by admin | May 25, 2021 | Corporate

By Dr. Zakir Husain

If the trilateral economic association between Israel, India and the UAE goes well, it would be a game changer in the regional economic and security cooperation.

A couple of days back the three nations came together in Dubai to tap their innovative (Israel), financial & supply chain network (UAE) and market (India) potential.

The event was organised by the International Federation of Indo-Israel Chambers of Commerce (IFIICC) in Dubai. IFFIICC was founded in December last year.

As claimed, the three nations can potentially create worth USD 110Bn trade by 2030.

UAE, India’s third largest trading partner after China and the US, is poised to increase its total bilateral trade to USD 100 Bn from USD 60 Bn in the next half a decade.

The collaborative efforts of three countries offer the scope for innovation, access to big markets and deep pockets to finance costly ventures.

Job creation, effective utilisation of natural resources, solution to scarce resources such as water, harnessing clean energy through renewable sources like solar, wind are other associated benefits.

The UAE ambassador H. E. Dr Ahmad AlBanna called the UAE a gateway to the world and this trilateral could benefit the world. Another member underlined that innovation and economic prospects of this trilateral are endless.

Association for innovation, better economic prospects are opportune to tap post-Covid-19 world.

The founder of IFIICC also stated that it is going to open it’s office globally and Indian diaspora is going to play a key role in this venture. Globally, the Indian diaspora is the largest.

The troika has also enormous security potential. They are capable of ensuring a joint common security umbrella. It would be easier to handle the security challenges, instead of the whole region. Already Israel is offering its services to the two other countries in cyber security.

It seems that the cooperation of the three offer big potential but how much they materialise it depends upon their willingness,overcoming political and mindset barriers.

It is also to be seen how the troika responds to the US. What will be its regional impact will also be interesting to see.

Will this provoke Iran, Turkey and Qatar to form such grouping… What will happen to Saudi Arabia…with whom it will cement such alliances…are some of the curiosities.

It will be too early to say it’s impact on big powers such as Russia, the US and China.

It is also to be understood commonly that generally “finance” is taken for granted, while the market receives better attention and technology tops the list. However, here all three countries are equally important.

Let’s see how they share the benefits, overcome hurdles and tap the potential of their natural partnership.

by admin | May 25, 2021 | Corporate, Islamic Banking, Islamic Finance, News

By Syed Ilyas Basha

Crypto-currency is an asset in virtual form, made available by its launchers for trading activities. It is exchanged in lieu of internationally tradable currencies like US Dollars, Euro etc. Though it sounds so but it is not a currency in that form. In simple words it is an imaginary mode of currency in units. It sponsors can be either individuals, traders or may be a Government. It is defined as a digital asset, designed to work as a medium of exchange. Its value is represented in units and such records are stored in a ledger in computerized database form. For exercising administrative control, creation of additional coins and register ownership, it uses cryptography as machine language. Though initiated in 2009 in US Market in 2009, it is being widely being dealt with since recent past months. Though based on speculative values it is not barred by most of the countries. A few have started planning to regulate it by issuing through their own Central Banks. While Bit-coin was the first to arrive, several similar have come up recently. Other prominent crypto-currencies are Doge-coin, Dark-net, Ethereum, Elongate, Rat-coin etc. It is placed in the wallet of the owner and used for making transactions world-wide. (Dogecoin is a decentralized, P2P digital currency that enables you to easily send money online.) So far several countries too have launched their own Crypto-currencies. To name a few are Ecuador, China, Senegal, Singapore, Tunisia. They may soon be joined by Estonia, Japan, Palestine, Russia and Sweden, which are looking to launch their own national crypto-currencies. Some of these countries are likely to take it a step further and replace paper tender altogether with China being one nation that is looking to take one step beyond a virtual and paper version. The system does not require a central authority and is maintained through distributed consensus. It also keeps an overview of crypto-currency units, their ownership, defines scope for new such units can be created, origin and the ownership. The ownership of crypto-currency units can be proved exclusively cryptographically. The validity of each crypto-currency’s coin is provided by a block-chain which is typically managed by a peer-to-peer network collectively adhering to a protocol for validating new blocks. The Block-chain is written in Java, the double-layer block-chain supports multiple ledgers on its crypto-currency layers. Block-chains are secured by design. Once recorded, the data in any given block cannot be altered retroactively without the alteration of all subsequent blocks, which requires collusion of the network majority.

UNIVERSAL ACCEPTABILITY

Though highly volatile, its mobility and transferability has been attracting some investors worldwide. The international Travel and payment industry is recognizing the importance this system enjoys today. Visa Inc., a global payments technology company has said on March 21, 2021, that it will allow the use of the crypto-currency USD Coin to settle transactions on its payment network, the latest sign of growing acceptance of digital currencies by the mainstream financial industry. The USD Coin (USDC) is a stable coin crypto-currency whose value is pegged directly to the US dollar. Tesla CEO Elon Musk has been vouching for bit-coin, the most popular crypto-currency, for quite some time. Musks Tesla has recently invested $1.5 billion in the crypto-currency. Tesla also mentioned the possibility of accepting payments in bit-coin, in the future. It is also being rumored that he himself is now planning to initiate a separate such unit in the market. The US Federal Reserve as usual welcomes every trade linked transaction as long as it pays taxes to the US Treasury. The consumers have to no recourse to that end. It has even allowed hundreds of ATM Machines and Crypto-currency vending machines to Bit-coin to promote this industry in the country. This has been the academic back-ground and practical usage for the consumers. This being a web-based platform is open with sky is the limit option all around the world for its users.

A FIELD FOR FRAUDSTERS?

With little control or lack of it, it is open for manipulation and misuse by fraudsters and frivolous elements simultaneously in the financial world. The absence of a Controlling and Regulatory Authority has enticed the hackers, fraudsters and criminals to this field of thick-air. There are many ways in which bit-coin is being actively used by criminals. It is difficult to accurately identify or regulate those individuals who seek it to benefit out of it features. It was reported that Bit-coin is frequently used as a means for paying for drugs or other illegal goods and services (such as weapons) and to hire individuals for malicious hacking. This includes trying to access other individuals financial information, other personal information, and also attempting to take over a specific computer. It was also reported to be deployed in acts of international distribution of weapons, similar such threats to the public safety. Thus it was found to be incredibly difficult to pin these activities on a specific individual or organization.

1.The Software Icon, Mr. John McAfee recently was charged in New York as he cashing-in in a pump-and-dump scheme. He had started promoting crypto-currencies on Twitter to drive up their value. Involved in money laundering acts, he was tricking the crypto-currency investors, according to US Department of Justice. Teamed up with Watson, both had used Twitter and raked in more than $13 million from investors through their fraudulent schemes,” according to US attorney Audrey Strauss.

2.In another similar incident a Delhi based Jeweller Mr.Umesh Verma was arrested in New Delhi on January 1, 2021 in a Rs.2.5 crore running a racket under the garb of being a crypto-currency promoter. He had fled to Dubai earlier in 2018 and living there since. Along with his son Bharat Verma and others, he had induced hundreds of investors into investing in a scheme operating under the name of Pluto Exchange, in the posh Connaught Place locality. He was promising monthly fixed returns 20 and 30 per cent and allegedly issued units of a crypto-currency called Coin Zarus. However, soon the returns dried up and post-dated cheques issued by Verma’s firm began to be dishonored, he had fled to Dubai. This confirms that its non-transparent character has made it more vulnerable for frauds.

A WIDER MARKET

Analysts believe there has been a growing acceptance for the digital currency in the current year as traditional currencies and assets took a pounding due to the global economic crisis. Bit-coins valuation has also soared as many big brand investors and companies have also stockpiled the digital currency. Most analysts believe that the Covid-19 hit year is responsible for the revival and meteoric rise of the digital currency. Many Bit-coin investors have said that the pandemic-hit year offered a perfect environment for the crypto-currency. The fact that interest rates on traditional investments hit rock bottom during the year also helped in the rise of Bit-coin as more investors poured their money into the crypto-currency. As the digital currency saw more investors, its value soared from just $7,200 dollar at the start of the year to almost $28,000 now. Matt Hougan, chief investment officer of Bitwise Asset Management, was quoted in a Bloomberg report saying that Bit-coin is moving from a fringe esoteric asset to the mainstream. If its going main stream, there is just so much money on the sidelines that is going to have to come in and establish a position that it leaves me very bullish for 2021, Hougan added.

China has recently announced it is planning to have its own Crypto-currency with regulatory backing. India, Japan have long been allowing its transactions un-officially, have planned to regulate it through legal backing. Strategists and investors believe today that Bit-coin trade or the broader crypto-currency industry could see tighter regulations in future, especially in the United States under Joe Bidens administration. Most crypto-currency experts feel that a lot will depend on how countries around the world regulate crypto trade, signaling that the air of uncertainty surrounding such trade remains at large. While most experts believe that the digital currency will improve on its position in 2021, they have warned interested investors to be prepared for sharp corrections and wild volatility.

Some of the nations are alert and more active to take on the fast rising risks to wealth. Turkeys central bank has banned the use of crypto-currencies and crypto assets including Bit-coin to purchase goods and services, citing possible “irreparable” damage and significant transaction risks. The bank published a legislation in the Official Gazette on Friday, saying that crypto-currencies and other such digital assets based on distributed ledger technology could not be used, directly or indirectly, as an instrument of payment.(India Today Tech/April 16, 2021). Similarly, Nigeria has ordered regulation of Bit-coin transactions through its February 5 directive by its Central Bank.

WHAT IS ISLAMIC PERSPECTIVE?

Basically, Islam does not allow trading of any product or article which is physically non-existent. Ethics based transactions can be possible when the commodity or service is in existence and its value in terms of exchange is agreed upon. Islamic Finance promotes total transparency in dealings and transactions. The Divine direction in Quran in Chapter 5 /Verse 2 is very clear on this. It says:

1) “And do help each other in virtuous, pious deed; and dont cooperate in matters of vices and adversity.”

2) “And dont consume deceitfully others wealth by resorting to wrong means and methods. (Chapter 2/Verse 188)

Islamic Finance stands for ethical application of money power for the progress and development of the society. It is named so because its genesis is the basic principles of Islam which accord top priority to the prosperity of every living being, protection of the weak, vulnerable and the needy. The Policies, operations and functioning are transparent. Progress and prosperity of the society is its target. Profit or Loss here means to earn profit and avoid profiteering. It is opposed to the theory of survival of the fittest. Everyone is important in the society. The belief in the divine authority and belief are driving force in transactions. The Managers are aware of their imminent and un-escapable accountability. The concept was institutionalized during the long tenure of Second Caliph, Omar bin al-Khattab. He established State Treasury Department to handle Finances. Both Public and Private sector find equal importance with minimum regulation by the State. Collection of annual obligatory Taxes from the eligible and distribution among the eligible was declared to be the duty of this department. Voluntary alms were placed under unregulated category. Another institution for Public Trusts with legal status of collective ownership was initiated for regulating and administering the alms, charities received. Violators of laws were severely dealt with irrespective of their status in the society. Prosperity, progress, peace and social justice were thus achieved in a period of few decades then.

Market-watchers describe Crypto-currency is a similar method launched by its’ initiators to drain out funds of the common man through web-based channels to lesser known destinations. Those interested to make money out of money simply cant resist it. Such a system leads to widen gap between haves and have-nots, the poor and the rich in the society. The main reason of social unrest and human miseries today can be attributed to increased application of these methods.

———————————————————————

The author is Director School of Islamic Finance, Hyderabad.Email: sdilyashyd@yahoo.com

by admin | May 25, 2021 | Opinions

Frank F. Islam

“While the American Rescue Plan is changing the course of the pandemic and delivering relief for working families, this is no time to build back to the way things were. This is the moment to reimagine and rebuild a new economy.” The American Jobs Plan

As the Biden administration approaches the end of its first one hundred days in office, it has already made excellent progress in implementing its Build Back Better agenda. The agenda includes a number of initiatives to address the needs of small businesses and individuals who had been mostly ignored and/or suffered the greatest losses during the COVID-19 era.

Toward the end of February, the Biden team instituted rules that modified the latest round of the Paycheck Protection Program (PPP) to give small businesses with less than 20 employees 14 days dedicated solely to them to apply for relief. These rules also benefited, among others, the self-employed, sole proprietors, independent contractors, and non-citizens who pay taxes. At the end of March, President Biden signed a two-month extension of the PPP until May 31 of this year to allow the SBA more time to accept and process applications.

The $1.9 trillion American Rescue Plan, signed into law on March 11, provides billions of dollars directed at those who had not received much assistance in earlier stimulus rounds. The Rescue Plan includes: a new grant program for restaurants and bars to meet payroll and other expenses; funding for the Shuttered Venue Operators Grant for music halls and other concert venues; additional dollars for the PPP, and expansion of eligibility criteria to include previously excluded non-profits; and low interest loans with a priority for some of the funds to go to “severely impacted small businesses with fewer than 10 workers.”

The $2 trillion+ The American Jobs Plan, introduced on March 31, is an “investment program” directed at creating millions of jobs, rebuilding America’s infrastructure, and positioning the U.S. to outcompete China. It is far too early to tell whether that Plan will become legislation and, if enacted, what its final contents will be.

The Plan as currently constructed, though, is ambitious and far-reaching. It includes provisions that: target 40 percent of the benefits of climate and clean infrastructure investments to disadvantaged communities; invest in rural communities and those impacted by clean energy; bring clean drinking water and broadband to all Americans, including the more than 35% of those in rural America who lack access; and enhance the caregiving economy substantially, providing assistance at home and in community facilities by creating jobs and raising wages in the “care economy” for home care workers — primarily women of color — who deliver essential services.

A White House statement on The American Jobs Plan begins as follows, “While the American Rescue Plan is changing the course of the pandemic and delivering relief for working families, this is no time to build back to the way things were. This is the moment to reimagine and rebuild a new economy.”

Social Ventures and the Impact Economy

The Jobs plan provides a framework for that re-imagination and rebuilding. It is truly robust. One thing that could be done to make it even more robust is to add social ventures into the re-imagination and rebuilding equation.

Social ventures are enterprises that apply business principles to achieve both business and social goals. These ventures can amplify the Build Back Better agenda because they’re enterprises that apply business principles to achieve both business and social goals. These ventures can amplify the Build Back Better agenda because they have double bottom lines. Those bottom lines are profit and positive social impact.

Through this dual focus, social ventures have created what is known as the impact economy. The impact economy is comprised of “organizations and private entrepreneurs in the ecosystem of private companies, non-profits, and foundations whose missions involve addressing social challenges and other issues pertaining to the public good.”

While it is not well known, the impact economy and social ventures are major contributors to the growth and development of the U.S. economy. A 2014 paper by GovLab of Deloitte Consulting LLP revealed that, “The impact economy already includes enterprises that employ as many as 10 million and produce an estimated $500 billion in annual revenues in the U.S. alone.” A 2016 report by DC’s Economic Strategy stated that “The impact economy is one of the fastest growing sectors of the US economy, accounting for 10% of all jobs nationwide.”

Halcyon is one of the world’s leading organizations in social venture incubation and impact investment. In a policy white paper it prepared in January of this year, Halcyon noted that the federal government has played a critical role in the development of start-ups and social ventures. Halcyon went on to observe, however, that “…major avenues remain for the government to increase its role as a catalyst for creating new, impact-driven businesses and help scale the most effective and impactful businesses.”

Halcyon recommends numerous actions that the federal government should take to play that catalytic role. They include:

- Re-establishing and further empowering the Office of Social Innovation and Civic Participation in the Domestic Policy Council to include for-profit social ventures.

- Tasking the Small Business Administration with the development of unique programs aimed at providing loans and financial assistance to social ventures.

- Tasking the Department of Commerce with creating a Qualified Social Venture Tax Exemption.

- Providing guidance to the Minority Business Development Agency at the U.S Department of Commerce to provide technical assistance and resources to social venture founders of color.

- Asking Congress to bolster the Office of Innovation and Entrepreneurship at the Economic Development Agency to increase the impact of its Build to Scale grant program to include a social venture track.

- Starting in K-12 programs, empowering the U.S. Department of Education to allow for the design and deployment of curricula and training programs throughout the U.S. education system, focusing on the skills needed to start a social venture.

- Prioritizing social ventures throughout the U.S. government procurement processes, creating opportunities for early stage ventures to provide products and services across the U.S. government apparatus.

Halcyon’s recommendations call for a comprehensive government-wide approach to supporting social ventures. This is appropriate, given the importance these ventures must assume in America’s emerging new economy.

These “new, impact-driven businesses” can be of all types and in all industry sectors. They will be most important, though, in those industries and for those businesses owners and employees who were hardest hit by the pandemic.

As we noted in a blog in August, 2020 those industries, businesses, and business owners most impacted by COVID-19 were:

- Smaller small businesses, with fewer than 20 employees, which constitute the bulk of small business employer firms

- Non-employer businesses that have no paid employees except the owner. About one-third of these businesses are owned by minorities and 40 percent are owned by females

- Businesses in the retail, arts and entertainment, personal services, food services, and hospitality sectors

- Businesses with employees owned by African Americans immigrants, Latinx, Asians, and females

- Mom and pop establishments with fewer than 5 employees in older historic neighborhoods, and in cities and towns with fewer than 10,000 residents across the country

The employees who lost their jobs due to the pandemic were disproportionately low-wage earners, women, minorities, and those working in the leisure, hospitality, retail, personal service, and health care sectors. Add to this group gig workers, and workers in occupations funded by state and local governments.

The bottom line is that businesses and individuals in those sectors and occupations should be primary targets for creating double bottom line enterprises. Such enterprises could be start-ups begun by business owners who lost their business or jobs due to the pandemic, or by individuals driven by desire to become social entrepreneurs and to assist impacted individuals, organizations, or locales.

Government and Social Ventures

The nature of those social ventures and others should be determined by the founders, with the assistance of the government and investors. The government must play a pivotal role in nurturing and sustaining these ventures for them to become a part of the new economy.

Through its initiatives to date, the Biden administration has demonstrated that it understands the need to address the situations of those that have been left behind due to the pandemic, or as a result of the increasing inequality and decreasing opportunity in our country’s economic system. By ensuring that social ventures are an essential component of its agenda, the administration can bring all of necessary forces to bear to right the country’s economic ship.

That means more government involvement and investment rather than less. Some have cautioned to be careful in the Biden shift toward big government, and to ensure that the government focuses its attention where it has the essential expertise and experience.

For example, the Washington Post editorial board advises “…the government should do more of what it does best.” It goes on to explain that is in providing public goods but not in allocating investment capital and “picking winners among alternative industries, companies, technologies, and locations….”.

Steven Rattner, investment asset manager who led the rescue of the automobile industry in the wake of the 2008 financial crisis, and now writes for the New York Times, advises, “But given its vast sweep (Biden jobs plan) …the administration should increase its chances of success by leaning more heavily on private models for help and using tax incentives to a greater extent for efficiency.”

These are solid pieces of advice. They are not arguments against big government nor for small government. They are recommendations for good government.

Good government works the pivot points by addressing areas that must be leveraged and addressed effectively in order to effectuate change and achieve positive outcomes. In the first chapter of our book, Working the Pivot Points: To Make America Work Again, we examined pivot points in American history, what was accomplished through them, and what might have happened if they had been handled differently.

In 2021, the United States of America — this experiment, this fragile crucible we call our democracy — is definitely at a pivot point. Pivot points define the character and shape the destiny of a nation and its people. They establish the rules of the game and influence the attitude of the public. They create an upward or downward trajectory and accelerate or decelerate forward movement and progress.

Creating The New Economy

Good government does the right things and gets the right people and right organizations involved in doing those things. It does not work alone. It works in public, private, and social venture partnerships to achieve the goals of building back better and creating the new economy, which includes the impact economy as a central element.

Many have compared Biden’s programs and plans to the massive New Deal intervention that was initiated by President Franklin Delano Roosevelt in response to the Great Depression. There is definitely some resemblance in terms of the level of governmental assistance provided though the revision of the PPP eligibility and the enactment of the American Rescue Plan.

But the better comparison for the proposed American Jobs Plan— which has also been referred to as the recovery plan and the infrastructure plan , we believe, is to what happened with the GI Bill, from its passage in Roosevelt’s fourth term as President and implementation under the presidencies of Harry Truman and Dwight D. Eisenhower. The GI Bill, which became law on June 22, 1944, had three core provisions for World War II veterans: support for college education or training; loans to buy homes or businesses; and unemployment compensation for a period of up to 52 weeks.

By the time the original GI Bill ended on July 25, 1956, less than 20% of the money that had been set aside for unemployment had been used. In contrast, 7.8 million of 16 million veterans had participated in the education or training programs. And between 1944 to 1952, nearly 2.4 million veterans received home loans backed by the Veterans Administration.

The GI Bill, combined with the presidencies of Roosevelt, Truman, and Eisenhower, unleashed the American educational, entrepreneurial, and exploratory spirit, and generated new economic benefits for most citizens (except for minorities). Eisenhower’s emphasis on national infrastructure, highlighted by initiating the construction of the interstate highway system, bolstered the creation of the new economy of that time.

Biden’s plan has the potential to do the same unleashing in the 21st century. It provides the basis for government to be a leader again, in collaboration with its partners to reimagine, reinvent, and renew America.

Most economists, including Federal Reserve Chair Jerome Powell, are now saying that the American economy is on the way toward a strong recovery. Given that, is there really a need for an intervention of the scope and nature of that being proposed by the President?

We believe there is a need for an intervention of this type, but will leave it to the legislators to determine the final size of such a jobs/recovery/ infrastructure plan and how it should be paid for. We also believe, regardless of the final content of the bill, that it must include social ventures as partners in building the new economy.

Our belief in this regard is prompted by the fact that on April 8 when Chairman Powell announced that there were many factors putting the nation “on track to allow a full recovery of the economy fairly soon,” he also issued a caution. As Christopher Rugaber reported for the Associated Press, Powell emphasized, “It’s important to remember we’re not going back to same economy. This will be a different economy.”

During his remarks, Powell stated that many Americans who are out of work will struggle to find jobs because some industries will likely be smaller than they were before the pandemic. He commented, “I think we need to really as a country — and I’m not talking about any particular bill — invest in things that will increase the inclusiveness of the economy and the longer term potential of it, and particularly invest in people so that they can …benefit from the prosperity of our economy.”

Social ventures are part of the key to increasing that inclusiveness and building that longer-term potential. America’s new economy is on the drawing board. Those who start, invest, and scale those social ventures will draw upon Americans’ heads, hearts, and souls to ensure that drawing of America has a head, heart, and soul that is open and welcoming to all.

by admin | May 25, 2021 | World

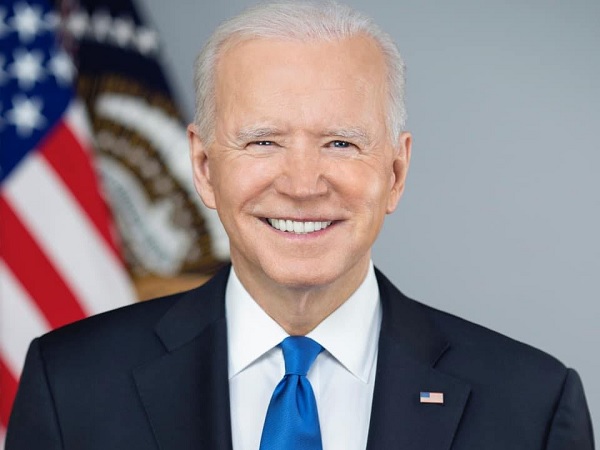

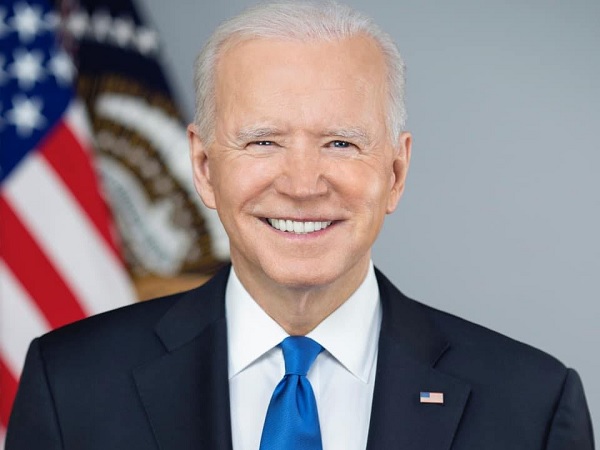

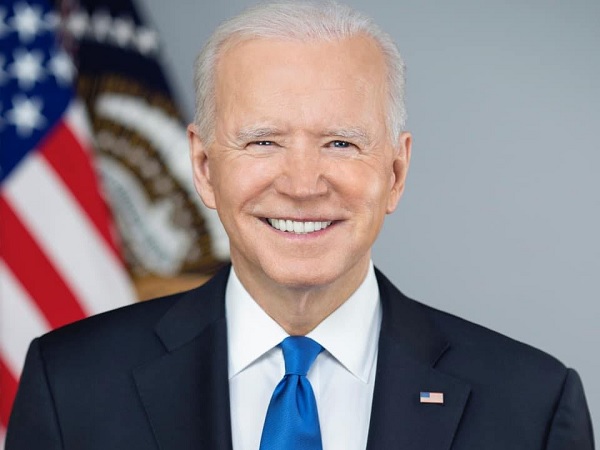

United States President Joseph R.Biden

Jill and I send our warmest greetings and best wishes to Muslim communities in the United States and around the world. Ramadan Kareem.

As many of our fellow Americans begin fasting tomorrow, we are reminded of how difficult this year has been. In this pandemic, friends and loved ones cannot yet gather together in celebration and congregation, and far too many families will sit down for iftar with loved ones missing.

Yet, our Muslim communities begin the month of revelation with renewed hope. Many will focus on increasing their consciousness of the presence of God in their lives, reaffirming their commitment to the service of others that their faith compels, and expressing gratitude for the blessings they enjoy-health, well-being, and life itself.

Muslim Americans have enriched our country since our founding. They are as diverse and vibrant as the America they have helped build. Today, Muslims are leading in our efforts to fight COVID-19, playing a pioneering role in vaccine development and serving as frontline health care workers. They are creating jobs as entrepreneurs and business owners, risking their lives as first responders, teaching in our schools, serving as dedicated public servants across the nation, and playing a leading role in our ongoing struggle for racial equity and social justice.

But still, Muslim Americans continue to be targeted by bullying, bigotry, and hate crimes. This prejudice and these attacks are wrong. They are unacceptable. And they must stop. No one in America should ever live in fear of expressing his or her faith. And my administration will work tirelessly to protect the rights and safety of all people.

On my first day as President, I was proud to end the shameful Muslim travel ban, and I will continue to stand up for human rights everywhere, including for Uyghurs in China, Rohingya in Burma, and Muslim communities all over the world.

As we remember those who we have lost since last Ramadan, we are hopeful for brighter days ahead. The Holy Qur’an reminds us that “God is the light of the heavens and earth,” who leads us out of darkness to the light. Although our White House festivities will be held virtually this Ramadan, Jill and I look forward to resuming the traditional White House Eid celebration in person next year, inshallah. We wish your families an inspiring and rewarding month.

by admin | May 25, 2021 | News

The spike in Covid cases has cast a shadow on businesses with migrant labourers bearing the brunt of the curbs and restrictions put in place by the various governments.

The spike in Covid cases has cast a shadow on businesses with migrant labourers bearing the brunt of the curbs and restrictions put in place by the various governments.

NEW DELHI — Congress leader Rahul Gandhi has demanded that the government should transfer money into the accounts of the migrants who are compelled to go back home due to the lockdown and pandemic.

Rahul Gandhi on Tuesday tweeted in Hindi, “Migrants are again moving back, so this is the responsibility of the union government to transfer money to their accounts. Will the government, which is blaming the public for the spread of the Covid, take such a public welfare work.”

The Congress has questioned the government over the handling of the Covid pandemic and said, “Where is the money of Covid tax and the PM-CARES fund gone?” asked Congress spokesperson Randeep Singh Surjewala

Thousands of migrants have thronged to bus stands to move to their native places after the Delhi government announced a week long lockdown from Monday 10 p.m. to arrest the spike of Covid cases. Anand Vihar and Kaushambi bus stands of Delhi and UP are once again abuzz with migrant labourers, who are fleeing from the city fearing that the shutdown of the public transport may force them to walk hundreds of kilometers, a scene reminiscent of the last year.

Hundreds of people including children and elderly queued up at these bus stations on Monday with their belongings to head home leaving their jobs and employment back in the city. Sweating in the scorching son, they were seen waiting for the transport for their destination.

The spike in Covid cases has cast a shadow on businesses with migrant labourers bearing the brunt of the curbs and restrictions put in place by the various governments.