by admin | May 25, 2021 | Muslim World

Islamabad : The government of Saudi Arabia has signed three grant agreements with Pakistan to finance three road infrastructure and energy projects under the China Pakistan Economic Corridor (CPEC).

Islamabad : The government of Saudi Arabia has signed three grant agreements with Pakistan to finance three road infrastructure and energy projects under the China Pakistan Economic Corridor (CPEC).

“These agreements have been inked in line with the understanding reached during Prime Minister Imran Khan’s recent visit to Saudi Arabia,” Information Minister Fawad Chaudhry told a press conference here on Thursday.

The agreements were signed by the Saudi envoy and the officials of Pakistan’s Finance Ministry, reports Dawn news.

“The first step has been taken as three grant agreements have been signed. This is a very positive step and bodes well for relations between the two countries,” the Minister added.

Giving a briefing about the federal cabinet’s meeting held earlier in the day, he said that a high-level Saudi delegation will arrive in Pakistan on Sunday for materialising the deal between Islamabad and Riyadh.

More agreements would be inked next week between a high-level Saudi delegation and Pakistani officials, Chaudhry said.

The accords will be related to Reko Diq’s gold and copper mines and the oil refinery at Gwadar Port, and the delegation would comprise the Saudi investment team, minister for petroleum and minister for energy.

“During the Prime Minister’s recent visit, Saudi Arabian leaders including Crown Prince Muhammad bin Salman were eager to finalise the deal within days despite the fact that such agreements require months for materialising,” the Minister said.

—IANS

by admin | May 25, 2021 | Opinions

By EAS Sarma,

By EAS Sarma,

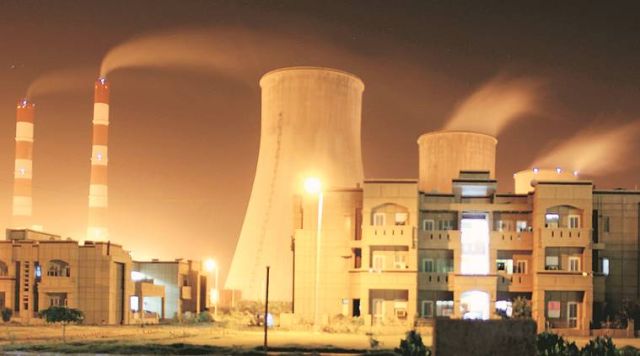

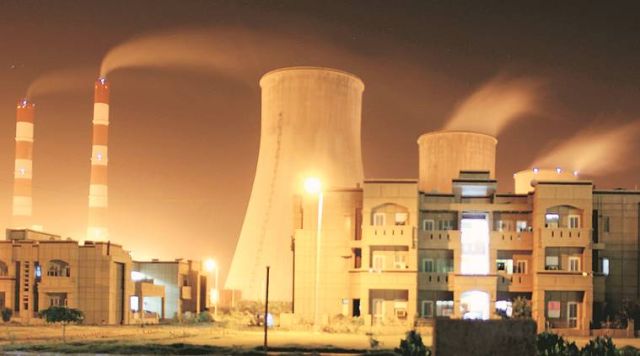

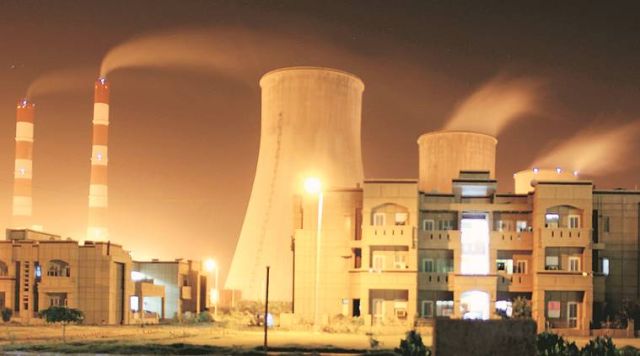

The government’s announcement to soon tender out 100 GW of solar power in one go is somewhat an ambitious step towards transition to clean energy, compared to the previous largest tender of 10 GW — which is likely to be opened in July.

The new tender has provisions for boosting domestic module manufacturing and energy storage capacities as well — absolutely essential in light of renewables now likely to outpace coal in new power capacity. India has thus expressed its resolve to shift its energy development trajectory from fossil-based resources to renewables.

This latest announcement lends further credence to the Power Minister’s claim that India will overshoot its 2022 target of 175 GW of installed renewables. Whether the target is overshot or net additions fall just short, the government’s periodic impetus for renewables in India shows that it is indeed committed to honoring the 2015 Paris Agreement.

However, it is a matter of serious concern that the imprudent decisions during the last decade or so to take up an unduly large number of coal-based power projects over and above the demand projections made by erstwhile Planning Commission and the huge time and cost overruns in implementing those projects have not only brought many PSU financial institutions under stress but also potentially neutralised the benefits expected from renewables.

PSU banks have been forced to divert their credit for refinancing the delayed coal-based projects rather than providing credit for projects based on renewables. In 2017 nearly 17 GW of coal-fired thermal power was re-financed and/or extended new financing by the public sector at a cost of Rs 60,767 crore ($9.35 billion).

Latest figures suggest that 40,130 MW (20.3 per cent) of India’s 199 GW of thermal power capacity has been classified as stressed assets; 2,520 MW of this is currently facing liquidation, while 10,430 MW may soon be headed that way as no power purchase agreements (PPAs) are in place.

Even existing coal-based power projects are operating at low Plant Load Factors (PLFs), imposing heavy costs on state power utilities. One reason for this is that the off-peak demand for electricity is not sufficient to allow the excess coal-based generation to operate at full capacity.

There are other reasons for this situation. Coal-based power generation is becoming non-competitive in the face of sub-INR 3/kwh tariffs discovered for utility scale solar and wind power. The massive new tender for new solar capacity will further aggravate this problem for coal-based plants. In some cases, the absence of reliable fuel supply contracts and bottlenecks in coal transportation have also resulted in coal-based plants running at low PLFs. It is unlikely that these constraints will get resolved soon.

The trend is, therefore, painfully obvious: Coal-fired power is increasingly becoming uncompetitive against renewables, and its future prices — after factoring in increasingly costlier coal imports and compliance with tightening emission norms — are only likely to inch upwards. Politico-economic considerations being what they are, higher costs of coal-based power lead to larger subsidies for electricity end-users, which imposes a heavy burden on the public exchequer.

Adding to the quagmire is the fact that coal-fired power plants have led to large-scale displacement of rural families, disrupting their livelihoods. Burning of coal, in the absence of effective regulatory oversight, has adversely affected the health of the local communities, leading to larger expenditure on public health schemes.

In the normal course, financial institutions would hve exercised prudence and refrained from extending credit to coal-based power projects in view of their declining viability and the uncertainty in the recovery of loans. It is therefore somewhat inexplicable that they should continue to invest heavily in coal-based power capacity, especially at a time when they are saddled with huge NPAs, especially power sector NPAs.

While private sector banks have a marginal role in this, it is the PSU banks that face this problem. If they continue to extend credit to unviable projects, would it not necessitate recapitalisation of the PSU banks from out of the tax-payers’ money and jeopardising the interests of the public shareholders?

Globally the trend is quite the opposite. Prominent insurers such Lloyd’s (UK), Allianz (Germany), AXA (France) and Dai-Ichi (Japan) have already announced their termination of insurance for coal-fired power and coal mining. Divestment from coal is also being pursued by ING (major Dutch financial institution), the Norwegian government’s $1trillion pension fund, the Asian Infrastructure Investment Bank (AIIB) and to an extent, the World Bank.

Even at the recently concluded G7 summit, institutional investors (including wealthy private firms) together worth nearly $26 trillion in global assets urged the leaders to phase out coal-fired power generation. Surely they would not have done so if they saw no trouble in remaining invested in coal. Of course for them returns on investment may be a more pressing concern than tackling global warming, but the two goals are not mutually exclusive.

What then, is driving India’s public sector financing for coal-fired power? And to what end? Are we so infatuated with relentless economic growth that we completely ignore coal-fired power’s debilitating impacts on our financial institutions, our citizens’ health and the world’s precariously low carbon emission allowances? Apparently, there are other than prudent considerations which are compelling the government to persuade PSU banks to finance coal-based power.

(EAS Sarma is a former Secretary, Ministry of Power and Ministry of Finance and also served as an energy advisor to the Planning Commission. The views expressed are personal. He can be reached at eassarma@gmail.com)

—IANS

by admin | May 25, 2021 | Corporate, Corporate finance, Corporate Governance, Economy, Finance, News, Politics

Kerala Finance Minister Thomas Issac

Thiruvananthapuram : Political leadership of south Indian states of Kerala, Karnataka, Andhra Pradesh and union territory of Puducherry on Tuesday mulled the terms of reference of the 15th Finance Commission and plan to submit a joint memorandum to the President on the issue, a Minister said.

“We have decided to prepare a joint memorandum on the manner in which the Finance Commission should go about things and take different states into confidence,” Kerala Finance Minister Thomas Issac told the media here.

The states would even explore legal steps on the issue, Issac said at the end of a workshop he organised here for his counterparts from southern states to facilitate a review and critique of the terms of reference.

“We have entrusted (state-owned) Gulati Institute of Finance and Taxation to prepare a draft and by end of April or early May, we will meet again to finalise the memorandum in Visakhapatnam. We will also invite governments of other non-BJP ruled states. Thereafter, the memorandum will be send to the President and others,” Issac said.

Earlier, in his inaugural address at the one-day event, Kerala Chief Minister Pinarayi Vijayan said it’s time they stood together to demand reframing of the terms of reference), as it was necessary to save the federal structure of the Indian Union.

The Finance Commission — which delves into the financial relations between the Centre and states — should be guided more by its constitutional mandate than arbitrary terms of reference, Vijayan said.

“… (there is) a conspicuous bias in-built in the terms of reference of the new commission. It is widely feared that these terms framed by the Centre will prevent the panel from fulfilling its constitutional responsibility,” Vijayan added.

Apart from Vijayan and Issac, those who attended the workshop were Puducherry Chief Minister V. Narayanasamy, Karnataka Agriculture Minister Krishna Byre Gowda, Andhra Pradesh Finance Minister Yanamala Rama Krishnudu and other top officials. Representatives from Telengana and Tamil Nadu were absent.

Vijayan said all states should appeal to the central government to reframe the terms of reference.

“The reframing of the terms of reference is imperative to strengthen the federal structure of the country and to reinforce its unity and integrity,” said Vijayan, a senior Communist Party of India-Marxist leader from Kerala.

Vijayan said the commission’s role assumes significance, given the fact that the Centre is given near monopoly over the right to mobilise resources.

“We are all aware that the terms of reference have created apprehension about the principles of fairness and equity in the distribution of national resources for development. The unity of India can be preserved only if there is real fairness and equity in devolution of financial powers and resources to the states by the Centre,” the Chief Minister added.

Vijayan expressed reservation over the Financial Commission proposal for “measurable performance-based-incentives” which he claimed was an attack on the federal structure of the Indian state.

“Such terms of reference, we fear, might end up altering the commission’s status from a constitutional authority entrusted with devolution of national fiscal resources to an administrative mechanism for fiscal administration and monitoring,” added Vijayan.

Karnataka Agriculture Minister Krishna Byre Gowda, in his address, said all states that performed their duty of bringing down the population in their respective jurisdictions, were set to lose out since the plan is to shift the base from 1971 to 2011 Census.

Ramakrishnudu flayed the Centre for alleged arbitrary manner in fixing the commission’s terms of reference.

Puducherry’s Narayanasamy, who also holds the finance portfolio, complained that when it came to central schemes, the Union government treated Puducherry as a state but with regard to grants it was treated as a union territory.

—IANS

by admin | May 25, 2021 | Investing, Muslim World

IDB Headquarters, Jeddah, Saudi Arabia

Jeddah : The Islamic Development Bank (IDB) Group has affirmed its commitment to further strengthen the mechanisms of economic and trade cooperation, expand and deepen partnerships among member countries in the fields of trade, investment and finance, as well as mobilize the necessary resources to meet economic challenges and achieve sustainable development.

This came in a speech delivered by Eng. Hani Salem Sonbol, CEO of ITFC on behalf of IDB president Dr. Bandar Hajjar, during the ministerial consultative meeting of the member states of Organization of Islamic Cooperation held on the sidelines of World Trade Organization’s 11th Ministerial Conference opened recently in Buenos Aires.

In his speech, Eng. Hani explained that the member countries are facing many economic, and social challenges, most visible of which are the accelerated growth of population, climate change, and an increase of unemployment rates, especially among youth.

“To meet these challenges, the Bank depends on the 1440H vision, in addition to the Bank’s ten-year strategic framework, and the Bank president’s five- year program, which focuses on enhancing the Group’s fieldwork presence, efficiency & empowerment, increase the awareness of IDB, and enhancing the ties with development partners and finally, the acquisition of science and innovation in introducing the Bank’s model of finance and financial governance and providing integrated development solutions.

“We sincerely hope that the five-year program will contribute to supporting the member countries’ efforts towards finding practical solutions to the developmental challenges that face them.”

In an expansionary move by the IDB Group to finance the private sector in Islamic countries, Eng. Hani has announced, on behalf of IDB President, that five new offices will be established in Egypt, UAE, Suriname, Uganda, and Bangladesh in the coming period to play a crucial role in providing development assistance to member states more effectively. He affirmed that these new offices would play a crucial role in providing developmental assistance to member countries more effectively.

He stressed the importance of lifting the levels of intra-OIC trade, noting that this represents a strategic objective of the Group in the context of economic globalization and the resulting emergence of international economic entities and interests that do not pay attention to small and marginal entities, And the application of the WTO Agreements with all the principles and standards established for trade practices between States.

On their part, the ministers have stressed on IDB’s developmental role and effective contribution to developing the capacities of the countries in the fields of trade, regional integration, and cooperation. Pointing out the need for the Bank to continue its support of member countries in WTO accession issues, trade facilitation and services and new issues for negotiation.

The meeting, chaired by Eng.Tariq Qabeel, the Egyptian minister of trade and industry, was attended by most of the member countries participating in the WTO ministerial meetings held from 10 to 13 December 2017.

—SM/UNA-OIC

by admin | May 25, 2021 | Muslim World

Rabat : Morocco’s gross domestic product (GDP) is expected to reach $121.4 billion in 2017 compared to $116 billion in 2016, according to the latest projection of the African Development Bank (ADB) published recently in Abidjan.

Rabat : Morocco’s gross domestic product (GDP) is expected to reach $121.4 billion in 2017 compared to $116 billion in 2016, according to the latest projection of the African Development Bank (ADB) published recently in Abidjan.

For the first time, Morocco’s GDP is forecasted to exceed MAD 120 billion. According to a statistical bulletin of socioeconomic indicators in Africa, the performance of the Moroccan economy almost doubled in the last 12 years, from $65.62 billion in 2006 to 121.42 billion in 2017.

With this significant growth in the national GDP, Morocco ranks sixth in Africa’s economic powers, following Nigeria with $581.5 billion, South African with $276.1 billion, Egypt with $263.7 billion, Algeria with $170.3 billion, and Sudan with 123.9 billion.

For the ADB, Morocco’s economic growth is expected to see a significant acceleration in 2017, settling at 4.5 percent and 3.9 percent in 2018, mainly due to a strong rebound in agricultural production. According to the bank, the kingdom will exceed the global, African, and North African average growth rates set at 3.5, 3, and 3.1 percent respectively in 2017.

Globally, the bank is expecting a general improvement of the African economic performance in the medium term, boosted by the efforts deployed by the countries in the structural transformation of their economies, which “must continue with urgency and intensity” in the face of volatile commodity prices.

According to the ADB, the dynamics of domestic demand and public investment in infrastructure have also helped support growth in many countries.

“Beyond the accumulation of physical capital, the productivity of these investments, which is important for sustainable growth, must remain a political priority,” ADB experts recommend. According to the bank, budgetary and current account deficits are expected to narrow due to strong export performance and increased government revenues.

At the regional level, East Africa remains the fastest growing region, with an estimated 5.4 percent in 2017 and 5.8 percent in 2018.

—SM/OIC-UNA

Islamabad : The government of Saudi Arabia has signed three grant agreements with Pakistan to finance three road infrastructure and energy projects under the China Pakistan Economic Corridor (CPEC).

Islamabad : The government of Saudi Arabia has signed three grant agreements with Pakistan to finance three road infrastructure and energy projects under the China Pakistan Economic Corridor (CPEC).