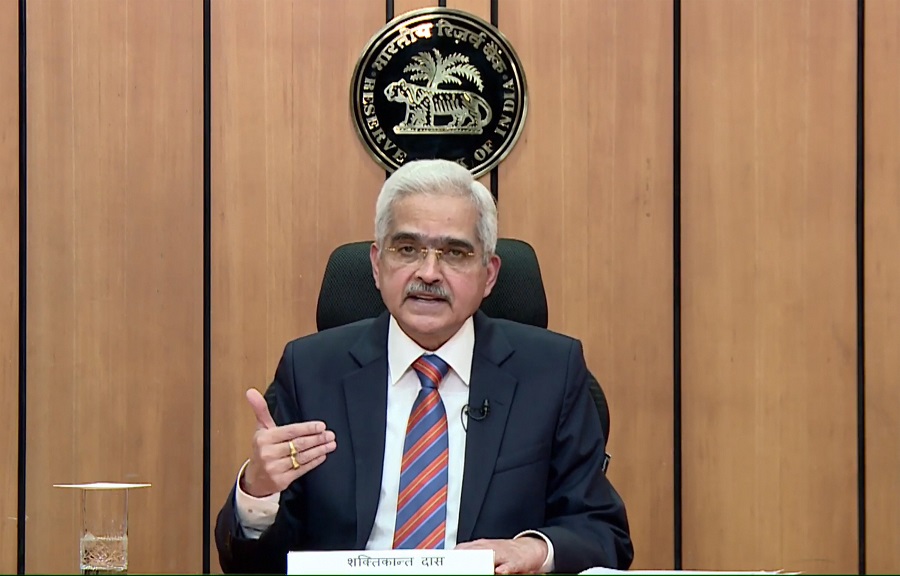

Bengaluru: While the integration of AI into financial services brings significant opportunities for customers, banks and regulators, the cutting-edge technology also poses its own set of challenges such as data privacy concerns that arise from handling vast volumes of personal information and the potential of misuse to spread misinformation, RBI Governor Shaktikanta Das said here on Monday.

Speaking at the Global Conference on ‘Digital Public Infrastructure and Emerging Technologies’, Das said, “Today, Artificial Intelligence (AI) is making forays in the financial sector in the form of services like chatbots, internal data processing for intelligent alerts, fraud risk management, credit modelling and other processes. Integrating this cutting-edge technology into a robust and responsible DPI (digital public infrastructure) presents an opportunity to amplify the capabilities and efficiency of DPI even further.”

He pointed out that the Report of India’s G20 Task Force on DPI states that the seamless fusion of DPI with AI would propel us into a new world of ‘Digital Public Intelligence’. Integration of AI into financial services brings significant opportunities for all stakeholders. For customers, AI enables hyper-personalised products and faster, more relevant services. Financial institutions like lenders benefit from advanced tools for risk and fraud management, streamlined operations, and reduced compliance costs. Regulators gain enhanced oversight and real-time monitoring capabilities, which would improve regulatory enforcement and market stability, the RBI Governor said.

However, such advancements come with serious challenges, he said, adding that data privacy concerns arise from handling vast volumes of personal information. Ethical AI governance is essential to ensure fairness and prevention of bias. Financial institutions must ensure that AI models are explainable, i.e., the ability to explain why certain results are produced. AI technology can also be misused to spread misinformation, potentially causing severe damage and disruption to DPIs as well as other digital systems. They can also damage the reputation and operations of financial institutions, Das said.

0 Comments