by Editor | May 25, 2021 | Opinions

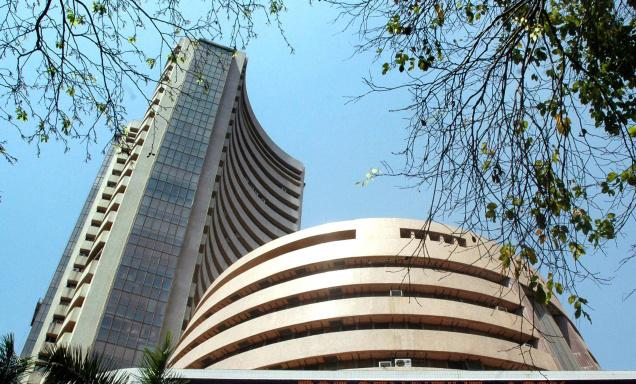

By Rohit Vaid, Mumbai, (IANS) The likely exit of Britain from the European Union (EU) and Reserve Bank of India (RBI) Governor Raghuram Rajan’s decision not to seek a second term might flare up volatility in the Indian equity markets in the upcoming week.

By Rohit Vaid, Mumbai, (IANS) The likely exit of Britain from the European Union (EU) and Reserve Bank of India (RBI) Governor Raghuram Rajan’s decision not to seek a second term might flare up volatility in the Indian equity markets in the upcoming week.

Investors will also be concerned over an initial deficit in monsoon rains, fluctuations in rupee value and food prices.

According to market observers, come Monday, June 20, a dour mood is expected to engulf investors, after Rajan said in a letter to his colleagues that he was not seeking a second term and will return to academia when his tenure ends in September.

After Rajan’s letter, Finance Minister Arun Jaitley said a successor would be named soon.

“The RBI Governor’s exit news could prompt investors to recheck their bullish convictions,” Anand James, Chief Market Strategist at Geojit BNP Paribas Financial Services, told IANS.

But the biggest risk to the key equity indices stems from the possible exit of Britain from the EU. The decision on the issue is subject to a referendum which will be conducted on June 23.

There might be far-reaching effects on global stock markets, as well as the international currencies, if Britain decides to exit the EU.

Besides, domestic investors will be concerned about the direct negative impact that some of the India-based companies and sectors that have investments and exposure to Britain will suffer.

The possible British exit will also lead to greater investments into less risky assets like gold and increase the overall outflows from the domestic equity markets.

“It is expected that the market would remain a little volatile due to the global events. Brexit is expected to heighten global volatility, thereby impacting capital flows at home,” D.K. Aggarwal, Chairman and Managing Director, SMC Investments and Advisors, told IANS.

According to Vaibhav Agrawal, Vice President and Research Head at Angel Broking, the possibility that Britain will vote to leave the EU has already rattled the global markets.

“US stock markets could see increased volatility as investors position for next week’s referendum,” Agrawal pointed out.

Other key global data points such as US homes sales, US crude oil inventory and employment data are expected to impact the general sentiments.

In addition, the US Federal Reserve Chairwoman Janet Yellen’s testimony to the US Congress might give further cues towards the next phase of the key lending rate hikes.

“The testimony can provide some insights into — when the next rate hike decision can come, as there are just three more monetary policy reviews left in the US,” explained James.

“A further extension to the US Fed rate hike will provide relief to the emerging markets (EM) like India.”

In its two-day policy meet last week, the US FOMC (Federal Open Market Committee) decided to maintain its key lending rates. The US Fed signalled its intention to limit the times it might increase key lending rates due to weak domestic jobs market.

A hike in the US interest rates can potentially lead FPIs (Foreign Portfolio Investors) away from emerging markets such as India.

Devendra Nevgi, Chief Executive of ZyFin Advisors, expects domestic developments to drive the markets after the global economic events conclude.

“The global risk appetite would drive the market sentiments. After the outcome, the markets will continue to focus on the domestic developments,” Nevgi said.

On the domestic front, strong economic fundamentals and recent economic announcements on major economic policy initiatives and debt recast plans are expected to attract investors.

“The factors such as prospects of better economic growth, expectations of a normal monsoon, double-digit earnings growth by the end of FY17 would continue to attract the foreign participants,” Aggarwal said.

“Besides these, the likely passage of the GST (Goods and Services Tax) Bill will continue to boost the confidence of the market participants.”

However, an initial deficit in monsoon rains will be closely followed by investors.

“Apart from the Brexit turmoil, the monsoon rainfall and passage of GST are the key triggers for the Indian markets,” Dhruv Desai, Director and Chief Operating Officer of Tradebulls, told IANS.

Investors were seen cautious last week after reports emerged that monsoon rains so far have been below average by around 25 per cent.

A weak monsoon, coupled with recent uptrend in macro-economic inflation data points could lead to a build-up in price pressure and reduce chances of a future rate cut.

(Rohit Vaid can be cntacted at rohit.v@ians.in)

by Editor | May 25, 2021 | Economy, News

Mumbai (IANS) Key Indian indices plunged on Wednesday as an amended tax treaty with Mauritius spooked investors at the prospects of a massive outflow of foreign capital from the equity markets.

Mumbai (IANS) Key Indian indices plunged on Wednesday as an amended tax treaty with Mauritius spooked investors at the prospects of a massive outflow of foreign capital from the equity markets.

Consequently, the key indices of the Indian equity markets traded deep in the red during the mid-afternoon trade session.

The wider 51-scrip Nifty of the National Stock Exchange (NSE) edged lower by 39 points or 0.49 percent, at 7,848.80 points.

The barometer 30-scrip sensitive index (Sensex) of the BSE, which opened at 25,548.97 points, traded at 25,602.69 points (at 2.00 p.m.) — down 169.84 points or 0.66 percent from the previous close at 25,772.53 points.

The Sensex has so far touched a high of 25,762.49 points and a low of 25,409.24 points during the intra-day trade.

The BSE market breadth was skewed in favour of the bears — with 1,496 declines and 934 advances.

Initially during the day’s trade, the equity markets opened on a negative note, as investors were spooked after the government on Tuesday announced amendments to the DTAA (Double Taxation Avoidance Agreement) with Mauritius.

The amended DTAA has increased the potential of a massive outflow of foreign funds from the equity markets. Mauritius is a major source of foreign investments into the Indian equity markets.

Besides, investors were seen cautious ahead of the release of key domestic macro-economic data such as CPI (Consumer Price Index) and IIP (Index of Industrial Production).

In addition, upcoming quarterly results from the banking sector and negative European markets stroked volatility.

However, markets pared some of its losses on the back of value buying after the initial correction.

“The potential of FIIs’ outflows from India due to the amendment of the tax treaty with Mauritius spooked investors,” Anand James, chief market strategist, Geojit BNP Paribas Financial Services, told IANS.

“Investors were seen cautious ahead of the release of banks’ fourth quarter results and the key-macro economic data.”

by Editor | May 25, 2021 | Investing

By Rohit Vaid Mumbai (IANS) Key macro-economic data, combined with quarterly earnings’ results and the progress in parliament, are expected to flare-up volatility in the Indian equity markets during the upcoming week.

By Rohit Vaid Mumbai (IANS) Key macro-economic data, combined with quarterly earnings’ results and the progress in parliament, are expected to flare-up volatility in the Indian equity markets during the upcoming week.

“In the coming week the market may remain volatile as macro-economic data, global markets and the movement of crude oil prices will dictate trends in the near term,” said Vaibhav Agarwal, vice president and research head at Angel Broking.

Key domestic macro-economic data such as the consumer price index (CPI) and IIP (index of industrial production) are slated to be released next week.

Besides, global macro-economic data on US retail sales and consumer sentiment, along with inflation figure from China and Eurozone GDP will influence the equity markets.

According to Anand James, chief market strategist, Geojit BNP Paribas Financial Services, the equity markets’ tone for the next week will be set by the Bank of Japan (BoJ), which is expected to release its March meeting minutes on Monday.

James elaborated that the dismal US non-farm payroll figures have fuelled talk about a possible recession and reduced the potential for a June rate hike.

“In this backdrop the possibilities of a RBI (Reserve Bank of India) rate cut would be played up, especially with IIP and CPI data scheduled for release on May 12,” James said.

The US data for last month showed that the economy created 160,000 jobs, against 215,000 in March.

Devendra Nevgi, chief executive of ZyFin Advisors said that the parliament session closing May 13 would be closely followed next week.

“The parliament session would be closely watched on the reforms and action on bills, some of which will need the upper house nod,” Nevgi said.

Further, market observers pointed out that the next batch of fourth quarter (Q4) results will also guide the equity markets.

“Investors will closely track the next batch of Q4 results,” Agarwal added.

Sector-wise, Pankaj Sharma, head of equities for Equirus Securities said that IT stocks will be influenced by Cognizant’s results which were declared on Friday.

“The performance and guidance is a bit disappointing from one of the largest IT companies which has similar model as other large cap Indian IT names,” Sharma said.

“And, this doesn’t inspire a lot of confidence on how this year would look like on growth for the Indian IT sector.”

The equity markets closed the previous week in the red, as negative global cues, along with disappointing Q4 results and profit booking, dented the equity markets.

During the week ended May 6, the wider 51-scrip Nifty of the National Stock Exchange (NSE) slipped by 116.35 points or 1.48 percent to 7,733.45 points.

The barometer 30-scrip sensitive index (Sensex) of the BSE declined by 378.12 points or 1.47 percent to 25,228.50 points.

(Rohit Vaid can be contacted at rohit.v@ians.in)

by Editor | May 25, 2021 | Opinions

By Rohit Vaid Mumbai, (IANS) Negative global cues, combined with the logjam in parliament and profit booking, depressed the Indian equity markets during the just concluded weekly trade.

By Rohit Vaid Mumbai, (IANS) Negative global cues, combined with the logjam in parliament and profit booking, depressed the Indian equity markets during the just concluded weekly trade.

Nevertheless, value buying at lower levels, healthy fourth quarter (Q4) results and stable crude oil prices averted a full scale sell-off.

This resulted in the equity markets trading in a narrow range due to a neck-and-neck race between the bulls and the bears.

During the week under review, the barometer 30-scrip sensitive index (Sensex) of the BSE declined by 231.52 points or 0.89 percent to 25,606.62 points.

The wider 50-scrip Nifty of the National Stock Exchange (NSE) slipped by 49.5 points or 0.62 percent to 7,849.80 points.

Besides, the broader markets underperformed the headline indices and closed marginally in the red, led by profit booking.

In addition, the unwinding of long positions due to the futures and options (F&O) expiry dented sentiments.

“Indian markets ended another week on a muted tone extending the range bound consolidation. A sustained trade above the lower end of the range may extend the range bound movement,” Nitasha Shankar, senior vice president for research with YES Securities, told IANS.

“VIX (volatility index) is approaching upper band of the bull zone portending to choppy and volatile sessions in the coming week.”

Further, volatility was sparked by the US FOMC (US federal open market committee) meet and the Bank of Japan’s (BoJ) monetary policy review.

The BoJ’s comments dragged the global and domestic markets lower among the two central banks’ announcements last week.

The global markets were spooked after the BoJ decided to maintain its monetary policy. Investors were disappointed as they expected a further easing by the BoJ.

“Bank of Japan’s shocking call on monetary policy by deciding to keep its interest rates unchanged, with no additional stimulus disturbed the global environment and added to the selling pressure,” said Dhruv Desai, director and chief operating officer, Tradebulls.

Anand James, chief market strategist, Geojit BNP Paribas Financial Services pointed out that the impact of the BoJ’s decision was further accentuated by the fact that Japanese markets went on a long holiday.

“The rush to close positions led to a near four percent plunge at close in Nikkei, casting a cloud on the bullish sentiments across the globe,” James said.

On the flip side, the US FOMC meet, as expected, kept interest rates unchanged, but signalled confidence in the US economic outlook, leaving the door open for a rate hike in June.

“The FOMC’s confidence in the US economic outlook, and the lack of reference to the global risks, were seen as encouraging signs for the market,” James said, adding: “Crude oil’s steady rise and close above $45 per barrel remained supportive.”

James added that Indian markets remained buoyant, helped by healthy quarterly earning figures which have been above expectations.

Pankaj Sharma, head of equities for Equirus Securities said: “If this trend sustains, the earning season may not really help or would go against the markets which under the circumstances is not a completely undesirable outcome.”

Even a healthy rise in foreign funds’ inflow during the week under review supported prices and countered global headwinds.

Data with stock exchanges revealed that FPIs (Foreign Portfolio Investors) purchased stocks worth Rs.1,060.89 crore during the week under review.

The same data showed that domestic institutional investors (DIIs) sold stocks worth Rs.1,409.89 crore.

Figures from the National Securities Depository Limited (NSDL) showed that the FPIs invested Rs.1,681.68 crore or $252.48 million in the equity markets from April 25-29.

Furthermore, a firm rupee boosted investors sentiments.

On a weekly basis, the Indian rupee gained 15 paise to 66.33 (April 29) against a US dollar from its previous close of 66.48 (April 22) to a greenback.

“April turned out be a low volatile month, in line with its historical volatility,” elaborated Anindya Banerjee, associate vice president for currency derivatives with Kotak Securities.

(Rohit Vaid can be contacted at rohit.v@ians.in)

by Editor | May 25, 2021 | World

Mumbai:(IANS) Profit booking, unwinding of long positions ahead of derivatives expiry and caution over a likely US rate hike dragged the key equity markets lower on Tuesday.

Mumbai:(IANS) Profit booking, unwinding of long positions ahead of derivatives expiry and caution over a likely US rate hike dragged the key equity markets lower on Tuesday.

Consequently, the barometer 30-scrip sensitive index (Sensex) of the Bombay Stock Exchange (BSE) closed the day’s trade in the red.

Similarly, the wider 50-scrip Nifty of the National Stock Exchange (NSE) ended in the negative territory. It dropped by 18 points or 0.24 percent, to 7,597 points.

The Sensex, which opened at 24,957.24 points, closed at 24,900.46 points — down 65.94 points or 0.26 percent from the previous day’s close at 24,966.40 points.

During the intra-day trade, the Sensex touched a high of 25,079.35 points and a low of 24,835.56 points.

The BSE market breadth favoured the bears — with 1,718 declines and 928 advances.

The barometer index had plunged by 371 points or 1.46 percent on Monday.

Initially, both the key indices of the Indian equity markets opened on a flat note, following their Asian peers. Even commodities like gold, oil and copper were at standstill at the beginning of the day’s trade.

Market observers cited that profit booking, and unwinding of long positions ahead of the derivatives expiry dented investors’ sentiments.

In addition, caution prevailed ahead of the US Federal Reserve chairman Janet Yellen’s speech at the Economic Club of New York later in the day.

The speech assumes significance as it can give cues on a likely US rate hike next month. Recent US economic growth data has increased chances of a rate hike.

A hike in the US interest rates is expected to lead away Foreign Portfolio Investors (FPIs) from emerging markets such as India.

Besides, upcoming US economic data such as ADP employment report figures and non-farm payroll numbers deterred investors from chasing prices higher.

However, some value buying, positive opening of the European markets and healthy foreign funds inflow briefly supported prices and led key indices to pare their initial losses.

Further, a stable rupee gave a boost to investors’ sentiments. The rupee ended the day’s trade at 66.54 to a US dollar from its previous close of 66.56-57 to a greenback.

“Profit booking and unwinding of long positions ahead of F&O (futures and options) expiry dented sentiments. Caution also prevailed ahead of the US Fed Chair Janet Yellen’s speech and upcoming ADP jobs data tomorrow and non-farm payroll data on Friday,” Anand James, chief market strategist, Geojit BNP Paribas Financial Services, told IANS.

“However, markets were able to pare some of their losses due to value buying and positive opening of the European markets.”

According to Vaibhav Agarwal, vice president and research head at Angel Broking, equity markets traded in a narrow range throughout the day’s trade and closed in the red led by a correction in pharma, IT (information technology) companies and index heavyweight HDFC.

“Traders remain cautious ahead of Federal Reserve Chairwoman Janet Yellen’s speech today and F&O expiry,” Agarwal noted.

“However, with expectations of a rate cut, we expect the selling pressure to reduce going forward. Investors would also keenly watch out for US jobs data for further cues on the rate hike.”

Furthermore, foreign institutional investors (FIIs) were net buyers during the day’s trade, while the domestic institutional investors (DIIs) sold stocks.

The data with stock exchanges showed that FIIs invested Rs.513.45 crore, while the DIIs sold stocks worth Rs.556.69 crore.

Sector-wise, healthy buying was witnessed in automobile, banking and metal stocks, whereas scrip of healthcare, capital goods and IT industries came under selling pressure.

The S&P BSE automobile index augmented by 156.19 points, followed by the banking index which increased by 69.96 points and the metal index rose by 29.39 points.

The S&P BSE healthcare index receded by 391.63 points, followed by capital goods index which declined by 125.23 points and the IT index fell by 45.73 points.

Major Sensex gainers during Tuesday’s trade were Tata Motors, up 2.63 percent at Rs.372.80; Maruti Suzuki, up 2.55 percent at Rs.3,730.85; Axis Bank, up 1.55 percent at Rs.429.35; Reliance Industries, up 1.46 percent at Rs.1,035.40; and Tata Steel, up 1.28 percent at Rs.303.90.

Major Sensex losers during the day’s trade were Lupin, down 6.27 percent at Rs.1,401.45; Cipla, down 3.83 percent at Rs.504.35; Dr.Reddy’s Lab, down 2.98 percent at Rs.2,945.15; Gail, down 2.88 percent at Rs.347.30; and Sun Pharma, down 2.10 percent at Rs.794.05.

By Rohit Vaid, Mumbai, (IANS) The likely exit of Britain from the European Union (EU) and Reserve Bank of India (RBI) Governor Raghuram Rajan’s decision not to seek a second term might flare up volatility in the Indian equity markets in the upcoming week.

By Rohit Vaid, Mumbai, (IANS) The likely exit of Britain from the European Union (EU) and Reserve Bank of India (RBI) Governor Raghuram Rajan’s decision not to seek a second term might flare up volatility in the Indian equity markets in the upcoming week.