Inflation rate, rupee, results to steer equity indices (Market Outlook)

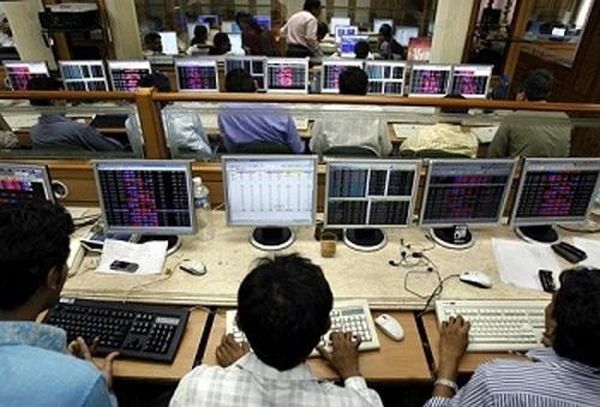

Mumbai : Key macro-economic inflation data points, combined with the last of first quarter earning results and the direction of foreign fund flows, are expected to drive the Indian equity indices next week.

Analysts opined that the movement of the Indian rupee against the US dollar as welll as global crude oil price volatility and high stock valuations will also affect investor sentiments.

“The domestic markets are likely to witness another eventful week, with more quarterly earnings, trends in global markets, investment by foreign and domestic investors,” SMC Investments & Advisors’ Chairman and Managing Director D.K. Aggarwal told IANS.

In terms of global cues, Delta Global Partners Founder and Principal Partner Devendra Nevgi told IANS: “The risk emanating from a potential Turkey-centred contagion spreading to EU banks will dominate the risk sentiment in the EMs (emerging markets) and Indian markets next week.”

“The USD is higher and the yields lower, indicating a risk-aversion scenario. The Indian rupee’s moves need to be closely watched, since it is already closer to an all-time low. The Turkish Lira’s steep fall and USD’s appreciation would negate the sentiment towards EM currencies in general, including the rupee.”

According to Anindya Banerjee, Deputy Vice President for Currency and Interest Rates with Kotak Securities, the Indian rupee is expected to range from 68.70 to 69.30 against a US dollar in the coming week.

“We should be prepared for a devaluation. However, lower crude oil prices and the Reserve Bank of India’s (RBI ) invention in defending the Indian rupee against the USD will mitigate the magnitude of devaluation,” Banerjee told IANS.

On the currency front, the rupee closed at 68.83 on August 10, weakened by 22 paise from its previous week’s close of 68.61 per greenback.

Besides the rupee, foreign fund inflows into the country might get impacted due to “global risk aversion”.

In terms of investments, provisional figures from the stock exchanges showed that foreign institutional investors (FIIs) bought scrips worth Rs 992.18 crore in the last week.

Apart from foreign funds, macro-economic inflation data points such as the consumer price index (CPI) and wholesale price index (WPI) for July will set the tone for the key indices.

Company-wise, Abbott India, Cadila Healthcare, Godrej Industries, Greaves Cotton, Oil India, Tata Chemicals, Tata Steel, Allahabad Bank, GMR Infra, Grasim Industries and Sun Pharma are expected to announce their Q1 earning results next week.

On technical charts, the National Stock Exchange (NSE) Nifty50 remains in an uptrend as it has closed at new life highs.

“Technically, while the Nifty has corrected from life highs, the underlying trend of the Nifty remains up,” HDFC Securities’ Retail Research Head Deepak Jasani told IANS.

“The intermediate uptrend is likely to continue once the immediate resistance of 11,495 points is taken out. Crucial supports to watch for any further weakness is at 11,329 points.”

Last week, both the key Indian equity indices — S&P Bombay Stock Exchange (BSE) Sensex and the NSE Nifty 50 — rose on the back of healthy inflow of foreign funds, along with domestic political developments and positive global cues.

Additionally, prediction of healthy economic growth by IMF combined with better-than-expected quarterly results and low crude oil prices aided the two key indices in making substantial gains.

Consequently, the S&P BSE Sensex closed at 37,869.23 points, higher by 313.07 points or 0.82 per cent from its previous close.

The positive sentiment pushed the barometer index to a fresh intra-day record high of 38,076.23 points and a closing high of 38,024.37 points during the trade week ended August 10.

Similarly, the wider Nifty50 on the NSE made gains. It ended at 11,429.50 points, higher by 68.7 points or 0.58 per cent from its previous close.

The Nifty50 made a fresh intra-day record high of 11,495.20 points and closing high of 11,470.70 points.

(Rohit Vaid can be contacted at rohit.v@ians.in)

—IANS