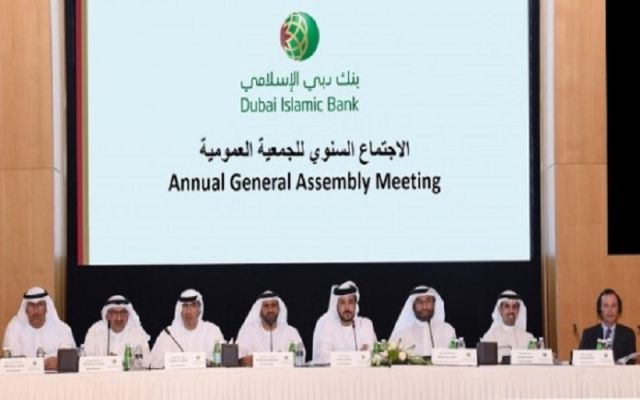

Dubai : Following the conclusion of its Annual General Meeting (AGM), Dubai Islamic Bank (DIB) announced recently that the meeting approved the distribution of 45 fills per share as cash dividend for 2017, closing another year with strong returns to shareholders since the bank embarked on a growth agenda four years ago.

Dubai : Following the conclusion of its Annual General Meeting (AGM), Dubai Islamic Bank (DIB) announced recently that the meeting approved the distribution of 45 fills per share as cash dividend for 2017, closing another year with strong returns to shareholders since the bank embarked on a growth agenda four years ago.

The general assembly also approved the bank’s 2017 financial statements. For the year 2017, DIB reported a net profit of AED 4.5 billion, an increase of 11 percent compared to AED 4.05 billion in 2016. Other agenda items discussed at the AGM included the review of the Fatwa and Shariah Supervisory Board Report and the reappointment of the bank’s external auditors.

The AGM has also approved DIB’s capital increase by way of a rights issue to bolster the bank’s CET1 further and facilitate credit expansion in 2018. The rights will be offered after obtaining the required approval from relevant regulatory authorities, CPI Financial News reported.

“The year 2017 has been yet another remarkable period of growth for the bank as we continue to make great strides towards our expansionary agenda in both local and international markets. Despite challenges stemming from the global economic slowdown and across the region, the bank’s continued to display its resilience to external factors with double-digit growth in profitability. As we move forward into 2018, we remain in full alignment with Dubai and the UAE’s plans of building a diversified economy and an attractive global hub for Islamic Finance,” said Director-General of the Ruler’s Court of Dubai, and Chairman of Dubai Islamic Bank Mohammed Ibrahim Al Shaibani, commenting on a fourth consecutive successful financial year.

DIB’s evolution in the last four years has witnessed a complete transformation in the size and scale of its business. With the balance sheet and related key metrics of financing and deposits nearly doubling or more during the period, the profitability has risen by an unprecedented three times with both returns on equity (ROEs) and returns on assets (ROAs) recording significant jumps as well. The last few years have also seen a complete reconstitution of the bank’s business model which now boasts a significantly more diversified portfolio with vastly reduced concentration risks.

“The bank has showcased another remarkable year. Our focus on returns to the shareholders continues with ROE at 18.7 percent and dividend payout of nearly 50 percent. Growth 2.0 is on course with the AGM approving the capital increase special resolutions. The continuous market leading performance that you have witnessed DIB give since 2014 has come from a very clearly defined strategic plan, which has focused on the franchise’s strengths effectively limiting the impact of market conditions over the last few years. I thank the shareholders for their continuous support throughout the recent growth phase and look forward to the same as we continue to strive for greater heights in the years to come,” said Dr. Adnan Chilwan, Group CEO of DIB.

—SM/UNA-OIC

0 Comments