by Editor | Sep 2, 2024 | Business, Economy, News

New Delhi: Oil marketing companies have increased the rate of 19 kg commercial LPG gas cylinders by Rs 39, effective from Sunday.

After the hike, the retail sales price of a 19 kg commercial LPG cylinder in Delhi is Rs 1,691.50.

Earlier on July 1, in a move to offer relief to businesses and commercial enterprises, oil marketing companies had announced a reduction in the prices of commercial LPG gas cylinders.

The price of the commercial LPG cylinder of 19 Kg was slashed by Rs 30. Consequently, the new retail sales price of a 19 kg commercial LPG cylinder in Delhi was Rs 1646.

On June 1st, the rate of 19 kg commercial LPG cylinders was reduced by Rs 69.50 in Delhi, bringing the retail sales price down to Rs 1676.

Prior to that, on May 1, 2024, there was a reduction of Rs 19 per cylinder

The frequent adjustments in LPG cylinder prices at the start of each month reflect the dynamic nature of the market.

Various factors, such as international oil prices, taxation policies, and supply-demand dynamics, play a significant role in these pricing decisions.

Although the exact reasons behind the recent price changes have not been disclosed, it is evident that the oil marketing companies are responsive to the broader economic conditions and markets.

by Editor | Sep 2, 2024 | Business, Economy, News

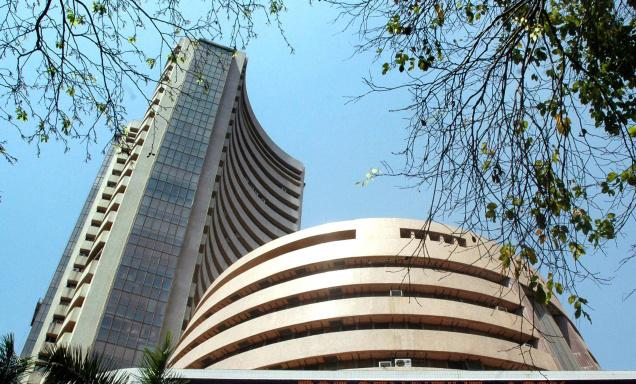

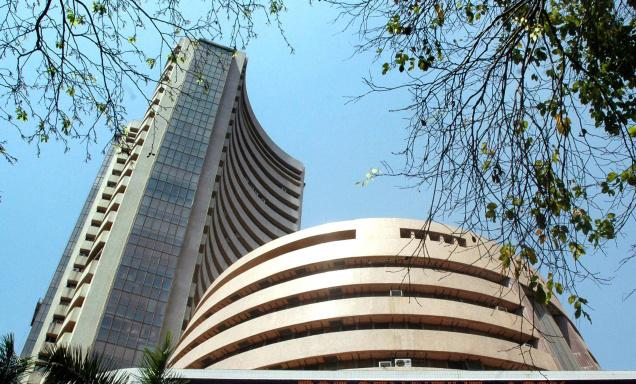

Mumbai: Indian equity frontline indices opened at an all-time high on Monday following a rally in the US market.

At the starting of the session, both Sensex and Nifty made a new all-time high at 82,725 and 25,333 respectively.

At 9:43 a.m., Sensex was 246 points or 0.30 per cent at 82,612 and Nifty was 77 points or 0.31 per cent at 25,313.

In the early trading session, Midcap and smallcap stocks traded flat compared to largecaps. Nifty midcap 100 index was down 45 points or 0.08 per cent at 59,234 and Nifty smallcap 100 index was up 19 points or 0.10 per cent at 19,326.

Among the sector indices, IT, fin service, FMCG, energy, pvt bank, consumption and infra were the major gainers. PSU bank, pharma, metal and PSE were the major losers.

According to market experts, “The market has entered a zone of steady but mild up-move caused by accumulation of quality largecaps. FIIs turning buyers last week mainly due to some large bulk deals also has improved sentiments in the market

by Editor | Sep 2, 2024 | Business, Economy, Technology

New Delhi: Bhavish Aggarwal-run Ola Electric clocked its lowest monthly sales this year, dropping 34 per cent sequentially to 27,506 units in August, as its market share nosedived further to 31 per cent.

As per vehicle registration data available on the central government’s Vahan portal, Ola Electric had a market share of 31 per cent in India’s electric two-wheeler (2W) market in August as its closest rivals TVS and Bajaj Auto logged 20 per cent and 19 per cent market share, respectively.

The company’s retail sales of 27,506 units are lowest in the calendar year to date, down by 34 per cent compared to 41,711 units it sold in July.

According to VAHAN data, 88,451 electric two-wheelers were registered in August 2024, as against 62,767 units in the year-ago period — a growth of 41% year-on-year. Sequentially, however, the industry shrank 41.5 per cent.

The surge in volumes of the TVS iQube and Bajaj Chetak models can be attributed to the newer, cheaper models introduced by the incumbents.

The share of Ola Electric dropped again on Monday, and was hovering around Rs 114 apiece during intra-day trade.

The company’s retail sales of 27,506 units are its lowest in the calendar year to date. While the August 2024 numbers are up 47 per cent YoY, these are down by 34 per cent compared to 41,711 units in July.

Ola Electric’s shares have tumbled over 27 per cent from its record peak of Rs 157.53 a piece, leaving investors jittery amid profit booking and broader market volatility. Ola Electric’s stock made a muted market debut on August 9 but saw a strong buying after the listing. At present, the scrip has been under selling pressure after scaling lifetime high.

According to market analysts, the stock value is inflated and will further correct itself and investors with high-risk appetite should only go for it. The experts mentioned that the company’s stock is not looking good and can slip further towards Rs 110 level over the near term.

by Editor | Sep 2, 2024 | Business, Economy, News

Mumbai: Tata Motors on Sunday reported 8 per cent drop in total domestic sales at 70,006 units in the month of August, as against 76,261 units in the year-ago period.

Domestic sales of commercial vehicles — including trucks and buses — fell 16 per cent (year-on-year) to 25,864 units as against 30,748 units in the year-ago period.

Total car sales, including electric vehicles and exports, declined 3 per cent to 44,486 units, as against 45,933 units in the sale month last year.

Domestic sale of MH and ICV in August, including trucks and buses, stood at 12,008 units, compared to 13,506 units in August 2023.

Total sales for MH and ICV (domestic and international) in August, including trucks and buses, stood at 12,708 units compared to 14,016 units in August 2023, the automaker informed.

Indian auto is entering the festive season with muted sales growth as oversized demand for oversized cars far comes off in the world’s third largest automotive industry.

In the April-June quarter in the current fiscal, Tata Motors reported a 74 per cent increase in net profit to Rs 5,566 crore, compared to the same period of the previous year, on the back of higher sales of its UK subsidiary Jaguar Land Rover.

Tata Motors’ revenue from operations rose 5.7 per cent to Rs 1,07,316 crore during the first quarter from Rs 1,01,528 crore a year ago. The share of JLR models increased to 68 per cent of the total revenue.

by Editor | Sep 2, 2024 | Business, Economy, News

New Delhi: The Unified Payments Interface (UPI) saw 41 per cent growth (year-on-year) at record 14.96 billion transactions in the month of August, as total transaction amount touched Rs 20.61 lakh crore — a 31 per cent YoY growth, the National Payments Corporation of India (NPCI) data showed on Sunday.

The average daily transaction amount stood at 483 million last month, as average daily transaction amount reached Rs 66,475 crore.

The value of UPI transactions processed has remained above Rs 20 lakh crore for four consecutive months.

In July, the UPI-based transactions clocked Rs 20.64 lakh crore and the total UPI transaction count was 14.44 billion. The average daily transaction volume stood at 466 million, as average daily transaction amount stood at Rs 66,590 crore, according to the NPCI data.

UPI is now adding up to 60 lakh new users every month, fuelled by the RuPay credit card on UPI and its launch in foreign countries. The NPCI has also set an ambitious target of achieving 1 billion UPI transactions per day in the coming years.

UPI processed nearly Rs 81 lakh crore transactions in the April-July period this year, which is a staggering 37 per cent increase (year-on-year), surpassing world’s leading digital payments platforms.