by admin | May 25, 2021 | Corporate, Corporate finance, Corporate Governance, Economy, News, Politics

New Delhi : India has macro-economic stability on the back of structural reforms like GST and the long term positive impact of demonetisation, with the financial markets expressing confidence through high-stock valuations, the Financial Stability and Development Council (FSDC) noted in its meeting held on Tuesday.

New Delhi : India has macro-economic stability on the back of structural reforms like GST and the long term positive impact of demonetisation, with the financial markets expressing confidence through high-stock valuations, the Financial Stability and Development Council (FSDC) noted in its meeting held on Tuesday.

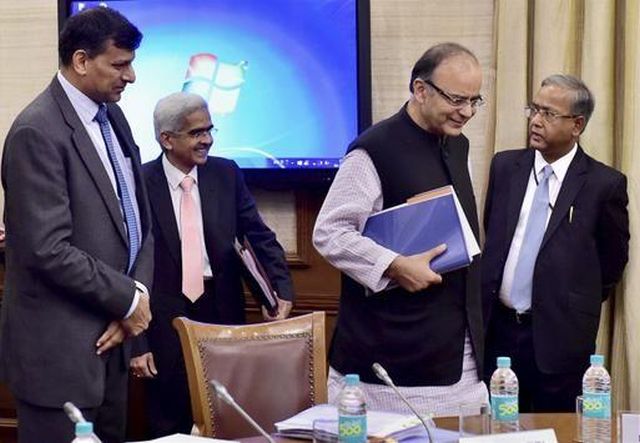

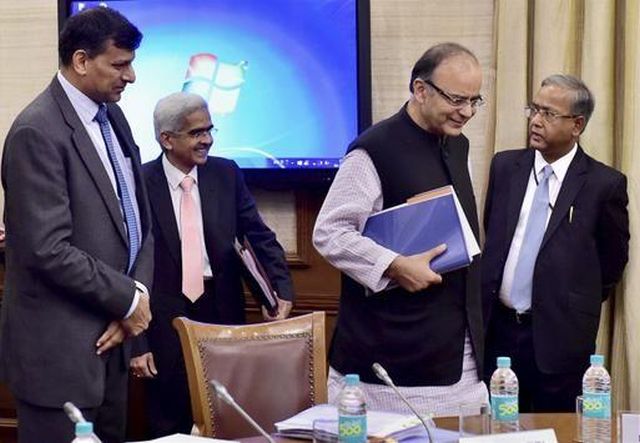

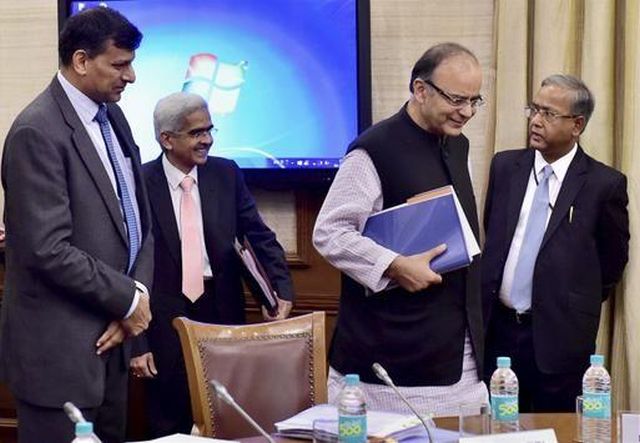

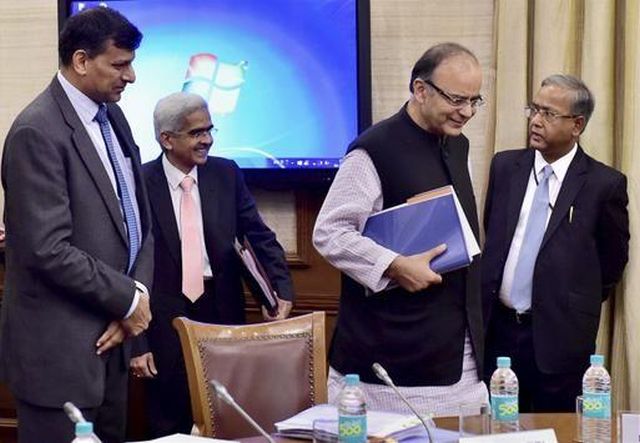

The 17th meeting of the FSDC was held here under the chairmanship of Finance Minister Arun Jaitley.

“The Council noted that India has macro-economic stability today on the back of improvements in its macro-economic fundamentals, structural reforms with the launch of the Goods and Services Tax (GST), action being taken to address the Twin Balance Sheet (TBS) challenge, extraordinary financial market confidence, reflected in high and rising bond and especially stock valuations and long-term positive consequences of demonetisation,” the Finance Ministry said in a statement.

It also deliberated on strengthening the regulation of the Credit Rating Agencies (CRAs).

The Council also discussed the issues and challenges facing the Indian economy and the members agreed on the need to keep constant vigil and be in a state of preparedness for managing any external and internal vulnerabilities.

It also took note of the progress of financial sector assessment programme for India, jointly conducted by the International Monetary Fund and the World Bank.

“The Council directed that the assessment report should be finalised by the end of this year,” it said.

A presentation on the state of economy was made by Chief Economic Adviser (CEA) Arvind Subramanian.

The meeting was attended by Reserve Bank of India Governor Urjit R. Patel, Finance Secretary Ashok Lavasa, Economic Affairs Secretary Subhash Chandra Garg, Financial Services Secretary Anjuly Chib Duggal, Ministry of Corporate Affairs Secretary Tapan Ray, Ministry of Electronics and Information Technology Secretary Ajay Prakash Sawhney, Securities and Exchange Board of India (Sebi) Chairman Ajay Tyagi, Insurance Regulatory and Development Authority of India (IRDAI) Chairman T.S. Vijayan, Pension Fund Regulatory and Development Authority (PFRDA) Chairman Hemant G. Contractor and other senior officers of the government and financial sector regulators.

FSDC took note of the developments and progress made in setting up of Computer Emergency Response Team in the Financial Sector (CERT-Fin) and Financial Data Management Centre and discussed measures for time bound implementation of the institution building initiative.

A brief report on the activities undertaken by the FSDC sub-committee chaired by the RBI Governor was placed before the Council.

It also undertook a comprehensive review of the action taken by members on the decisions taken in earlier meetings of the Council.

The Central KYC Registry (CKYCR) system was also discussed and the Council took note of the initiatives taken in this regard by the members and discussed the issues/suggestions in respect of its operationalisation.

—IANS

by admin | May 25, 2021 | Business, Economy, Markets, News, Politics, SMEs

Kolkata : In what could be a bitter experience for the sweet-loving residents of West Bengal, over two lakh sweet shops, celebrated for their “rosogollas” and “mishti doi”, across the state went on a 24-hour strike on Monday to protest imposition of five per cent GST.

Kolkata : In what could be a bitter experience for the sweet-loving residents of West Bengal, over two lakh sweet shops, celebrated for their “rosogollas” and “mishti doi”, across the state went on a 24-hour strike on Monday to protest imposition of five per cent GST.

Monday’s protest is expected to cause an estimated loss of Rs 100 crore to the industry employing around 10 lakh people directly.

From north to south Kolkata, and its suburbs, most of the popular large, medium and small sweet outlets were shut.

Iconic sweetmakers K.C. Das, whose erstwhile owner Nabin Chandra Das is widely regarded as the inventor of the rosogolla in 1868, said all its four outlets here were closed.

“Business loss estimated to be around Rs 2 to 3 lakh in total for the day,” K.C. Das’ Director Dhiman Das said.

Sweet shop owners have also resolved to strengthen the agitation against the Goods and Services Tax (GST) in days to come.

“We are not comfortable with GST. From August 24 to 26, we will also observe a hunger strike. If the Centre doesn’t pay heed to our demands of exemption from the tax, then we will intensify our protest,” West Bengal Mistanna Byabasayee Samity’s General Secretary R.K Paul told IANS.

“If you calculate on a daily basis, Rs 5,000 is the approximate sale per shop. If two lakh shops are shut on a day, then the loss is around Rs 100 crore per day,” he said.

Factor in 10 to 15 per cent profit from the sales and establishment plus employee cost per day, pointed out Paul.

While the industry is directly responsible for the livelihoods of at least 10 lakh people, Paul said, there is no estimate of those living-off the business indirectly.

“We need accessories as well. For example, paper (for packaging) and printing presses etc. So you can see many people are dependent on the industry indirectly as well,” he said.

Elaborating on their opposition to GST, he said the Rs 50,000 crore industry in Bengal is “hugely different” from the sweet-making ventures in other states, in terms of the products being “highly perishable”, a category exempted from the new tax regime.

“We deal with highly perishable goods. Our sweets are very delicate and have a shelf life of 24 hours. In other states, the kind of sweets they produce is different and can stay on for longer. We were exempted from VAT. The Centre has exempted highly perishable goods from GST. We don’t understand why they included our sweets in GST if they are highly perishable,” he said.

Contacted by IANS, the 1885-established Balaram Mullick and Radharaman Mullick sweetmakers also said that they are participating in the strike.

“Our shop is unofficially open to cater to the orders/deliveries placed in advance. We are transacting business with only those who are scheduled to collect their pre-ordered items today (Monday). Customers who are coming in for regular purchases are being turned away,” a salesperson said.

Confectioners said what has added to their woes is that their products fall under all slabs — 28 per cent for any sandesh/sweet with chocolate in it, five per cent for rosogolla and sandesh, and 12 per cent for mishti doi.

In addition to the evergreen traditional recipes of rosogolla, mishit doi and sandesh, Bengal sweetmeat makers have adapted to modern tastes by incorporating ingredients like chocolates, fruit pulps like those of mangoes, kiwis and blueberries and extending their repertoire with innovations like ice-cream sandesh and kulfi sandesh.

—IANS

by admin | May 25, 2021 | Corporate, Corporate finance, News

Mumbai:(IANS) Introduction of the GST system is expected to have a macro economic impact and will set a new course for cooperative federalism by strengthening Centre-state partnership, the RBI said in a report released here on Friday.

Mumbai:(IANS) Introduction of the GST system is expected to have a macro economic impact and will set a new course for cooperative federalism by strengthening Centre-state partnership, the RBI said in a report released here on Friday.

According to the Reserve Bank of India (RBI) report entitled ‘State Finances: A Study of Budgets of 2016-17’, the Goods and Services Tax (GST) introduction is expected to have significant macro economic implications in terms of growth, inflation, export competitiveness and fiscal balance in the years ahead.

“The successful implementation of GST will result in additional revenue through simpler and easier tax administration, supported by robust and user-friendly IT (information technology) systems,” the study said.

It said the GST is expected to reduce administrative costs for collection of tax revenue and improve revenue efficiency while uniformity in tax rates and procedures will lead to economy in compliance cost.

The GST regime will also increase the shareable pool of resources, resulting in transfer of large funds to the states for developmental works.

“Such an outcome will ensure debt sustainability of states in the long term. In fact, the GST is likely to set a new course for cooperative federalism in India by strengthening Centre-state partnership,” the study said.

According to the RBI study, most of the central cesses will be subsumed into the GST and in turn increase the divisible pool of resources which is to the advantage of states.

“Introduction of a new cess on luxury and demerit goods may be contrary to the GST spirit but the proceeds will be used to compensate the states; thus, the overall impact of GST will be beneficial,” the study said.

The study said that from the point of view of implementation, it could be argued that the GST is imposed on consumption while cess, which is typically applied at the stage of manufacturing, may be difficult to administer and could also lead to cascading effects.

On the status of state’s finances, the study said that increasing reliance on market borrowing, along with enabling conditions for additional borrowing by states, poses challenges for the sustainability of state finances as higher state borrowings raise yields and cost of borrowing.

Due to prevailing uncertainty about the revenue outcome from the GST implementation, the outlook for revenue receipts of states could turn uncertain, the study said.

“There is, however, the cushion of compensation by the Centre for any loss of revenue for initial five years. In this context, the GST remains the best bet for states in clawing back to the path of fiscal consolidation over the medium term,” the study said.

by admin | May 25, 2021 | Business

By Priya Yadav,

By Priya Yadav,

Visakhapatnam, (IANS) : Seafood should be treated as agricultural produce and exempted from the GST, proposed to come in force from April 1, 2017, said an advisor to a marine products exporters association.

Raghavan Ramabadran, a Chennai-based partner in law firm Lakshmikumaran and Sridharan, which is an advisor to Seafood Exporters Association of India, said the Marine Products Export Development Authority (MPEDA), under the Union Ministry of Commerce and Industry, has been demanding the “exemption of seafood products from the GST” before the bill is implemented.

“The authority has been doing a detailed analysis of the impact of GST on the marine industry,” he said on the sidelines of the three-day-long 20th edition of the India International Seafood Show, jointly organised by the MPEDA and the SEAI, which began here Friday.

Intended to provide a valuable forum for exchange of experiences and exposure to new technologies which will intimately help in boosting exports of the country’s marine products, the IISS is also aimed at boosting India’s aquaculture industry with the US, EU, Southeast Asia, Japan and China as major partners.

This year’s seafood show has been organised with the theme of “Safe and Sustainable Indian Aquaculture” to project the quality of aquaculture.

On other issues facing the Indian industry, SEAI Secretary General Elias Sait said: “Under the Uruguay Round Agreements Act, approved in late 1994, the anti-dumping and countervailing duty may get removed after the sunset review from February 2016-2017.”

Under the anti-dumping duty, the US industries may petition India for relief from imports sold there at less than fair value (“dumped”), Elias said.

Meanwhile, Ramabadran, citing MPEDA statistics, said: “India exports less than one per cent ready to be tabled marine products. They are further processed and labelled under a foreign brand. This makes India a consumer country and not a manufacturer.”

The exported products contain preservatives to increase the shelf life but are not completely processed, and are being transported in raw form only, he said.

India, being the world’s seventh largest seafood producer, needs to increase value added operations in the marine industry and promote sustained small scale aquaculture through empowerment of farmers, said Ramabadran.

“The processing operations should be encouraged in the country under Prime Minister Narendra Modi’s ‘Make in India’ initiative. It will not only create employment but also boost the growth of the seafood industry,” he added.

(Priya Yadav can be contacted at priya.y@ians.in)

by admin | May 25, 2021 | Economy, News

New Delhi : (IANS) The government hopes that the biennial elections in the Rajya Sabha will give it enough seats in the upper house of parliament to pass the Goods and Services Tax (GST) Bill, Finance Minister Arun Jaitley said on Thursday.

New Delhi : (IANS) The government hopes that the biennial elections in the Rajya Sabha will give it enough seats in the upper house of parliament to pass the Goods and Services Tax (GST) Bill, Finance Minister Arun Jaitley said on Thursday.

“Numbers are going to significantly change in the Rajya Sabha with the biennial elections. Every political party in parliament, barring one, has told me it will support GST,” Jaitley said, fielding questions at the annual India Today Conclave here.

The GST Bill has been approved by the Lok Sabha and is currently stalled in the upper house, where the ruling National Democratic Alliance (NDA) lacks a majority.

Referring to the Congress party, that is opposing the bill in its current form, Jaitley said the party has an “issue on constitutional capping” of GST tariffs.

“Our tariffs are not decided by constitutional caps,” the finance minister said, adding that such a move would limit the scope of making future changes.

“Today state governments tell me they are all in favour of GST. Even Karnataka, which has a Congress government, wants the GST,” he added.

New Delhi : India has macro-economic stability on the back of structural reforms like GST and the long term positive impact of demonetisation, with the financial markets expressing confidence through high-stock valuations, the Financial Stability and Development Council (FSDC) noted in its meeting held on Tuesday.

New Delhi : India has macro-economic stability on the back of structural reforms like GST and the long term positive impact of demonetisation, with the financial markets expressing confidence through high-stock valuations, the Financial Stability and Development Council (FSDC) noted in its meeting held on Tuesday.