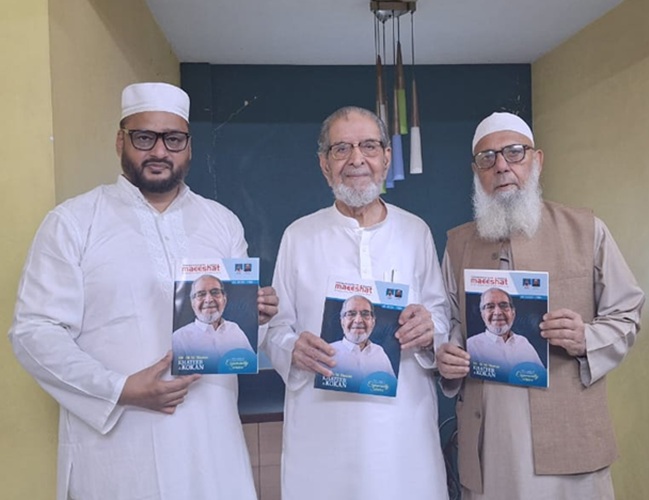

Dr. Nikhat Mushir for Maeeshat

Energy sector is comprised of energy producing products, production, distribution, market, producers, distributors and consumers. Energy producing resources are mainly categorised as renewables (hydal, thermal, nuclear, solar, wind etc.) and non-renewables such as oil, gas, coal. The importance of energy resources was well put in the opening remarks of World Future Energy Summit 2012 which was, “Energy is critical to everything we do, from powering our economies to achieving the Millennium Development Goals, from combating climate change to underpinning global security. It is a golden thread connecting economic growth, social equity and preservation of the environment”.

Need of Renewable Energy

According to Organisation for Economic Co-operation and Development’s report, the global population is expected to be more than 9 billion by 2050. This rise in population will create an exceptional rise in demand for energy. The hydrocarbon fuel has already damaged the atmosphere and thus the call to reduce carbon footprint has been made.In World Economic Forum 2013 summit, it was concluded to alleviate risks from future climate change, the ‘green economic growth’ pathmust be formulated. Renewable energy can be successfully and fully adopted only when we have proper and affordable technology to harness full potential of renewable sources of energy.

The trans-national organisations such as World Bank, European Commission, United Nations Environment Programme and others took up green projects very seriously. There has been some advancement towards development of ‘green growth’ modality. In 2008, the International Bank for Reconstruction and Development along with International Finance Corporation launched the ‘Strategic Framework for Development and Climate Change’ programme to integrate the public and private sector for the climate change. In the same year, the World Bank pioneered the ‘Green Bond’ initiative to support sustainable projects (The World Bank, 2014). The biggest achievement of such initiative was increased awareness towards renewable energy resource that led to six times greater investments in renewables in year 2011 than in year 2004.

The GCC and Renewable Energy

The GCC countries known for being oil rich states, with its hydrocarbon resources contributing to around 90 percent of its GDP are equally concerned about climate change as the rest of the world as it is a participant of the United Nations Framework Convention on Climate Change(UNFCCC) and has pledged its commitment towards the initiative. Qatar even hosted the UNFCCC in 2012.

Apart from the challenge of climate change, GCC’s depleting non-renewable energy resources is also compelling it to diversify its energy sector. The rising population leading to current rates of consumption growth, if it continues in the case of Saudi Arabia, the oil exports could be reduced by the end of the decade or sooner than expected. In case of Oman and Bahrain, the two GCC states with the smallest hydrocarbon endowment, are already in depletion led decline.

The share of the installed capacity of renewable energy is only 7 percent of the total in the Gulf (UNDP, 2014). Thus, there is a significant need to develop renewable energy sector and financing channels for the development of green projects. In the GCC, success of the renewable energy sector relies highly on the structural changes and to this end, they have alray taken several steps. One was to liberalise the energy sector and other was policy changes to control the consumption of hydrocarbon energy in order to improve energy security and carbon footprint.

Recently, there has been surge in renewable energy projects in the GCC. Saudi Arabia desires to install as part of its ‘Vision 2030’ program, 9.5 gigawatt of power project based out of renewable energy. In 2011, the Saudi government established the King Abdullah City of Nuclear and Alternative Energy. The purpose of the city is to build up the knowledge base to develop the technique to generate alternative energies. The Kingdom also plans to make good use of wind, nuclear, waste-to-power and geo-thermal sources of renewable energy to produce power. Kuwait Institute for Scientific Research (KISR) has planned to build a wind plant of 15 megawatt and solar plant of 5 to 10 megawatt capacity. In Oman, there are facilities with about 235 kilo-watt of solar energy producing ability. Its purpose is to light the streets, remote watering, television transmission, monitoring earthquakes and heating. There are many pilot projects in renewable sector such as 105 mega-watt solar projects launched in 2010. The wind turbines project of the World Trade Centre in Kingdom of Bahrain is just another example of alternative energies project.

The GCC countries are one of the regions in the world that receives the highest sunlight, which can be utilised to establish an advantageous position in a world of alternate energies. Large number of private investors and government has already taken keen interest as discussed above in the development of green economy. They are also considering their priorities in the field of alternative energy and have conceptualised their plans and many projects have effectively begun like Masdar Solar City project of Abu Dhabi. Masdar city projects involves the features such as the least carbon emitting city in the world, using only solar energy for its power generation and wind energy for cooling with eco-friendly vehicles. A solar and wind field will be set up outside the city along with geo-thermal plants to create the largest hydrogen power station in the world.

Islamic Finance in Renewable Energy

There is a verse in Quran that states –

“Eat and drink, but waste not by excess; Verily He loves not the excessive.” [1]

Quranic teaching discourages extravagance and wastage and encourages one to be frugal and careful while using the bounties on the earth that are natural resources. To preserve the environment and all forms of life on earth is at the core of Islam. Islamic finance is a value based economic system, driven by the principle of public interest. Islamic finance and green energy development, both are for sustainable and balanced development of the whole community.

The Islamic Development Bank, a Jeddah based Islamic finance development bank mandates to use all efforts to use only the cleanest resources with minimum environmental destruction. It also will focus on hydropower generation which has been underutilised in many nations. The unused potential of hydropower for small scale will be explored by copying already existing innovative models. The nuclear power generation will be explored for electricity generation. It will embark on nuclear plan keeping in view all the hazardous nature of nuclear power plant well into consideration. Natural gas and oil transportation and distribution will be of top priority since the natural gas is the cleanest form of hydrocarbon fuel. It can take advantage of its location of highest solar exposure region in the world and lead solar energy development.

IDB is an important investor for renewable energy sector and its chief economist said, “Estimates for the 2030 agenda indicate that we need to move from billions to trillions of dollars of support annually for sustainable development. We will be using Islamic finance to bring new resources to the table”. The IDB pointed out that it might issue green sukuk climate related projects during the United Nations conference in Paris on global warming. This ‘green bonds’ have given people a new way to address and support the environmental issues.

Green Sukuk

Green Sukuk is akin to ‘Green Bond’ which are being utilised for sustainable or green projects. It is basically a form of sukuk which is issued to fund environment friendly projects. (Climate Bonds, 2016). It is suitable in the development of eco-friendly renewable energy projects. Moreover, such products are appealing to large number and varied investor base in the capital market.

Green Sukuk Working Group

In 2012, in order to assist the Green Bond concept, a Green Sukuk Working Group was established by the Clean Energy Business Council (CEBC) of WANA along with the Gulf Bond and Sukuk Association. This group finds green energy projects for the shariah investors.

The CEO of Desert Technologies, a Saudi based renewable developer, said that the Green Sukuk could help launch more projects and products in markets where Islamic finance is strong and about two thirds of new renewables installations are expected to be in emerging markets.

The Dubai Supreme Council of Energy (DSCE) initiated ‘Green Economy for Sustainable Development’. It has joined the World Bank to design financing strategy for its green investment programme whereby it will use green bonds as well as sukuk. The DSCE has a green investment programme in place since 2010 as part of the Dubai Integrated Energy Strategy (DIES) 2030 plan. It has a target of 71 percent of total power output from gas, 12 percent from nuclear energy, 12 percent from clean coal and 5 percent from solar energy. The plan’s second part is to reduce energy demand by 30 percent.

Conclusion

The investment in sustainable infrastructure should be the goal to conserve the environment, and Islamic finance is leading its way towards green projects. These projects are compatible with the spirit of Islamic finance. The GCC countries also seems enthusiastic towards green energy projects where Islamic finance sector could find opportunity.

[1] Al-Qur’an, Chapter 7 verse 31

0 Comments