Saudi Aramco participates in the Future Investment Initiative 2017

By Saif Alam Siddiqui, Riyadh

(Riyadh: Maeeshat News): Saudi Aramco participated in Future Investment Initiative (FII) 2017. The aim of FII2017 is to harness Kingdom’s strong investment capabilities and exploit its unique strategic location that leads to a global investment hub connecting three continents. FII 2017 organized in the capital from 24-26 October, in association with Saudi Public Investment Fund (PIF), in the context of Saudi Arabia’s Vision 2030, it’s a major gathering of global business and policy influencers.

Under the patronage of King Salman bin Abdulaziz Al-Saud and the leadership Crown Prince and Chairman of the Public Investment Fund Mohammed bin Salman, the aim of the initiative is to provides a platform for expert analysis on current and future global investment trends, with an objective of achieving impactful, sustainable returns in line with the ambitious national transformation program Vision 2030.

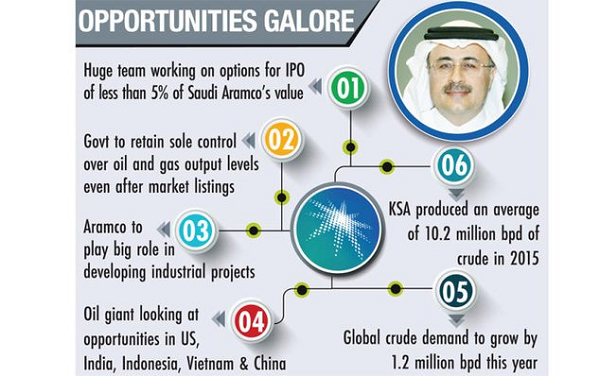

Saudi Aramco President and CEO Amin Nasser took part in FII’s first panel discussion titled “The Big Shift: What New Frameworks Are Needed to Understand the Future?,” discussing economic and business transformations alongside leaders of global institutions, Yasir Al-Rumayyan, Chief Executive, Managing Director, and Secretary-General of the Public Investment Fund, Victor Chu, chairman and CEO of First Eastern Investment Group; Larry Fink, chairman and CEO of BlackRock; and Christine Lagarde, managing director at the International Monetary Fund.

Nasser expressed his view and highlighted Saudi Aramco’s initiatives and achievements for Vision 2030. “Saudi Aramco is committed to supporting Vision 2030’s key aims of a diversified economy, anchored by a thriving private sector. Our strategic intent to become the world’s leading energy and chemicals company, which includes integrating across the petroleum value chain, expanding our downstream business and doubling our refining capacity, aligns with such key national goals through the creation of new industries and business lines, increased exports and quality jobs” , On the other hand “In the same way, Saudi Aramco’s technology focus on ultra-clean oil and gas and Carbon Capture, Utilization and Storage technologies that can turn legacy fuels into lower emission fuels, supports the Kingdom’s commitment to the Paris Agreement while also leveraging the economic power of long-term innovation.”

Lastly Nasser concluded that Saudi Aramco’s efforts to increase the energy sector’s greater efficiency through localization and an emphasis on renewables likewise are growth engines for taking the economy beyond oil.