New Delhi : No reference has been made to the Union Corporate Affairs Ministry by its Serious Fraud Investigation Office (SFIO) on the issue involving the private sector ICICI Bank and Videocon Group, its Secretary Injeti Srinivas said on Wednesday.

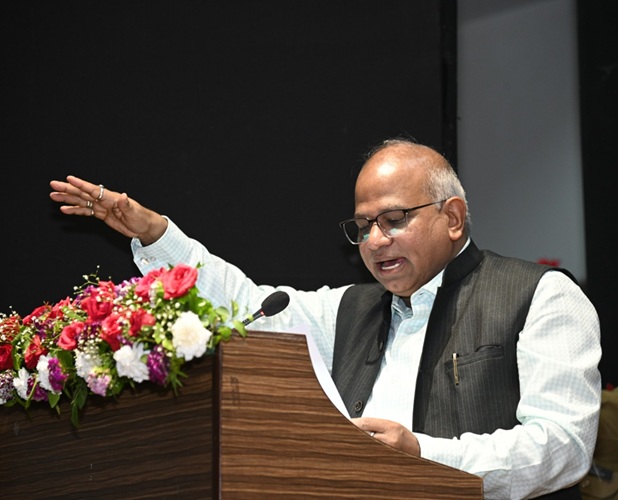

Speaking to reporters here on the sidelines of a conference on Resolving Insolvency organised by industry chamber CII, Srinivas, however, also said that it is well within the rights of the SFIO to make a reference on the matter.

“If the SFIO considers it necessary to make a reference to the ministry, it is well within its ambit,” he said, adding that no such reference had been made to the ministry.

Officials here said on Tuesday that the Income Tax Department has issued a notice to Deepak Kochhar, the husband of ICICI Bank Chief Executive Chanda Kochhar, in connection with its ongoing tax evasion probe in the Videocon bank loan case.

He has been named by the Central Bureau of Investigation (CBI) in its preliminary enquiry registered last week and the agency had also questioned a few ICICI bank officials as part of the probe to find if any quid pro quo was involved in the bank issuing a Rs 3,250 crore loan to the Videocon Group in 2012.

The deal recently made news after reports questioned the loan and linked it to a possible quid pro quo that Videocon group promoter Venugopal Dhoot allegedly had with NuPower Renewables, a company founded by Deepak Kochhar.

In its preliminary enquiry — a precursor before lodging an FIR — the CBI had named Dhoot, Deepak Kochhar and unidentified others.

In his address at the conference earlier, Srinivas, who heads the Insolvency Law Committee, that made public its recommendations on Tuesday, said that Less than half of the staggering Rs 9 lakh crore worth of non-performing assets (NPAs), or bad loans, accumulated by banks had returned due to the system set in place by the Insolvency and Bankruptcy Code enacted by Parliament in 2016.

—IANS

0 Comments