by admin | May 25, 2021 | Banking, Economy, Markets, News

Mumbai : Despite heavy volatility, fresh inflows of foreign funds and buying interest in FMCG, banking and realty stocks lifted the Indian equity market for the fourth straight session on Wednesday.

Mumbai : Despite heavy volatility, fresh inflows of foreign funds and buying interest in FMCG, banking and realty stocks lifted the Indian equity market for the fourth straight session on Wednesday.

Accordingly, the BSE Sensex crossed the 36,000-mark while the NSE Nifty50 reclaimed the 10,850-level. The rise came after a sharp dip in the mid-afternoon session.

The domestic investor sentiment was boosted by firm global markets and expectations of healthy corporate earnings for the October-December quarter.

Globally, investor sentiment was upbeat after the US-China trade talks concluded during the day. Investors expect a positive outcome from the three-day talks.

Index-wise, the Nifty50 rose by 53 points or 0.49 per cent to settle at 10,855.15 points.

The Sensex closed at 36,212.91 points, higher by 231.98 points or 0.64 per cent from the previous close of 35,980.93 points. It had opened at 36,181.37 and touched an intra-day high of 36,250.54 and a low of 35,863.29 points.

“The market started on a positive note but took some caution ahead of major quarterly results scheduled tomorrow. In totality with expectation of a breather from the US-China meeting which concluded today led the market to close on a positive bias,” said Vinod Nair, Head of Research, Geojit Financial Services.

“Buying interest has been seen across sectors led by private banks, IT and FMCG while PSU banks declined due to profit booking post recent gains.”

The Indian rupee stood weaker by 26 paise at Rs 70.46 per dollar from its previous close of 70.20. In just two days the rupee has lost over 75 paise.

On the other hand, Brent crude futures rose to around $59 per barrel.

“Technically, with the Nifty moving up further, traders will need to watch if the recent gains can sustain in the near term. Further upsides are likely once the immediate resistances of 10,870 are taken out,” said Deepak Jasani of HDFC Securities.

“Crucial supports to watch for resumption of weakness is at 10,815.”

Investment-wise, FIIs bought Rs 276.14 crore while DIIs bought stocks worth over Rs 439.67 crore on Wednesday.

Stock-wise, the top gainers on Sensex were Axis Bank, ITC, Tata Motors, Bharti Aitel, HDFC which inched up in the range of 1 to 3 per cent.

In contrast, Yes Bank lost 3.07 per cent and Tata Steel, ONGC, Heromoto Corp, NTPC declined up to 2 per cent.

—IANS

by admin | May 25, 2021 | Economy, Markets, News

Mumbai : Profit booking, along with a slight rise in global crude oil prices and depreciation in the Indian rupee, pulled the key Indian equity indices lower on Wednesday after three consecutive days of gains.

Mumbai : Profit booking, along with a slight rise in global crude oil prices and depreciation in the Indian rupee, pulled the key Indian equity indices lower on Wednesday after three consecutive days of gains.

Sector-wise, except for IT and FMCG stocks, all others witnessed heavy selling pressure led by auto, finance and banking counters.

Index-wise, the benchmark S&P BSE Sensex settled at 34,779.58 points, down 382.90 points or 1.09 per cent.

The NSE Nifty closed at 10,453.05 points, down 131.70 points, or 1.24 per cent.

The volatility during the trade session can be gauged by the 878.27 points swing in Sensex from an intra-day high of 35,605.43 points and a low of 34,727.16.

Vinod Nair, Head of Research, Geojit Financial Services said: “Market slid below 10,500 mark as rise in oil price and volatility in INR influenced investors to book profit.”

“Global market remain mixed ahead of the release of FOMC minutes later in the day to get cues about rate hike trajectory. Currently the market valuation has moderated to some extent and bond yield has reduced. However, the outcome of Q2 earnings will have a say on the market.”

According to Abhijeet Dey, Senior Fund Manager-Equities, BNP Paribas Mutual Fund: “Initial positive momentum gave way to heavy selling pressure as stock markets in India wiped off intra-day gains and plummeted into negative terrain.”

“Selling in auto and financial stocks put pressure on bourses. Meanwhile, US President Donald Trump continued his criticism of the Federal Reserve, calling it his biggest threat as it was raising rates too fast. Trump had previously said that the Fed has ‘gone crazy’ and attributed last week’s plunge on Wall Street to the US central bank.”

On Wednesday, the Indian rupee closed at 73.60, down 14 paise from its previous close of 73.46 per US dollar.

In addition, brent crude oil prices inched up to over $81.60 a barrel.

Provisional data with the exchanges showed that foreign institutional investors bought stocks worth Rs 140.02 crore, whereas domestic institutional investors sold scrip Rs 343.11 crore.

HDFC Securities’ Retail Research Head Deepak Jasani said: “Technically, with the Nifty correcting sharply, traders will need to watch if the index can now hold above the immediate supports of 10,410 points; else a further correction is likely.”

The top gainers in the Sensex were ITC, up 1.34 per cent at Rs 286.35; Coal India, up 1.28 per cent at Rs 280.05; Wipro up 1.20 per cent at Rs 324 ;Infosys up 1.16 per cent at Rs 704.50; and Hindustan Uniliver, up 1.08 per cent at Rs 1,561.05.

Major losers included Yes Bank, down 6.85 per cent at Rs 231.75; Adani Ports, down 5.41 per cent at Rs 315; Maruti Suzuki, down 3.79 per cent at Rs 6,878.70; Tata Motors, down 3.40 per cent at Rs179.20; and Tata Steel, down 3.39 per cent at Rs 554.65 per share.

—IANS

by admin | May 25, 2021 | Business, Economy, Markets, News, SMEs

Kolkata : Britannia Industries is looking forward to expand their businesses, a company official said on Monday.

Kolkata : Britannia Industries is looking forward to expand their businesses, a company official said on Monday.

The FMCG major may shift its dairy project from Maharashtra as the state government has not yet finalised the incentive scheme, the official said.

“I believe that now we are poised to look at businesses outside even our adjacents (adjacent business).

“Today, we are in a position in terms of management to be able to look at acquisitions if they make sense,” company’s Chairman Nusli N. Wadia told shareholders at the 99th Annual General Meeting (AGM) here.

“We planned the project in Maharashtra and waited for over one year for finalising the incentive. Unfortunately, they have not done it…We are looking at shifting (the dairy project) because the Maharashtra government (has) already delayed long enough… If it does not get finalised, then we have to move,” Wadia said on the sidelines of the AGM.

Asked whether the company had any discussion with Andhra Pradesh government, he said: “Of course, many time.”

The company plans to invest Rs 300 crore in a dairy project, he said. The company which completed 100 years on March 21, said its board recommended bonus debentures and proposed subdivide of shares.

“This is to inform you that the Board of Directors at its meeting held today (Monday) has recommended and approved issuance of secured redeemable non-convertible debentures, as bonus debentures of Rs 60,” the company said in a regulatory filing.

It will be in the ratio of one (bonus debenture) for every one equity share, held by the shareholders of the company on a record date as may be decided, subject to the approval of National Company Law Tribunal, Kolkata, and any other approval as may be required, it said.

According to Wadia, the company would be issuing over 12 crore bonus debentures of about Rs 720 crore. He also said the company would invest Rs 400-500 crore of capital expenditure in the coming year with a focus on dairy, rusks and cakes businesses.

Wadia said the company would be launching more products in September.

During the AGM the board decided to give notice to appropriate authority and stock exchanges to subdivide the equity shares of Rs 2.

According to the company’s annual report, the board recommended a dividend of 1250 per cent and the total dividend payout amounts to Rs 361.84 crore including dividend distribution tax of Rs 61.70 crore.

The company reported a 19.6 per cent increase in its consolidated net profit at Rs 258 crore in the first quarter of the current fiscal (2018-19) as compared to Rs 216 crore in the year-ago period and on a comparable basis, its consolidated revenue was up for the quarter by 13.6 per cent.

—IANS

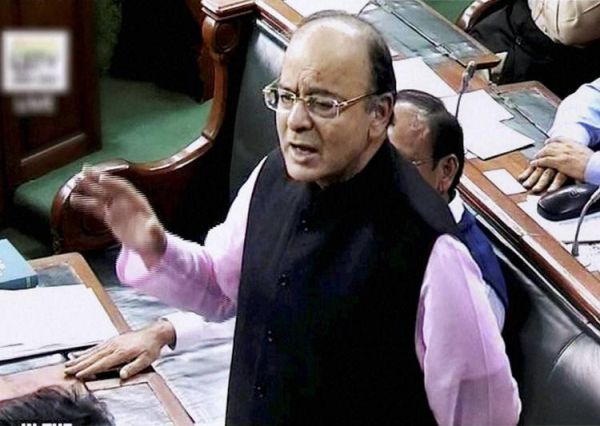

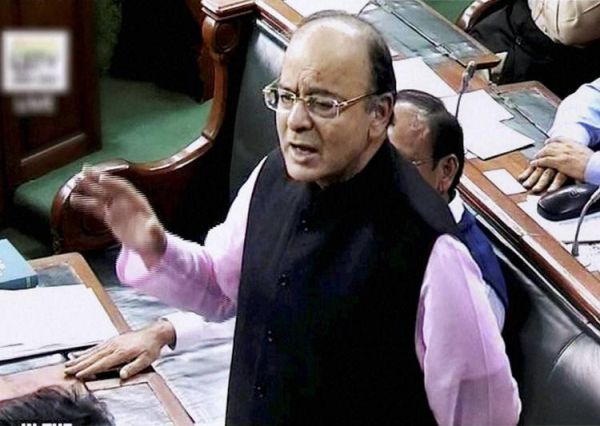

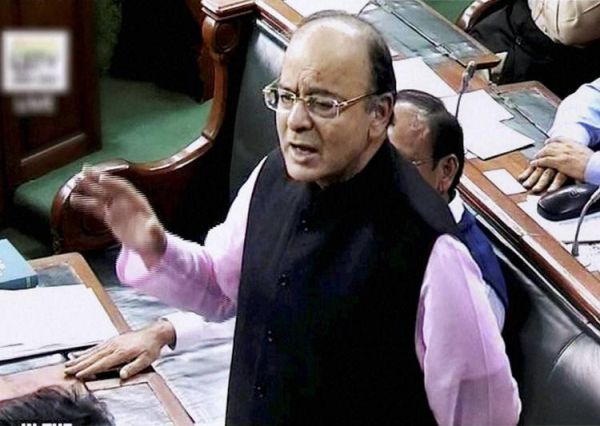

by admin | May 25, 2021 | Corporate, Corporate finance, Corporate Governance, Economy, News, Politics

By Porisma P. Gogoi,

By Porisma P. Gogoi,

New Delhi : The government’s move to increase expenditure on food processing, infrastructure, healthcare and rural economy will generate more demand for the fast moving consumer goods (FMCG) sector, said industry players.

“The country has been through two muted years of growth after economic reforms like demonetisation and GST (Goods and Services Tax). Hence, from the Union Budget 2018-19, expectation was to see policies and steps to boost growth,” Harsha V. Agarwal, Director, Emami, told IANS.

“Infrastructure, education, healthcare and rural economy are the major beneficiaries from this budget, signalling more job creation and spending power in the hands of the largest population which will automatically help the FMCG sector by generating strong demand,” Agarwal said.

The various measures announced by the government will lead to increase in rural consumption, improve overall rural economy and have a trickling effect on the corporates, according to Sanjana Desai, Head of Business Development, Desai Brothers (Food Division – Mother’s Recipe).

Desai Brothers owns and manages the brand Mother’s Recipe — a food company which makes a vast range of pickles, pastes and ready-to-cook mixes.

“The Union Budget 2018-19 is largely positive for FMCG. As anticipated by the FMCG sector, government’s thrust on boosting the rural economy is welcome,” said Desai.

“Increased allocation under various schemes such as MNERGA (Mahatma Gandhi National Rural Employment Gurantee Act), rural infrastructure and others will not only increase rural income through employment generation by these projects but will also improve connectivity giving a boost to rural/agri businesses,” she added.

In the last full budget just presented by Finance Minster Arun Jaitley before the 2019 general elections, the government announced that it would spend more on agriculture, livelihood and infrastructure in the rural area and increased funds for crop insurance, rural roads, irrigation besides setting higher targets for farm credit.

With total budgetary outlay of Rs 2,01,933 crore for agriculture and rural development, the government has emphasised on development of food processing, dairy and fishery sectors to enhance farmers’ income.

The industry players also appreciated the Finance Minister’s move to reduce the corporate tax rate for all companies with turnover of up to Rs 250 crore, up from Rs 50 crore.

“We welcome government’s move to reduce corporate tax from 30 per cent to 25 per cent for companies with revenue of up to Rs 250 crore. This initiative will give a boost to company revenue and allow businesses like us to invest more in expansion leading to employment generation, which is a primary focus for the government,” said Oliver Mirza, Managing Director and CEO, Dr Oetker India.

Dr Oetker India is a German packaged food company which acquired the Fun Foods brand in 2008.

“This move will also provide a great stimulus to the government’s initiatives like ‘Make in India’ and ‘Startup India’. Tax benefits combined with increased allocation to the food processing sector will give a great impetus to the overall FMCG industry,” Mirza said.

(Porisma P. Gogoi can be contacted at porisma.g@ians.in)

—IANS

by admin | May 25, 2021 | Economy, Markets, News

Mumbai : The key Indian equity indices on Friday extended gains for the second consecutive session to close on a higher note as positive global cues and a surge in FMCG, healthcare, metal and auto stocks gave a boost to investors’ sentiments.

Mumbai : The key Indian equity indices on Friday extended gains for the second consecutive session to close on a higher note as positive global cues and a surge in FMCG, healthcare, metal and auto stocks gave a boost to investors’ sentiments.

According to market observers, the upward rally of the equity markets was fuelled by positive hopes of the ruling BJP’s win in the critical Gujarat Assembly Elections 2017 which will take place in two phases on December 9 and December 14.

The wider Nifty50 of the National Stock Exchange (NSE) rose by 98.95 points or 0.97 per cent to close at 10,265.65 points.

The barometer 30-scrip Sensitive Index (Sensex) of the BSE reclaimed the psychologically important 33,000-mark and closed around 300 points higher.

On a closing basis, the BSE Sensex surged by 301.09 points or 0.91 per cent to 33,034.20 points.

The BSE market breadth was bullish — 1,584 advances and 1,116 declines.

“Markets rallied higher on Friday after the sharp bounce back seen on Thursday. The upmove was driven by hopes that the ruling BJP would win critical state elections in Gujarat beginning this weekend,” Deepak Jasani, Head, Retail Research, HDFC Securities, told IANS.

“Positive global cues also boosted sentiments. Sectorally, the top gainers were the FMCG, pharma, metal and auto indices,” he added.

In the broader markets, the S&P BSE mid-cap index closed higher by 0.89 per cent and the small-cap index by 1 per cent.

On the currency front, the rupee strengthened by 12 paise to close at 64.45 against the US dollar from its previous close at 64.57.

Provisional data with the exchanges showed that foreign institutional investors sold scrips worth Rs 675.16 crore while domestic institutional investors bought stocks worth Rs 1,243 crore.

Vinod Nair, Head of Research, Geojit Financial Services, said: “Investor’s sentiment has lifted amid favorable political cue for the ruling party in Gujarat ahead of state election. Positive global market ahead of US employment data also added fuel to the domestic market rally.

“Investors hurried to accumulate beaten down stocks as sectors like FMCG, pharma, metal indices gained attention and outperformed.”

All the 19 sub-indices of the BSE ended in the positive territory, led by the S&P BSE FMCG index, which augmented by 2.23 per cent, followed by metals index by 1.36 per cent and auto index by 1.35 per cent.

Major Sensex gainers on Friday were: ITC, up 3.44 per cent at Rs 261.70; Tata Motors, up 2.21 per cent at Rs 411.05.50; Sun Pharma, up 2.21 per cent at Rs 521.50; Tata Motors (DVR), up 2.05 per cent at Rs 233.75; and Hindustan Unilever, up 1.97 per cent at Rs 1,317.55.

Major Sensex losers were: Hero MotoCorp, down 1.19 per cent at Rs 3,513.05; State Bank of India, down 1.09 per cent at Rs 313.15; Reliance Industries, down 1.04 per cent at Rs 920.95; Tata Consultancy Services, down 0.64 per cent at Rs 2,601; and Asian Paints, down 0.56 per cent at Rs 1,137.

—IANS

Mumbai : Despite heavy volatility, fresh inflows of foreign funds and buying interest in FMCG, banking and realty stocks lifted the Indian equity market for the fourth straight session on Wednesday.

Mumbai : Despite heavy volatility, fresh inflows of foreign funds and buying interest in FMCG, banking and realty stocks lifted the Indian equity market for the fourth straight session on Wednesday.