by Editor | May 25, 2021 | Islamic Banking, Islamic Finance, Muslim World, News

Dubai : Following the conclusion of its Annual General Meeting (AGM), Dubai Islamic Bank (DIB) announced recently that the meeting approved the distribution of 45 fills per share as cash dividend for 2017, closing another year with strong returns to shareholders since the bank embarked on a growth agenda four years ago.

Dubai : Following the conclusion of its Annual General Meeting (AGM), Dubai Islamic Bank (DIB) announced recently that the meeting approved the distribution of 45 fills per share as cash dividend for 2017, closing another year with strong returns to shareholders since the bank embarked on a growth agenda four years ago.

The general assembly also approved the bank’s 2017 financial statements. For the year 2017, DIB reported a net profit of AED 4.5 billion, an increase of 11 percent compared to AED 4.05 billion in 2016. Other agenda items discussed at the AGM included the review of the Fatwa and Shariah Supervisory Board Report and the reappointment of the bank’s external auditors.

The AGM has also approved DIB’s capital increase by way of a rights issue to bolster the bank’s CET1 further and facilitate credit expansion in 2018. The rights will be offered after obtaining the required approval from relevant regulatory authorities, CPI Financial News reported.

“The year 2017 has been yet another remarkable period of growth for the bank as we continue to make great strides towards our expansionary agenda in both local and international markets. Despite challenges stemming from the global economic slowdown and across the region, the bank’s continued to display its resilience to external factors with double-digit growth in profitability. As we move forward into 2018, we remain in full alignment with Dubai and the UAE’s plans of building a diversified economy and an attractive global hub for Islamic Finance,” said Director-General of the Ruler’s Court of Dubai, and Chairman of Dubai Islamic Bank Mohammed Ibrahim Al Shaibani, commenting on a fourth consecutive successful financial year.

DIB’s evolution in the last four years has witnessed a complete transformation in the size and scale of its business. With the balance sheet and related key metrics of financing and deposits nearly doubling or more during the period, the profitability has risen by an unprecedented three times with both returns on equity (ROEs) and returns on assets (ROAs) recording significant jumps as well. The last few years have also seen a complete reconstitution of the bank’s business model which now boasts a significantly more diversified portfolio with vastly reduced concentration risks.

“The bank has showcased another remarkable year. Our focus on returns to the shareholders continues with ROE at 18.7 percent and dividend payout of nearly 50 percent. Growth 2.0 is on course with the AGM approving the capital increase special resolutions. The continuous market leading performance that you have witnessed DIB give since 2014 has come from a very clearly defined strategic plan, which has focused on the franchise’s strengths effectively limiting the impact of market conditions over the last few years. I thank the shareholders for their continuous support throughout the recent growth phase and look forward to the same as we continue to strive for greater heights in the years to come,” said Dr. Adnan Chilwan, Group CEO of DIB.

—SM/UNA-OIC

by Editor | May 25, 2021 | Banking, Business Summit, Economy, Events, Markets, Media, News

By Maeeshat Desk,

Dubai / Mumbai, Sep 28: Mr. Danish Reyaz, Managing Director of Maeeshat Media Pvt. Ltd. and Editor-in-Chief of Maeeshat English monthly, attended the two-day India-UAE Strategic Conclave in Dubai. He was one of the special invitees to the business summit held at Al-Habtoor City in Dubai from 27-28 Sep.

Danish Reyaz, Editor-in-Chief, Maeeshat, (right) shaking hand with Sheikh Nahyan Bin Mubarak Al Nahyan, Cabinet Member and Minister of Culture and Knowledge Development, UAE at India-UAE Strategic Conclave in Dubai on 28 Sep 2017.

Danish Reyaz, Editor-in-Chief, Maeeshat, (extreme left) with business leaders from India and UAE at India-UAE Strategic Conclave in Dubai on 27 Sep 2017.

On the sidelines of the conclave Mr. Danish Reyaz met various business leaders from India and UAE including Sheikh Nahyan Bin Mubarak Al Nahyan, Cabinet Member and Minister of Culture and Knowledge Development, UAE. The summit was organized under the patronage and presence of Sheikh Nahyan. He also met Ashish Kumar Chauhan, MD & CEO of Bombay Stock Exchange.

The India-UAE business summit was supported by the Indian government’s flagship Make in India program. Its industry partner was UAE India Business Council (UIBC). Industry association partners were: Indian Business & Professional Council (IBPC), Indian Economic Trade Organisation (IETO), Asian-Arab Chamber of Commerce (AACC) and Abu Dhabi Chamber of Commerce & Industry.

Danish Reyaz interacting with business leaders from UAE at India-UAE Strategic Conclave in Dubai on 27 Sep 2017.

Maeeshat was among the media partners of the summit. Other media partners were Banking Finance (monthly journal), Infrastructure Today and Entrepreneur magazine.

The India-UAE business summit was held about two years after Prime Minister Narendra Modi visited UAE.

PM Modi’s visit to UAE (16-17 August 2015) was first by any Indian prime minister in the last 34 years. Held at the invitation of UAE’s Crown Prince Mohamed Bin Zayed AI Nahyan, PM’s visit had marked the “beginning of a new and comprehensive strategic partnership between India and UAE in a world of multiple transitions and changing opportunities and challenges.”

Danish Reyaz, Editor-in-Chief, Maeeshat, (right) with Ashish Kumar Chauhan, MD & CEO of Bombay Stock Exchange at India-UAE Strategic Conclave in Dubai on 28 Sep 2017.

The Macro Agenda of this two-day conclave included: Public-Private Partnerships, Investment Development & Promotion, FDI Regulatory Frameworks, Decoding Sustainable, Impactful & Responsible Investment and Regional & Global Investor Support.

More than 400 business leaders from the two countries were expected to attend the two-day business summit which was aimed at expanding the India-UAE economic relations at large scale.

The Economic Times was the organizer of the business summit.

by Editor | May 25, 2021 | Investing, Muslim World

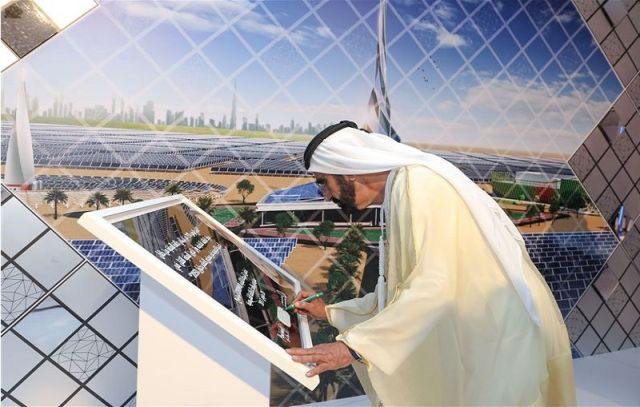

Dubai : Dubai announced the launch of the world’s largest single-site Concentrated Solar Power (CSP) project using an Independent Power Producer (IPP) model, with a capacity of 700 megawatts at a cost of $3.8 billion. Sheikh Mohammad bin Rashid Al Maktoum, vice president and prime minister of the UAE and ruler of Dubai, launched the project on Saturday.

Dubai : Dubai announced the launch of the world’s largest single-site Concentrated Solar Power (CSP) project using an Independent Power Producer (IPP) model, with a capacity of 700 megawatts at a cost of $3.8 billion. Sheikh Mohammad bin Rashid Al Maktoum, vice president and prime minister of the UAE and ruler of Dubai, launched the project on Saturday.

The Government of Dubai Media Office said in a statement that the project comes as part of implementing the fourth stage of the Mohammad bin Rashid Al Maktoum Solar Park and to support the end goals of Dubai Clean Energy Strategy 2050.

“The UAE has succeeded in building a global green economy model based on the environmental sustainability and clean energy and supported by clear plans. These plans will contribute to strengthening the foundations of such model and developing it according to the world’s finest standards so as to make the most of this field and invest in enhancing infrastructure, building capabilities and training competent national competencies,” said Sheikh Mohammad.

“Implementing the world’s largest Concentrated Solar Power project reaffirms the UAE’s leadership in renewable clean energy all over the world and enhances our status at the forefront of the most advanced countries in this field,” he added.

Sheikh Mohammad bin Rashid stressed that the UAE is steadily moving towards achieving Dubai Clean Energy Strategy 2050 goals, which have been launched to turn Dubai into a global hub for clean energy and green economy and become the lowest carbon footprint in the world by 2050.

—AB/IINA

by Editor | May 25, 2021 | Halal Industries

Dubai Islamic Economy Development Centre (DIEDC) and the Emirates Authority for Standardization and Metrology (ESMA) hold a signing ceremony after approval of the International Halal Accreditation Forum (IHAF) by the government of UAE.

Dubai Islamic Economy Development Centre (DIEDC) and the Emirates Authority for Standardization and Metrology (ESMA) hold a signing ceremony after approval of the International Halal Accreditation Forum (IHAF) by the government of UAE.

The foundation members include: (1) Dubai Accreditation Department (2) Emirates National Accreditation System (3) General Coordination for Accreditation (Brazil) (4) American Association for Laboratory Accreditation (USA) (5) Pakistan National Accreditation Council (Pakistan) (6) Entidad Nacional de Acreditacion (Spain) (7) Gulf Centre for Accreditation (8) Saudi Accreditation Committee (9) United Kingdom Accreditation Service and (10) Joint Accreditation System of Australia and New Zealand.

(Source: Joint Accreditation System of Australia and New Zealand, JAS-ANZ)

The primary objective of establishing IHAF is to harmonise conformity assessment practices in the halal sector, and establish Multilateral Recognition Agreements between member bodies that will facilitate halal trade globally, according to JAS-ANZ.

Initiative will prop up Dubai’s ambition of emerging as a global capital of Islamic economy

Representatives of 10 countries have signed a memorandum of understanding (MoU) in Dubai for the establishment of the International Halal Accreditation Forum (IHAF) to be based in the emirate.

The move is a significant development that boosts the efforts of the Dubai Islamic Economy Development Centre (DIEDC) to articulate Dubai’s ambition of emerging as a global capital of Islamic economy.

Jointly spearheaded by DIEDC and the Emirates Authority for Standardisation and Metrology (Esma), the latest initiative in the UAE reinforces the government’s efforts to shape the country into a global reference in halal product certification and enabling legislation.

Once established, IHAF will aim to regulate the halal industry and introduce an inspection mechanism that safeguards customers’ rights and industry promotions. In addition, the accreditation body will help build credibility and confidence in halal-certified food and non-food products globally, while facilitating trade movement in the halal industry and ensuring greater cooperation among regional and international organisations.

The issue of global standardisation of halal products and services has been on the agenda of several stakeholders of the Islamic economy since the nascent sector gained international recognition in recent years.

Speaking on the occasion, Mohammed bin Abdullah Al Gergawi, chairman of the DIEDC, said: “Each economic system requires a well-defined structure and culture, agreeable standards and unified references. This is why we consider the agreement to establish the International Halal Accreditation Forum an essential initiative that contributes to the development of Islamic economy. The agreement will facilitate the structured organisation of varied sectors of Islamic economy and the formation of its entities.”

He added: “Furthermore, it will enable the documentation of local and international references and lay down specifications for a unanimously agreed mechanism that will be binding on all participating countries in the Islamic economy space. This initiative will establish a unified foundation for the concept of halal and halal production mechanisms – so that we can use it as a benchmark and expand its scope to include even more countries.”

Dubai has been taking steps to beef up its Sharia regulations as part of plans to carve out an Islamic financial industry in the emirate. The UAE Cabinet on Sunday approved the launch of a Sharia Authority, a regulator to set standards for Islamic finance products.

The body will oversee the Islamic financial sector, approve financial products and set rules and principles for banking transactions in accordance with Islamic jurisprudence.

(reference:http://halalfocus.net)

by Editor | May 25, 2021 | Corporate, Corporate Buzz, Muslim World

Dubai: Emirates Group full-year profit grew by 50 per cent to a record high in 2015-2016 as low oil prices slashed operating costs at the world’s largest international airline.

Dubai: Emirates Group full-year profit grew by 50 per cent to a record high in 2015-2016 as low oil prices slashed operating costs at the world’s largest international airline.

Profit rose to Dh8.2 billion ($2.2 billion) in the 12 months to March 31, up from Dh5.5 billion in the previous year, Emirates said on Tuesday.

It is the Group’s 28th consecutive year of profitability and its highest ever profit. Revenue declined 3 per cent to Dh92.9 billion under pressure from the strong dollar.

“The US dollar continued to rise strongly against currencies in most of our key markets,” Chairman and Chief Executive Shaikh Ahmad Bin Saeed Al Maktoum said at Emirates headquarters in Dubai.

The strong dollar had a “Dh6 billion impact on the airline revenue and a Dh4.2 billion impact on the airline bottom line,” Shaikh Ahmad said.

Emirates airline recorded its strongest ever profit with a 56 per cent increase to Dh7.1 billion though revenue fell by 4 per cent to Dh85 billion, largely due to the dollar.

Falling oil prices, which lost around 32 per cent of their value in Emirates’ financial year, gave the airline a Dh9 billion cost saving, Shaikh Ahmad said. Its fuel bill, down 31 per cent, accounted for 26 per cent of its operating costs compared to 35 per cent in the year prior.

While the airline saw savings in the lower fuel price there was also a negative impact on air travel, Shaikh Ahmad said.

(reference:http://gulfnews.com)

Dubai : Following the conclusion of its Annual General Meeting (AGM), Dubai Islamic Bank (DIB) announced recently that the meeting approved the distribution of 45 fills per share as cash dividend for 2017, closing another year with strong returns to shareholders since the bank embarked on a growth agenda four years ago.

Dubai : Following the conclusion of its Annual General Meeting (AGM), Dubai Islamic Bank (DIB) announced recently that the meeting approved the distribution of 45 fills per share as cash dividend for 2017, closing another year with strong returns to shareholders since the bank embarked on a growth agenda four years ago.