urjit R. Patel, Finance Secretary Ashok Lavasa, Economic Affairs Secretary Subhash Chandra Garg, Financial Services Secretary Anjuly Chib Duggal, Ministry of Corporate Affairs Secretary Tapan Ray, Ministry of Electronics and Information Technology Secretary Ajay Prakash Sawhney, Securities and Exchange Board of India (Sebi) Chairman Ajay Tyagi, Insurance Regulatory and Development Authority of India (IRDAI) Chairman T.S. Vijayan, Pension Fund Regulatory and Development Authority (PFRDA) Chairman Hemant G. Contractor and other senior officers of the government and financial sector regulators.

FSDC took note of the developments and progress made in setting up of Computer Emergency Response Team in the Financial Sector (CERT-Fin) and Financial Data Management Centre and discussed measures for time bound implementation of the institution building initiative.

A brief report on the activities undertaken by the FSDC sub-committee chaired by the RBI Governor was placed before the Council.

It also undertook a comprehensive review of the action taken by members on the decisions taken in earlier meetings of the Council.

The Central KYC Registry (CKYCR) system was also discussed and the Council took note of the initiatives taken in this regard by the members and discussed the issues/suggestions in respect of its operationalisation.

—IANS