by Editor | Aug 26, 2024 | Business, Economy, News

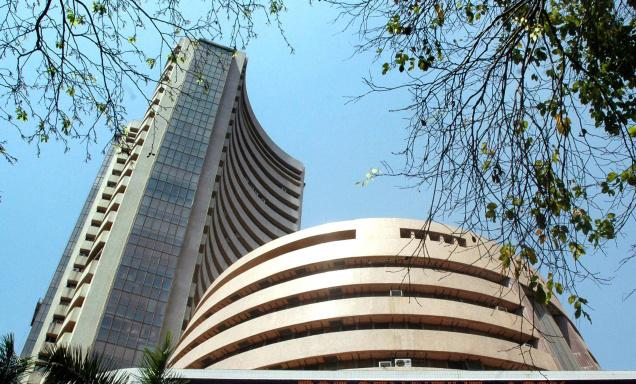

New Delhi: The week gone by had plenty of action and markets built on the super booster dose of August 16, when it registered super gains of over 1,300 points on BSE Sensex and 400 points on Nifty. This week saw no jump but, they built on the head start and inched upwards to set up what could be a flourish in the coming week.

BSE Sensex gained 649.37 points or 0.81 per cent to close at 81,086.21 points while Nifty gained 282 points or 1.15 per cent to close at 24,823.15 points. The broader markets saw BSE 100, BSE 200 and BSE 500 gain 1.26 per cent, 1.31 per cent and 1.53 per cent respectively. BSE Midcap was up 1.96 per cent while BSE Smallcap gained 3.39 per cent. During the week, BSE Sensex gained in four sessions and lost a tad in the opening session of the week, while Nifty gained in all five trading sessions. Markets are within striking distance of all-time highs made on August 1, earlier this month.

The Indian Rupee gained 7 paise or 0.08 per cent to close at Rs 83.89. Dow Jones had a decent showing backed by a superlative effort on Friday, the closing day of the week when it gained 462 points. This helped Dow gain 515.32 points or 1.27 per cent to close at 41,175.08 points. Dow gained on three of the five trading sessions and lost on two.

There is a lot of activity happening in the primary markets. Shares of Saraswati Saree Depot Limited which were issued at Rs 160, listed on Tuesday, August 20, debuted at Rs 200 and closed at an upper circuit of Rs 209.95 on day one. The gains made were Rs 49.95 or 31.21 per cent. By Friday, the share witnessed profit-taking and closed at Rs 180.10, a gain of Rs 20.10 or 12.56 per cent on BSE. On NSE, the share closed lower at Rs 177.95, a gain of Rs 17.95 or 11.21 per cent.

The issue from Interarch Building Products Limited which had opened on August 19, and closed on August 21, received excellent response. The price band was Rs 850-900. The issue consisted of a fresh issue of Rs 200 crore and an offer for sale of 44,47,630 shares. The issue was subscribed 93.81 times overall with the QIB portion subscribed 197.29 times, the HNI portion subscribed 130.93 times and the retail portion subscribed 19.5 times. There were 24.42 lakh applications in all.

The second issue to tap the capital markets was Orient Technologies Limited which opened its issue on August 21 and closed on August 23. The issue consists of a fresh issue of Rs 120 crore and an offer for sale of 46 lakh shares, in a price band of Rs 195-206.

by Editor | Aug 26, 2024 | Business, Economy, News

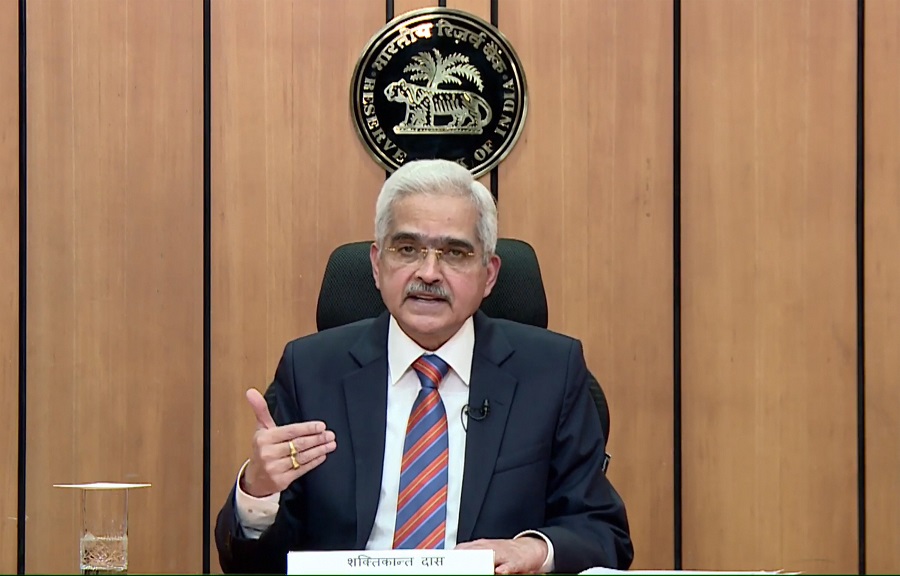

Bengaluru: RBI Governor Shaktikanta Das on Monday offered India’s UPI system as a plug-and-play system for other countries to facilitate quicker and cheaper cross-border remittances among the community of nations.

Addressing the RBI@90 Global Conference here on ‘Digital Public Infrastructure and Emerging Technologies’, the RBI Governor said, “In this journey of attaining harmonisation and interoperability of payments among countries, a key challenge could be the fact that countries may prefer to design their own systems as per their domestic considerations. We can overcome this challenge by developing a plug-and-play system which allows replicability while also maintaining the sovereignty of respective countries.”

“India has made some progress in this direction and would be happy to develop a plug-and-play system for the benefit of the community of nations,” Das announced.

He explained that the UPI system has the potential to evolve into a cheaper and quicker alternative to the available channels of cross-border remittances. A beginning can be made with small-value personal remittances as it can be quickly implemented.

“India is a vast country with great diversity. A solution that works well in India has the potential to be customised to the unique requirements of any other country,” the RBI Governor pointed out.

He said that the conference planners have organised a deep dive session on Day 2 on India’s UPI, especially for the international delegates and requested all delegates to participate and derive benefit from the various sessions and also share their experiences which could provide learnings for all.

Das also highlighted that the theme of India’s G20 presidency in 2023 was ‘One Earth, One Family, One Future’. It underlies India’s thought process in how it sees the world and itself as being part of one family with a common future.

He said that a recurring agenda of importance across all multilateral settings including the G20 and international standard-setting bodies like the Committee on Payments and Market Infrastructures (CPMI) has been to bring efficiency to cross-border payments. A lot of initiatives and experimentation in bilateral and multilateral arrangements among various countries are already underway.

Ideally, while the legacy payment systems should be able to connect to each other, the actual implementation of interoperability would pose challenges and may involve certain trade-offs. Technical barriers may be surmounted by using common (international) technical standards. Further, the governance structure or management framework for long-term sustainability would also need to be finalised, the RBI Governor added.

by Editor | Aug 26, 2024 | Business, Economy, News

Mumbai: The National Stock Exchange (NSE) benchmark Nifty extended its gains after opening in the green and hit 25,000 in mid-session on Monday.

It is the eighth-consecutive session when the Nifty is trading with gains.

At 1:10 P.M., Nifty was at 25,025, up 201 points or 0.81 percent and the Sensex was up 671 points or 0.83 percent at 81,757.

Indian equity indices are following US market gains after Federal Reserve Chair Jerome Powell’s dovish commentary at the Jackson Hole which hinted at a likely rate cut in September.

Among the sectoral indices, Nifty IT gained the most, up by 1.49 percent. Fin service, FMCG, realty, metal, energy and auto were the major gainers.

PSU banks and pharma were major laggards.

In the Sensex pack, NTPC, HCL Tech, Wipro, Bajaj Finserv, Tech Mahindra, HDFC Bank, TCS, Infosys, Reliance, L&T, Power Grid and Titan were top gainers.

Ultratech Cement, Maruti Suzuki and Sun Pharma were the top losers.

by Editor | Aug 26, 2024 | Business, Economy, News

Bengaluru: While the integration of AI into financial services brings significant opportunities for customers, banks and regulators, the cutting-edge technology also poses its own set of challenges such as data privacy concerns that arise from handling vast volumes of personal information and the potential of misuse to spread misinformation, RBI Governor Shaktikanta Das said here on Monday.

Speaking at the Global Conference on ‘Digital Public Infrastructure and Emerging Technologies’, Das said, “Today, Artificial Intelligence (AI) is making forays in the financial sector in the form of services like chatbots, internal data processing for intelligent alerts, fraud risk management, credit modelling and other processes. Integrating this cutting-edge technology into a robust and responsible DPI (digital public infrastructure) presents an opportunity to amplify the capabilities and efficiency of DPI even further.”

He pointed out that the Report of India’s G20 Task Force on DPI states that the seamless fusion of DPI with AI would propel us into a new world of ‘Digital Public Intelligence’. Integration of AI into financial services brings significant opportunities for all stakeholders. For customers, AI enables hyper-personalised products and faster, more relevant services. Financial institutions like lenders benefit from advanced tools for risk and fraud management, streamlined operations, and reduced compliance costs. Regulators gain enhanced oversight and real-time monitoring capabilities, which would improve regulatory enforcement and market stability, the RBI Governor said.

However, such advancements come with serious challenges, he said, adding that data privacy concerns arise from handling vast volumes of personal information. Ethical AI governance is essential to ensure fairness and prevention of bias. Financial institutions must ensure that AI models are explainable, i.e., the ability to explain why certain results are produced. AI technology can also be misused to spread misinformation, potentially causing severe damage and disruption to DPIs as well as other digital systems. They can also damage the reputation and operations of financial institutions, Das said.

by Editor | Aug 26, 2024 | Business, Economy, News

Mumbai: The Securities and Exchange Board of India (SEBI) has reportedly issued show-cause notices to Paytm Founder and CEO, Vijay Shekhar Sharma, and erstwhile board members of One 97 Communications Ltd (Paytm’s parent company), over alleged misrepresentation of facts during the company’s initial public offering (IPO) in November 2021.

Paytm shares declined as much as 9 per cent during the intra-day trading and closed 4.48 per cent down at Rs 530 a piece.

The average of 12-month analyst price targets implies a potential downside of 16 per cent.

According to multiple reports citing sources, the SEBI notices also allege non-compliance with promoter classification norms. The markets regulator probed Paytm Payments Bank after receiving inputs from the Reserve Bank of India (RBI).

Paytm of SEBI did not immediately respond to reports. Sharma apparently enjoys the rights of a promoter without the responsibilities and restrictions, according to a recent blog post by Institutional Investor Advisory Services Ltd.

In 2023, the Institutional Investor Advisory Services raised questions on Sharma’s stake in the parent firm, as well as the employee stock options granted to him by the company ahead of the IPO.

The latest SEBI notice may make it difficult for Paytm to get its payment aggregator licence reinstated.

Paytm recently got a government nod to apply for the licence after it assured authorities that the funds in Paytm Payments Services accounts are not from foreign sources.

Sharma is the founder and CEO of One97 Communications Ltd, but is not classified as promoter, according to stock exchange disclosures.