by Editor | May 25, 2021 | Muslim World

Jeddah, (IINA) – New markets for Islamic finance are emerging, with African countries launching debut sovereign sukuk and East Asian countries enabling their domestic markets to tap into Islamic financing, Saudi Gazette reported.

Jeddah, (IINA) – New markets for Islamic finance are emerging, with African countries launching debut sovereign sukuk and East Asian countries enabling their domestic markets to tap into Islamic financing, Saudi Gazette reported.

A glimpse of the 2015-2016 edition of the ‘State of the Global Islamic Economy’ said ahead of the Global Islamic Economy Summit that will run in Dubai on Oct. 5-6, 2015 said. The Islamic Development Bank (IDB) and the Bill & Melinda Gates Foundation have formally launched a $500 million grant facility to address poverty and diseases in IDB member countries. Meanwhile, European banks in Russia and Germany, for example, are also investing in Islamic finance through debut sovereign sukuk and Islamic banking windows.

Besides, as the demand for safe, wholesome and humane food grows around the world, producers of halal food who truly adhere to the concepts of ‘halal’ and ‘tayyib’ foods have an opportunity to become the global standard for this segment.

The report cited Saffron Road as a leading premium US brand in the halal and all-natural market. The company is ranked as the fastest growth brand of natural entrées in the US, among all frozen entrées, not just halal. The brand will achieve over $40 million in retail sales this year, and is expected to grow over 50 percent next year.

Moreover, there have been many success stories in the ever-burgeoning halal travel sector. HalalBooking.com, a travel search and booking website for halal-conscious travelers, has achieved tremendous success. The website’s booking for Turkey-based hotel clients has exceeded millions per resort, and hopes to reach 10 million per hotel for many of its properties by end 2015 and through 2016. This is in addition to other success stories such as Yamsafer, a hotel booking start-up from Palestine that raised $3.5 million from Global Founders Capital.

Furthermore, the report noted a new frontier in the Islamic economy that is the digital component. This segment has woven itself into the lives of many Muslims worldwide as an integral part of their lifestyle. From Qur’an and halal travel mobile apps to online Islamic education services and tools for locating the nearest halal restaurants, the Islamic Digital Economy has emerged as a high growth segment. Success stories include Zabihah.com, a leading location-based guide to halal restaurants and markets with a digital reach of 10 million unique users, MuslimPro, a prayer, and the ‘qibla’ tracking mobile app with over 10 million Android downloads in 16 different languages.

In addition, pharmaceuticals & cosmetics sector offers several success stories and opportunities for growth. The halal cosmetics sector in particular is growing quickly in the Asia Pacific through smaller brands, forcing large companies such as Unilever to start looking at halal cosmetics to ensure they maintain their strong presence in this region. South East Asia is leading the development of halal vaccinations for meningitis, hepatitis and meningococcal for hajj pilgrims.

Muslim fashion e-commerce platforms such as Hijup and Modanisa are receiving further investments to grow their user base, while mainstream fashion players such as Uniqlo, Mango and Tommy Hilfiger are following the lead of haute couture houses such as DKNY in tapping into the modest fashion market, the report said.

The report is released ahead of the Global Islamic Economy Summit 2015, organized by the Dubai Chamber of Commerce, Dubai Islamic Economy Development Centre (DIEDC) and Thomson Reuters.

Abdulla Mohammad Al Awar, CEO of DIEDC, said “the launch of this year’s State of the Global Islamic Economy report reiterates the commitment of Dubai Islamic Economy Development Centre, along with Thomson Reuters and DinarStandard to nurture a knowledge-based Islamic economy within the emirate and wider UAE as part of our continued priority to develop Dubai as the Capital of Islamic Economy. We are confident the report will inspire and empower entrepreneurs, industry leaders and investors from within the Arab world and beyond to evaluate and develop an actionable, practical and high impact market strategy focused on growing the opportunities for Islamic economy in their own geographies.”

by Editor | May 25, 2021 | Halal Industries

London, (IINA) – Islamic finance has been growing rapidly over the past decades, reaching $1.8 trillion in 2014 and is expected to exceed $3 trillion by 2018, Consultancy.uk reported.

London, (IINA) – Islamic finance has been growing rapidly over the past decades, reaching $1.8 trillion in 2014 and is expected to exceed $3 trillion by 2018, Consultancy.uk reported.

“Consultancy.uk is the leading online platform for the management consulting industry in the UK.”

In a recent article by BearingPoint Institute, the consulting firm considers the differences between the partnership practice of Islamic banking and the practice of interest. The firm also explores the wider challenges faced by both Islamic and western banking institutions as the practice of Islamic banking further expands to meet the needs of up to 1.6 billion potential participants in Islamic financial products and services.

Islamic states, such as Saudi Arabia, Qatar and Malaysia, also practice a form of finance, called Islamic finance, which eschews one of Western finances fundamental concepts: interest.

The principles of Islamic banking come from the Sharia law that prohibits usury, uncertainty and speculation; rather it requires transparency and necessitates physical presence for money transfers.

Today Islamic banking is a $1.8 trillion dollar financial structure, with a large number of different segments being served by Islamic banking institutions. The baking practice is growing rapidly, with double digits, and is expected to be worth up to $3 trillion by 2018.

One of the main financial instruments in Islamic banking is sukuk, which is roughly equivalent to bonds. Through entering into partnerships with small players, Islamic banks provide a different funding source than government finances, which accounts for 62 percent of some markets. Furthermore, unlike conventional bonds, sukuk grants the investor a share of an asset, along with cash and risk. The largest part of the total bonds issued in the market has been provided to financial services at 26 percent, followed by energy & utilities at 25 percent. Transport comes in at 19 percent followed by real estate at 8 percent.

According to BearingPoint, a number of challenges face the form of banking. The main challenge relates to staying within international and national regulations while at the same time making sure that providers keep their reputations and remain within the spirit and the letter of the practice. Finding relevant skills also is an issue for institutions, at both the level of principles and operational practice required in meeting face to face and upholding strong bonds.

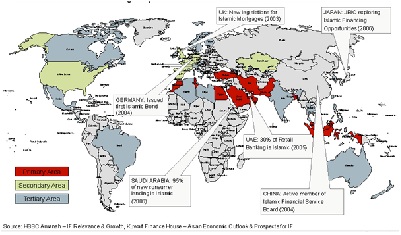

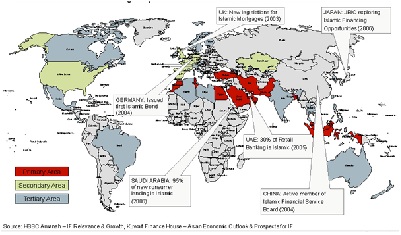

Western financial institutions seeking to enter the Islamic financial market face considerable hurdles. According to the researchers, a lack of cultural awareness and a fundamentally wrong intention behind the practice are possible barriers. One way to enter the relevant markets is to create subsidiaries that are their own brands, like ‘Amanah’ created by the HSBC group. As the practice is expanding into new areas, the risk of Western business not fully understanding the way of engaging with partners makes it considerably more difficult to reach out to the Middle East, Africa and Far Eastern countries, such as Malaysia and Indonesia. Banks in these regions are increasingly likely to come across organizations for whom it has a place customers, partners, suppliers, and governmental and non-governmental organizations.

by Editor | May 25, 2021 | Halal Industries

Al Rajhi Saudi bank

Riyadh:(IINA) – In a ranking exercise of the top Islamic Banks based on assets, the leading Islamic Finance industry title IslamicFinance.com has released a charting application to visualize rankings, according to Sukuk, and Islamic Finance websites.

Based on the rankings Gulf based banks dominate global Islamic bank rankings with Al Rajhi bank maintaining its top ranking based on assets of over $82 billion, followed by Kuwait finance house on $56.8 billion, Dubai Islamic bank on $33.73 billion and Abu Dhabi Islamic bank with $30.49 billion in assets.

The associated ranking application ‘The Islamic Bank Chart‘ released by IslamicFinance.com to visualize Islamic Banking ranking data allows for the comparison of top ranked banks, as well as the ability to filter by country or to select a specific bank.

Overall, Islamic finance assets are heavily concentrated in the Middle East and Asia, although the number of new markets is expanding. The GCC region accounts for the largest proportion of Islamic financial assets as the sector sets to gain mainstream relevance in most of its jurisdictions; the region represents 37.6 percent of the total global Islamic financial assets. The Middle East and North Africa (MENA) region (excluding GCC) ranks a close second, with a 34.4 percent share, buoyed by Iran’s fully Shariah compliant banking sector. Asia ranks third, representing a 22.4 percent share in the global total, largely spearheaded by the Malaysian Islamic finance marketplace.

by Editor | May 25, 2021 | Corporate, Corporate finance, Investing, Islamic Finance, News, Opinions

Dr Piotr Konwicki

By Dr Piotr Konwicki

Turkey’s G20 Presidency has made financing for growth a key component of its agenda and will promote Islamic finance as a tool to facilitate this worldwide. At a recent IMF discussion the Turkish deputy prime minister told the audience that Islamic finance “is for all mankind” and praised that fact that the UK as one of the leading Islamic finance centres, is the first country outside the Muslim world to issue Islamic bond (Sukuk)

Turkey stresses that since the global financial crisis, traditional sources of infrastructure and SME finance have been constrained. The banking sector, which has traditionally been a major source of funding, has undergone a significant deleveraging process. Against this backdrop, there has been a gradual shift towards a model that includes a greater share of asset-based funding, pooling in private sector resources and designing appropriate risk sharing methods.

Islamic finance – the fastest growing area of finance in 21st Century, with assets ascending from $600 billion in 2007 to over $1.3 trillion in 2012 – seems to “tick” many of these boxes.

Islamic finance is a type of financial system that operates according to Sharia – a legislative framework, based mostly on Quran, which regulates all aspects of Islamic life. The two foundational principles are the prohibition of interest (riba) and Profit and Loss sharing. No Islamic finance product can involve Rishwah (corruption), Maysir (gambling), Gharar (unnecessary risk) and Jahl (ignorance).

Proponents of Islamic finance stress that in particular the risk-sharing principle re-creates a link between lenders and firms, making banks behave more like partners in business. An Islamic bank has a duty to help its customer and, if necessary, share some of the project losses. During the financial crisis trust has been severely tested and in particular SMEs often perceive banks as a source of the problem, not a solution, so this is effectively a more “ethical” model.

Contracts form the backbone of the profit-and-loss-sharing model of Islamic financing. For example Mudarabah is basic contract made between an investor who solely provides the capital and an entrepreneur who solely manages the project. If the venture is profitable, the profit will be distributed based on a pre-agreed ratio.

Proponents of this model link it to the Prophet Muhammad’s communitarian vision that Muslims with wealth should invest it productively to expand the welfare of the community, rather than simply being moneylenders who extract rents regardless of success or failure.

Islam makes it clear that this extension of the community welfare applies to all people, not only Muslims. This has been noted, among others by the Osservatore Romano, which in 2009 wrote that conventional banks should look at the rules of Islamic finance to restore confidence amongst their clients at a time of global economic crisis.

Islamic finance also has a unique potential correctly picked-up by Turkey. A recent Pakistani survey shows that (1) about 70% of the population is excluded for the banking system due to the low income levels and (2) when a first-time customer enters the market, there is an 86% chance that he will choose an Islamic bank.

Peruvian economist H. DeSoto coined a term of “dead capital” – physical resources and capital that are not used for any purpose other than to provide physical service to their owners. He estimates that the developing and former communist countries possess US$9.3 trillion worth of this and suggests that the ability of using this capital as a productive asset is what distinguishes the rich from the poor. Islamic finance carries a potential – through its risk-sharing and possibility of microloans – to put this capital into action and lift many people from poverty; one of the United Nations Millennium Development goals.

However despite its significant growth and ethical appeal, Islamic finance faces an array of challenges and needs to develop products which meet the sophisticated needs of its customers if it is to reach all Muslims, let alone ‘all mankind.’

Islamic Finance is generally more expensive than conventional banking due to high transaction and monitoring costs. Each Islamic financial institution employs a Sharia committee to oversee transactions and confirm compliance with Islamic Law. The existence of such a committee increases the cost base – while it is difficult to precisely assess it, for example Malaysian Takaful (Islamic insurance) companies in 2010 had 50% higher management cost ratio compared with traditional insurance firms.

Islamic finance also remains inferior to conventional banking and finance in terms of product development. It copies the financial instruments from the conventional sector and often fills the gaps left by it – due to either too high risk or not large enough size. During the period 2008-2010, Islamic banks in Indonesia charged almost 50% higher financing rates than their conventional equivalents.

There is a lack of standard global guidelines and no single authority governing Islamic Finance, which means that in some cases a product is deemed Sharia compliant in one market and not in another – this is especially the case with Malaysian products, which are often deemed not Sharia complaint in the Gulf.

Unfortunately, due to events that are very much in the public eye every day, religious tensions and negative associations with Islam also exist. Particularly taking into account a closer integration with Sharia, Islamic Finance could be seen by some as a “back door” attempt to introduce Sharia to Western states where separation of the State and religion is a cornerstone of political and economic systems.

So although Islamic Finance has the potential to be applied to a wide menu of financial instruments and provide a viable, ethical system on a global scale, there are significant challenges that have to be met, including adoption of unified standards of accountability, transparency and efficiency.

If it can meet these challenges and is able to help mobilise a sizeable fraction of the “dead capital” then Islamic Finance might, as Turkey suggests, genuinely contribute the worldwide growth.

Dr Piotr Konwicki is a Senior Lecturer in Finance at the University of Bedfordshire Business School.

Courtesy: economia

by Editor | May 25, 2021 | Investing, Islamic Finance, News, Opinions

By Er. Izhar Khan

Religion is thought to influence economic performance at the individual, group, and national level. Islam is a religion of peace which today governs the life of 1.6 billion Muslims around the world. Islam gives the principles to lead life in all areas to Muslims in particular and Non-Muslims in general. Quran states that Allah created human being to worship him and as his representative on earth.

The belief in the divine revelation is fundamental and obeying Allah’s command is duty of every Muslim. The Allah not only commands Muslims to perform religious duty but also once free from it should spread on the earth to seek from his bounty (Quran 62:10). Islam wants Muslims to take economic activities in large way which will benefit them as well as others. Prophet Muhammad صلى الله عليه وسلم preferred trade as best means of earning the sustenance and also encouraged the Muslims to do trade. The people of Mecca including the first four caliphs of Islam were traders. They were skilled traders and merchants who use to trade with Syria, Yemen, Ethiopia and Iraq. Later Trade was one of the best ways for Muslims to take the Message of Islam to rest of the world through Silk Route. It is believed that Message of Islam reached to China, Malaysia, and Indonesia through ancient Silk route trade.

However people of Mecca in while trading did not differentiate between lawful and unlawful, good and bad, harmful. Quran established the principles of trade for Muslims and said that O people, eat from the earth’s products all that is lawful and good, and do not follow the steps of Satan( Quran 2:168). Dealing in Riba (i.e. interest) was common among the people and did not consider it unlawful or Haram. Quran narrates their saying like this: they say, Trade is just like usury; whereas Allah permitted trading and forbidden Riba (Quran 2:275).

Allah has equated the dealing in Riba to War with Allah and his Messenger; And if you do not (give up Riba), then be informed of a war [against you] from Allah and His Messenger (Quran 2:279). Prophet Muhammad صلى الله عليه وسلم cursed the receiver and the payer of interest, the one who records it and the two witnesses to the transaction and said: “They are all alike [in sin]. (Muslim, Tirmidhi)

One would wonder why Islam criticises those dealing in Riba and gives strict warning in case of Non obedience. Nejatullah siddiqui one of the prominent Islamic Economist of our time says that Islam has prohibited Interest because it is unfair (Zulm).The word Riba in Arabic language means is “ to excess” or “ increase”. Let us take an example Why Interest is considered to be unfair;

For Example people A in need of money say $10 approaches person B for loan who has money. The person B lends to person A with condition that in return he will pay back $15. Here there will be an increase of $5 to principal amount but this increase of $5 is unjust because A is taking undue advantage of B’s condition. Therefore Allah says that He will destroy any unjust increase but will increase charity.

Riba creates many problems like;

- Unequal distribution of wealth in society

- Destroys the social and Economic system of the country

- Causes Global debt Crisis

Today whole world is embroiled in financial crisis. And the world is divided between rich and poor, Developed and underdeveloped, progressive and Non progressive society. Behind all this Interest is one of the major factors behind all these. Today as per the World Bank report the GDP ($577.4 billion) of 40 Heavily Indebted Poor Countries is less than the wealth ($586.7 billion) of the world’s 11 richest people combined. World Bank reports that in 2005, 43% of the world population had income less than US$1.25/day.

Interest has destroyed many country one of which is Nigeria let us see what president Obasanjo of Nigeria said in, G8 Summit Okinawa , 2000;

“All that we had borrowed up to 1985 or 1986 was around $5 billion and we have paid about $16 billion yet we are still being told that we owe about $28 billion. That $28 billion came about because of the injustice in the foreign creditors’ interest rates. If you ask me what the worst thing in the world is, I will say it is compound interest.”

African nation’s service to debts has not left them with money to spend on their children health. According to UNICEF, 22,000 children die each day due to poverty and poor sanitation. It even pushes many into sex slavery According to CNN report, Debt is the major cause of child prostitution in Cambodia. By Debt I mean loan with interest. To our surprise according to UK’s famous newspaper independent the Britain is still repaying debt worth £2billion from the World War I.

Islam provides the economic system which is based on equality and justice. It has capability to fulfil the modern day economic dream of full employment, stability, economic growth, and improving efficiency, and equity. It has the system of zakat which is the remedy to eradicate poverty consider if just the top ten richest people in the world paid zakat – a mere 2.5% of their wealth – it would amount to a staggering £7.7 billion! The power of that money in tackling poverty would be huge.

Er. Izhar Khan: Msc student in the world Renowned University, University of Glasgow United Kingdom

Jeddah, (IINA) – New markets for Islamic finance are emerging, with African countries launching debut sovereign sukuk and East Asian countries enabling their domestic markets to tap into Islamic financing, Saudi Gazette reported.

Jeddah, (IINA) – New markets for Islamic finance are emerging, with African countries launching debut sovereign sukuk and East Asian countries enabling their domestic markets to tap into Islamic financing, Saudi Gazette reported.