by admin | May 25, 2021 | Corporate, Corporate Buzz

Chennai : Banks will not remain closed for five consecutive days starting from Thursday, a union leader said on Monday.

Chennai : Banks will not remain closed for five consecutive days starting from Thursday, a union leader said on Monday.

“The banks will work on March 31 (Saturday) and there is no continuous holidays as per messages in the social media,” D. Thomas Franco Rajendra Dev, General Secretary of the All India Bank Officers Confederation told IANS.

He said banks will be closed on Thursday and Friday owing to Mahaveer Jayanthi and Good Friday.

Saturday will remain open since it is the fifth Saturday of the month. Banks are only closed on second and fourth Saturdays.

On April 2, the banks will remain shut for annual closing of accounts.

—IANS

by admin | May 25, 2021 | Banking, Corporate, Corporate finance, Economy, Finance, Markets, News

New Delhi : Gross non-performing assets (NPA) in Indian banks are expected to rise to Rs 9.5 lakh crore by March, from Rs 8 lakh crore in March last year, said a ASSOCHAM-Crisil joint study.

New Delhi : Gross non-performing assets (NPA) in Indian banks are expected to rise to Rs 9.5 lakh crore by March, from Rs 8 lakh crore in March last year, said a ASSOCHAM-Crisil joint study.

Stressed assets in March 2018 are expected to be at Rs 11.5 lakh crore, the report titled “ARCs headed for a structural shift,” said.

“High level of stressed assets in the banking system provides enormous opportunity size for asset reconstruction companies (ARCs) which are an important stakeholder in the NPA resolution process,” ASSOCHAM said in a statement quoting the study.

It, however, said that owing to capital constraints, growth of ARCs is expected to come down significantly.

“While growth is expected to fall to around 12 per cent until June 2019, however the AUM (assets under management) are expected to reach Rs 1 lakh crore, and that is fairly sizeable.”

The study added that with banks expected to make higher provisioning over and above the provisions made for stressed assets, they may sell the assets at lower discounts, thus increasing the capital requirement.

The study also said that effective implementation of the Insolvency and Bankruptcy Code would be a remedy to the challenge of prolonged litigation and it can help improve the recovery rate of stressed assets’ industry further.

Power, metal and construction sectors contribute the bulk of stressed assets. According to an analysis of 50 stressed assets (forming nearly 40 per cent of stressed assets in the system), sectors like metal, construction and power form nearly 30 per cent, 25 per cent and 15 per cent respectively, while other sectors together form the remaining 30 per cent.

The report stated that 2018 would see a structural shift in the stressed assets’ space as increased stringency in banks’ provisioning norms for investments in security receipts (SRs) is likely to result in more cash purchases.

“Fiscal 2018 marks beginning of third phase of ARCs which promises to change the landscape as new regulations and other changes kick-in.”

—IANS

by admin | May 25, 2021 | Banking, Corporate, Corporate Buzz, Corporate finance, Economy, Markets, News

Mumbai : The Indian banking sector has been classified under ‘Group 5’ along with countries such as Italy, Spain, Ireland, the UAE and South Africa by rating agency Standard & Poor’s (S&P) on the basis of their economy and industry risk criteria, the American analysts said on Wednesday.

Mumbai : The Indian banking sector has been classified under ‘Group 5’ along with countries such as Italy, Spain, Ireland, the UAE and South Africa by rating agency Standard & Poor’s (S&P) on the basis of their economy and industry risk criteria, the American analysts said on Wednesday.

Noting that the “low-income” Indian economy and the government’s limited fiscal flexibility constrain the country’s economic resilience, S&P in its “Banking Industry Country Risk Assessment: India”, however, said the medium-term outlook for growth remains healthy, which “provide sound development opportunities for Indian banks”.

“We classify the banking sector of India in group ‘5’ under our Banking Industry Country Risk Assessment (BICRA). The other countries in group ‘5’ are Spain, Ireland, Italy, Panama, Bermuda, Poland, Peru, Qatar, South Africa and the UAE.

“The anchor for banks operating only in India is ‘bbb-‘,” an S&P Global Ratings release said.

“The medium-term outlook for India’s growth remains healthy due to good demographics, public and foreign direct investments, private consumption, and reforms such as the removal of barriers to domestic trade through GST,” it said.

Assessing the risk of rising economic imbalances for banks as “low”, the report, however, drew attention to the massive non-performing assets (NPAs), or bad loans, in the Indian banking system that have crossed the staggering level of Rs 8.5 lakh crore.

“Banks’ asset quality is weak and has been deteriorating in the past four years, accentuated by historically weak foreclosure laws,” S&P said.

“In terms of industry risk, the banking system’s good franchise, extensive branch networks, and large domestic savings support a granular and stable deposit base. Nevertheless, directed lending and the dominance of government-owned banks continue to create some market distortion,” it said.

“The government’s twin steps of establishing a new bankruptcy process to shorten the time for resolving insolvency and improving the ability of public sector banks to take haircuts via higher capital infusions could alleviate asset quality weaknesses, if executed well,” it added.

S&P-owned rating agency Crisil has said banks will need to take a “haircut” of up to 60 per cent on their bad loans to resolve the issue of accumulated NPAS, which is holding up higher economic growth.

According to Crisil, tepid investment growth and the high level of NPAs are the two uncertain factors clouding the outlook on India achieving a Gross Domestic Product growth rate of over seven per cent in the next fiscal.

“Banks will need to take a haircut of up to 60 per cent to resolve the issue of NPA,” Crisil Chief Analytical Officer Pavan Aggarwal said at an editors meet last week in New Delhi

“The top 50 NPA accounts constitute 50 per cent of all bad loans of banks in the country and account for Rs 4,25,000 crore of NPAs,” he said.

In a report released in Washington last week, the International Monetary Fund (IMF) cautioned that the high volume of NPAs and the slow pace of mending corporate balance sheets are holding back investment and growth in India.

The IMF’s Financial System Stability Assessment for India said that overall “India’s key banks appear resilient, but the system is subject to considerable vulnerabilities”.

“Stress tests show that… a group of public sector banks are highly vulnerable to further declines in asset quality and higher provisioning needs,” it said.

—IANS

by admin | May 25, 2021 | Banking, Corporate, Corporate finance, Corporate Governance, News, Politics

New Delhi : Recapitalisation is a major issue for state-run banks owing to the massive non-performing assets (NPAs), or bad loans, accumulated by them and they are now exploring various sources of raising capital, according to a leading public sector bank (PSB).

New Delhi : Recapitalisation is a major issue for state-run banks owing to the massive non-performing assets (NPAs), or bad loans, accumulated by them and they are now exploring various sources of raising capital, according to a leading public sector bank (PSB).

“Banks’ capitalisation is a major issue for PSBs. We have to make high provisions, also now with the NCLT (National Company Law Tribunal) cases,” UCO Bank Chief Executive R.K. Thakkar told BTVi channel.

The Reserve Bank of India (RBI) has identified the second batch of large accounts which have defaulted in repayment of loans and has advised banks to resolve them.

In June, the RBI had come out with a list of 12 large accounts, which totalled about 25 per cent of the current gross NPAs of the banking system for reference to the NCLT under the Insolvency and Bankruptcy Code (IBC).

“We are trying various source to raise capital… We have requested the government for support, but for the balance beyond the budgetary support we have to go to the market, depending on the appropriate time,” Thakkar said.

He said the UCO Bank’s capital requirement for the current fiscal is to the tune of Rs 3,000 crore and “with the provisioning required for the NCLT cases the requirement may go up to another Rs 500-600 crore.”

The RBI has also advised banks to make higher provisions for the accounts to be referred under the IBC.

This was intended to improve bank provision coverage ratios and to ensure that banks are fully protected against likely losses in the resolution process.

Thakkar said that he expected the first tranche of the government support to arrive to the bank in a month’s time.

He also said that recapitalisation bonds would be one of the possible instruments to explore in the efforts to supplement the government recapitalisation.

The PSBs have accumulated a high ratio of NPAs, going up to 17-18 per cent of their loan portfolio.

The government has committed Rs 70,000 crore for banks’ recapitalisation over five years, of which Rs 10,000 crore remains to be disbursed for the current fiscal.

—IANS

by admin | May 25, 2021 | Banking, Economy, News, Opinions

By Syed Zahid Ahmad for Maeeshat

Considering higher attraction for voters in election manifestos of parties in state elections, it is required that the Election Commission of India should think about framing regulation to prevent political parties offering bribes through election Manifestos. Since political parties are not allowed to distribute materialistic offers to voters before polling, these parties feel privileged to extend attractive offers for public through election manifestos. It is a kind of futuristic bribes offered to voters without any cost to political parties.

If election commission is not serious to take any action over such manifestos where parties announce to distribute laptops, televisions, bicycles or two wheelers etc., its high time the voters should realize that if political parties promise to distribute such attractive materials after winning election; its cost would be ultimately paid by citizens of that state only, and not by the parties.

Voters must realize that the political parties who promise to distribute cycles, bikes, laptops, tablets and televisions after winning election are making fool of the public on the name of eradicating backwardness and poverty. These parties are really not serious about state development; rather going to exploit the citizens through awkward fiscal policies after winning elections. Voters must understand the economics behind such offers. It is needed to understand how the party if wins election fulfill such promises. Will the party pay from its own fund for fulfilling such promises? Obviously No!

Fulfilling such highly attractive promises will ultimately cost the public living in particular state. To fulfill such promise the state Government need fund for purchase of materials. To raise required funds, the Government will obviously increase tax revenues. Increasing tax revenues by state Government will ultimately add inflation and tax burden on public including entrepreneurs and consumers. The ugly tax structure would ultimately go to increase inflation and adverse conditions to attract fresh and abroad investors in the state. The ugly fiscal policy will push the state downward instead of increasing potential for state economic growth.

Now it is upon the public who consider the manifesto attractive to cast votes how they consider the economics of attractive promises in manifestos. If the voters react sensibly to such attractive promises, the parties would obviously become serious in planning for state development.

The statistics available at website of the Reserve bank of India reflects financial deprivation of Bihar as one of the reason for Bihar’s under development. Bihar being third top populated state in India after Utter Pradesh and Maharashtra deserves fair attention for inclusive growth of India. Ignoring Bihar would always led India fail in achieving the target of better growth rate. Considerably Bihar shares as much as 9% of Indian Population, thus deserves better treatment by sincere planners for the nation’s development.

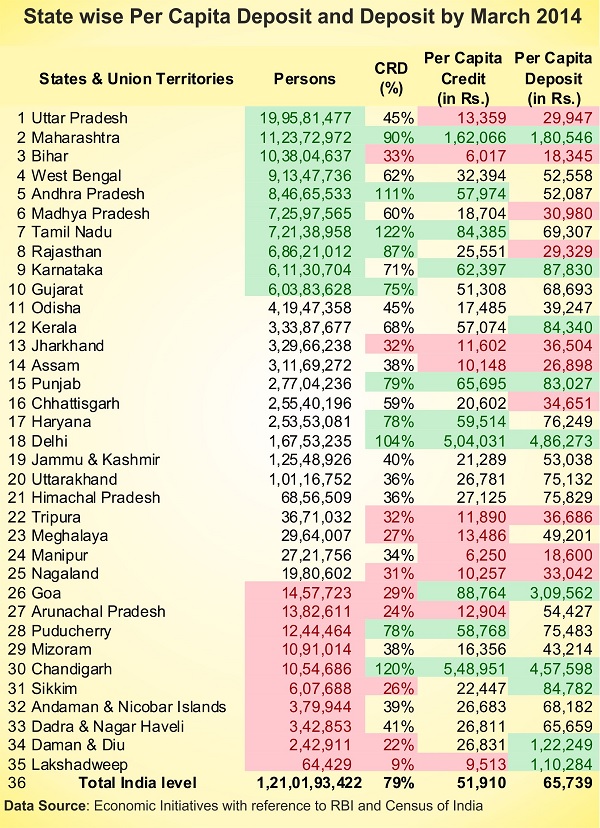

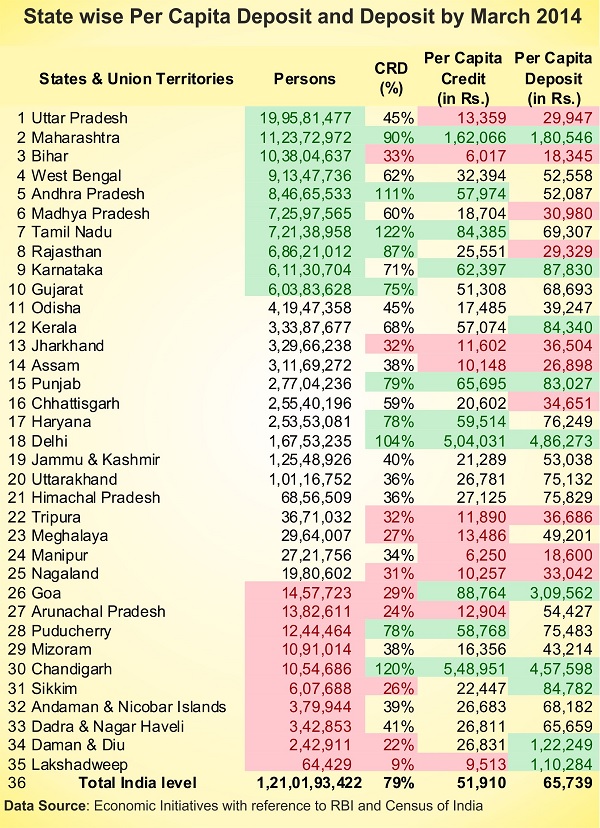

Considering Bihar election, political parties should raise issue of the lowest per capita credit availed by Bihar. It may be noted that Bihar is getting merely Rs. 6,017 as per capita credit disbursed by Indian banks compared to Rs. 5,48,951 for people of Chandigarh and Rs. 5,04,031 for people living in Delhi. Credit Deposit Ratio for Bihar is merely 33% against national average of 79%.

It might be questioned why Credit Deposit ratio for states like Tamil Nadu, Andhra Pradesh, Chandigarh and Delhi is over 100%? People of Tamil Nadu received 122% credit of Deposits made in Banks whereas people of Bihar get just 33% of their Deposits as credits extended by Indian banks. Why political parties not find any reason for this deficit in finance as reason of Bihar’s backwardness compared to other states like Chadigarh, Delhi, Andhra Pradesh and Maharashtra.

Political parties should sincerely raise the point why the per capita credit availed by Bihar is just Rs. 6,017 compared to national average per capita credit of Rs. 51,910 extended by Indian scheduled commercial banks? Whoever be the economists behind these political parties, can anyone deny that without ensuring adequate supply of finance, we cannot raise Bihar’s growth potentials?

If any party is really serious to help poor people of Bihar, they should really think about promoting micro and smaller enterprises in Bihar. There is desired that political parties may announce launching of Micro Equity Fund for micro and smaller enterprises allowing them feel equality in financial sector compared to corporate who avail equity from stock markets. Such micro equity funds may allow micro and smaller enterprises boost their entrepreneurship; ultimately boosting manufacturing activities in the state.

The people of Bihar should ask the political parties to ensure that they avail what people of Bihar really deserve and the new Government should just keep on facilitating the people of Bihar develop their state.

He can be reached economicinitiatives@gmail.com

Chennai : Banks will not remain closed for five consecutive days starting from Thursday, a union leader said on Monday.

Chennai : Banks will not remain closed for five consecutive days starting from Thursday, a union leader said on Monday.